Story by Annika Kim Constantino • Yesterday

A federal bankruptcy judge halted roughly 40,000 of lawsuits alleging Johnson & Johnson's baby powder and other talc products caused cancer.

Judge Michael Kaplan put a temporary hold on the suits that will last through mid-June, The Wall Street Journal reported.

The decision is part of J&J subsidiary LTL Management's second attempt to settle talc cases in bankruptcy proceedings.

In this photo illustration, a container of Johnson and Johnson baby powder is displayed on April 05, 2023 in San Anselmo, California.© Provided by CNBC

A federal bankruptcy judge on Thursday halted roughly 40,000 lawsuits that allege Johnson & Johnson's baby powder and other talc products caused cancer.

The decision is part of J&J's second attempt to settle thousands of talc cases in bankruptcy proceedings.

J&J in 2021 spun off its subsidiary, LTL Management, to carry its talc-related liabilities and file for Chapter 11 bankruptcy protections.

Judge Michael Kaplan during a hearing Thursday in U.S. Bankruptcy Court in Trenton, New Jersey, put a temporary hold on the suits that will last through mid-June, The Wall Street Journal reported.

J&J won't have to go to trial over any other talc claims during the pause, but new lawsuits can still be filed against the company, The Journal reported.

Kaplan said during the hearing that J&J has an "uphill battle" ahead, according to the newspaper.

The pause will give J&J time to reach a permanent settlement with plaintiffs in the talc cases. The company recently proposed an $8.9 million settlement for current and future talc-related claims and said it expects to bring that plan to bankruptcy court in mid-May.

J&J in a statement called Kaplan' decision "a win for claimants" because it brings them "one step closer" to being able to vote on the proposed settlement.

The New Brunswick, New Jersey-based company also said it believes claimants will overwhelmingly support the proposal.

J&J previously said more than 60,000 claimants have already committed to voting in favor of the plan.

"When presented with a clear and complete explanation and the opportunity to make an informed choice, we firmly believe the claimants will approve the plan," said Erik Haas, J&J's worldwide vice president of litigation.

Kaplan's decision is narrower than the one he made after LTL Management first filed for Chapter 11 in 2021.

The judge ruled in February 2022 that J&J can use the bankruptcy system to resolve talc allegations, enabling the company to avoid fighting thousands of individual lawsuits.

Kaplan essentially affirmed J&J's use of a strategy known as the "Texas two-step," which allows companies to split valuable assets from liabilities through a so-called divisive merger.

But in January, the U.S. Court of Appeals for the 3rd Circuit overturned that ruling. The appeals court said that neither LTL nor J&J had a legitimate need for bankruptcy protection because they were not in "financial distress."

Amid the ongoing legal fights, J&J has continued to deny the allegations that its talc products caused cancer.

Chief Financial Officer Joseph Wolk said on an earnings call Tuesday that it was "unfortunate" that J&J has to "put dollars towards quite frankly baseless scientific claims."

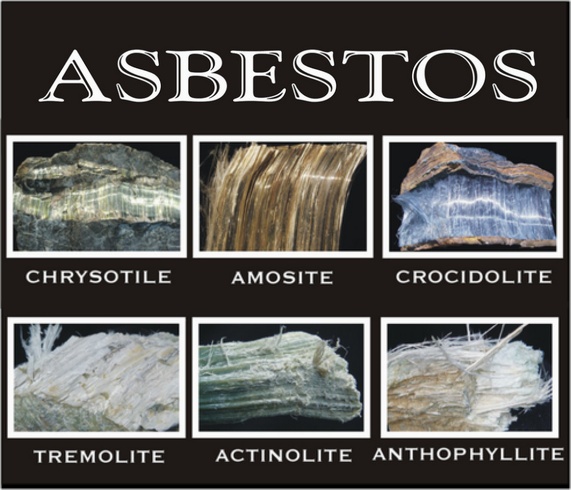

The suits allege J&J's talc products were contaminated with the carcinogen asbestos, which caused ovarian cancer in thousands of individuals.

Some lawsuits link several deaths to J&J's talc products.

Story by By Mike Spector • Yesterday

FILE PHOTO: Bottles of Johnson & Johnson baby powder line a drugstore shelf in New York© Thomson Reuters

NEW YORK (Reuters) - A U.S. judge on Thursday halted most of the tens of thousands of lawsuits alleging Johnson & Johnson’s baby powder and other talc products caused cancer and stopped any trials as part of a company subsidiary’s second attempt to settle cases in bankruptcy proceedings.

U.S. Bankruptcy Judge Michael Kaplan put most of the litigation temporarily on hold during a hearing in Trenton, New Jersey. The decision, for the most part, granted a request from J&J to freeze cases while it attempts to reach a permanent settlement with current plaintiffs that would also set aside money for future lawsuits.

J&J says it has broad support for a proposed $8.9 billion settlement, a contention disputed by lawyers representing talc claimants who oppose it.

The J&J subsidiary, LTL Management, filed for bankruptcy a second time earlier this month to help finalize the latest deal, despite a federal appeals court’s decision in January that invalidated its first Chapter 11 filing, on the grounds the J&J unit was not in financial distress.

“I have more questions than answers,” Kaplan said during Thursday's court hearing, referring to arguments made to him about the second bankruptcy case earlier this week.

The judge halted roughly 38,000 talc lawsuits consolidated in a federal district court in New Jersey. He allowed other cases to proceed as long as no trials commence.

He said he would revisit the ruling in late May.

Erik Haas, J&J’s worldwide vice president of litigation, in a statement called the ruling “a win for claimants” and expressed confidence they would ultimately approve the proposed settlement.

LTL Management argued that allowing litigation against J&J to continue would imperil current settlement efforts. J&J previously used a complex legal maneuver, known as a Texas two-step, to shift responsibility for the lawsuits to LTL.

Leigh O’Dell, one of the lead lawyers for plaintiffs in cases consolidated in the New Jersey federal court, said prohibiting trials limits pressure on J&J.

Related video: J&J talc unit asks judge to halt cancer lawsuits as it pursues $8.9 bln settlement (WION) Duration 1:12 View on Watch

“We continue to believe that this bankruptcy effort is illegitimate … and that stance will be affirmed through the appellate process,” she said in a statement.

The judge’s ruling kept in legal limbo consumers alleging J&J talc caused their ovarian cancer or mesothelioma. Some plaintiffs allege asbestos in the talc sickened them. For now, none can test their claims before juries.

J&J has said its talc is safe, asbestos-free and does not cause cancer.

The healthcare conglomerate has not filed for bankruptcy itself. In October 2021, J&J divided its consumer business in two and offloaded the talc lawsuits onto a newly created subsidiary, LTL, which then declared bankruptcy.

In January, the 3rd U.S. Circuit Court of Appeals in Philadelphia invalidated LTL's bankruptcy filing. Kaplan dismissed the bankruptcy earlier this month, only for LTL to file for Chapter 11 again in his court about two hours later.

'UPHILL BATTLE'

Talc plaintiffs opposing J&J's proposed settlement plan to file a motion to dismiss the second bankruptcy filing, one of their lawyers said in court on Tuesday.

They portray J&J’s actions as an abuse of the bankruptcy system by a multinational conglomerate valued at more than $400 billion and in little danger of running out of money to pay cancer victims.

A U.S. Department of Justice official charged with monitoring the case has also pushed back against the second bankruptcy.

“Undoubtedly, the debtor has an uphill battle,” Kaplan said, referring to LTL’s settlement and reorganization prospects.

J&J and its subsidiary have argued bankruptcy delivers settlement payouts more fairly, efficiently and equitably than a “lottery” offered by trial courts, where some litigants get large awards and others nothing.

Jim Murdica, a lawyer tasked with resolving talc cases for J&J, testified in a deposition last weekend that as many as 80,000 claimants support the company’s settlement offer - enough to meet a bankruptcy threshold requiring agreement from 75% of all claimants, he said.

Lawyers representing opposing talc plaintiffs contend those figures reflect mostly unfiled claims and that people behind them have not yet agreed to the settlement. J&J and LTL argue their settlement process is typical.

LTL terminated a funding agreement with its parent company that the appeals court found insulated it from the financial distress necessary to legitimately declare bankruptcy.

Its lawyers now argue that new financing agreements leave LTL Management in financial distress. At the same time, they contend the agreements provide enough funds to pay plaintiffs and avoid rendering LTL insolvent, countering arguments from plaintiffs' lawyers that the transactions were fraudulent.

(Reporting by Mike Spector; Editing by Bill Berkrot)