By — Sarah Parvini,

LOS ANGELES (AP) — President Joe Biden on Tuesday signed an ambitious executive order on artificial intelligence that seeks to ensure the infrastructure needed for advanced AI operations, such as large-scale data centers and new clean power facilities, can be built quickly and at scale in the United States.

The executive order directs federal agencies to accelerate large-scale AI infrastructure development at government sites, while imposing requirements and safeguards on the developers building on those locations. It also directs certain agencies to make federal sites available for AI data centers and new clean power facilities. Those agencies will help facilitate the infrastructure’s interconnection to the electric grid and help speed up the permitting process.

WATCH: How artificial intelligence impacted our lives in 2024 and what’s next

In a statement, Biden said AI will have “profound implications for national security and enormous potential to improve Americans’ lives if harnessed responsibly, from helping cure disease to keeping communities safe by mitigating the effects of climate change.”

“However, we cannot take our lead for granted,” the Democratic president said. “We will not let America be out-built when it comes to the technology that will define the future, nor should we sacrifice critical environmental standards and our shared efforts to protect clean air and clean water.”

Under the new rules, the departments of Defense and Energy will each identify at least three sites where the private sector can build AI data centers. The agencies will run “competitive solicitations” from private companies to build AI data centers on those federal sites, senior administration officials said.

Developers building on those sites will be required, among other things, to pay for the construction of those facilities and to bring sufficient clean power generation to match the full capacity needs of their data centers. Although the U.S. government will be leasing land to a company, that company would own the materials it creates there, officials said.

With less than a week before President-elect Donald Trump takes office, a big question is whether the incoming administration will keep or rescind the new order. Much of the order’s focus is on reducing the bottlenecks of getting energy-hungry data centers connected to new sources of electricity.

“It has to be a priority because otherwise you’re going to have blackouts, you’re going to have citizens or businesses being affected by this,” said computer scientist Sacha Luccioni, climate lead at the AI company Hugging Face. “Making it easier to facilitate interconnection of infrastructure to the electric grid is kind of a no brainer that would be useful for the next administration, no matter what their priorities are in terms of sustainability or climate.”

Biden said the efforts are designed to accelerate the clean energy transition in a way that is “responsible and respectful to local communities” and does not add costs to the average American. Developers selected to build on government sites will be required to pay all costs of building and operating AI infrastructure so that development does not raise electricity prices for consumers, the administration said.

The orders also direct construction of AI data centers on federal sites to be done with public labor agreements. Some of the sites are reserved for small and medium-sized AI companies, according to government officials.

Government agencies will also complete a study on the effects of all AI data centers on electricity prices, and the Energy Department will provide technical assistance to state public utility commissions regarding electricity tariff designs that can support connecting new large customers with clean energy.

As part of the order, the Interior Department will identify lands it manages that are suitable for clean energy development and can support data centers on government sites, administration officials said.

“The volumes of computing power, electricity needed to train and operate frontier models are increasing rapidly and set to surge even more,” said Tarun Chhabra, deputy assistant to the president and coordinator for technology and national security. “By around 2028, we expect that leading AI developers will be seeking to operate data centers with as much as five gigawatts of capacity for training AI models.”

Deploying AI systems at scale also requires a broader network of data centers across different parts of the country, he said.

“From a national security standpoint, it’s really critical to find a pathway for building the data centers and power infrastructure to support frontier AI operations here in the United States,” he said, adding that building data centers in the U.S. will prevent “adversaries from accessing these powerful systems to the detriment of our military and our national security.”

WATCH: How Russia is using artificial intelligence to interfere in elections

That type of investment will also prevent the U.S. from growing dependent on other countries to access AI tools, Chhabra said.

The executive order comes on the heels of the Biden administration’s proposed new restrictions on exports of artificial intelligence chips, an attempt to balance national security concerns about the technology with the economic interests of producers and other countries. That proposal raised concerns of chip industry executives as well as officials from the European Union over export restrictions that would affect 120 countries.

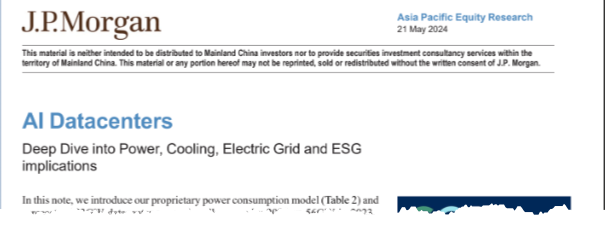

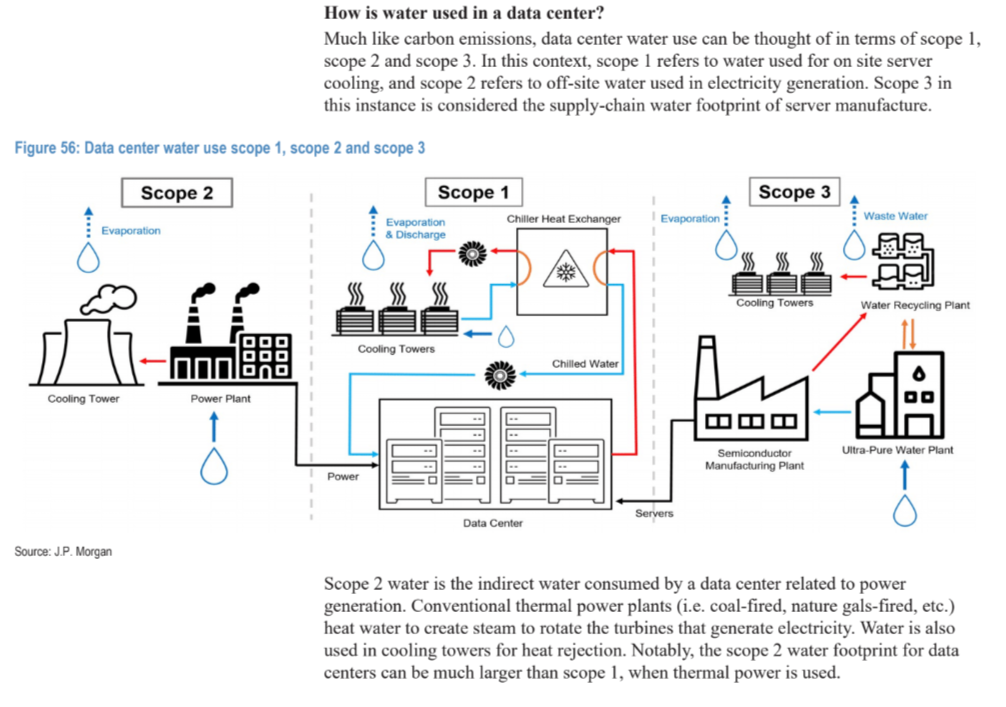

Missing from the order is how to manage the water consumption of AI data centers. There is a growing concern in states with multiple data centers over how to balance the economic development they bring with their impact on water resources as they use vast amounts of water for cooling, said J. Alan Roberson, executive director of the Association of State Drinking Water Administrators.

“Across the country, everyone is trying to get a better idea of the impact of data centers on water use now and in the future,” he said.

The executive order could have instructed federal agencies to collect information about how much water data centers use to help state and local officials making zoning decisions about whether to allow them, but it did not, he added.

AP writers Matt O’Brien and Jennifer McDermott in Providence, Rhode Island contributed to this report.

Left: FILE PHOTO: An AI (Artificial Intelligence) sign is seen at the World Artificial Intelligence Conference (WAIC) in Shanghai, China July 6, 2023. Photo by Aly Song/ Reuters/ File Photo

RelatedAs artificial intelligence rapidly advances, experts debate level of threat to humanity

By Paul Solman, Ryan Connelly Holmes

Hollywood’s video game performers head to picket line over artificial intelligence

By Sarah Parvini, Associated Press

Scientists harness power of artificial intelligence to battle wildfires

By Miles O'Brien

Go Deeperai

artificial intelligence

executive order

joe biden

By —

Sarah Parvini, Associated Press