Environmentalists Say FuelEU Maritime’s Transition is Too Slow

Environmentalists continue to be critical of the maritime industry as well as regulators in their efforts to get shipping to align with the broader climate goals of the Paris Agreement on global warming. The influential group Transport & Environment (T&E) released a new study looking at the potential impact of the FuelEU Maritime legislation finalized earlier this year and how it will address shipping and specifically container shipping’s use of fossil fuels. Reporting that it will be a slow transition, T&E is recommending that the European Commission make further improvements to the “Fit for 55” package for the shipping sector.

The group calls the FuelEU Maritime component “arguably the most important shipping-related legislation,” in the EU’s new package and said the program which reached a political agreement in the spring of 2023 is a welcome step in tackling shipping’s emissions. They said the regulation is “a positive step,” citing the introduction of mandates to transition to lower carbon fuels and the small, initial sub-target which they said will “kick-start the use of sustainable e-fuels.”

T&E’s new study aimed to analyze the impact of FuelEU Maritime combined with the European Union’s Emission Trading System (EU ETS) by modeling how shipping companies are most likely to act in the face of different regulatory constraints and pricing. The model, they reported, allowed them to predict potential demand from container operators in the EU for a range of marine fuels. The study projects what mix of technologies and fuels will be in demand from the containership segment across a period of 30 years from 2025, as well as the primary costs involved.

“Given the limited ambition of the GHG intensity reduction targets, FuelEU Maritime green-lights a slow-motion transition away from fossil fuels in shipping, with oil-based fuels and fossil gas still likely to make up the majority of fuel demand until 2045,” the group reports. “We find that under the existing regulation, the industry would see a slow transition away from polluting fossil fuels, such as LNG, which ships could continue using into the 2050s, towards more sustainable e-fuels.”

Under their base case pricing scenario, T&E’s study suggests that the current legislation will fall short of encouraging significant extra demand for non-biologic renewable fuels. They expect that demand for fossil LNG will continue to grow until at least 2035 when e-ammonia could begin to rapidly grow. They also looked at the impact of lowered biofuel prices or delays in the feasibility of ammonia engines.

Pricing they find could impact demand for other shipping fuels, including bio-methanol, e-methanol, e-diesel, and e-methane. They, however, speculate that in the “base case,” demand and efficiency assumptions, could lead to unsustainable volume demands for biofuel. They find it could reach an equivalent to 114 percent of current consumption by all EU transport. T&E believes that a sustainable transition is possible under an alternative scenario with lower demand growth and improved energy efficiency. However, they report that e-fuels’ share of shipping fuel demand would still need to reach 18 percent in 2035 and 85 percent in 2040 respectively to decarbonize the shipping sector.

“The shift to cleaner fuels is likely to be driven almost entirely by the progressive reduction in GHG intensity targets,” contends T&E. Based on that belief along with the conclusions that the current regulation permits “unacceptably heavy use of fossil LNG and also does too little to guarantee demand for renewable fuels,” T&E is recommending further “improvements” to the Fit for 55 package for shipping.

They continue to call for the greenhouse gas intensity targets to be aligned with the Paris Agreement. To achieve their targets, they want higher and additional targets for renewable fuel along with expanding the FuelEU package to cover more ships, including below 5,000 gross tons as well as offshore vessels and other non-cargo ships. They also want mandates for more sustainable fuels, such as ammonia, methanol, and hydrogen, to replace the existing LNG bunkering infrastructure.

T&E concludes its recommendations by calling for the implementation of mandatory energy efficiency requirements on European shipping. They also want strong penalties for non-compliance to discourage the shipping industry from simply paying for compliance instead of making significant changes to reduce emissions.

T&E Highlights Continuing Rise in European Shipping’s CO2 Emissions

Harmful emissions for ships operating in Europe grew to a three-year high as the industry edges closer to pre-pandemic levels reports the NGO Transport & Environment (T&E). Performing an analysis and review of the data released under the European Commission’s Monitoring, Reporting, and Verification requirement, T&E contends the shipping industry is continuing to move closer to the point of no return in the efforts to stop global warming.

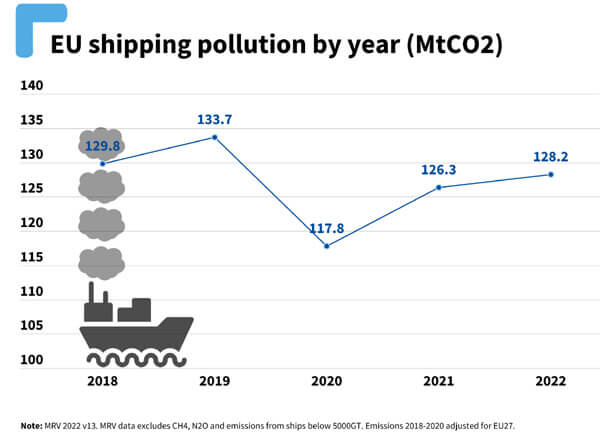

The outspoken environmental group used the 2022 data released at the beginning of July from the EC’s monitoring of vessels. They sought to adjust the historic data to reflect the change in geographic scope when the UK exited the EU and reporting in 2021. Emissions they showed have risen in the past two years from a low in 2020 during the pandemic.

Total emissions were up about three percent in 2022 versus the prior year and are up nearly nine percent from the low point in 2020. Despite the increases in the past two years, emissions measures in metric tons of CO2 are down from both 2018 and 2019 levels. Despite being up last year, levels are still down over four percent from the 2019 peak.

“Carbon emissions are at a three-year high as shipping companies continue to go all guns blazing. Europe’s shipping giants are up there with coal plants and airlines as the continent’s biggest polluters,” said Jacob Armstrong, shipping manager at T&E. “Without stricter regulations, shipping companies will continue to spurn investments in efficiency and green fuels.”

Breaking down the nearly 130 million tonnes of CO2 emissions recorded in 2022, T&E reports containerships accounted for the largest portion or nearly 30 percent of total emissions in Europe. Bulk carriers and tankers were a distant second and third, each around 15 percent of emissions.

The largest increases came from liquified natural gas shipments. LNG gas carriers’ emissions were up 58 percent according to T&E’s analysis. They cited Europe’s efforts at ramping up sanctions on Russian oil, and the push for more seaborne imports to meet gas needs. Similarly, cruise ship emissions were almost double in 2022 over the prior year as the industry continued to overcome previous disruptions to international travel due to the pandemic.

As expected, the largest shipping companies are also the ones T&E cites are the largest emitters. MSC, they contend is currently Europe’s 11th biggest polluter and the largest in the shipping industry with 10 million tonnes of emissions in 2022. MSC was followed in T&E’s analysis by CMA CGM, Maersk, COSCO, and Hapag-Lloyd in the list of shipping emitters.

The group does not address the potential impact going forward from either the EU’s ETS scheme due to start in 2024 or the IMO’s revised targets to cut emissions. They do highlight a small increase in port carbon emissions, saying that this could be easily fixed by greater shore-side electrification. European ports are moving quickly to expand shore power availability in response to coming mandates.

While the environmentalists highlight the growth over the past two years, industry analyst Xeneta issued its analysis showing that CO2 emissions overall were down in the container segment in the first quarter of 2023. They reported the declines were found on 10 of the 13 top ocean freight lanes. Emily Stausbøll, Xeneta Shipping Analyst, said that much of the improvements are down to carriers reducing speeds, which delivers fuel efficiency gains while also allowing them to cater to considerably lower demand in a subdued macroeconomic climate.

Xeneta expects that the container carriers will continue to slow down the speeds of deployed ships which will also help to balance against the addition of newbuilds that were ordered over the past few years. They expect that the segment will continue to seek a balance between speed, size, and filling factor going forward which will contribute to declines in overall emissions.

No comments:

Post a Comment