GREEN CAPITALI$M

Green Energy: Great Plains Institute identifies 14 locations across the US for hydrogen and carbon management hubs

The 14 ‘most ideal locations’ were evaluated against a set of criteria that measured each regions pre-existing industrial and natural resources.

February 4, 2022 | Jessica Cummins

USA-based non-partisan energy research firm, Great Plains Institute has identified 14 optimal locations for future hydrogen and carbon management hubs across the US as an early step before the Department of Energy begins doling out billions of dollars from the Infrastructure Bill for hub funding.

The $8 billion allocated for future hydrogen hubs was provided by the Biden administration’s Infrastructure Investment and Jobs Act, which will support the creation of at least four regional hydrogen hubs.

The infrastructure bill also provided $12.1 billion to support new carbon management technologies, including money to build out regional CO2 transportation and storage infrastructure networks.

According to the institute, the 14 ‘most ideal locations’ were evaluated against a set of criteria that measured each regions pre-existing industrial and natural resources.

The 14 ‘most ideal locations’ were evaluated against a set of criteria that measured each regions pre-existing industrial and natural resources.

February 4, 2022 | Jessica Cummins

USA-based non-partisan energy research firm, Great Plains Institute has identified 14 optimal locations for future hydrogen and carbon management hubs across the US as an early step before the Department of Energy begins doling out billions of dollars from the Infrastructure Bill for hub funding.

The $8 billion allocated for future hydrogen hubs was provided by the Biden administration’s Infrastructure Investment and Jobs Act, which will support the creation of at least four regional hydrogen hubs.

The infrastructure bill also provided $12.1 billion to support new carbon management technologies, including money to build out regional CO2 transportation and storage infrastructure networks.

According to the institute, the 14 ‘most ideal locations’ were evaluated against a set of criteria that measured each regions pre-existing industrial and natural resources.

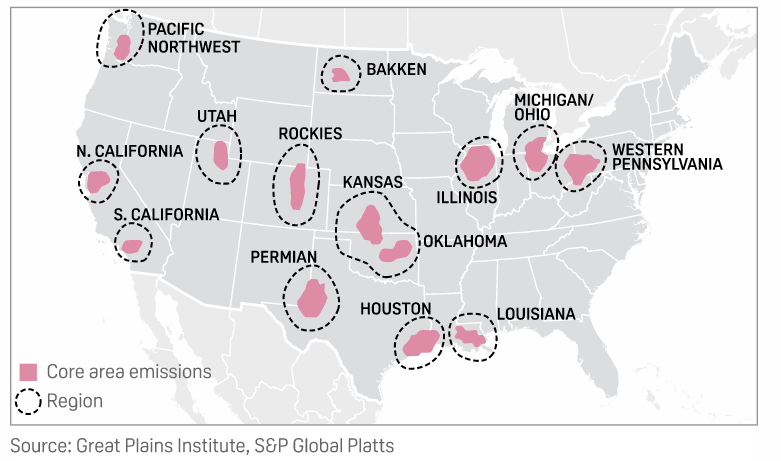

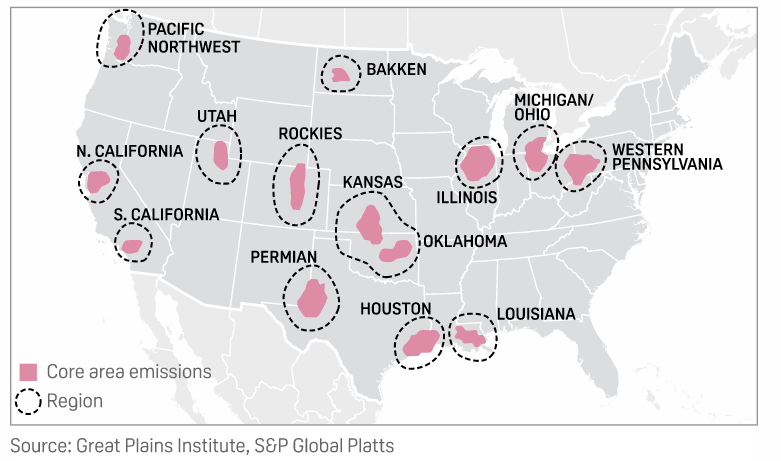

Regional opportunities for hub development. Pic: Great Plains Institute, S&P Global Platts

Each of the 14 locations “have a high concentration of industrial emitters, high fossil fuel use, facilities that qualify for 45Q tax credits, existing hydrogen and ammonia production”, the firm said, as well as large naturally occurring geologic formations for hydrogen or CO2 storage.

Regions are also evaluated for their existing commodity distribution infrastructure, such as highways, railroads, and waterways, and for their existing fossil fuel distribution infrastructure for hydrogen blending.

With all these ingredients, Great Plains Institute director of research Dane McFarlane said these hubs can achieve beneficial economies scale – “enabling investment breakeven for industrial capture retrofit and maximising the amount of carbon capture achieved.”

Each of the 14 locations “have a high concentration of industrial emitters, high fossil fuel use, facilities that qualify for 45Q tax credits, existing hydrogen and ammonia production”, the firm said, as well as large naturally occurring geologic formations for hydrogen or CO2 storage.

Regions are also evaluated for their existing commodity distribution infrastructure, such as highways, railroads, and waterways, and for their existing fossil fuel distribution infrastructure for hydrogen blending.

With all these ingredients, Great Plains Institute director of research Dane McFarlane said these hubs can achieve beneficial economies scale – “enabling investment breakeven for industrial capture retrofit and maximising the amount of carbon capture achieved.”

Emission Control: The global clean-energy transition hit a record breaking $755 billion investment during 2021

Energy | February 4, 2022 | Jessica Cummins

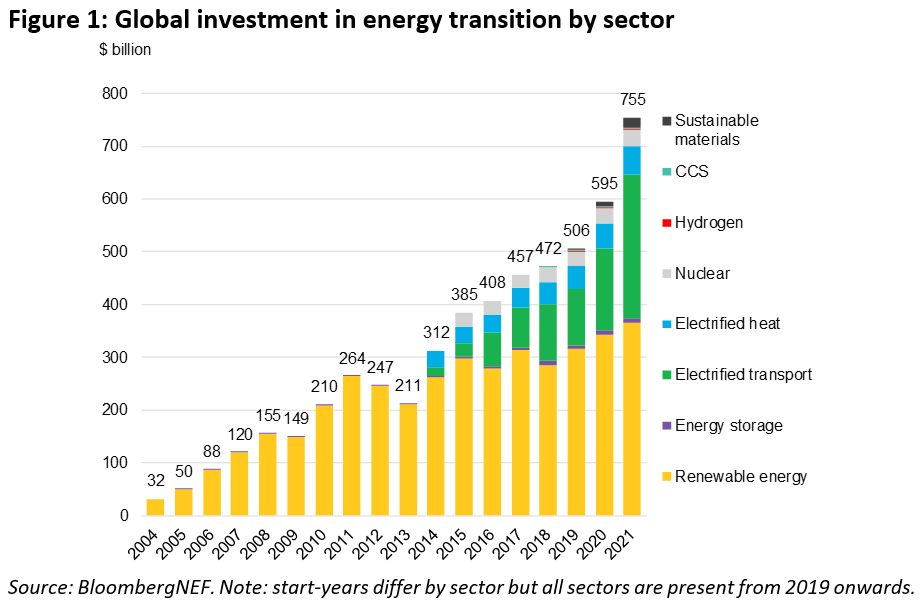

Off the back of rising climate ambition and policy action from countries around the world, research firm BloombergNEF says a new record $755 billion was invested into the low-carbon energy transition in 2021.

Clean power and electrification accounted for most of the investment, the firm said, recording $731 billion while hydrogen, carbon capture and storage, and sustainable materials made up the rest at $24 billion.

Pic: BloombergNEF

Investment rose in almost every sector covered in the report titled Energy Transition Investment Trends 2022, with carbon capture and storage (CCS) being the only sector to record a dip in investment, though there were many new projects announced in the year.

BloombergNEF head of analysis Albert Cheung said the global commodities crunch has created new challenges for the clean energy sector.

“This has raised input costs for key technologies like solar modules, wind turbines and battery packs,” he said.

“Against this backdrop, a 27% increase in energy transition investment in 2021 is an encouraging sign that investors, governments and businesses are more committed than ever to the low carbon transition and see it as part of the solution for the current turmoil in energy markets.”

Investment rose in almost every sector covered in the report titled Energy Transition Investment Trends 2022, with carbon capture and storage (CCS) being the only sector to record a dip in investment, though there were many new projects announced in the year.

BloombergNEF head of analysis Albert Cheung said the global commodities crunch has created new challenges for the clean energy sector.

“This has raised input costs for key technologies like solar modules, wind turbines and battery packs,” he said.

“Against this backdrop, a 27% increase in energy transition investment in 2021 is an encouraging sign that investors, governments and businesses are more committed than ever to the low carbon transition and see it as part of the solution for the current turmoil in energy markets.”

While $755 billion is a massive number, US International Development Finance Corporation climate officer Jack Levine says that number needs to triple to $2.1 trillion per year between 2022-2025 to get on track for net-zero.

Regional and country leaders

Record amounts were invested in all three regions covered in the report: Asia Pacific (APAC), Europe, Middle East & Africa (EMEA), and the Americas (AMER).

APAC was both the largest region for investment at $368 billion (nearly half the global total), and the region with the highest growth at 38% in 2021.

Energy transition investment in EMEA grew by 16% in 2021, reaching $236 billion, while the Americas saw investment grow by 21% to $150 billion.

China was again the largest single country for energy transition investment, committing $266 billion in 2021.

The United States was in second place with $114 billion, though EU member states as a bloc committed more at $154 billion.

Germany, the UK, and France rounded out the top five countries for energy transition investment in 2021.

Asia-Pacific countries now hold four of the top 10 places in terms of energy transition investment levels, with India and South Korea joining China and Japan.

New poll highlights ‘clean industries’ as the key to future prosperity

Around 60% of voters in Queensland and New South Wales believe the government’s top investment priority should be in renewables and say the states’ future economic prosperity lies in clean industries such as green hydrogen, critical minerals (lithium and cobalt), and manufacturing renewable products.

A new poll by the Climate Council of more than 2,000 voters in regional, rural, and metropolitan Queensland and New South Wales was released yesterday, highlighting that while both states dominate Australia’s coal exports, residents understand the ‘coal and gas’ era is coming an end.

Former Deloitte partner and leading economist Nicki Hutley said there is huge opportunity for the historical coal and gas heartlands of New South Wales and Queensland to grasp the economic rewards of the zero-emission transformation.

“Significantly, voters recognise that further cuts to carbon emissions – critical if we are to keep global warming in check – will increase jobs and lift economic growth,” she said.

“They also think regional areas will benefit the most, however, there is a strong view that there needs to be better support from government for communities that currently rely on fossil fuels in order for them to adjust to the changes.”

Solar installation. Pic: Climate Council

Solar PV, a renewable energy company designing and developing large-scale solar farms in Queensland based on the Sunshine Coast, said while the company was experiencing “a very exciting time in Queensland” it is also a “fork in the road” as far as renewable energy jobs go.

“What is missing is the Federal government – it needs to incentivise investment to create a real future for Queensland,” she said.

“It needs to provide a framework that can give investors certainty and improve the resilience and robustness of the grid.”

Overall, less than a quarter of respondents back fossil fuels as the best source of future jobs (27% in QLD and 19% in NSW) and only a quarter of voters in QLD and about one-fifth in New South Wales believe coal and gas lies in the state’s future.

Utilising technology to increase distributed energy in low voltage networks

The Australian Renewable Energy Agency (ARENA) has seen the potential benefit of tech produced by Brisbane based company eleXsys Energy, which is designed to increase distributed energy resources (DER) hosting capacity on low voltage power lines.

Around $451,167 in funding has been invested to eleXsys Energy to demonstrate the potential of their new technology, eleXsys, which is a device that works by regulating voltage on low voltage power lines via dynamically providing or absorbing reactive power, for the benefit of new and existing DER customers where the device is installed.

By maintaining voltage within normal operating bands, eleXsys can better utilise DER, such as locally produced solar and battery storage, without expensive grid upgrades.

The $1.92 million trial will be undertaken in conjunction with local distribution network service provider (DNSP) Energy Queensland who will undertake testing of eleXsys at its Real Time Digital Simulator facility in Cairns to show how the device performs across a wider range of network types

Solar PV, a renewable energy company designing and developing large-scale solar farms in Queensland based on the Sunshine Coast, said while the company was experiencing “a very exciting time in Queensland” it is also a “fork in the road” as far as renewable energy jobs go.

“What is missing is the Federal government – it needs to incentivise investment to create a real future for Queensland,” she said.

“It needs to provide a framework that can give investors certainty and improve the resilience and robustness of the grid.”

Overall, less than a quarter of respondents back fossil fuels as the best source of future jobs (27% in QLD and 19% in NSW) and only a quarter of voters in QLD and about one-fifth in New South Wales believe coal and gas lies in the state’s future.

Utilising technology to increase distributed energy in low voltage networks

The Australian Renewable Energy Agency (ARENA) has seen the potential benefit of tech produced by Brisbane based company eleXsys Energy, which is designed to increase distributed energy resources (DER) hosting capacity on low voltage power lines.

Around $451,167 in funding has been invested to eleXsys Energy to demonstrate the potential of their new technology, eleXsys, which is a device that works by regulating voltage on low voltage power lines via dynamically providing or absorbing reactive power, for the benefit of new and existing DER customers where the device is installed.

By maintaining voltage within normal operating bands, eleXsys can better utilise DER, such as locally produced solar and battery storage, without expensive grid upgrades.

The $1.92 million trial will be undertaken in conjunction with local distribution network service provider (DNSP) Energy Queensland who will undertake testing of eleXsys at its Real Time Digital Simulator facility in Cairns to show how the device performs across a wider range of network types

.

eleXsys Energys’ device absorbs reactive power for the benefit of new and exiting distributed energy resources customers. Pic: eleXsys Energy

ARENA CEO Darren Miller said technology will play an increasingly important role in adding more renewables to our energy makeup.

“To help increase the amount of distributed energy we can have on Australia’s energy network, it’s vital that ARENA supports these new technologies such as the eleXsys which not only help to connect more home solar and batteries, but also helps to avoid expensive network augmentation works to support increased demand.”

eleXsys Energy will manufacture and install five eleXsys devices, with three being directly connected to Energy Queensland’s network, one being trialled behind the meter on a customer’s premises, and the other being used for testing at the Real Time Digital Simulator facility.

The final findings of the project will be made public through a comprehensive knowledge sharing report.

ASX green energy stocks

Scroll or swipe to reveal table. Click headings to sort.

ARENA CEO Darren Miller said technology will play an increasingly important role in adding more renewables to our energy makeup.

“To help increase the amount of distributed energy we can have on Australia’s energy network, it’s vital that ARENA supports these new technologies such as the eleXsys which not only help to connect more home solar and batteries, but also helps to avoid expensive network augmentation works to support increased demand.”

eleXsys Energy will manufacture and install five eleXsys devices, with three being directly connected to Energy Queensland’s network, one being trialled behind the meter on a customer’s premises, and the other being used for testing at the Real Time Digital Simulator facility.

The final findings of the project will be made public through a comprehensive knowledge sharing report.

ASX green energy stocks

Scroll or swipe to reveal table. Click headings to sort.

Kalina Power (ASX:KPO) was the biggest gainer this fortnight after releasing its quarterly update, where it said primary activities focused on the developed of its flagship 64MW primate site at the Kalina Energy Centre in Saddle Hills, Alberta.

The company’s Canadian subsidiary, KALiNA Distributed Power Limited (KDP) continued its engineering, contracting and regulatory approvals to position the project to achieve Full Notice to Proceed (FNTP).

KPO managing director Ross McLachlan said with the project essentially now shovel-ready, it is continuing efforts to ensure that the terms of the EPFC contract are suitable for project funding.

“To that end, we are considering various contracting strategies with our supply chain partners and Enerflex to achieve the right balance of price, risk and schedule that can work for all parties,” the company said.

Pure Hydrogen (ASX:PH2) was the second biggest gainer on its announcement that it entered into a joint venture in India to supply hydrogen powered products and vehicles.

PH2 is the second largest shareholder of H2X, which signed a binding agreement with Advik Hi-Tech, a global automotive components manufacturer.

The JV company will begin production of H2X’s Series of Fuel Cell Powered Generators. H2X currently has two of these units ready for deployment in Australia.

Up 5% this last fortnight was Leigh Creek Energy (ASX:LCK) after revealing it had achieved carbon neutral status at its Leigh Creek Urea Project in South Australia.

LCK managing director Phil Staveley said the company reached carbon neutrality eight years earlier than originally planned with working having started on Year 2 emission reduction programs.

Pilbara iron ore miner Fortescue Metals Group (ASX:FMG) is also up on the back of news that it has entered into a share sale and purchase agreement to acquire Williams Advanced Engineering Ltd (WAE).

WAE will be vertically integrated into Fortescue’s diversified resources and green energy business and will be managed via Fortescue Future Industries (FFI), Fortescue’s green energy and green technology division.

This acquisition of WAE provides critical technology and expertise in high-performance battery systems and electrification, FMG says, and will enable Fortescue to accelerate and support the decarbonisation of its mining operations.

THE REALITY IS THAT CCS IS NOT GREEN NOR CLEAN IT IS GOING TO BE USED TO FRACK OLD DRY WELLS SUCH AS IN THE BAKAN SHIELD IN SASKATCHEWAN

https://plawiuk.blogspot.com/2014/10/the-myth-of-carbon-capture-and-storage.html

ALSO SEE https://plawiuk.blogspot.com/search?q=CCS

https://plawiuk.blogspot.com/2014/10/the-myth-of-carbon-capture-and-storage.html

ALSO SEE https://plawiuk.blogspot.com/search?q=CCS

No comments:

Post a Comment