By Ben Dickson

-December 15, 2020

This article is part of our series that explore the business of artificial intelligence

Last week, Hyundai officially announced the much-anticipated deal to acquire a controlling interest in famous robotics company Boston Dynamics. According to a joint press release by the two companies, Hyundai will buy an 80-percent stake in Boston Dynamics, and SoftBank, the previous owner of the robotics company, will retain 20 percent ownership after the transaction is completed in June 2021. While details have yet to be revealed, the deal puts Boston Robotics at a $1.1 billion valuation.

The mere fact that Boston Dynamics has managed to survive so long in an industry that has been marked with failures and shuttered companies is commendable. But what will the acquisition mean for the future of the company that made its fame with YouTube videos of robots performing impressive feats? The press release and the history of the company provide some hints. And depending on what you expect from Boston Dynamics, the outcome can be both good and bad.

What is the value of Boston Dynamics?

Boston Dynamics was founded in 1992 as a spinoff from the Massachusetts Institute of Technology, working on robotics projects largely funded by the military. In 2013, as advances and interest in deep learning began to pick pace, Google’s moonshot subsidiary Google X bought the robotics company for an undisclosed amount.

But Google did not succeed in turning Boston Dynamics—or any of its other robotic ventures—into a profitable business. It eventually shut down Google X Robotics and sold Boston Dynamics to Japanese investment giant SoftBank for a reported $165 million in 2017.

Therefore, even though changing hands three times in a decade is not a good outlook for any company, the $1.1 billion valuation shows that Boston Dynamics’ value has increased, and SoftBank is making a lot of money out of the deal.

“Boston Dynamics is at the heart of smart robotics,” Masayoshi Son, the chairman and CEO of SoftBank said, according to Friday’s release. “We are thrilled to partner with Hyundai, one of the world’s leading global mobility companies, to accelerate the company’s path to commercialization. Boston Dynamics has a very bright future and we remain invested in the company’s success.”

This begs the question: If Boston Dynamics has “a very bright future,” then why sell your major stake? This probably means that its “present” is not very bright.

Running a robot company is hard

The past few years have seen the fall of several robotics companies. After running out of money to support its hardware and software business, Anki, a startup that raised $200 million to create cute home robots, shut down in 2019 and later sold its assets to edtech startup Digital Dream Labs. Mayfield Robotics, the maker of the Kuri home robot, also ceased operations in 2018. Rethink Robotics, the manufacturer of the famous Baxter and Sawyer robots, also closed shop in 2018. Its assets were later acquired by German automation firm HAHN Group.

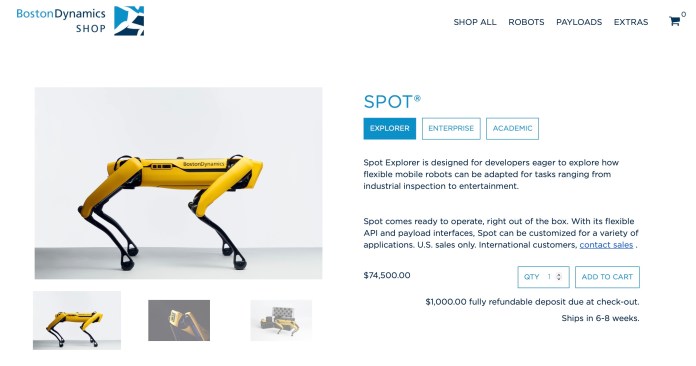

Meanwhile, under the SoftBank ownership, Boston Dynamics tripled its staff, bought new headquarters, and finally started leasing the quadruped robot Spot for an undisclosed price in 2019. Earlier this year, Boston Dynamics started selling the robot at a hefty $74,500.

Friday’s press release states that after the launch of Spot, Boston Dynamics has sold “hundreds of robots in a variety of industries, such as power utilities, construction, manufacturing, oil and gas, and mining.”

According to a Bloomberg report, the real sales figure is close to 400 units, which amounts to about $30 million. But Boston Dynamics’ operations cost SoftBank more than $150 million, which means the company is still far from being profitable.

Also, so far, Spot’s biggest use case has been navigating and inspecting complex environments. In June, Zack Jackowski, Boston Dynamics’ lead robotics engineer, told The Verge, “We mostly sell the robot to industrial and commercial customers who have a sensor they want to take somewhere they don’t want a person to go. Usually because it’s dangerous or because they need to do it so often that it would drive someone mad. Like carrying a camera around a factory 40 times a day and taking the same pictures each time.”

But inspection is a task that drones can already accomplish with much less difficulty and at lower costs. In fact, several companies already provide drone inspection solutions for the industries mentioned in Boston Dynamics’ press release.

This means that at present, Boston Dynamics faces a tough challenge growing in a market that has already been largely conquered by drones equipped with advanced computer vision technology.

So why would Hyundai pay such a huge sum for a company will not be profitable for the time being? This brings us back to Son’s remark about the “bright future” of Boston Dynamics.

Boston Dynamics under Hyundai

The true benefit of Spot and other robots Boston Dynamics is creating is their ability to interact with and manipulate their environment. In fact, one of the advertised features of Spot was its ability to attach and use props such as a mechanical arm that can open doors and pick up objects. But the technology is still in early stages and dexterous manipulation of objects is a hot area of artificial intelligence research.

That is the future of Boston Dynamics. To get there, the company will need more time and money that SoftBank could not provide.

This is where Hyundai enters the picture. From the press release: “Hyundai Motor Group will provide Boston Dynamics a strategic partner affording access to Hyundai Motor Group’s in-house manufacturing capability and cost benefits stemming from efficiencies of scale (emphasis mine).”

With the backing of Hyundai, Boston Dynamics will be able to reduce manufacturing costs and sell Spot and its future robots at much more competitive prices and sell more units.

Beyond economies of scale, Boston Dynamics will benefit from becoming a subsidiary of one of the world leaders in robotics. Hyundai is already heavily invested in robotics research and production. It is engaged in several projects that, like Boston Dynamics’ robots, are focused on solving mobility problems. The integration will provide Boston Dynamics with the right tools to speed up its research in a cost-efficient way and develop robots that can do more than just inspect their environment.

While I don’t have enough information to provide an exact estimate, but I believe that under Hyundai, Boston Dynamics finally has the potential to develop a profitable business model. In this light, it makes sense for SoftBank to relinquish major ownership, knowing that its 20-percent stake will become much more valuable if Boston Dynamics has access to the right manufacturing infrastructure and facilities.

The long-term impact on Hyundai and Boston Dynamics

“Over time, Hyundai Motor Group plans to expand its presence into the humanoid robot market with the aim of developing humanoid robots for sophisticated services such as caregiving for patients at hospitals,” according to the release.

This is an important statement, I believe, for two reasons. First, it shows that Hyundai shares Boston Dynamics’ vision in biped (and quadruped) robots. And second, Hyundai also acknowledges that this is an area that requires long-term investment.

So, as long as Hyundai doesn’t give up on its dreams of creating human-like robots, Boston Dynamics is in good hands even if it isn’t profitable.

But long-term dreams tend to change. While Hyundai’s vision for caregiving robots is commendable, it is also a very complicated problem, one that cannot be solved with today’s AI technologies and has no clear solution in sight (prominent roboticist Rodney Brooks has a series of posts that discuss this challenge).

Hyundai a publicly-traded company that is expected to turn in profits every year. Should the company see that its robotics efforts will not yield results in a timely fashion, it might have a change of heart. What will happen to Boston Dynamics then?

As we’ve seen with DeepMind and OpenAI, when an AI research lab becomes too enmeshed with commercial entities, it gradually undergoes a transformation, drifting from pushing the limits of science to developing products that turn in short-term return on investment.

Boston Dynamics might claim to be a commercial company. But at heart, it is still an AI and robotics research lab. It has built its fame on its advanced research and a continuous stream of videos showing robots doing things that were previously thought impossible. The reality, however, real-world applications seldom use cutting-edge AI and robotics technology. Today’s businesses don’t have much use for dancing and backflipping robots. What they need are stable solutions that can integrate with their current software and hardware ecosystem, boost their operations, and cut costs.

As Boston Dynamics’ vice president of business development Michael Perry told The Verge in June, “[A] lot of the most interesting stuff from a business perspective are things that people would find boring, like enabling the robot to read analogue gauges in an industrial facility. That’s not something that will set the internet on fire, but it’s transformative for a lot of businesses.”

So, the good is that under Hyundai, Boston Dynamics has a better chance to survive. The bad: It might have to shed some of this coolness and become a bit boring. You can’t build a profitable robotics company on viral YouTube videos.

No comments:

Post a Comment