'Trans women are women': Canadian orgs declare support on International Women's Day

Organizations across Canada are driving home the point that transgender women must be considered when it comes to gender equality

Elianna Lev

Wed, March 8, 2023

Organizations across Canada are driving home the point that transgender women must be considered when it comes to gender equality.

To coincide with International Women’s Day, the Canadian Centre for Gender & Sexual Diversity (CCGSD) has gathered signatures from hundreds of community organizations throughout the country to publicly affirm that gender equality can't be achieved without supporting, celebrating, and uplifting trans women. The Elementary Teachers’ Federation of Ontario, Oxfam Canada, Imagine Canada and the Canadian Anti-Hate Network are just some of the organizations who have signed on to show their support for the statement.

Jaime Sadgrove is the manager of communications and advocacy with CCGSD, and uses they/them pronouns. They say the marked escalation of transphobic rhetoric and attacks in recent years could give the impression that there isn’t support for welcoming trans women into women’s spaces.

“We’re really of the belief that’s not what most people think,” Sadgrove tells Yahoo Canada.

“If you look at opinion polling, most people are broadly supportive of gender affirming care, the needs of trans people and that trans women are women who have a right to be included in the feminist movement.”

Across the U.S., anti-trans bills are being introduced at a sweeping pace. These range from denying the right of trans children and teachers from being visible in schools, blocking state recognition through birth certificates, and the ban on widely recognized gender-affirming healthcare.

Trans women are women who have a right to be included in the feminist movement.

Sadgrove says while we don’t hear anti-trans rhetoric being used as much by Canadian politicians publicly, the media landscape showcases similar messaging, by questioning trans-affirming care as a way to undermine the idea that trans people deserve to have access to care that lets them live as the person they are.

They add that while anti-trans political thought might not appear to be as mainstream in Canada, there is a growing movement, particularly in schools.

Sadgrove says there's been a spike in the number of school board trustee candidates running on anti-trans platforms. In February, an incident involving a high school student from Renfrew, Ont., gained attention from some right-wing American media outlets. The Grade 11 student was suspended for anti-trans rhetoric and later was arrested and charged with trespassing, when he returned to school regardless.

“When you look at what’s in the mainstream media about trans people and their needs, it’s really sensationalized, there’s a lot of disinformation,” Sadgrove says.

While the federal government is working on a national action plan to combat hate, Sadgrove says the CCGSD hasn’t heard anything that suggests they’re considering the needs of LGBTQ+ communities.

“We’re making sure that trans people especially, because they’re baring the brunt of that hate, have a seat at that table and that plan includes resources specifically dedicated to fighting trans hate,” they say.

It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Thursday, March 09, 2023

CRIMINAL CAPITALI$M

Chris Kay

Wed, March 8, 2023

(Bloomberg) -- The tiny island of Mauritius spent years trying to clean up its image as a base for murky money launderers and shell firms. The short-seller allegations against billionaire Gautam Adani are once again reviving questions about the country’s role as a tax haven for India’s tycoons.

In a report late January that sent Adani stocks on a $153 billion downward spiral, Hindenburg Research said that entities controlled by the tycoon’s brother, Vinod, or his associates used Mauritius as a conduit for money laundering and share-price manipulation. Though the report mentioned a “vast labyrinth” of shell companies from the Caribbean to the United Arab Emirates, it pinpointed offshore firms in Mauritius as having played a pivotal part.

The US-based short seller said 38 firms connected to Vinod were domiciled in the tropical island, located in the Indian Ocean off the eastern coast of Madagascar. Hindenburg claims some were used to reroute money from India that was then used to buy shares in the group, and inflate their stock prices back home. In the five years prior to the bombshell report, Adani equities saw some of their wildest rallies, with flagship Adani Enterprises Ltd. surging almost 2,600%, about 41 times the gain in the benchmark Nifty 50 index.

Staffers at Vinod’s Dubai offices recently directed requests for comment to the ports-to-energy conglomerate’s headquarters in India. A representative for Adani Group didn’t respond to a request for comment. In its 413-page rebuttal issued on Jan. 29, the group said Vinod has no role in Adani Group’s day-to-day affairs. The offshore entities are public shareholders in Adani portfolio companies and “innuendoes that they are in any manner related parties of the promoters are incorrect,” it said.

While it isn’t illegal to register businesses in low-tax jurisdictions like Mauritius, the allegations around the offshore shell firms appear to be a throwback to a time when the tourist paradise featured in a slew of other Indian corporate controversies since the late 1990s. The biggest of them was a stock market scandal that saw a broker drive up prices of select shares between 1998 and 2001.

The accusations against Adani — some reported by local media years before Hindenburg dropped its report — come at an uncomfortable time for Mauritius, which has been attempting to detoxify its financial industry and getting noticed for its efforts: the European Union just last year took it off a blacklist of countries it deems deficient in their anti money laundering and terrorism financing regimes.

“Adani’s alleged use of Mauritius as a center for shell companies is not unusual in the Indian context,” said Bhaskar Chakravorti, the dean of global business at The Fletcher School at Tufts University. What would be unusual is if this happened despite the cleanup efforts, he said. The “sheer scale” of what’s being alleged by Hindenburg is “staggering,” according to Chakravorti.

Hindenburg’s allegations landed right before a visit to India by Mahen Kumar Seeruttun, Mauritius’s minister of financial services and good governance, to drum up investment. In a February interview with Bloomberg News, Seeruttun said that the Adani Group has complied with all regulations in his country’s jurisdiction and his government will cooperate with Indian authorities on the matter.

“We want to uphold our reputation as a jurisdiction of repute and substance,” Seeruttun said.

In earlier comments to Bloomberg, Dhanesswurnath Thakoor, chief executive of the nation’s Financial Services Commission, denied that Mauritius is a tax haven. He said the country complies with the Organisation for Economic Co-operation and Development’s minimum taxation standards with a 15% corporate rate. In comparison, the British Virgin Islands levies no tax.

Corrosive Role

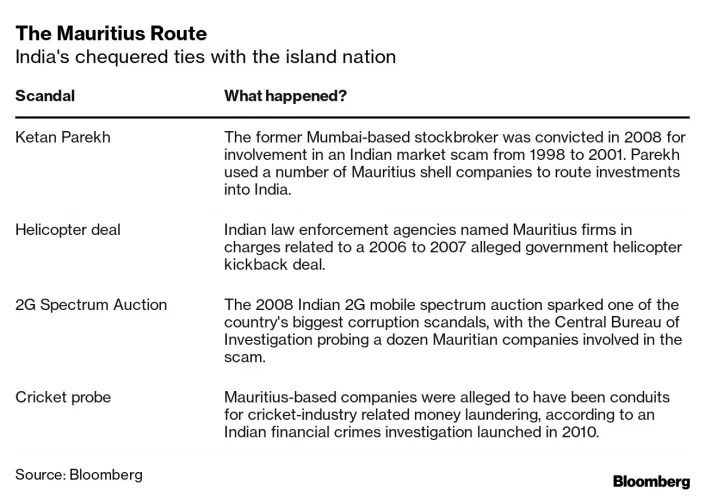

Mauritius-based shell companies have been at the center of at least four major probes by Indian agencies in the past two decades for allegedly being conduits of illegal money. The country has also been accused by the UK’s Tax Justice Network group of playing a “corrosive role in Africa,” inflicting a $2.4 billion tax loss annually.

Commenting this week, Seeruttun said that reports like the one from Hindenburg do create doubts in the minds of some people about Mauritius, but the business community overseas has confidence in its jurisdiction. “Predictability, certainty, stability are the key words that they look for, and this is what Mauritius offers,” he said.

The origins of Mauritius’s status, which the Tax Justice Network says is a tax haven, can be traced to a treaty it signed with India in the early 1980s to promote trade and investment, where it eliminated double taxation and capital gains levies. At that time, Indian officials didn’t foresee that their country would soon abandon its Soviet-style socialist economy and embrace foreign capital.

As the South Asian nation was opening up, Mauritius signed into law an offshore business act in 1992, along with dozens of other bilateral tax treaties, allowing foreigners to set up companies with little disclosure or tax. Despite a headline corporate rate of 15%, for some entities, it effectively meant just 3%.

Combined with India’s cultural ties — two thirds of the island’s 1.3 million-strong population are of Indian origin — the treaties allowed Mauritius to become the South Asian nation’s largest source of foreign investment for some time until the year through March 2018.

The country, which gained independence from the British in 1968, is now one of the wealthiest in Africa. Services make up close to 70% of its $12 billion economy. According to the Tax Justice Network, about 2.3% of global tax haven flows make their way through the island known for its luxury holiday resorts and pristine beaches. That compares with the 6.4% for top-ranked BVI.

“Historically the treaty with Mauritius was the standard way to invest into India,” said Reuven Avi-Yonah, a corporate and international taxation professor at the University of Michigan Law School. “It contained no limits on who the ultimate recipient of the income could be as long as the funds flowed through Mauritius.”

‘Layering’ of Ownership

As those flows gained momentum, so did suspicions that Indian entities were routing their money via Mauritius, a maneuver called round tripping, which could be used by companies and individuals to evade tax and launder criminal proceedings, according to Arun Kumar, a retired professor who taught at New Delhi’s Jawaharlal Nehru University. Money trails and ownership from India were obscured by a process of “layering” through multiple overseas shell companies, he said.

“They were using this web to basically prevent investigative agencies from figuring out who’s moving what money and make it look as if these were genuine foreign funds and not round-trip funds,” said Kumar, who’s authored a book on India’s illicit economy.

Eventually, Mauritius came under global pressure after the Paradise Papers, a trove of documents leaked to the International Consortium of Investigative Journalists in 2017, alleged the country was a secretive financial hub that allowed businesses and wealthy individuals to shield their assets and profits from taxation.

For India, a succession of financial scandals and frustration at attempts to make foreign corporates pay more tax led to the two countries in 2016 reworking their treaty. It closed a popular loophole so India could tax short-term capital gains, though zero levies remain on investments held for over a year.

Little Impact

India also tightened rules on so-called participatory notes, which were used to anonymously invest in Indian stocks and derivatives, forcing issuers to verify client identity.

Mauritius reworked some of its tax laws and treaties, supporting in October 2021 a global agreement that introduced a minimum corporate tax rate as well as greater disclosure for businesses with annual revenue above 750 million euros ($791 million).

Those measures did see the Financial Action Task Force — a global watchdog — remove Mauritius in 2021 from its gray monitoring list. Within months, the EU moved to take it off its blacklist.

The steps also meant the waning of Mauritius’s position as India’s biggest source of foreign direct investment. After peaking at $15.9 billion in the year through March 2018, the flows have dropped sharply to $9.4 billion, according to Reserve Bank of India data, relegating the country below Singapore and the US.

“The Mauritius route is less appealing now because of both the changes in the law and in the tax treaty,” said Avi-Yonah.

Even so, Mauritius remains a popular offshore base for many investors seeking opportunities in some of the biggest markets.

The furor over Adani isn’t forcing a reckoning on the island’s sandy shores. Lovania Pertab, the chairperson of the local chapter of Transparency International, the anti-corruption group, said nobody wants to wreck its lucrative offshore financial industry. But setting up 38 companies in Mauritius, as Hindenburg alleges Adani did in their report, “looks very abnormal,” she said.

“In Mauritius, nobody is talking about it,” she said. “They don’t want to appear to be India bashing.”

--With assistance from Kamlesh Bhuckory, Sudhi Ranjan Sen, Debjit Chakraborty, Ashutosh Joshi and Ishika Mookerjee.

DESANTISLAND

DeSantis' new Disney World board hints at future controversy

A sign near the entrance of the Reedy Creek Improvement District administration building is seen on Feb. 6, 2023, in Lake Buena Vista, Fla. The first meeting of the new board of Walt Disney World’s government — overhauled by sweeping legislation signed by Republican Gov. Ron DeSantis as an apparent punishment for Disney publicly challenging Florida’s so-called “Don’t Say Gay” bill — dealt with the rote affairs any other municipal government handles. Board members on Wednesday, March 8, faced calls for better firefighter equipment, lessons on public records requests and bond ratings. They replaced a board that had been controlled by Disney during the previous 55 years that the government operated as the Reedy Creek Improvement District. (AP Photo/John Raoux, File)

MIKE SCHNEIDER

Wed, March 8, 2023

LAKE BUENA VISTA, Fla. (AP) — The first meeting of the new board of Walt Disney World’s government — overhauled by sweeping legislation signed by Republican Gov. Ron DeSantis as punishment for Disney publicly challenging Florida's so-called “Don’t Say Gay” bill — dealt with the rote affairs any other municipal government would handle: calls for better firefighter equipment, lessons on public records requests and bond ratings.

But the five board members appointed by DeSantis hinted Wednesday at future controversial actions they may take, including prohibiting COVID-19 restrictions at Disney World and recommending the elimination of two cities that were created after the Florida Legislature in 1967 approved the theme park resort's self-governance.

The board also approved hiring the same law firm that advised the governor's office in making changes to the governing district to help interpret the new legislation.

For the most part, the new board members listened in a hotel ballroom outside Disney World as members of the public and workers from the district's departments explained what they do.

Martin Garcia, the board's new chair, said the major distinction between the old board controlled by Disney and the new one appointed by DeSantis will be a broader constituency encompassing more than just a single company, instead also representing workers and residents of surrounding communities.

“You didn’t elect us, but the people of Florida elected a governor who appointed us,” Garcia said. “I see there will be much broader representation.”

The other new board members for what has been rechristened the Central Florida Tourism Oversight District included Bridget Ziegler, a conservative school board member and wife of the Florida Republican party chairman Christian Ziegler; Brian Aungst Jr., an attorney and son of a former two-term Republican mayor of Clearwater; Mike Sasso, an attorney; and Ron Peri, head of The Gathering USA ministry.

They replaced a board that had been controlled by Disney during the previous 55 years that the government operated as the Reedy Creek Improvement District.

The new name will require a new logo to replace the old one that's on 123 vehicles, 300 trash cans and 1,000 manhole covers, district administrator John Classe told board members.

The takeover of the Disney district by DeSantis and the Florida Legislature began last year when the entertainment giant, facing intense pressure, publicly opposed “Don’t Say Gay,” which bars instruction on sexual orientation and gender identity in kindergarten through third grade, as well as lessons deemed not age-appropriate.

DeSantis moved quickly to penalize the company, directing lawmakers in the GOP-dominated Legislature to dissolve Disney’s self-governing district during a special legislative session, beginning a closely watched restructuring process.

In taking on Disney, DeSantis furthered his reputation as a culture warrior willing to battle perceived political enemies and wield the power of state government to accomplish political goals, a strategy that is expected to continue ahead of his potential White House run.

After the meeting, Josh D’Amaro, chairman of Disney Parks, Experiences & Products, said in a statement that he was hopeful the new board would continue to maintain “the highest standards" for the resort's infrastructure, set by its predecessor, and support ongoing growth at the resort.

During public comments at Wednesday's meeting, the leader of the union for the district’s firefighters, which had clashed with the previous board, welcomed the new members, calling the new board “a fresh start.” Jon Shirey urged the new board to devote resources to purchasing new fire trucks, improving pay and increasing staff, saying the 32 firefighters who are on duty each day is just two more than it was in 1989.

"It’s safe to say that Disney has grown exponentially,” Shirey said.

___

Follow Mike Schneider on Twitter at @MikeSchneiderAP

DeSantis' new Disney World board hints at future controversy

A sign near the entrance of the Reedy Creek Improvement District administration building is seen on Feb. 6, 2023, in Lake Buena Vista, Fla. The first meeting of the new board of Walt Disney World’s government — overhauled by sweeping legislation signed by Republican Gov. Ron DeSantis as an apparent punishment for Disney publicly challenging Florida’s so-called “Don’t Say Gay” bill — dealt with the rote affairs any other municipal government handles. Board members on Wednesday, March 8, faced calls for better firefighter equipment, lessons on public records requests and bond ratings. They replaced a board that had been controlled by Disney during the previous 55 years that the government operated as the Reedy Creek Improvement District. (AP Photo/John Raoux, File)

MIKE SCHNEIDER

Wed, March 8, 2023

LAKE BUENA VISTA, Fla. (AP) — The first meeting of the new board of Walt Disney World’s government — overhauled by sweeping legislation signed by Republican Gov. Ron DeSantis as punishment for Disney publicly challenging Florida's so-called “Don’t Say Gay” bill — dealt with the rote affairs any other municipal government would handle: calls for better firefighter equipment, lessons on public records requests and bond ratings.

But the five board members appointed by DeSantis hinted Wednesday at future controversial actions they may take, including prohibiting COVID-19 restrictions at Disney World and recommending the elimination of two cities that were created after the Florida Legislature in 1967 approved the theme park resort's self-governance.

The board also approved hiring the same law firm that advised the governor's office in making changes to the governing district to help interpret the new legislation.

For the most part, the new board members listened in a hotel ballroom outside Disney World as members of the public and workers from the district's departments explained what they do.

Martin Garcia, the board's new chair, said the major distinction between the old board controlled by Disney and the new one appointed by DeSantis will be a broader constituency encompassing more than just a single company, instead also representing workers and residents of surrounding communities.

“You didn’t elect us, but the people of Florida elected a governor who appointed us,” Garcia said. “I see there will be much broader representation.”

The other new board members for what has been rechristened the Central Florida Tourism Oversight District included Bridget Ziegler, a conservative school board member and wife of the Florida Republican party chairman Christian Ziegler; Brian Aungst Jr., an attorney and son of a former two-term Republican mayor of Clearwater; Mike Sasso, an attorney; and Ron Peri, head of The Gathering USA ministry.

They replaced a board that had been controlled by Disney during the previous 55 years that the government operated as the Reedy Creek Improvement District.

The new name will require a new logo to replace the old one that's on 123 vehicles, 300 trash cans and 1,000 manhole covers, district administrator John Classe told board members.

The takeover of the Disney district by DeSantis and the Florida Legislature began last year when the entertainment giant, facing intense pressure, publicly opposed “Don’t Say Gay,” which bars instruction on sexual orientation and gender identity in kindergarten through third grade, as well as lessons deemed not age-appropriate.

DeSantis moved quickly to penalize the company, directing lawmakers in the GOP-dominated Legislature to dissolve Disney’s self-governing district during a special legislative session, beginning a closely watched restructuring process.

In taking on Disney, DeSantis furthered his reputation as a culture warrior willing to battle perceived political enemies and wield the power of state government to accomplish political goals, a strategy that is expected to continue ahead of his potential White House run.

After the meeting, Josh D’Amaro, chairman of Disney Parks, Experiences & Products, said in a statement that he was hopeful the new board would continue to maintain “the highest standards" for the resort's infrastructure, set by its predecessor, and support ongoing growth at the resort.

During public comments at Wednesday's meeting, the leader of the union for the district’s firefighters, which had clashed with the previous board, welcomed the new members, calling the new board “a fresh start.” Jon Shirey urged the new board to devote resources to purchasing new fire trucks, improving pay and increasing staff, saying the 32 firefighters who are on duty each day is just two more than it was in 1989.

"It’s safe to say that Disney has grown exponentially,” Shirey said.

___

Follow Mike Schneider on Twitter at @MikeSchneiderAP

SLEAZY CRIMINAL CAPITALI$M

JPMorgan sues former exec over ties to Epstein sex abuse

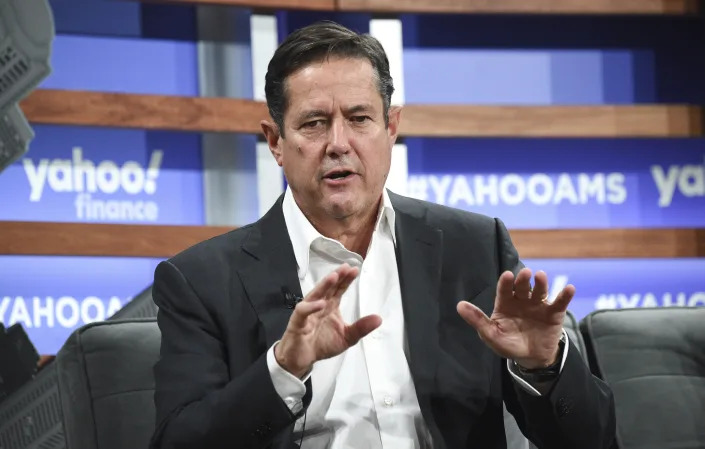

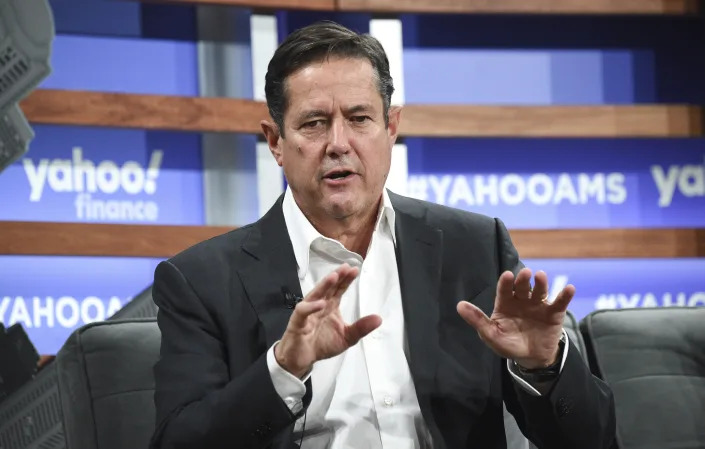

Barclays CEO Jes Staley participates in the Yahoo Finance All Markets Summit at Union West on Oct. 10, 2019, in New York. Facing lawsuits over its own relationship with Jeffrey Epstein, JPMorgan Chase on Wednesday, March 8, 2023, sued its former executive Staley, saying he knew “without a doubt” that Epstein was abusing and trafficking girls. (Photo by Evan Agostini/Invision/AP, File)

KEN SWEET

Wed, March 8, 2023

NEW YORK (AP) — JPMorgan Chase sued its former executive Jes Staley on Wednesday, alleging that he aided in hiding Jeffrey Epstein’s yearslong sex abuse and trafficking in order to keep the financier as a client.

The New York bank seeks to hold Staley personally liable for any financial penalties that JPMorgan may have to pay in two related cases. It is also seeking to force Staley to pay back wages he earned during the time he allegedly was aware of the abuse and “personally observed” Epstein's behavior on multiple occasions.

“In light of Staley’s intentional and outrageous conduct in failing to disclose pertinent information and abandoning (JPMorgan’s) interests in favor of his own and Epstein’s personal interests, (the bank) is entitled to punitive damages,” the bank said in its lawsuit.

A lawyer for Staley had no comment on the lawsuit.

JPMorgan's lawsuit was filed after the bank was sued by the government of the U.S. Virgin Islands, as well as by a woman identified as Jane Doe, who was allegedly abused by Epstein. Those lawsuits claim JPMorgan should have seen evidence of Epstein's sex trafficking and knowingly benefited from it.

Previous lawsuits have shown Staley and Epstein exchanged hundreds of emails and text messages over the years, and they were seen to have a close relationship that went beyond the professional relationship a banker would have with a wealthy client.

The bank continues to deny the allegations in its lawsuit, however it appears to allege that Staley may have committed sexual assault. It notes in its lawsuit that the anonymous Doe described a “powerful financial executive” could “use his clout within JP Morgan to make Epstein untouchable.” The bank says that the financial executive was Staley.

Epstein was arrested in 2019 on federal charges accusing him of paying underage girls hundreds of dollars in cash for massages and then molesting them at his homes in Florida and New York. He was found dead in jail on Aug. 10 of that year, at age 66. A medical examiner ruled his death a suicide.

Staley left JPMorgan in 2013 to become CEO of London-based bank Barclays. He resigned last year following a report by British regulators into his past links with Epstein.

____

AP Business Writer Barbara Ortutay contributed to this report from San Francisco.

Barclays CEO Jes Staley participates in the Yahoo Finance All Markets Summit at Union West on Oct. 10, 2019, in New York. Facing lawsuits over its own relationship with Jeffrey Epstein, JPMorgan Chase on Wednesday, March 8, 2023, sued its former executive Staley, saying he knew “without a doubt” that Epstein was abusing and trafficking girls. (Photo by Evan Agostini/Invision/AP, File)

KEN SWEET

Wed, March 8, 2023

NEW YORK (AP) — JPMorgan Chase sued its former executive Jes Staley on Wednesday, alleging that he aided in hiding Jeffrey Epstein’s yearslong sex abuse and trafficking in order to keep the financier as a client.

The New York bank seeks to hold Staley personally liable for any financial penalties that JPMorgan may have to pay in two related cases. It is also seeking to force Staley to pay back wages he earned during the time he allegedly was aware of the abuse and “personally observed” Epstein's behavior on multiple occasions.

“In light of Staley’s intentional and outrageous conduct in failing to disclose pertinent information and abandoning (JPMorgan’s) interests in favor of his own and Epstein’s personal interests, (the bank) is entitled to punitive damages,” the bank said in its lawsuit.

A lawyer for Staley had no comment on the lawsuit.

JPMorgan's lawsuit was filed after the bank was sued by the government of the U.S. Virgin Islands, as well as by a woman identified as Jane Doe, who was allegedly abused by Epstein. Those lawsuits claim JPMorgan should have seen evidence of Epstein's sex trafficking and knowingly benefited from it.

Previous lawsuits have shown Staley and Epstein exchanged hundreds of emails and text messages over the years, and they were seen to have a close relationship that went beyond the professional relationship a banker would have with a wealthy client.

The bank continues to deny the allegations in its lawsuit, however it appears to allege that Staley may have committed sexual assault. It notes in its lawsuit that the anonymous Doe described a “powerful financial executive” could “use his clout within JP Morgan to make Epstein untouchable.” The bank says that the financial executive was Staley.

Epstein was arrested in 2019 on federal charges accusing him of paying underage girls hundreds of dollars in cash for massages and then molesting them at his homes in Florida and New York. He was found dead in jail on Aug. 10 of that year, at age 66. A medical examiner ruled his death a suicide.

Staley left JPMorgan in 2013 to become CEO of London-based bank Barclays. He resigned last year following a report by British regulators into his past links with Epstein.

____

AP Business Writer Barbara Ortutay contributed to this report from San Francisco.

Diabolical liberty: after-school Satanists club threatens to sue district over ban

Erum Salam

Wed, March 8, 2023

Photograph: Joseph Prezioso/AFP/Getty Images

An after-school Satanists club in Pennsylvania is threatening to raise hell after local district leaders denied them the ability to convene on their school grounds.

The American Civil Liberties Union (ACLU), together with its Pennsylvania chapter, sent a letter to the Saucon Valley school district demanding that they allow the After School Satan Club, or ASSC, access to school facilities in accordance with the US constitution’s first amendment right to practice religion freely.

The ACLU alleges that the Satanist club was initially approved to use district facilities, but that approval was rescinded after district officials received pushback from community members. The club’s requested meeting dates were subsequently denied.

The After School Satan Club says it is a secular organization and its members do not actually believe in or worship the devil. According to their website, the club “does not believe in introducing religion into public schools and will only open a club if other religious groups are operating on campus”.

By contrast, the Good News Club, an organization sponsored by a local evangelical church devoted to spreading the word about the Bible, is allowed to host meetings on public school property.

In the letter addressed to the district, the ACLU said: “The district has intentionally opened up its facilities for general community use and, in so doing, may not limit access to this forum based on the content of our clients’ speech, their religious identity, or their viewpoint – even if some may find their beliefs ‘controversial or divisive’. Nor may the district restrict our clients’ access to this forum based on others’ animus toward our clients’ religion, or based on the anticipated or actual reactions to the content or viewpoint of our clients’ speech.”

The ACLU is threatening the school district with a lawsuit on behalf of the club and the Satanic Temple if the alleged discrimination continues.

Sara Rose, deputy legal director for the ACLU of Pennsylvania, told the Guardian: “It’s unfortunate that the school district is doubling down on its unconstitutional and discriminatory action against the club and The Satanic Temple. We are consulting with our clients as they carefully consider their next steps.”

The incident represents the larger debate about religious freedom in the US. Religion has served as a battleground for abortion rights, pitting those who believe in patient autonomy and a person’s right to choose whether or not they want an abortion against religious anti-abortion activists who believe abortion is a sin.

This is not the first time self-described Satanists in America have waged war against the religious far-right. The Satanic Temple group, based in Massachusetts, has a long history of advocating on issues such as abortion rights, prayer in classrooms and the distribution of Bibles in schools.

Satanic Temple members do not believe in Satan in a literal sense, but see Lucifer as a symbol of rebellion and opposition to authoritarianism.

The Saucon Valley school district did not respond to a request for comment.

Erum Salam

Wed, March 8, 2023

Photograph: Joseph Prezioso/AFP/Getty Images

An after-school Satanists club in Pennsylvania is threatening to raise hell after local district leaders denied them the ability to convene on their school grounds.

The American Civil Liberties Union (ACLU), together with its Pennsylvania chapter, sent a letter to the Saucon Valley school district demanding that they allow the After School Satan Club, or ASSC, access to school facilities in accordance with the US constitution’s first amendment right to practice religion freely.

The ACLU alleges that the Satanist club was initially approved to use district facilities, but that approval was rescinded after district officials received pushback from community members. The club’s requested meeting dates were subsequently denied.

The After School Satan Club says it is a secular organization and its members do not actually believe in or worship the devil. According to their website, the club “does not believe in introducing religion into public schools and will only open a club if other religious groups are operating on campus”.

By contrast, the Good News Club, an organization sponsored by a local evangelical church devoted to spreading the word about the Bible, is allowed to host meetings on public school property.

In the letter addressed to the district, the ACLU said: “The district has intentionally opened up its facilities for general community use and, in so doing, may not limit access to this forum based on the content of our clients’ speech, their religious identity, or their viewpoint – even if some may find their beliefs ‘controversial or divisive’. Nor may the district restrict our clients’ access to this forum based on others’ animus toward our clients’ religion, or based on the anticipated or actual reactions to the content or viewpoint of our clients’ speech.”

The ACLU is threatening the school district with a lawsuit on behalf of the club and the Satanic Temple if the alleged discrimination continues.

Sara Rose, deputy legal director for the ACLU of Pennsylvania, told the Guardian: “It’s unfortunate that the school district is doubling down on its unconstitutional and discriminatory action against the club and The Satanic Temple. We are consulting with our clients as they carefully consider their next steps.”

The incident represents the larger debate about religious freedom in the US. Religion has served as a battleground for abortion rights, pitting those who believe in patient autonomy and a person’s right to choose whether or not they want an abortion against religious anti-abortion activists who believe abortion is a sin.

This is not the first time self-described Satanists in America have waged war against the religious far-right. The Satanic Temple group, based in Massachusetts, has a long history of advocating on issues such as abortion rights, prayer in classrooms and the distribution of Bibles in schools.

Satanic Temple members do not believe in Satan in a literal sense, but see Lucifer as a symbol of rebellion and opposition to authoritarianism.

The Saucon Valley school district did not respond to a request for comment.

CRYPTO CRIMINAL CAPITALI$M

Bankman-Fried's bid to shift blame complicated by new charges

Former FTX Chief Executive Sam Bankman-Fried arrives to the

Bankman-Fried's bid to shift blame complicated by new charges

Former FTX Chief Executive Sam Bankman-Fried arrives to the

Manhattan federal court in New York

Wed, March 8, 2023

By Luc Cohen

NEW YORK (Reuters) -Since his December arrest on fraud charges, FTX founder Sam Bankman-Fried and his lawyers have suggested part of his defense will be seeking to distance himself from the day-to-day operations of the now-bankrupt cryptocurrency exchange.

But new accusations against him and a third former member of his inner circle in recent weeks could complicate that strategy, some experts said.

Federal prosecutors in Manhattan unveiled new charges on Feb. 23 that appeared to undermine some of Bankman-Fried's public claims since the collapse of FTX, and later revealed the guilty plea and cooperation of the exchange's former engineering chief Nishad Singh.

Former FTX technology chief Gary Wang and Caroline Ellison, formerly the CEO of Bankman-Fried's Alameda Research hedge fund, had each previously pleaded guilty and are cooperating.

Bankman-Fried previously pleaded not guilty to stealing billions of dollars in FTX customer funds to plug losses at Alameda.

The 31-year-old former billionaire and his lawyers have suggested they will attempt to shift blame onto Ellison and dispute her expected testimony at his Oct. 2 trial.

It is common for defendants to challenge the credibility of cooperating witnesses, often arguing that they are motivated to lie and implicate others in a bid to win leniency.

Doing so is more difficult when multiple witnesses point the finger at the same person, experts said.

"The defendant is going to say, 'No, you did it, you're the one who was the most responsible, and now you're trying to blame me,'" said Rebecca Mermelstein, a former Manhattan federal prosecutor and now a partner at O'Melveny.

Spokespeople for Bankman-Fried and for the U.S. Attorney's office in Manhattan declined to comment.

'VERY DIFFERENT VIEW'

At her plea hearing in December, Ellison admitted she and Bankman-Fried conspired to mislead Alameda's lenders, with Alameda providing secret loans to Bankman-Fried which the hedge fund then hid on its balance sheets.

Bankman-Fried appeared to contradict that in a Jan. 12 blog post, saying he was not running Alameda and "was told" - without saying by whom - that its balance sheets were accurate.

Bankman-Fried's defense lawyer Mark Cohen also challenged another of Ellison's statements to prosecutors: according to U.S. District Judge Lewis Kaplan, she told them that Bankman-Fried had instructed FTX employees it was "best not to have documents" because they could be used as evidence.

"We have a very different view of what happened," Cohen said at a Feb. 16 court hearing. "That's for trial, your Honor, but that's not what happened."

Ellison's lawyer did not respond to requests for comment.

In unveiling the new charges in a superseding indictment, prosecutors dismissed the idea that Bankman-Fried was in the dark about his former colleagues' crimes. Prosecutors said he directed Ellison to mislead creditors about the money Alameda borrowed, and that he remained Alameda's "ultimate decisionmaker" despite stepping down as CEO.

"The superseding indictment seems designed to undercut the defenses that he has floated in public," said Mark Kasten, counsel at Buchanan Ingersoll & Rooney in Philadelphia.

It also complicates Bankman-Fried's defense because it contains references to an electronic message Bankman-Fried received from Ellison, as well as messages between him and Singh, who is referred to in the indictment as CC-1. Prosecutors described the conversation between the two men as a plot to conceal a scheme to make illegal political campaign donations.

Beyond the content of the particular messages, the mere revelation that prosecutors have them could be troubling for Bankman-Fried, since contemporaneous statements by a defendant can make it harder to refute witness testimony, experts said.

Despite the hurdles, experts said Bankman-Fried will still likely dispute that he knew former members of his inner circle were breaking the law, Kasten said.

"He still is going to have to attack the government witnesses," Kasten said, summing up one possible defense: "Yes, he was the public face of the company, but he trusted his confidantes to run the business, and he thought that they were doing it lawfully."

(Reporting by Luc Cohen in New York; Editing by Daniel Wallis and Noeleen Walder)

Wed, March 8, 2023

By Luc Cohen

NEW YORK (Reuters) -Since his December arrest on fraud charges, FTX founder Sam Bankman-Fried and his lawyers have suggested part of his defense will be seeking to distance himself from the day-to-day operations of the now-bankrupt cryptocurrency exchange.

But new accusations against him and a third former member of his inner circle in recent weeks could complicate that strategy, some experts said.

Federal prosecutors in Manhattan unveiled new charges on Feb. 23 that appeared to undermine some of Bankman-Fried's public claims since the collapse of FTX, and later revealed the guilty plea and cooperation of the exchange's former engineering chief Nishad Singh.

Former FTX technology chief Gary Wang and Caroline Ellison, formerly the CEO of Bankman-Fried's Alameda Research hedge fund, had each previously pleaded guilty and are cooperating.

Bankman-Fried previously pleaded not guilty to stealing billions of dollars in FTX customer funds to plug losses at Alameda.

The 31-year-old former billionaire and his lawyers have suggested they will attempt to shift blame onto Ellison and dispute her expected testimony at his Oct. 2 trial.

It is common for defendants to challenge the credibility of cooperating witnesses, often arguing that they are motivated to lie and implicate others in a bid to win leniency.

Doing so is more difficult when multiple witnesses point the finger at the same person, experts said.

"The defendant is going to say, 'No, you did it, you're the one who was the most responsible, and now you're trying to blame me,'" said Rebecca Mermelstein, a former Manhattan federal prosecutor and now a partner at O'Melveny.

Spokespeople for Bankman-Fried and for the U.S. Attorney's office in Manhattan declined to comment.

'VERY DIFFERENT VIEW'

At her plea hearing in December, Ellison admitted she and Bankman-Fried conspired to mislead Alameda's lenders, with Alameda providing secret loans to Bankman-Fried which the hedge fund then hid on its balance sheets.

Bankman-Fried appeared to contradict that in a Jan. 12 blog post, saying he was not running Alameda and "was told" - without saying by whom - that its balance sheets were accurate.

Bankman-Fried's defense lawyer Mark Cohen also challenged another of Ellison's statements to prosecutors: according to U.S. District Judge Lewis Kaplan, she told them that Bankman-Fried had instructed FTX employees it was "best not to have documents" because they could be used as evidence.

"We have a very different view of what happened," Cohen said at a Feb. 16 court hearing. "That's for trial, your Honor, but that's not what happened."

Ellison's lawyer did not respond to requests for comment.

In unveiling the new charges in a superseding indictment, prosecutors dismissed the idea that Bankman-Fried was in the dark about his former colleagues' crimes. Prosecutors said he directed Ellison to mislead creditors about the money Alameda borrowed, and that he remained Alameda's "ultimate decisionmaker" despite stepping down as CEO.

"The superseding indictment seems designed to undercut the defenses that he has floated in public," said Mark Kasten, counsel at Buchanan Ingersoll & Rooney in Philadelphia.

It also complicates Bankman-Fried's defense because it contains references to an electronic message Bankman-Fried received from Ellison, as well as messages between him and Singh, who is referred to in the indictment as CC-1. Prosecutors described the conversation between the two men as a plot to conceal a scheme to make illegal political campaign donations.

Beyond the content of the particular messages, the mere revelation that prosecutors have them could be troubling for Bankman-Fried, since contemporaneous statements by a defendant can make it harder to refute witness testimony, experts said.

Despite the hurdles, experts said Bankman-Fried will still likely dispute that he knew former members of his inner circle were breaking the law, Kasten said.

"He still is going to have to attack the government witnesses," Kasten said, summing up one possible defense: "Yes, he was the public face of the company, but he trusted his confidantes to run the business, and he thought that they were doing it lawfully."

(Reporting by Luc Cohen in New York; Editing by Daniel Wallis and Noeleen Walder)

Hungary vows to fight in EU court to defend anti-LGBT law

Thu, March 9, 2023

BUDAPEST (Reuters) - Hungary's Justice Minister said late on Wednesday that Budapest would fight in the Court of Justice of the EU to defend an education law that Brussels says discriminates against people on the basis of sexual orientation and gender identity.

Justice Minister Judit Varga said in a Facebook post she had submitted a counter claim to the court because the government would stick to its stance that education was a matter for national governments to decide.

Prime Minister Viktor Orban's anti-LGBT campaign escalated in June 2021 when the parliament, dominated by his Fidesz party, passed a law banning the use of materials seen as promoting homosexuality and gender change at schools.

The government has said the law aimed to protect children, not target the LGBT community.

"Just as we have done so far, we will go to the wall if it's about protecting our children," Varga said, adding that uphold the legislation was necessary and further measures would be taken. She did not specify what they would be.

The standoff comes at a time when Brussels has suspended the disbursement of billions of euros of much-needed EU funds to Hungary until Budapest implements reforms to improve judicial independence and tackle corruption.

The European Commission referred Hungary to the Court of Justice of the EU over the anti-LGBT law in mid-2022.

The commission has said it considers that the law violates the EU's internal market rules, the fundamental rights of individuals and EU values.

Orban said in a speech last month, defending the legislation: "Gender propaganda is not just ... rainbow chatter, but the greatest threat stalking our children. We want our children to be left alone .... This kind of thing has no place in Hungary, and especially not in our schools."

(Reporting by Krisztina Than; Editing by Bradley Perrett)

Thu, March 9, 2023

BUDAPEST (Reuters) - Hungary's Justice Minister said late on Wednesday that Budapest would fight in the Court of Justice of the EU to defend an education law that Brussels says discriminates against people on the basis of sexual orientation and gender identity.

Justice Minister Judit Varga said in a Facebook post she had submitted a counter claim to the court because the government would stick to its stance that education was a matter for national governments to decide.

Prime Minister Viktor Orban's anti-LGBT campaign escalated in June 2021 when the parliament, dominated by his Fidesz party, passed a law banning the use of materials seen as promoting homosexuality and gender change at schools.

The government has said the law aimed to protect children, not target the LGBT community.

"Just as we have done so far, we will go to the wall if it's about protecting our children," Varga said, adding that uphold the legislation was necessary and further measures would be taken. She did not specify what they would be.

The standoff comes at a time when Brussels has suspended the disbursement of billions of euros of much-needed EU funds to Hungary until Budapest implements reforms to improve judicial independence and tackle corruption.

The European Commission referred Hungary to the Court of Justice of the EU over the anti-LGBT law in mid-2022.

The commission has said it considers that the law violates the EU's internal market rules, the fundamental rights of individuals and EU values.

Orban said in a speech last month, defending the legislation: "Gender propaganda is not just ... rainbow chatter, but the greatest threat stalking our children. We want our children to be left alone .... This kind of thing has no place in Hungary, and especially not in our schools."

(Reporting by Krisztina Than; Editing by Bradley Perrett)

BANNED IN INDIA BUT NOT GOP W.VA

Child marriage ban bill defeated in West Virginia House

JOHN RABY\

Wed, March 8, 2023

CHARLESTON, W.Va. (AP) — A bill that would have prohibited minors from getting married in West Virginia was defeated Wednesday night in a legislative committee.

The Republican-dominated Senate Judiciary Committee rejected the bill on a 9-8 vote, a week after it passed the House of Delegates.

The vote came shortly after the bill's main sponsor, Democratic Del. Kayla Young of Kanawha County, testified briefly before the committee. She said that since 2000 there have been more than 3,600 marriages in the state involving one or more children.

Currently, children can marry as young as 16 in West Virginia with parental consent. Anyone younger than that also must get a judge’s waiver.

“For now, there will be no floor for the age of marriage in WV, endangering our kids,” Young wrote on Twitter after the vote.

In a rebuke, Cabell County Democratic Sen. Mike Woelfel reminded the committee after the vote that Wednesday was International Women’s Day.

Some of the bill's opponents have argued that teenage marriages are a part of life in West Virginia.

Kanawha County Republican Sen. Mike Stuart, a former federal prosecutor who sided with the majority, said his vote “wasn’t a vote against women.” He said his mother was married when she was 16, and “six months later, I came along. I’m the luckiest guy in the world.”

The bill would have established that 18 is the age of consent and removed the ability of a minor to obtain consent through their parents, legal guardians, or by court petition. Existing legal marriages, including those done in other states, would have been unaffected.

According to the nonprofit group Unchained At Last, which seeks to end forced and child marriage, seven states have set the minimum age for marriage at 18, all since 2018. Supporters of such legislation say it reduces domestic violence, unwanted pregnancies and improves the lives of teens.

Although recent figures are unavailable, according to the Pew Research Center, West Virginia had the highest rate of child marriages among the states in 2014, when the state's five-year average was 7.1 marriages for every 1,000 children ages 15 to 17.

Child marriage ban bill defeated in West Virginia House

JOHN RABY\

Wed, March 8, 2023

CHARLESTON, W.Va. (AP) — A bill that would have prohibited minors from getting married in West Virginia was defeated Wednesday night in a legislative committee.

The Republican-dominated Senate Judiciary Committee rejected the bill on a 9-8 vote, a week after it passed the House of Delegates.

The vote came shortly after the bill's main sponsor, Democratic Del. Kayla Young of Kanawha County, testified briefly before the committee. She said that since 2000 there have been more than 3,600 marriages in the state involving one or more children.

Currently, children can marry as young as 16 in West Virginia with parental consent. Anyone younger than that also must get a judge’s waiver.

“For now, there will be no floor for the age of marriage in WV, endangering our kids,” Young wrote on Twitter after the vote.

In a rebuke, Cabell County Democratic Sen. Mike Woelfel reminded the committee after the vote that Wednesday was International Women’s Day.

Some of the bill's opponents have argued that teenage marriages are a part of life in West Virginia.

Kanawha County Republican Sen. Mike Stuart, a former federal prosecutor who sided with the majority, said his vote “wasn’t a vote against women.” He said his mother was married when she was 16, and “six months later, I came along. I’m the luckiest guy in the world.”

The bill would have established that 18 is the age of consent and removed the ability of a minor to obtain consent through their parents, legal guardians, or by court petition. Existing legal marriages, including those done in other states, would have been unaffected.

According to the nonprofit group Unchained At Last, which seeks to end forced and child marriage, seven states have set the minimum age for marriage at 18, all since 2018. Supporters of such legislation say it reduces domestic violence, unwanted pregnancies and improves the lives of teens.

Although recent figures are unavailable, according to the Pew Research Center, West Virginia had the highest rate of child marriages among the states in 2014, when the state's five-year average was 7.1 marriages for every 1,000 children ages 15 to 17.

Russia-based Insight Group acquires Deere & Co leasing arm

The Deere & Co farm equipment plant in Ankeny, Iowa

Wed, March 8, 2023

(Reuters) - Russia-based private equity firm Insight Investment Group has acquired the Russian leasing arm of farm equipment maker Deere & Co, a state register of corporate entities showed.

Insight Investment Group confirmed the acquisition of John Deere Financial LLC, a subsidiary of the U.S. company, but declined to disclose the price. It said the deal had obtained approval from a Russian government commission on the control of foreign investment.

Russia has tightened rules on asset sales by investors from so-called "unfriendly" countries - those that have imposed sanctions against Moscow over its actions in Ukraine.

Those selling stakes in Russian assets may now have to do so at half price or less, the finance ministry has said, with the Russian budget potentially taking a 10% cut of any transaction.

John Deere last March suspended shipments of machines to Russia and subsequently Belarus, saying it was deeply saddened by the "significant escalation of events in Ukraine".

The company could not immediately be reached for comment on Wednesday.

Insight has issued bonds worth more than 100 billion roubles ($1.32 billion) and said it used some of those funds to buy both John Deere Financial and a leasing arm from engineering company Siemens AG last year.

"Our goal is to build a leasing holding which will unite leasing companies with different areas of expertise," Insight Group said. "Following this strategy, we have acquired John Deere Financial and do not exclude making other deals in this market."

($1 = 75.9530 roubles)

(Reporting by Alexander Marrow; Editing by Mark Trevelyan)

The Deere & Co farm equipment plant in Ankeny, Iowa

Wed, March 8, 2023

(Reuters) - Russia-based private equity firm Insight Investment Group has acquired the Russian leasing arm of farm equipment maker Deere & Co, a state register of corporate entities showed.

Insight Investment Group confirmed the acquisition of John Deere Financial LLC, a subsidiary of the U.S. company, but declined to disclose the price. It said the deal had obtained approval from a Russian government commission on the control of foreign investment.

Russia has tightened rules on asset sales by investors from so-called "unfriendly" countries - those that have imposed sanctions against Moscow over its actions in Ukraine.

Those selling stakes in Russian assets may now have to do so at half price or less, the finance ministry has said, with the Russian budget potentially taking a 10% cut of any transaction.

John Deere last March suspended shipments of machines to Russia and subsequently Belarus, saying it was deeply saddened by the "significant escalation of events in Ukraine".

The company could not immediately be reached for comment on Wednesday.

Insight has issued bonds worth more than 100 billion roubles ($1.32 billion) and said it used some of those funds to buy both John Deere Financial and a leasing arm from engineering company Siemens AG last year.

"Our goal is to build a leasing holding which will unite leasing companies with different areas of expertise," Insight Group said. "Following this strategy, we have acquired John Deere Financial and do not exclude making other deals in this market."

($1 = 75.9530 roubles)

(Reporting by Alexander Marrow; Editing by Mark Trevelyan)

Canadian Solar (CSIQ) Begins Operation of Three Solar Projects

Zacks Equity Research

Wed, March 8, 2023

Canadian Solar Inc.CSIQ recently announced that its three solar projects in Japan, Oita Kitsuki, Gunma Takasaki and Yamaguchi Hofu, boasting a capacity of 42 Megawatt-peak (MWp) began their operation in the first quarter of 2023.

The 53,000 MWh of energy generated from the three projects would be enough to power over 15,000 households. Meanwhile, Canadian Solar has also inked deals with various grids under Japan's feed-in-tariff program. This ensures the inflow of revenue for the company from the projects.

Canadian Solar’s Strong Footing in Japan

The company already enjoys a strong footing in Japan with nearly 518 MWp of utility-scale projects in operation or under construction and two partnership platforms in the Canadian Solar Infrastructure Fund and Japan Green Infrastructure Fund.

With the addition of the aforementioned solar projects, Canadian Solar aims to solidify its position in the Japanese solar market and capitalize on the growing solar demand in the region. Its capability to produce efficient modules adds to its competitive advantage in the region.

With the largest and strongest development platforms, Canadian Solar may continue to strengthen its footprint in Japan. This, in turn, may continue to bolster its revenue-generation prospects from the region.

Global Solar Market Boom

The global solar market has been rapidly gaining momentum due to increased focus on adopting renewable sources of energy and lowering the cost of panels complementing the growth. Various incentives and rebates by the government to support the development have been fueling the solar market’s growth.

The strong demand from various channels like roof-top-based solar panels for commercial and residential users and large-scale solar projects like utility-scale solar power plants and solar farms further triggers the penetration of the solar market.

Per the report from Mordor Intelligence, the global solar energy market is expected to grow at a CAGR of 12.7% over a period of 2023-2028 period. Such expanding market size entails promising returns for companies like Canadian Solar that are continuously striving to propel their positioning in the solar market.

Other solar players that have carved out a strong position in the global solar market are:

Enphase Energy ENPH enjoys a valuable position in the global solar market by manufacturing fully integrated solar-plus-storage solutions and microinverters. As of Dec 31, 2022, Enphase shipped more than 58 million microinverters. Currently, more than three million Enphase residential and commercial systems have been deployed across 145 countries.

Enphase boasts a long-term (three-five) earnings growth rate of 45.4%. ENPH shares have rallied 27.3% in the past year.

ReneSola SOL continues to benefit from a steady flow of contracts from domestic and international customers. With the successful execution of its downstream strategy, SOL is currently expanding its business in international markets. It is committed to adding an incremental project pipeline to its core markets, including the United States, the United Kingdom, Spain, Poland, France, Germany and Hungary.

The Zacks Consensus Estimate for 2023 sales suggests a growth rate of 9.5% from the prior-year reported figure. The company delivered an earnings surprise of 400% in the last reported quarter.

SolarEdge SEDG optimized inverter solutions address a broad range of solar markets. The company registered record revenues in 14 European countries and may continue to witness strong growth momentum.

SolarEdge’s long-term earnings growth rate is pegged at 31%. SEDG shares have rallied 11% in the past month.

Price Movement

In a year, shares of Canadian Solar have soared 15% compared with the industry’s growth of 23.6%.

Zacks Equity Research

Wed, March 8, 2023

Canadian Solar Inc.CSIQ recently announced that its three solar projects in Japan, Oita Kitsuki, Gunma Takasaki and Yamaguchi Hofu, boasting a capacity of 42 Megawatt-peak (MWp) began their operation in the first quarter of 2023.

The 53,000 MWh of energy generated from the three projects would be enough to power over 15,000 households. Meanwhile, Canadian Solar has also inked deals with various grids under Japan's feed-in-tariff program. This ensures the inflow of revenue for the company from the projects.

Canadian Solar’s Strong Footing in Japan

The company already enjoys a strong footing in Japan with nearly 518 MWp of utility-scale projects in operation or under construction and two partnership platforms in the Canadian Solar Infrastructure Fund and Japan Green Infrastructure Fund.

With the addition of the aforementioned solar projects, Canadian Solar aims to solidify its position in the Japanese solar market and capitalize on the growing solar demand in the region. Its capability to produce efficient modules adds to its competitive advantage in the region.

With the largest and strongest development platforms, Canadian Solar may continue to strengthen its footprint in Japan. This, in turn, may continue to bolster its revenue-generation prospects from the region.

Global Solar Market Boom

The global solar market has been rapidly gaining momentum due to increased focus on adopting renewable sources of energy and lowering the cost of panels complementing the growth. Various incentives and rebates by the government to support the development have been fueling the solar market’s growth.

The strong demand from various channels like roof-top-based solar panels for commercial and residential users and large-scale solar projects like utility-scale solar power plants and solar farms further triggers the penetration of the solar market.

Per the report from Mordor Intelligence, the global solar energy market is expected to grow at a CAGR of 12.7% over a period of 2023-2028 period. Such expanding market size entails promising returns for companies like Canadian Solar that are continuously striving to propel their positioning in the solar market.

Other solar players that have carved out a strong position in the global solar market are:

Enphase Energy ENPH enjoys a valuable position in the global solar market by manufacturing fully integrated solar-plus-storage solutions and microinverters. As of Dec 31, 2022, Enphase shipped more than 58 million microinverters. Currently, more than three million Enphase residential and commercial systems have been deployed across 145 countries.

Enphase boasts a long-term (three-five) earnings growth rate of 45.4%. ENPH shares have rallied 27.3% in the past year.

ReneSola SOL continues to benefit from a steady flow of contracts from domestic and international customers. With the successful execution of its downstream strategy, SOL is currently expanding its business in international markets. It is committed to adding an incremental project pipeline to its core markets, including the United States, the United Kingdom, Spain, Poland, France, Germany and Hungary.

The Zacks Consensus Estimate for 2023 sales suggests a growth rate of 9.5% from the prior-year reported figure. The company delivered an earnings surprise of 400% in the last reported quarter.

SolarEdge SEDG optimized inverter solutions address a broad range of solar markets. The company registered record revenues in 14 European countries and may continue to witness strong growth momentum.

SolarEdge’s long-term earnings growth rate is pegged at 31%. SEDG shares have rallied 11% in the past month.

Price Movement

In a year, shares of Canadian Solar have soared 15% compared with the industry’s growth of 23.6%.

Subscribe to:

Posts (Atom)