Russia's Nuclear Ambitions Face Funding Crisis

- Russian energy entities, including Rosatom, are experiencing significant financing difficulties, raising doubts about their ability to fulfill international energy project commitments.

- Kazakhstan has decided to independently build thermal power plants originally contracted to Russia's Inter RAO due to a lack of promised financing, and is increasingly turning to China for nuclear power plant construction.

- Rosatom is seeking government financial support to maintain its global leadership in the nuclear energy market and carry out new projects, citing limited financing options due to international sanctions.

Russian energy entities are experiencing financing woes, raising questions about whether Rosatom, Russia’s nuclear energy agency, will be able to fulfill its obligations to build Kazakhstan’s first atomic power plant.

Already, financing troubles have caused another Russian state-controlled firm, Inter RAO, to lose out on constructing three thermal power plants in Kazakhstan.

During a July 30 appearance before the Russian State Commission on Energy, Andrei Petrov, a top Rosatom official, openly acknowledged that Rosatom was seeking government support. The entity has the resources to complete ongoing work, but by 2027, it will need a financial injection to carry out new projects, Petrov indicated.

Rosatom officials have been somewhat cagey in specifying exactly what kind of support they are seeking and have shied away from specifying an amount. For example, Rosatom’s chief, Alexei Likhachev, recently stated the entity is seeking the “provision of special resources” from the government, according to a report published by the Interfax news agency.

In 2024, a Rosatom official, referring to a program to develop floating nuclear power plants, indicated that Rosatom had limited financing options due to international sanctions on Russia, and required state-subsidized low-interest loans in order for the company to maintain its industry lead in several areas. Rosatom presently enjoys a roughly 50 percent share of the global nuclear energy market, with operations even in several NATO member states, such as Turkey and Hungary.

“The only way to maintain leadership with this product [floating nuclear power plants] is to subsidize exports even more than we already are,” Interfax quoted Vladimir Aptekarev, a top official at the Rosatom subsidiary Atomenergomash JSC, as saying in 2024, citing Chinese competition.

The Russian government, given the immense burden on the state budget imposed by its war effort in Ukraine, has so far resisted pleas from energy entities for increased support. Rosatom officials have acknowledged that the lack of assistance has hindered efforts to build new types of thermal and nuclear units, known as units Shelf-M and Elena-AM.

The Russian government’s cash crunch appears to be responsible for delays in construction of three planned Kazakh thermal power plants near Kokshetau, Semey and Ust-Kamenogorsk. Inter RAO signed a contract to build the three plants at an estimated cost of about $2.7 billion, with financing to be provided by Russian state-connected institutions. But the money never materialized.

On July 31, Deputy Kazakh Prime Minister Roman Sklyar confirmed that Kazakhstan was ditching the contract with Inter RAO, adding that it would build the plants on its own, according to media reports.

“When the company [Inter RAO] took on the obligation to build these facilities, it was supposed to receive export financing at a low rate. Unfortunately, they were unable to do this, so it was decided to build them independently,” he said.

The Kazakh government’s decision to move on from Inter RAO on the thermal plant projects instantly sparks questions about the fate of Rosatom’s deal to build Kazakhstan’s first nuclear power station.

When Kazakhstan’s Atomic Energy Agency announced in June that Rosatom would lead the consortium to build the plant on the shores of Lake Balkhash, it indicated that the deal was contingent on the Russian entity’s ability to arrange financing. “Work on the issue of attracting state export financing at the expense of the Russian Federation has begun,” a KAEA statement announced at the time.

At the same time in June, Kazakh officials made the unexpected announcement that they were giving a contract to China’s National Nuclear Corporation (CNNC) to build a second nuclear power plant. At the time, observers saw the announcement as a shrewd move to keep Kazakhstan’s two powerful neighbors, Russia and China, happy. But in hindsight, the move can also be seen as a hedge.

On July 31, Kazakhstan appeared to give a vote of no-confidence in Rosatom’s ability to deliver on the nuclear plant. Sklyar, the deputy prime minister, announced that CNNC would lead construction of a third nuclear power plant in Kazakhstan. He declined to disclose a cost estimate for the projects, adding that the locations of both the second and third nuclear power stations had not been determined.

Even so, it appears Kazakhstan has a backup plan already in place in case the Rosatom deal falls through.

Tractebel, NRG-Pallas extend cooperation on research reactor

_43281.jpg)

Tractebel - part of France's Engie Group - has more than 60 years of experience in nuclear engineering and since 2015, alongside its subcontractor NucAdvisor, has acted as Owner's Engineer for the planned Pallas reactor. This has involved providing multidisciplinary expertise in engineering, safety, licensing and project management.

The company said the extended agreement "reinforces Tractebel's commitment to supporting the reactor's successful completion".

Tractebel said its contribution "entails embedding long-term experts within the integrated project team with the support of Tractebel's global nuclear competence centres, acting as an independent third-party reviewer for civil engineering works, and holding a Safety Chair position within the Pallas Safety Committee".

The company also plays an active role in delivering training and facilitating knowledge transfer to strengthen the Intelligent Customer and Design Authority capabilities of the Pallas organisation. It said its experts have worked on all phases of the Pallas project, from initial feasibility studies and the tendering phase to the various design phases and now construction.

Tractebel has provided engineering services for: siting and licensing support (supporting detailed site characterisation and preparing licensing documentation, both nuclear and conventional); design and safety (ensuring compliance with nuclear safety and engineering standards - including technical Health, Safety, and Environment in design, reviewing technical specifications and safety analysis reports); project and risk management (supporting procurement strategies and risk mitigation); and construction oversight (advising on civil works, including the complex foundation and pit construction.

"This project demonstrates Tractebel's ability to support complex, multidisciplinary endeavours, while maintaining the highest standards of safety, technical integrity, and project delivery," said Deepak Narasimhamurthy, Country Manager, The Netherlands, Tractebel. "It also shows how international collaboration, technical expertise, and a shared mission can drive innovation in healthcare and energy. This new agreement demonstrates NRG-Pallas's trust and our shared objectives, positioning Tractebel as a long-term strategic partner in the Netherlands' nuclear future."

In March 2023, Tractebel signed a memorandum of understanding with NRG-Pallas to collaborate in providing engineering services for the construction of large nuclear power plants in the Netherlands.

The Pallas reactor project

NRG-Pallas applied in June 2022 to the Dutch regulator, the Authority for Nuclear Safety and Radiation Protection, for a permit to construct and operate the Pallas reactor. ANVS granted a construction licence in mid-February 2023. Preparatory work on the foundation began in May 2023. This work was carried out by Belgian construction firm Besix, which was awarded a contract in November 2022.

In May this year, NRG-Pallas announced that the building of the construction pit - a hole of about 50 metres by 50 metres and 17.5 metres deep - and the foundation for the Pallas reactor had been completed.

Last month, the Netherlands' outgoing Minister of Health, Welfare and Sport Daniëlle Jansen informed the House of Representatives that the project to construct the Pallas research reactor is ready to enter the next phase of construction.

Although funding had been allocated in the coming years for the construction of the Pallas reactor, the Dutch government has yet to make a final decision on its construction. The European Commission has already approved, under EU state aid rules, the Dutch government's plan to invest EUR2 billion (USD2.2 billion) in the construction of Pallas.

Former Minister of Health, Welfare and Sport Ernst Kuipers instructed NRG-Pallas not to take any irreversible steps, but to continue with the preparations for the project in the meantime to avoid unnecessary delays.

The Pallas research reactor is to be built at Petten to replace the existing High Flux Reactor (HFR), which began operating in September 1960 and supplies about 60% of Europe's and 30% of the world's medical radioactive sources. Pallas will be of the "tank-in-pool" type, with a thermal power of around 55 MW, and able to deploy its neutron flux more efficiently and effectively than the HFR.

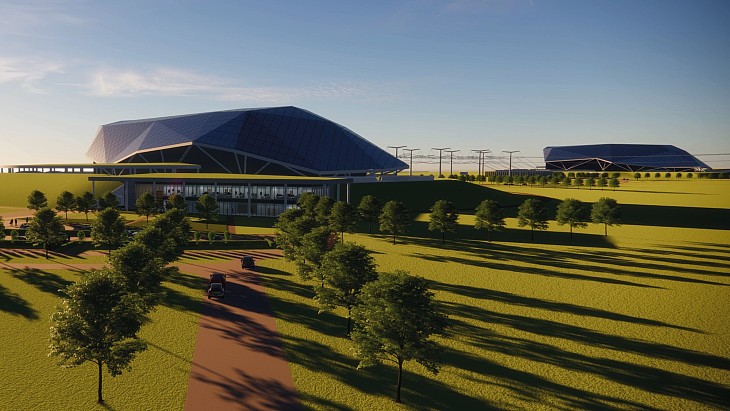

Rolls-Royce SMR agreements with Škoda and Curtiss-Wright

The agreement is described as the beginning of a strategic partnership, with Rolls-Royce SMR, now 20% owned by the Czech nuclear operator and Škoda JS parent company CEZ, saying that building long-term relationships with Czech suppliers was an important part of plans to deploy up to 3 GW of its units in the country.

Ruth Todd, Rolls-Royce SMR’s Operations & Supply Chain Director, said: "This agreement ... demonstrates our commitment to provide local opportunities to the Czech supply chain. Starting collaboration now will help Škoda JS supply its products to the required high standards and allow us to deliver this transformational opportunity together."

Silvana Jirotková, Director of the SMR Development Department at ČEZ, called it a "significant step in preparing the first Czech small modular reactor. From the beginning, we have emphasised that involving Czech industry in the development and construction of new nuclear sources is our priority, and the cooperation between the British SMR developer and this traditional Pilsen-based company is proof of that".

František Krček, Škoda JS CEO, said: "We are ready, and we have the significant support of our owner to invest further significant resources in the development of the SMR industry. We also want to involve our engineering capacities in this project in addition to our production capacities."

Rolls-Royce SMR has also signed a contract with another Czech company, ÚJV Řež, for the analysis, testing, and evaluation of critical SMR components.

Curtiss-Wright

In a separate announcement, Rolls-Royce SMR has also secured a multi-million-pound strategic partnership with Curtiss-Wright's UK-based nuclear business.

The Dorset business, formerly Ultra Energy, will provide design, qualification, testing and supply of the Non-programmable Diverse Reactor Protection Systems - "safety critical back-up instruments, designed to provide an independent means of shutting down a reactor. They are simple and robust, deploying proven-in-use electronic technology and techniques, while avoiding the use of microprocessors, software or programmable devices."

Ognjen Starovic, General Manager, Curtiss-Wright, said: "We have a strong UK-based team focused on supporting this partnership and we're all excited to be part of the Rolls-Royce SMR story. We take great pride in helping to deliver a British SMR, as well as provide our people with new career opportunities and create long-term job growth in the region."

Ruth Todd said "securing industry-leading expertise will further de-risk our programme by underpinning a critical element of the design".

Background

The Rolls-Royce SMR is a 470 MWe design based on a small pressurised water reactor. It will provide consistent baseload generation for at least 60 years. 90% of the SMR - measuring about 16 metres by 4 metres - will be built in factory conditions, limiting on-site activity primarily to assembly of pre-fabricated, pre-tested, modules which significantly reduces project risk and has the potential to drastically shorten build schedules.

In June this year it was selected as the UK government's preferred technology for the country's first SMR project. It is aiming to sign contracts with Rolls-Royce SMR later this year and will form a development company. It will also aim to allocate a site later this year and connect projects to the grid in the mid-2030s. A final investment decision is expected to be taken in 2029.

In October 2024, Rolls-Royce SMR was selected by CEZ to deploy up to 3 GW of electricity in the Czech Republic.

Hot testing of second Taipingling unit completed

_16015.jpg)

"On 30 July, with the drainage of the primary circuit of Unit 2 of the Taipingling nuclear power plant to the circuit water level and the successful completion of the last test of Phase II.3, it marked the successful completion of the hot performance test, and the unit took another step towards the goal of high-quality commissioning," China General Nuclear (CGN) said.

Hot functional tests involve increasing the temperature of the reactor coolant system and carrying out comprehensive tests to ensure that coolant circuits and safety systems are operating as they should. Carried out before the loading of nuclear fuel, such testing simulates the thermal working conditions of the power plant and verifies that nuclear island and conventional equipment and systems meet design requirements.

Cold functional tests - which are conducted to confirm whether components and systems important to safety are properly installed and ready to operate in a cold condition - were completed at Taipingling 2 earlier this year. The main purpose of those tests - which marked the first time the reactor systems were operated together with the auxiliary systems - was to verify the leak-tightness of the primary circuit.

Taipingling units 1 and 2 (Image: CGN)

The Taipingling plant will eventually have six Hualong One reactors. The construction of the first and second units began in 2019 and 2020, respectively. Hot testing of unit 1 was completed in September 2024. Unit 1 is scheduled to start up in 2025, with unit 2 following in 2026.

Construction of the second phase of the plant - units 3 and 4 - was approved by China's State Council on 29 December 2023, with construction of unit 3 getting under way in June this year.

Hungary looking at deployment of BWRX-300s

Poland's Synthos Green Energy is project developer for BWRX-300 small modular reactors (SMRs) in the region. The signing of the agreement took place in the presence of Hungarian Foreign Affairs and Trade Minister Peter Szijjartó, US Chargé d’Affaires Robert Palladino, and Polish Chargé d’Affaires Jacek Śladewski.

Szijjártó said that with the increasing electricity demand there was a need to sustain energy security by increasing nuclear capacity and "SMRs are the ideal solution for us". He announced the launch of preliminary work in Hungary to prepare for the introduction of SMRs, which "encompasses technology, infrastructure, financial, and legislative measures" under the letter of intent.

Hunatom is part of the Paks II Group.

The US Embassy in Hungary said "the signing marks a major milestone for the US Foundational Infrastructure for Responsible Use of Small Modular Reactor Technology (FIRST) Program, which co-funded a two-part licensing and regulatory study for SGE in Poland. Under the FIRST Program, the US SMR Pan-European Regional Interest Nuclear Group or SPRING project is now poised to facilitate deliveries of more BWRX300s in the region, through a fleet deployment approach that will increase efficiency and reliability and lower costs".

Palladino said: "The United States and Hungary are deepening our relationship across the board: in defence, in commerce, in space, and in energy. This is no accident. We are doing so because we share interests, and more importantly, because we share values: sovereignty, freedom, and the right to chart our own course.

"Hungary has made a clear and sovereign choice to invest in its energy future with trusted partners. And the United States is proud to be one of them. We are not here to impose; we are here to invest."

Synthos Green Energy's Michał Sołowow said: "I am here as an entrepreneur, but also as a Polish patriot. As a patriot, I know that our agreement is a step towards increasing the energy independence of the entire region, including Poland and Hungary."

Hungary currently has four operable reactors generating about half its electricity. The Paks plant, 100 kilometres south of Budapest, comprises four Russian-supplied VVER-440 pressurised water reactors, which started up between 1982 and 1987. An inter-governmental agreement was signed in early 2014 for Russian enterprises and their international sub-contractors to supply two VVER-1200 reactors at Paks II. First concrete has been scheduled for the first unit for later this year, or in 2026.

The BWRX-300 is a 300 MWe water-cooled, natural circulation SMR with passive safety systems that leverages the design and licensing basis of GE Vernova Hitachi Nuclear Energy's 1500 MW ESBWR boiling water reactor.

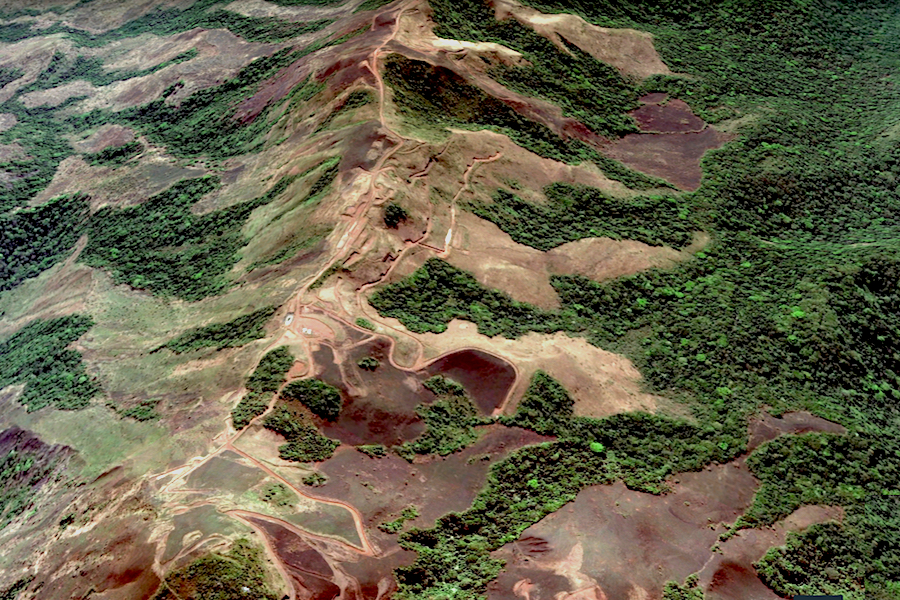

Pilot uranium processing plant launched in Tanzania

The plant, located at the Nyota deposit, will be used to test uranium processing technologies and inform the design of the main processing complex with a production capacity of up to 3,000 tonnes of uranium per year. Its construction is scheduled to begin in the first quarter of 2026, with commissioning scheduled for 2029.

The official pilot plant commissioning ceremony was attended by government officials led by Samia Suluhu Hassan, Tanzania’s President, who said: "This is a landmark achievement for our country. For the first time, Tanzania is stepping onto the global uranium map with the capacity to supply a strategic mineral that is essential for safe and sustainable energy generation worldwide."

According to Tanzania's Ministry of Minerals the "strategic project is set to transform" the country’s "mining and energy landscape, opening new doors for foreign investment, clean energy solutions and high-value technological advancements". It said the government holds a 20% stake "projected to earn USD40 million annually in dividends, channelled into national development projects", and hundreds of direct and indirect jobs would be created.

It said that Tanzania will enter the list of the top 10 uranium-producing nations.

Alexey Likhachev, Rosatom director general, said the corporation was helping to develop Tanzania's "unique geological potential … as with all our partners, we intend to build cooperation with the Republic on the basis of equality and mutual understanding. At the same time, in its activities, Rosatom is always guided by the principles of sustainable development with unconditional compliance with high environmental and social standards. We will be happy to help Tanzania take an important step towards integration into the global nuclear energy industry".

The proposed environmental protection system for the project includes real-time ecosystem monitoring, closed-loop water supply systems with water recycling, and biodiversity conservation programmes, Rosatom said.

The Mkuju River project is owned by Mantra Tanzania Ltd. and is located in the Namtumbo district of the Ruvuma region. Mantra Tanzania is part of Rosatom subsidiary Uranium One Group which is an international mining group of companies which also has assets in Kazakhstan and Namibia.

Tomari 3 meets safety requirements, regulator concludes

_73538.jpg)

Under Japan's reactor restart process, plant operators are required to apply to the Nuclear Regulation Authority (NRA) for: permission to make changes to the reactor installation; approval of its construction plan to strengthen the plant; and final safety inspections to ensure the unit meets new safety requirements. Operators are required to add certain safety-enhancing equipment within five years of receiving the NRA's approval of a reactor engineering work programme.

The Tomari plant comprises two 550 MWe pressurised water reactors (PWRs) (units 1 and 2) and a 912 MWe PWR (unit 3). All three units have been offline since unit 3 stopped power generation for regular inspection in 2012. Hokkaido EPC is seeking regulatory approval to restart all three reactors.

The utility applied for a review in July 2013 to assess whether its plan for upgrades at Tomari 3, which started operation in 2009, satisfies updated safety standards introduced following the March 2011 accident at the Fukushima Daiichi plant.

After approving a draft report in April this year, following a period for public comments the NRA has now formally adopted its findings that unit 3 meets the new regulatory safety standards and has issued Hokkaido EPC a permit to make changes to the reactor installation. It becomes the 18th Japanese reactor to pass the regulator's safety screenings.

"We would like to express our sincere gratitude to the Nuclear Regulation Authority and everyone involved with Tomari Nuclear Power Plant who have been involved in the review for over 12 years since our application," said Hokkaido EPC President and CEO Susumu Saito. "The permit we received today recognises that the basic policy and basic design for safety measures for Tomari Nuclear Power Plant Unit 3 comply with the new regulatory standards, and we view it as a major milestone toward restarting operations."

The company built a new 16.5-metre-high seawall to protect the plant from tsunamis, but later agreed to build one 19 metres in height, based on the regulator's advice. Construction of the seawall is currently under way and expected to be completed in early 2027. Hokkaido EPC has also upgraded its quake-resistant design for the facilities to cope with more intense acceleration of seismic waves - from up to 550 gals to 693 gals.

The company will still need to obtain the consent of local governments before it can restart Tomari 3.

In May 2022, the Sapporo District Court issued a ruling granting a request for an injunction against the operation of the three-unit Tomari plant. A lawsuit filed by about 1200 plaintiffs, including local residents, in November 2011 claimed the plant has insufficient countermeasures against earthquakes and tsunamis and called for it to be decommissioned. An appeal by Hokkaido EPC against that decision is currently being heard at the Sapporo High Court.

"We believe that the understanding of the local community and the people of Hokkaido is essential for restarting operations," Saito said. "We will seize every opportunity to provide explanations to as many people as possible so that we can gain their understanding.

"Our pursuit of improving the safety of Tomari Nuclear Power Plant is never-ending. We will continue to strive to achieve the world's highest standards of safety through continuous efforts, including further safety improvements and the enhancement of various training programmes."

The NRA is still reviewing the safety of Tomari units 1 and 2.