BDS CANADA

The calls to Scotiabank’s senior vice president were not going well.

Since 2022, a Vancouver-based campaigner Angus Wong had been trying to raise concerns about the bank’s investments in Israeli weapons maker Elbit Systems. While working for corporate accountability group Ekō, he had written up the first petition calling for Scotiabank to divest from Elbit.

Every time he got bank officials on the phone, he was met with dismissive responses. At one point, executives told him to stop “harassing” the bank, insisting there was nothing to discuss.

But then something shifted.

Following a wave of protests for Palestinian rights—including a high-profile disruption at the Giller Prize gala in Toronto in 2023—Scotiabank officials suddenly got aggressive.

“They demanded I stop the divestment campaign,” recalled Wong, who has also been a board member of The Breach since 2024. “I told them, ‘I have never spoken to any of the organizers of those protests. I don’t even know who they are. The only way to stop this campaign is for you to divest from Elbit Systems.’”

This week, the years of activism culminated in a major victory. Scotiabank’s latest financial statements show the bank has sold its remaining 165,000 shares in Elbit, completing a full divestment from a company whose weapons and technology are critical to Israel Defense Forces (IDF) operations.

A decentralized campaign of protests, sit-ins, and cultural boycotts has been pressuring the bank to sell off its shares ever since Scotiabank’s significant stake in Elbit became public knowledge in fall 2022.

While the bank has not acknowledged the role of that campaign—or made much fanfare of its divestment—Scotiabank’s 1832 Asset Management subsidiary gradually reduced its holdings beginning in late 2023, culminating in the sale of its last remaining shares valued at $83 million.

It marks one of the biggest victories in Canada for the Boycott, Divestment, and Sanctions movement, also known as BDS.

“The most significant outcome of this campaign, perhaps even more important than the divestment itself, is the recognition of the power of decentralized organizing,” said Wong.

Retreat under pressure

For large corporations holding shares in weapons manufacturers or companies tied to Israel’s illegal settlements, divestment rarely happens all at once. Instead, “often their sort of ‘divestment strategy’ is this slow, trickling, staggered divestment,” said Maen Hammond, a campaigner and former colleague of Wong’s at Ekō. Hammond is Palestinian and currently based in the West Bank.

But zoom out from the quarterly statements, said Hammond, and “it’s obviously a direct divestment of this money in and around the timing of what seems to be a very effective grassroots, decentralized mobilizing campaign against the company.”

As recently as 2023, Scotiabank owned approximately $500 million worth of Elbit shares, making it the largest foreign shareholder in the weapons manufacturer. Over the following year, it gradually and quietly reduced its stake, halving it to about $238 million by March 2024. The fund briefly increased its holdings in early 2025 before continuing to sell off shares.

Scotiabank has faced intense waves of protests across Canada since Israel’s assault on Gaza escalated in October 2023. At the time, Scotiabank was the longtime title sponsor of the Giller Prize, one of the country’s most prestigious literary awards. That relationship became a focal point in November 2023, when activists took the stage at the Toronto gala to denounce the bank’s investments in Elbit, turning a marquee cultural event into a flashpoint in the divestment campaign.

In February 2025, after a year of sustained activism by a coalition of artists called No Arms in The Arts—including hundreds of Canadian authors calling for divestment—the Giller Prize ended its nearly two-decade-long partnership with Scotiabank.

Scotiabank branches have also been the target of repeated sit-ins and vandalism, with activists painting messages on bank buildings including “DROP ELBIT,” and “GAZA IS STARVING.”

In a statement issued after Scotiabank’s full divestment was confirmed, the No Arms In The Arts coalition said that nationwide campaigns turned the bank’s Elbit stake into a reputational liability. “The campaigns against Scotiabank set a critical precedent for what is deemed a permissible investment by supposedly ‘neutral’ investors,” the group said.

“For over a year, Scotia’s senior vice presidents were dismissive in their interactions with me,” said Wong, “but then mass decentralized actions—including the Giller Prize disruption—happened, and they panicked and started divesting.”

BDS wins big

Inspired by the strategy that helped end apartheid in South Africa, the BDS movement applies economic and political pressure to the Israeli state to force it to comply with international law and respect Palestinian rights. It has pushed governments, corporations, and institutions to shed their complicity in Israel’s occupation and violations of human rights.

The Canadian BDS Coalition has logged a number of victories, including Hydro‑Québec cutting ties with Israel Electric and Air Canada cancelling a multi-million-dollar contract with Israel Aerospace Industries in 2017.

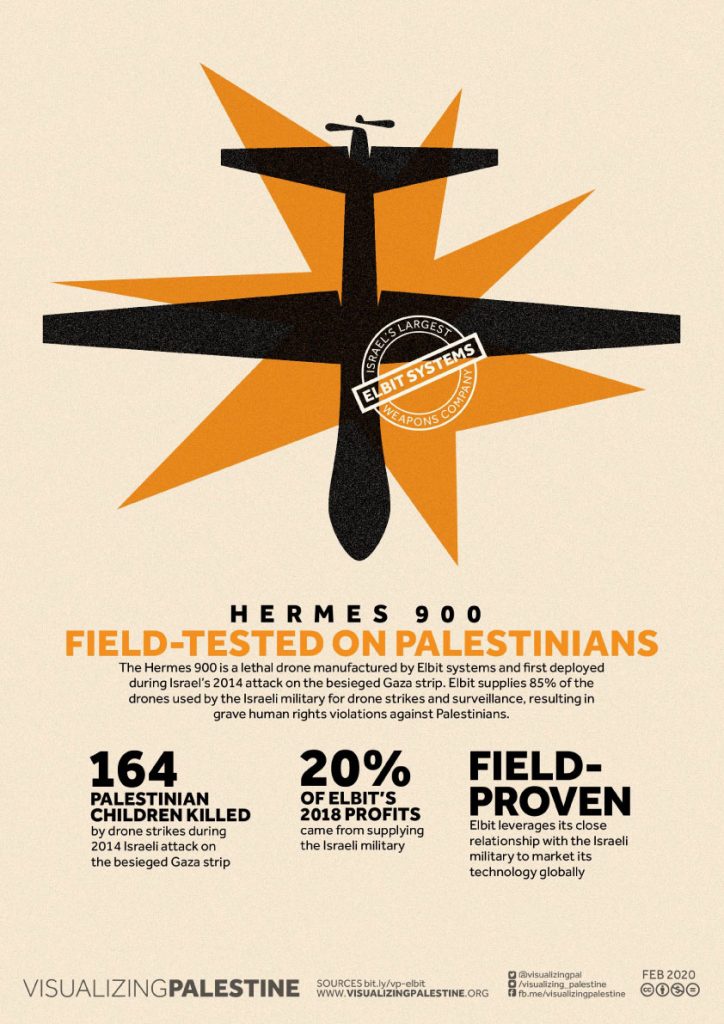

Elbit Systems has long been a target of the international BDS campaign. As Israel’s largest private weapons manufacturer, Elbit provides roughly 85 per cent of the IDF’s land-based equipment and drone fleet, according to the Database of Israeli Military and Security Export.

These drones and unmanned aerial vehicles, or UAVs, have been widely used in assaults on Gaza stretching back over a decade. In 2014, a strike from a Hermes 450 drone made by Elbit killed four Palestinian children who were playing soccer on a Gaza beach. And in 2024, Israel used the same model to kill seven World Central Kitchen aid workers in Gaza—one of whom, Jacob Flickinger, was a Canadian citizen.

Elbit markets its military hardware and software to regimes engaged in violent repression worldwide, with weapons tested in assaults against Palestinians seeing a spike in global demand. Canada has awarded over $44 million in contracts to Elbit, procuring the company’s Hermes 900 Starliner aerial drone in 2020 and hiring Elbit to support an airspace monitoring project in 2021.

The international BDS campaign against Elbit has seen the U.K.’s Barclays bank, Norway’s largest pension fund, and a major Japanese trading firm divest from or cut ties with the weapons company. Scotiabank is the latest in a tide that’s turning against Elbit.

There are other BDS campaigns still ongoing in Canada, including against Indigo Books’ CEO Heather Reisman over her funding of Israeli lone soldiers; against companies selling wine, dates, and citrus produced in illegal settlements; and against the Azrieli Foundation, the Canadian charitable arm of an Israeli real-estate developer.

Risky business

In November 2023, Wong and Hammond had that call with the Scotiabank vice presidents, who demanded Wong stop the divestment campaign.

“It became clear that the bank was more concerned about the inconvenience of protests outside their offices than the ethical implications of their investments in Elbit,” Hammond recalled. “Three white female Scotia executives were literally crying crocodile tears—not over Elbit’s role in genocide, but because they had to walk past protesters to get to work.”

Scotiabank has claimed that its decision to sell its Elbit shares was driven by routine investment reviews rather than pressure from activists. Wong, however, points to the bank’s incremental sell-off and its public responses to mounting scrutiny as clear signs that the protests forced its hand.

When corporations divest, the response from Israel and its supporters has been swift and irate. When Airbnb announced in 2018 that it would de-list properties in illegal Israeli settlements, Israeli authorities and pro-Israel advocacy groups threatened the company with lawsuits.

And in 2021, when Ben & Jerry’s released a statement saying it would stop selling ice cream in Israeli settlements, then-Israeli Prime Minister Naftali Bennett vowed to take “aggressive action” and the Israeli government dispatched diplomatic envoys to pressure the company and its parent corporation.

In contrast, Puma and General Mills each quietly withdrew from partnerships in Israel without publicly attributing their decisions to human rights concerns.

“Having been involved in many of the biggest divestment campaigns, and talking to executives at Airbnb and Ben & Jerry’s who faced enormous backlash from the Israeli state, it’s no wonder companies like General Mills, Puma, and now Scotiabank are denying that their divestments have anything to do with protests or the BDS movement,” said Wong.

But this victory highlights a shift in corporate risk calculations, where grassroots movements can impose costs on running business as usual during a genocide.

The question now is not just where Canada’s BDS movement will turn its attention next, but how many more institutions will be forced to reconsider their investments in Israel’s occupation.

No comments:

Post a Comment