Reuters

Mon, November 13, 2023

A warning sign for a natural gas pipeline is seen as natural gas flares at an oil pump site outside of Williston

(Reuters) - The U.S. needs more natural gas pipeline capacity to maintain reliable gas supply during extreme cold weather, a trade group representing pipeline companies said on Monday in support of regulators who last week urged sought new rules to prevent a repetition of last winter's power outages.

The Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corp (NERC) urged lawmakers to fill a regulatory blind spot to maintain reliable supply of natural gas that was highlighted by an inquiry into power outages during Winter Storm Elliott in December 2022.

Elliott delivered sub-freezing temperatures and extreme weather warnings to almost two-thirds of the U.S., resulting in unforeseen energy generation supply losses.

Speaking for operators of around 200,000 miles (322,000 km) of pipelines, the Interstate Natural Gas Association of America (INGAA) said the regulators' report confirmed that its members "used all possible flexibility and storage withdrawals to deliver as much natural gas through the system as possible."

Declining production reduced flows of gas into pipelines during Elliott, while demand for the fuel for heating and power generation increased, dramatically lowering line pressures.

Falling pressure levels put the pipeline system at risk of collapse, the INGAA said, forcing operators to implement scheduling restrictions and reduce previously confirmed nominations for transporting the fuel.

The report had found that in New York City, Consolidated Edison declared an emergency because it faced a system collapse that would have taken "many months" to restore service in the middle of the winter.

"The United States needs more natural gas pipeline capacity to maintain a resilient system that affords homes and the power grid access to multiple sources of this critical fuel," the INGAA said.

In its 2023-24 winter outlook, the NERC said last week that prolonged, wide-area cold snaps threaten the availability of fuel supplies for natural gas-fired generation, warning there is not enough natural gas pipeline and infrastructure for the U.S. Midwest, Mid-Atlantic, and Northeast regions.

(Reporting by Deep Vakil in Bengaluru; Editing by Marguerita Choy)

US plans to buy 1.2 million barrels of oil for Strategic Petroleum Reserve

Reuters

Updated Mon, November 13, 2023

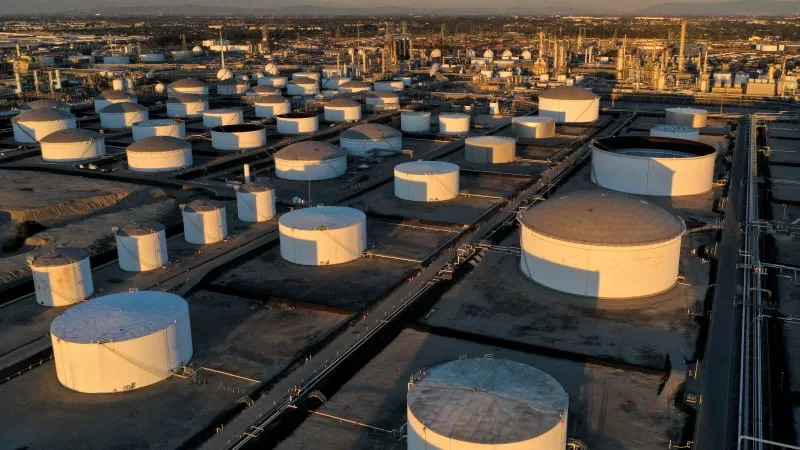

Department of Energy officials lead reporters on a tour of the Strategic Petroleum Reserve in Freeport

WASHINGTON (Reuters) - The U.S. plans to buy 1.2 million barrels of oil to help replenish the Strategic Petroleum Reserve after it sold off the largest amount ever last year, the Energy Department said on Monday.

The department said the planned purchase for the oil is at an average price of $77.57 a barrel from two companies after 18 bids were submitted.

The administration of President Joe Biden last year conducted the largest ever sale from the SPR of 180 million barrels, part of a strategy to stabilize soaring oil markets and combat high pump prices in the aftermath of Russia's invasion of Ukraine. If the purchase is finalized it will have bought back about 6 million barrels.

As oil prices have risen on production cutbacks by Saudi Arabia and Russia, it has been difficult for the administration to buy back oil for the reserve. Last month it raised the price at which it hopes to buy back oil to $79 or less a barrel, up from an earlier price range of about $68 to $72.

Last month the Energy Department said it hopes to buy 3 million barrels for December delivery and another 3 million for January at the higher price. It said it expects to issue additional oil purchase solicitations for the reserve on a monthly basis through at least May 2024.

"President (Joe) Biden and the Energy Department remain committed to refilling the SPR at fair prices, safeguarding this critical energy security asset while getting a good deal for American taxpayers," a department spokesperson said.

The department has said oil in last year's emergency sales sold for an average of $95 per barrel.

(Reporting by Timothy Gardner; Editing by Sandra Maler and Chris Reese)

Here’s one energy win Biden probably won't brag about

Yahoo Finance

Sun, November 12, 2023 at 9:00 AM MST·5 min read

30

Rick Newman is a senior columnist for Yahoo Finance.

U.S. oil production recently hit a new record high. There’s a good chance you’ll never hear President Biden mention it.

Domestic oil production has crept up to 13.2 million barrels per day, slightly above the prior record high of 13.1 million barrels in 2020, right before the COVID pandemic hit. It’s likely to drift higher still in 2024. You might think you’re hearing this wrong. So to reiterate: Yes, the United States is producing more oil under President Biden than it did under President Trump.

That wasn’t supposed to happen. Biden campaigned for the White House by vowing to “end fossil fuel." One of his first acts as president was to cancel the permit for the Keystone XL pipeline that would have carried Canadian oil to refineries on America’s Gulf Coast. Biden is a champion of renewable energy who proved it by signing into law the biggest set of green energy incentives in American history last year.

So Biden would suddenly sound like a fossil fuel cheerleader if he boasted about record levels of oil production under his watch. He’d also upset liberal Democrats who pushed for the “green new deal,” which would have gone a lot further than Biden has gone in forcing the U.S. economy off of fossil fuels. The best Biden can probably do is remind Americans when energy prices fall, while continuing to tout his green energy agenda, which may not be a resounding sell to the moderate swing voters likely to determine whether Biden gets a second presidential term next year.

Yet Biden has clearly learned how important fossil fuels are to his standing with voters, and to his political future. Biden’s approval rating sank as inflation begin to rise in late 2021 and 2022. The high point for inflation was a low point for Biden. The overall inflation rate hit 9% in June 2022, the same month U.S. gasoline prices hit $5 per gallon, the highest level ever. Pump prices have since come down — the current national average for a gallon of regular is $3.40 — but Biden’s approval rating has never recovered.

Biden has spent much of his presidency trying to manage gasoline prices. His administration sold 180 million gallons of oil from the nation’s strategic reserve, to boost global supplies and bring prices down. That brought the reserve to the lowest level since 1984. He and his deputies tried to jawbone US drillers into producing more, but private-sector energy companies aren’t answerable to the president. They’re answerable to investors and shareholders eager to lock in profits instead of putting more money into production, risking oversupply.

Biden has also tried to get foreign drillers, such as Saudi Arabia, to produce more oil, without much luck. The Saudis and other member nations of the oil-exporting group OPEC have been cutting production, not boosting it. In October, the Biden administration even eased sanctions on dictatorial Venezuela, hoping to squeeze a few more barrels out of the oil-rich nation, even though its energy infrastructure is in shambles.

[Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.]

The market is now accomplishing what Biden couldn’t. U.S. drillers are producing more energy because they can make more money doing it. Oil prices crashed during the COVID pandemic, even turning negative for a brief time as there was more oil in storage than anybody knew what to do with. But they’ve since recovered to a range of $75 to $95 per barrel. U.S. drillers can make healthy profits at those levels. The OPEC production cuts are actually benefiting US energy firms by keeping prices high enough to make more drilling profitable.

Another happy fact Biden will probably never tout: The United States is the world’s top oil producer. That has been the case since 2018, due to new horizontal fracking technology that made vast amounts of energy, much of it in Texas, newly accessible. As OPEC nations produce less, U.S. barrels become more important to the global market.

Is the boom in U.S. oil production bad news for efforts to wean the world off fossil fuel and address global warming?

There are two ways to look at it. Some environmentalists want to speed the transition to renewables by forcing cuts in the supply of fossil fuels, so that renewables are the only option for some consumers. That’s imprudent, because there’s a good chance it will raise prices for end users if renewables aren’t cost-competitive with fossil fuels, which they aren’t in many places, such as areas where wind and solar aren’t yet wired into the grid.

Biden has discovered the political peril that can come with imposing limits on fossil fuels. Canceling the Keystone XL pipeline in 2021 had no effect on oil or gasoline prices, since the pipeline wasn’t even built and no oil was moving through it. But Biden took a public stance in opposition to fossil fuels, and when gas prices spiked in 2022, consumers blamed him. Biden asked for it.

A better approach to accelerating the green energy transition is doing everything feasible to bring more renewables to market, so that scaling up production helps lower costs and makes renewables cost-competitive with fossil fuels. This is exactly what Biden’s green energy incentives are doing, by effectively lowering the break-even point for green energy production and drawing more investors into the business, to boost supply.

To some extent, this is already working. Biden’s green energy incentives are generating far more investment than drafters of the legislation estimated in 2022. The Energy Dept. recently forecast a decline in US gasoline consumption in 2024, partly because so many electric vehicles are now on the road.

But there are potholes, too. Electric vehicle sales seem to be flatlining, for instance, perhaps revealing a ceiling on the portion of car buyers willing to accept the higher prices and practical limits of electrics.

The bottom line? Green energy adoption will continue, but abundant fossil fuels will be necessary for the rest of Biden’s political career, and well beyond, whether he wants to admit it or not.

Follow Rick Newman on Twitter at @rickjnewman.

No comments:

Post a Comment