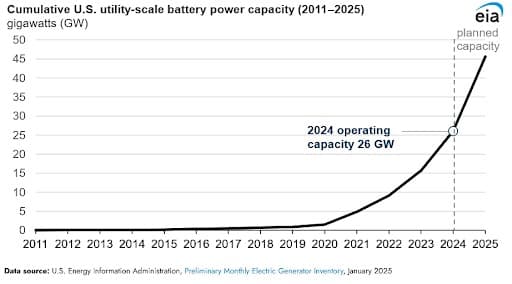

U.S. Utility-Scale Battery Storage Has Surged 15-Fold Since 2020

- U.S. utility-scale battery capacity has grown 15-fold since 2020.

- A proposed U.S. bill could cut battery production by 75% and slash EV sales by 40% by 2030, threatening over 130,000 clean energy jobs.

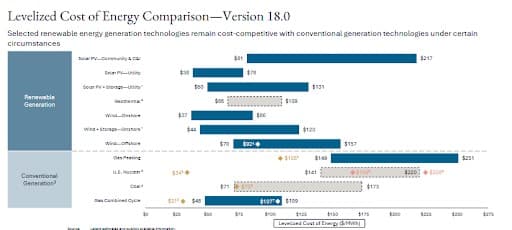

- Lazard: The cost of solar paired with batteries is now competitive with new natural gas and coal plants.

For years, battery systems have only played a marginal role in U.S. electricity networks, with power utilities focusing more on building out capacity from natural gas plants and renewable energy sources. According to energy data portal Cleanview, five years ago, the United States had 74 times more wind farm capacity and 30 times more solar capacity than battery capacity within its power generation system.

However, steady cost declines coupled with rising energy density levels have encouraged utilities to ramp up their battery installations, with battery storage output now exceeding other power sources in certain power markets. And, it’s boom time for the U.S. utility-scale battery storage market: currently, there are only around 5 times more solar and wind capacity in the country compared to battery capacity, thanks in large part to a 40% decline in battery prices since 2022. Currently, 19 states have installed 100 MW or more of utility-scale battery storage.

Source: U.S. Energy Information Administration

According to Cleanview, there are just under 30,000 megawatts (MW) of utility battery capacity across the U.S., good for a massive 15-fold increase since 2020. For some context, the U.S. solar sector has added 84,200 MW over the timeframe, while the wind sector has increased its capacity by just 7,000 MW. Falling costs are the biggest reason for the surge in U.S. battery deployments: according to financial advisory and asset management firm Lazard the levelized cost of electricity (LCOE) for utility-scale solar farms paired with batteries ranges from $50-$131 per megawatt hour (MWh). This makes the pair competitive with new natural gas peaking plants (LCOE of $47 to $170 per MWH) and even new coal-fired plants with LCOE of $114 per MWh.

According to Lazard's 2025 LCOE+ report, new-build renewable energy power plants are the most competitive form of power generation on an unsubsidized basis (i.e., without tax subsidies). This is highly significant in the current era of unprecedented power demand growth in large part due to the AI boom and clean energy manufacturing. Renewables also stand out as the quickest-to-deploy generation resource, with the solar plus battery combination often boasting far shorter deployment times compared to constructing new natural gas power plants.

Source: Lazard

That said, growth in the U.S. utility-scale battery storage deployments has not been uniform. California is, by far, the national leader in utility-scale battery storage, accounting for ~13,000 MW or about 42% of the national total. According to the California Energy Commission, the California Independent System Operator (CAISO) has installed ~21,000 MW of solar capacity and ~12,400 MW of battery capacity, allowing the state to rely heavily on batteries during peak demand periods.

For instance, batteries supplied around 26% of CAISO’s power output on June 19 between 7 p.m. and 9 p.m, surpassing natural gas which supplied 23%, according to electricity portal GridStatus. Texas’ Electric Reliability Council of Texas (ERCOT) comes in second with 8,200 MW of installed battery capacity. Arizona, Nevada and New Mexico, have also been recording rapid growth in installed battery capacity as they look to complement robust growth by their solar sectors.

Battery Production Set To Decline

Unfortunately, the U.S. battery manufacturing sector will not be in a position to take advantage of this explosive growth thanks to unfavorable policies under the Trump administration. Last month, the U.S. House of Representatives narrowly passed the “big, beautiful bill”, with its fate now hanging in the balance in the Senate ahead of Republicans’ self-imposed July 4 deadline. The contentious legislation is designed to pay for tax cuts, extra spending on defense and immigration enforcement by leveraging deep cuts to clean energy credits under the Inflation Reduction Act (IRA). According to a recent analysis by the International Council on Clean Transportation, the bill could slash U.S. battery production by ~75% by 2030 to 250 GWh from the previously projected 1,050 gigawatt-hours, and EV sales by 40%.

According to the report, the bill will effectively eliminate 130,000 potential jobs in the EV sector by 2030, with the majority in battery manufacturing. Companies have announced a total of 128 U.S. facilities for battery manufacturing since former President Biden signed the IRA into law in 2022, with more than half yet to begin construction. Interestingly, Red and purple states including Texas, Michigan, Nevada, Tennessee, Kentucky and Georgia, will be the most adversely impacted if the bill becomes law.

By Alex Kimani for Oilprice.com

No comments:

Post a Comment