[By Bill Sweetman]

The speed, agility, range, and stealth of an individual aircraft type are still important, but they’re no longer the whole story of air combat. Advances in sensing, processing, and communications are changing military operations.

The Chengdu J-36, the big Chinese combat aircraft that first appeared on 26 December, has been developed to exploit these changes and support China’s strategic goal: establishing regional dominance, including the ability to annex Taiwan by force.

If J-36s can fly supersonically without using afterburning, as the prototype’s shape suggests they will, each will be able to get into and out of battle faster and more safely than conventional fighters and bombers, which cruise subsonically. A high degree of stealth will greatly help J-36s in penetrating defenses. Supersonic cruise would also mean each J-36 could fly more missions in a given period.

The design’s big main weapon bays are sized for considerable air-to-surface missiles, which J-36s could launch against such targets as airfields, aircraft carriers and air-defense batteries. With great speed and height, J-36s could also throw inexpensive glide bombs farther than other aircraft could.

The main weapon bays are big enough to carry unusually large air-to-air missiles for engaging aircraft at great ranges, including vital support units such as tankers and air surveillance radar planes. Targeting data for this might come from other aircraft, ships, satellites, or ground sources. The missiles might also be launched at fighters at ranges that keep J-36s safe from counterattack.

J-36s are themselves likely to be sources of targeting data for other aircraft and for ships, using large passive and active sensors that aircraft of such size can easily carry. They may command aircraft that fly with them. In all this, they’d use radio links that are hard for an enemy to detect.

To call the J-36 an airborne cruiser may not be far off the mark—and may call into question the West’s decision to prioritize the development and production of fighters that are, by comparison, mere torpedo boats.

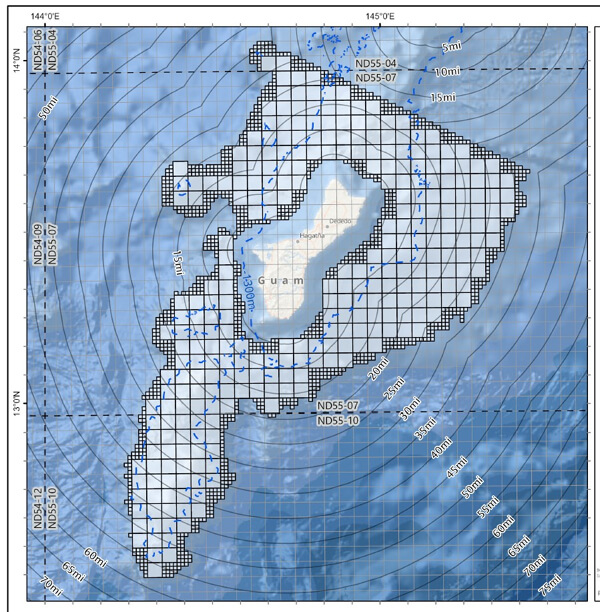

For the Taiwan mission, China’s principal opposing force is US-led air power, comprising the US Air Force and the US Navy’s aircraft carriers, with support from Japan, Australia, Taiwan, and maybe South Korea and others. Air power from China’s opponents can hinder its maritime and amphibious operations, resulting in slower progress and higher casualties.

So, counter-air capability is crucial for China. This is what the US thinks of as China’s anti-access and area denial capability. It includes surface-to-air weapons, fighters, air-base attacks and the information realm.

To understand where the J-36 fits in, start by considering China’s current force, of which the Chengdu J-20 is the spearhead. The J-20 is fast and stealthy, with good range for a fighter, but its weapon bays are limited to short-range and medium-range air-to-air weapons. Like the F-35, it is more detectable outside its forward quadrant. That becomes a greater vulnerability in a networked environment, where a sensor platform on your beam may not be well placed to launch a weapon but will pass your track to one that is.

The long-range Xi’an H-6 bomber, used as a missile carrier, can launch attacks at air bases throughout the Western Pacific. But its effect is limited to the warheads of up to six costly missiles that must fly far enough to keep their vulnerable launch aircraft safe.

The J-36 combines speed and range with all-aspect stealth. Potential internal loads include such long-range air-to-air missiles as the PL-15, which the J-20 cannot carry internally. Heavier, air-to-surface missiles would be aimed at airfields and warships. It also probably supports the kind of mass-precision attacks made possible by accurate, more autonomous weapons, or—as autonomous technology advances—the carriage of loitering munitions and jammers.

The J-36’s smaller outboard weapon bays might accommodate defensive and support weapons, possibly on extending rails like the J-20’s side bays.

The large transparent side apertures in the forward fuselage could be wide-field-of-view passive warning and cueing systems. But there’s another possibility: if you wanted to integrate a high-energy anti-missile laser into an aircraft, with a hemisphere-plus field of fire but without unstealthy turrets, it might from the outside look like those transparencies. A single optical chain could feed left and right steerable heads under the conformal windows. Cue panic.

Speed is not just valuable for survivability, although it does erode missile engagement envelopes. Even Mach 1.8 supersonic cruise halves flight time and greatly increases sortie rate compared with a subsonic-cruise aircraft.

The US considered developing a supersonic strike aircraft in the early 2000s. But with 9/11 and the cost of the F-35 program, a high-speed project could not get funded. ‘Response time, and cost per target killed, were the two holy grails,’ a Northrop Grumman engineer commented in early 2001. The supersonic aircraft was big and complex, but the sortie generation rate was far higher than that of subsonic alternatives, and fewer aircraft were needed. And it could use cheap, unpowered glide weapons with a stand-off range estimated at 170km from a Mach 2 launch.

Speed on one side of a conflict is an important advantage. If the J-36 can penetrate to threaten bases in the second island chain, forcing the US to move B-21s, B-52s and other high-value assets further back, US strike sortie rate and effectiveness will diminish.

It’s important to keep in mind that the J-36 will be part of a family of systems and a network of capabilities. The appearance over the holiday season of the KJ-3000 airborne early warning and control system, based on the Xi’an Y-20 airlifter, is significant.

China has produced five different airborne radar systems since 2003, more than any other nation, all based on the technology of active electronically scanned arrays (AESAs). It has expanded their role beyond that of forward-passing adversary track data to fighter aircraft. AESA radars can update tracks much faster than a rotating-antenna radar, so these systems can provide guidance-quality midcourse updates to missiles.

Compared with the propeller-driven KJ-500, the KJ-3000 can be moved faster and farther forward to support an operation, and it can fly higher for greater sensor range. Working with a KJ-3000, the J-36s could launch missiles while remaining radar-silent.

If its speed and stealth allow it safely to get close to the enemy, a J-36 itself will be able to provide targeting data to other weapons, such as missiles launched by H-6s that prudently stay well behind it. It will also be the command and control hub for other aircraft, crewed and uncrewed. If it is a two-seater, the second crew member will likely be a force manager.

As for how to classify the J-36, too many people have rushed to call it a ‘sixth-generation fighter’.

The ‘fifth-generation’ term, invented in Russia, was picked up by Lockheed Martin as a marketing tool in the early 2000s. What Lockheed Martin would call 5-gen fighters combine supersonic speed and maneuverability with some degree of stealth. The Chengdu J-20 fighter is fifth-generation by that standard.

But this ‘generation’ taxonomy misleads more than it informs, because combat aircraft designs need not and do not fall into discrete sequential groups of characteristics.

And ‘fighter’, ‘bomber’ and ‘strike’ definitions are getting less clear. Most Boeing F-15s, nominally fighters, have been built as strike aircraft, and the fighter-derived Sukhoi Su-34 is another step down the same path. Designed against air and land threats, the J-36 is even larger than the Su-34. Its size and flight performance put it into its own category, for which there is no name. Maybe ‘airborne cruiser’ will catch on.

Bill Sweetman is a veteran, award-winning journalist and aerospace industry executive. This article appears courtesy of The Strategist and may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.