China and US ‘just flexing muscles’ over critical metals, BHP chair says

The US and China are battling to project power as they compete to secure critical minerals supply, the new chair of BHP said on Thursday, downplaying any potential for the global miner to be caught between its top customer and the world’s biggest economy.

“You’ve got two very, very powerful nations just flexing their muscles,” Ross McEwan told reporters after BHP’s annual general meeting in Melbourne. “It’s not the first time this has happened.”

He said “critical minerals are becoming a vital thing,” adding, “And I think a business like ours and a country like ours actually just needs to work with all parties.”

US President Donald Trump and Australian Prime Minister Anthony Albanese signed a critical minerals agreement aimed at countering China’s dominance in the sector on Monday.

“I think, it’s a little bit early to actually see the outcomes of what we see as a good meeting between the prime minister of Australia and the president of the United States. But I think it was a very good meeting to start those conversations,” McEwan told shareholders at the annual meeting.

BHP is a major producer of copper, iron ore, steelmaking coal, and soon to be potash, and those markets are its focus rather than niche critical minerals, he added.

Australia is quite well positioned to support the US as it tries to derisk its critical mineral supply chain, CEO Mike Henry said, after he and two top Rio Tinto executives met with Donald Trump and Interior Secretary Doug Burgum in the Oval Office on August 19.

“I was impressed on just how fierce the focus is in the US on getting more … mines and processing facilities up and going,” Henry said. BHP is looking with partner Rio Tinto to build the Resolution copper mine in Arizona, which would account for a quarter of US demand for the metal.

“I think we should see (the agreement) as symbolically significant, in that it goes to just how seriously this issue has been put down and the position that Australia can play in supporting the US,” Henry said.

New opportunities

BHP would be forced to take more “difficult decisions” for its metallurgical coal business in Australia if there were no tax changes to support it, the CEO and chair both said.

BHP last month said it would suspend operations and cut 750 jobs at a Queensland coking coal mine it shares with a unit of Mitsubishi, blaming low prices and high state government royalties that have dented its returns.

“Without change, there’s without doubt going to be more difficult decisions that are going to be made,” Henry said. The business generated a 1% return on capital last year.

Henry has been widely expected to step down in the next year after a typical six-year tenure. On Thursday, he said it was an exciting time to be in the market and he was enjoying the role.

Amid speculation an interloper could crash the planned $53 billion mega-merger of Teck and Anglo American, BHP’s former takeover target, McEwan said BHP had a watching brief.

“We do keep an eye on what’s going on in the marketplace and opportunities that come up, be they small or large, or just tuck-ins, in which you can use the infrastructure.”

(By Melanie Burton and Renju Jose; Editing by Himani Sarkar and Sonali Paul)

US, Orion partner on $5B critical minerals fund

ALL CAPITALI$M IS $TATE CAPITALI$M

The US government has teamed up with Orion Resource Partners and Abu Dhabi’s ADQ to establish a new billion-dollar fund to invest in critical minerals, marking another major step in President Donald Trump’s push to secure key resources and reduce reliance on China’s supply chains.

The initiative, known as the Orion Critical Mineral Consortium, was announced Thursday by Orion and supported by the US International Development Finance Corp. (DFC).

According to Orion’s statement, the three partners — DFC, Orion and ADQ — have made initial capital commitments totaling $1.8 billion, with plans to expand the pool to as much as $5 billion in the future. Bloomberg News first reported in September that the DFC and Orion were in talks to establish the joint fund.

With this cornerstone investment, the Orion-led consortium will “engage with mission-aligned investors and partner nations that have expressed their ambition to secure the critical minerals that underpin the modern economy,” the firm said.

Bridging minerals gap

DFC — created toward the end of Trump’s first term in 2019– will co-fund the consortium, with its initial investment matched by funds managed by Orion and ADQ. The consortium will focus on “existing or near-term producing assets,” rather than on early-stage exploration projects that could take a decade to become operational, its statement said.

The initiative “represents a significant step forward in bridging the substantial funding gap needed to accelerate investment in the critical minerals supply chain, while at the same time boosting US economic growth,” Orion Resource Partners CEO Oskar Lewnowski stated in a press release.

Ben Black, chief executive officer of the DFC, said the consortium was created to “establish a robust pipeline of secure critical mineral investments vital to advancing American economic prosperity.”

The initiative is part of Washington’s broader strategy to counter Beijing’s dominance over global mineral supply chains, particularly in materials such as copper, cobalt and rare earths, which are essential to the defense industry and the global energy transition.

US investments

The US has already moved to strengthen mineral ties with allies. Earlier this week, Washington signed a landmark agreement with Australia to boost access to rare earths and other critical materials. It is also negotiating a similar bilateral deal with the Democratic Republic of Congo, the world’s largest cobalt producer and a key copper supplier. Since Trump’s return to the White House, the US government has made direct equity investments in mining companies to secure strategic resources.

In parallel, US mining companies are also stepping up efforts to secure federal support. In July, MP Materials, its sole rare earth miner, entered into a public-private partnership with the US Department of Defense (now Department of War) to develop a domestic rare earth magnet supply chain. Industry groups are intensifying lobbying efforts in Washington to benefit from the administration’s pledged investments in firms deemed essential to national security.

The launch of the consortium underscores growing momentum in the US to rebuild domestic and allied capacity in the critical minerals sector — a strategic response to rising geopolitical competition over the resources that underpin the global economy of the future.

Orion, a leading financier in the mining industry with about $8 billion in assets under management, has been expanding its global partnerships. Earlier this year, it announced a $1.2 billion venture with Abu Dhabi sovereign wealth fund ADQ to invest in resource projects. The creation of the Orion Critical Mineral Consortium further deepens this collaboration, positioning both firms as key players in reshaping Western access to critical raw materials, it said.

Cyclic Materials, VAC sign 10-year rare earth magnet recycling deal

Canadian rare earth and metals recycler Cyclic Materials announced Wednesday an expansion of its partnership with magnetic materials developer VACUUMSCHMELZE (VAC).

The companies have signed a 10-year exclusive agreement for recycling 100% of the magnet byproducts from VAC’s new manufacturing facility in Sumter, South Carolina, which is set to begin operations at the end of 2025.

Cyclic Materials raised $57 million in its Series B equity round last year, backed by Microsoft, Amazon, Hitachi Ventures, BMW iVentures, Jaguar Landrover’s lnMotion fund, and specialized funds such as Energy Impact Partners, ArcTern Ventures and Fifth Wall.

In April, Cyclic announced it invested over $20 million in its own first commercial facility in Mesa, Arizona.

The extended partnership with VAC builds on the 2024 agreement, ensuring efficient recycling of critical materials used in high-performance permanent magnets, the Ontario-based company said.

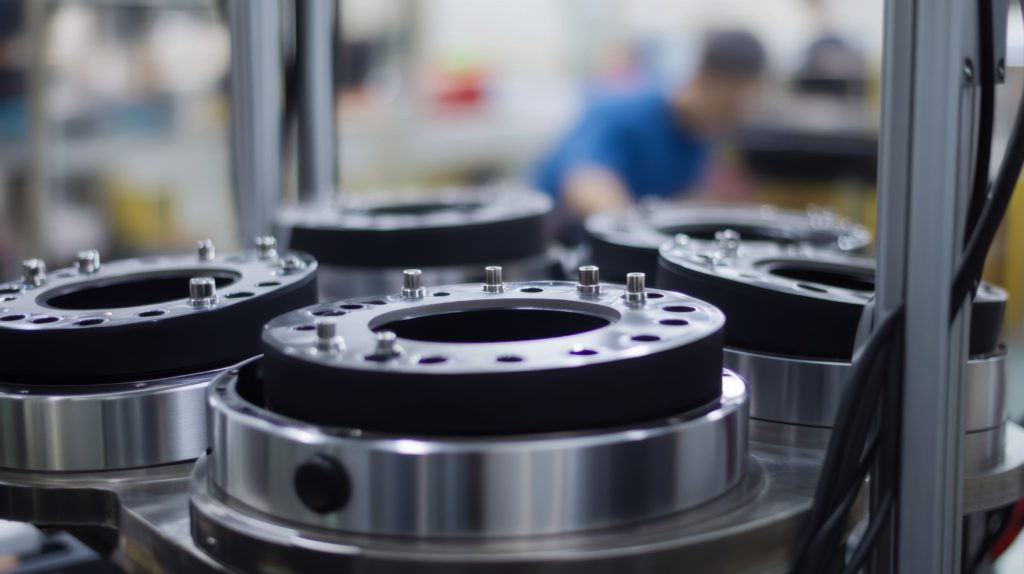

VAC produces neodymium-iron-boron (NdFeB) rare earth magnets, which are essential to automotive, defense, industrial and renewable energy applications. VAC said the extended agreement also strengthens its commitment to circularity with the option to reintegrate recycled mixed rare earth oxides (rMREOs) from Cyclic into its own production processes.

“At Cyclic Materials, our mission is to recover critical materials from permanent magnets that can be put back into the magnet supply chain to reduce the reliance on traditional mining methods and overseas sources,” Cyclic chief executive officer Ahmad Ghahreman said in a news release.

“With the extension of our partnership with VAC, we’re collectively building more momentum towards our goal of building a North American supply chain,” Ghahreman added. “VAC brings not only a reliable source of raw materials for extraction but also decades of expertise in rare earth magnet technology.”

“The addition of this new contract for our South Carolina facility strengthens our ability to localize the recovery and reintegration of REEs back into our production,” Erik Eschen, CEO of VAC, stated.

“By continuing to leverage Cyclic Materials’ innovative recycling processes alongside our advanced magnet manufacturing, we are collectively ensuring a sustainable and high-purity feedstock for high performance magnets to meet current and future industrial demand.”

Fall in China’s exports of rare earth magnets stokes supply chain fears

China’s exports of rare earth magnets fell in September, reigniting fears that the world’s top supplier could wield its dominance over a component key for US defence firms and makers of items from cars to smartphones as leverage in trade talks.

In April and May, Beijing squeezed global automakers with export curbs on a range of rare earths items and related magnets, while negotiators faced off over triple-digit US tariffs on goods from the world’s second-largest economy.

Four months on, after Washington and Beijing unexpectedly reprised threats of fresh tariffs and rare earth export curbs, worry is growing that China could return to the same playbook.

That would mean it reneges on a June deal with the United States to ease the flow of critical minerals.

China’s shipments of rare earth magnets fell 6.1% in September from August, customs data showed on Monday, ending three months of gains, and dropping even before Beijing unveiled a dramatic expansion of its export licensing regime this month.

“The sharp swings in rare earth magnet exports show that China knows it holds a key card in international trade talks,” said Chim Lee, senior analyst at the Economist Intelligence Unit.

Exports fall from seven-month high

The September fall to 5,774 tons from a seven-month high of 6,146 tons in August aligns with reports that China is already making it harder for firms to secure licences for exports of rare earth magnets.

Its commerce ministry is applying scrutiny similar to that seen in April, at the height of the trade war.

On an annual basis, September shipments rose 17.5%.

Last week, China’s commerce ministry accused the United States of stoking global panic over its rare earth controls by deliberately misunderstanding the curbs, and said it would approve export licences intended for civilian use.

Still, analysts worry China could once again entangle civilian commercial users in curbs aimed at choking US defence firms’ access to critical materials.

“China’s ability to throttle rare earth exports is an exceptionally powerful tool,” said Dan Wang, China director at Eurasia Group.

Apart from disrupting production, such measures would fuel insecurity over access to critical industrial inputs and growing reliance on China, she added.

“The world has to adjust to its management style,” she said, adding that Western countries are not used to complying with a monopolistic control of critical resources from countries on ‘the other side’.

By country, Germany, South Korea, Vietnam, the United States and Mexico were the top five export destinations for Chinese rare earth magnets by volume last month.

Over the nine months of the year, exports of such magnets totalled 39,817 tons, a fall of 7.5% from the corresponding 2024 period.

No sign of backing down

Shipments to the United States fell 28.7% in September on the month, the data showed, while exports to Vietnam rose 57.5% over the same period.

The Netherlands processed 109% more rare earth magnets than in August, though the figure is skewed by the huge Rotterdam port, a major transit hub for Europe-bound trade.

Just before the release of the data, President Donald Trump told reporters aboard Air Force One that he did not want China to “play the rare earth game with us”.

He suggested he might hold off on raising tariffs back to levels in excess of 100% if the world’s top agricultural buyer committed to purchasing US soybeans.

But Beijing shows no sign of backing down, adamant that its new wider curbs, set to take effect just days before the November 10 expiry of the latest 90-day tariff truce with the United States, are consistent with measures in other major economies.

President Xi Jinping is set to meet Trump in South Korea later this month, but economists warn that trade friction between the two biggest economies may be the new normal.

“The surge in exports during the third quarter came after it (China) eased export controls earlier in the year, but that’s likely to drop again following the tighter restrictions introduced recently,” added EIU analyst Chim Lee.

(By Joe Cash and Beijing Newsroom; Editing by Christopher Cushing and Clarence Fernandez)

U.S. Rare Earth Company Signs Strategic Deal With Japanese Government

Amid a global race to secure critical minerals outside China’s control, U.S. rare earth developer REAlloys Inc. has forged a strategic alliance with Japan Organization for Metals and Energy Security (JOGMEC), the government agency under Japan’s Ministry of Economy, Trade and Industry (METI) charged with safeguarding the nation’s industrial supply chains.

The agreement, outlined in a Memorandum of Understanding (MoU), sets out a framework for joint development, technology transfer, and industrial-security cooperation, according to Blackboxstocks Inc. (NASDAQ: BLBX), which is currently in the process of merging with REalloys.

The pact marks JOGMEC’s first formal engagement with an American rare earth producer. It also signals closer alignment between Washington and Tokyo on resource independence. Both governments have identified rare earths and advanced magnets as essential for defense, energy, and semiconductor supply chains that are increasingly exposed to Chinese dominance.

JOGMEC has been one of the world’s most active catalysts for diversification, financing projects from Australia to Africa to lessen market concentration. The REAlloys partnership extends that effort to North America’s resource base and manufacturing capacity.

Focused Collaboration on Advanced Magnet Supply

Under the MoU, JOGMEC, acting on behalf of METI, will facilitate the licensing and transfer of Japanese separation and magnet-fabrication technologies to REAlloys’ North American facilities. The initiative targets the rapid scale-up of high-performance magnets such as neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo), which are materials central to defense systems, EVs, and chip manufacturing.

Both sides will also examine JOGMEC-supported financing for REAlloys’ vertically integrated supply chain, which includes upstream mining assets in Saskatchewan, a midstream separation complex in Saskatoon, and planned downstream magnet production in Ohio.

Leonard Sternheim, REalloys’ chief executive, said the collaboration unites two complementary strengths.

“Japan brings unparalleled magnet and processing technology; North America brings scale and resources,” he said. “Together, we are accelerating regional self-sufficiency in critical materials.”

Structured Access and Allied Security

The agreement provides for structured offtake arrangements guaranteeing reliable long-term supply of rare earth alloys and magnets to Japanese manufacturers. In return, REAlloys will dedicate part of its scandium and yttrium output from Hoidas Lake and secondary monazite sources to Japan, while maintaining its supply to U.S. defense and energy programs.

Hiroshi Kubota, executive vice president of JOGMEC, described the accord as a model for allied resilience.

“This partnership strengthens the foundation of economic security among trusted partners,” Kubota said. “By linking Japan’s technology and North America’s resources, we enhance global supply stability for materials essential to the future economy.”

The collaboration takes shape amid intensifying global competition for strategic minerals and renewed pressure to diversify away from China, which continues to dominate more than 80 percent of global rare earth refining and magnet production. Beijing’s 2023 and 2024 export restrictions on gallium, germanium, and rare earth processing technology have heightened supply insecurity across allied economies, accelerating government-backed efforts in both Washington and Tokyo to localize production.

Within this environment, the REalloys-JOGMEC partnership stands as a coordinated industrial response, linking Japan’s processing expertise and the United States’ raw resource base to build a secure, transparent alternative supply chain. Both sides said the agreement also opens the door to further cooperation, including the application of JOGMEC’s seabed resource technologies and new joint-research initiatives focused on long-term industrial resilience and allied strategic autonomy.

Other Companies Making Moves in the Critical Resources Race

Vale S.A. (NYSE: VALE) is one of the world's largest diversified mining companies, with a core business in iron ore, but it is also a significant global producer of key battery metals, notably nickel and copper. As a massive, established producer of these base metals, Vale's output naturally includes byproducts like cobalt, which is often found in nickel ores. The company's operations span several continents, making it a pivotal supplier to global industrial and clean energy sectors.

The company's immense scale in nickel production is its most critical contribution to the energy transition, as nickel is a high-demand component in many electric vehicle battery chemistries. Vale is actively positioning its high-quality nickel as a preferred source for the electric vehicle supply chain, aiming to meet the strict environmental and traceability standards required by Western automakers.

Vale is currently focused on enhancing and expanding its high-grade nickel and copper assets, particularly in Canada and Brazil. It continues to refine its business to meet the specific requirements of the battery market, including investments in downstream processing capabilities to convert raw nickel materials into the high-purity sulfates required by battery cathode manufacturers.

Energy Fuels Inc. (NYSE American: UUUU) is the leading U.S. producer of uranium, but in a strategic pivot, it has leveraged its unique White Mesa Mill in Utah—the only conventional uranium mill in the country—to become a key player in domestic rare earth element (REE) processing. The company processes monazite sand, a feedstock containing REEs like NdPr, positioning it as an emerging, high-potential participant in the rare earth supply chain.

The company’s critical role lies in addressing the processing bottleneck that has historically crippled the U.S. rare earth sector. While some mining occurs domestically, the necessary chemical separation and purification of REEs has been almost entirely controlled by foreign entities. By producing a mixed rare earth carbonate at White Mesa, Energy Fuels is recreating a vital midstream capability in the U.S., a national security imperative.

Energy Fuels is now in the final stages of a major initiative to upgrade its White Mesa Mill to produce separated rare earth oxides, moving further up the value chain. This ambitious step would enable the company to supply high-purity rare earth oxides directly to U.S. and allied magnet manufacturers.

MP Materials Corp. (NYSE: MP) operates the Mountain Pass rare earth mine in California, a facility that has become the cornerstone of America's strategy to re-shore its magnetic material supply chain. The company extracts and concentrates rare earth elements, focusing heavily on neodymium and praseodymium ($\text{NdPr}$), which are indispensable in the powerful magnets required for modern technologies. The very existence of this scaled, domestic mining operation gives the U.S. industrial base a vital, non-Chinese source of raw rare earth materials.

The company’s true strategic value is its commitment to moving beyond just mining and toward a fully integrated domestic processing capability. Recognizing that global supply chain vulnerability lies primarily in the separation and metalization of rare earths, MP Materials has embarked on an ambitious plan to establish full vertical integration within the U.S.

MP Materials has secured significant support, both commercially and governmentally, to accelerate its build-out of a domestic magnet manufacturing ecosystem. The company has entered into a major public-private partnership with the U.S. Department of Defense, which includes capital investment and long-term purchase commitments to de-risk its expansion.

Critical Metals Corp. (NASDAQ: CRML) is a development-stage firm that has assembled a geostrategic portfolio of future-facing metal assets across Europe and North America. The company’s core focus is on two significant projects: the Wolfsberg Lithium Project in Austria and the massive Tanbreez Rare Earth Project in Greenland. This dual-asset strategy targets two of the most sought-after critical materials for Western industrial supply security: lithium for batteries and high-grade heavy rare earth elements for defense and technology.

The company holds a unique position in the European market through its Wolfsberg Lithium Project, which is Europe's first fully permitted lithium mine. Located strategically near major automotive and battery manufacturing hubs, Wolfsberg is poised to be a major domestic supplier for the European electric vehicle sector, reducing the continent’s reliance on imports. Similarly, the Tanbreez project is one of the world’s largest rare earth deposits, and its abundance of scarce heavy rare earths is of acute strategic interest to Western governments.

Critical Metals has been systematically de-risking its projects and securing the necessary funding to move toward production. The company recently finalized agreements that significantly increase its ownership stake in the Tanbreez project, demonstrating a commitment to ownership control.

USA Rare Earth, Inc. (NASDAQ: USAR) is focused on establishing the capability to produce sintered neodymium permanent magnets in the United States, utilizing materials sourced from allied nations. Rather than solely focusing on the upstream mining of rare earths, the company's strategic vision is to address the crucial downstream gap in American manufacturing, the capacity to turn rare earth oxides into finished magnets, a step currently dominated by foreign entities.

The establishment of domestic rare earth magnet manufacturing is a paramount national priority, as these components are essential for advanced military hardware and electric vehicle motors.

The company's current activities center on advancing the construction and equipment procurement for its magnet manufacturing plant. USA Rare Earth recently signed a Memorandum of Understanding with Lynas Rare Earths to explore a strategic partnership, aiming to connect its magnet production capability directly to a secure supply of rare earth feedstocks from the largest non-Chinese producer.

Lynas Rare Earths Ltd. (OTC: LYSDY) is the largest established producer of separated rare earth materials outside of the People’s Republic of China. The Australian company operates the high-grade Mount Weld mine in Western Australia and runs an advanced separation facility in Malaysia, supplying finished rare earth products, including the critical $\text{NdPr}$ oxide, to manufacturers around the globe.

Lynas provides a fully functioning, proven alternative to Chinese supply, giving Western consumers a critical degree of resilience in their technology supply chains. The company's operations offer an assured origin for high-quality, separated rare earth oxides, which is essential for global automakers, electronics firms, and the defense sector that rely on these materials for permanent magnets. Its long history of reliable supply is a key factor in its strategic importance.

The firm is currently expanding its industrial footprint to further strengthen its non-Chinese supply chain. Lynas is constructing a cracking and leaching plant in Kalgoorlie, Australia, to improve its processing efficiency.

General Motors Company (NYSE: GM) is one of the world’s largest automakers and a leading force in the electric vehicle transition, making it a pivotal consumer and strategist in the critical minerals market. Unlike miners, GM's involvement comes from the demand side; it must secure vast, long-term supplies of battery materials—primarily lithium, nickel, and cobalt—to execute its goal of producing millions of electric vehicles annually.

The company is aggressively pursuing a dual strategy of vertical integration and supply diversification to secure its battery raw materials. GM has made a major investment, valued at hundreds of millions of dollars, in the Thacker Pass lithium project in Nevada to secure a domestic source of the metal. Furthermore, the company is collaborating with recyclers to develop a circular economy for battery metals, ensuring a continuous supply stream from both mined and recycled sources.

Southern Copper Corporation (NYSE: SCCO) is a leading producer of copper, a metal deemed critical due to its indispensable role in electrification, alongside significant output of molybdenum, a critical alloy material. The company operates some of the largest copper mines in the world, primarily in Peru and Mexico, and controls vast reserves that assure a multi-decade supply of this foundational metal for global industry.

The company's importance is directly proportional to copper's role as the backbone of modern electrical infrastructure, from transmission grids to electric vehicle wiring. With global demand for copper projected to soar due to the shift to clean energy, Southern Copper's substantial production capacity is vital for preventing a severe supply crunch in a market that faces historic deficits. Its operations are essential to supporting global infrastructure investment and the manufacture of high-tech devices.

Southern Copper is investing heavily in massive mine expansion projects across its core operational areas to increase its annual production capacity. The firm is committing capital to its projects in Peru and Mexico to bring additional reserves into operation, thereby cementing its position as one of the world’s most dominant copper producers.

Piedmont Lithium Inc. (NASDAQ: PLL) is a lithium developer with projects in North Carolina, Ghana, and Quebec, aiming to supply the rapidly expanding electric vehicle battery market in North America and Europe. The company is particularly focused on developing its Carolina Lithium project, one of the largest hard-rock lithium resources in the United States, alongside its stake in projects that are either operating or nearing production in other key allied jurisdictions.

Piedmont represents a crucial domestic link in the U.S. lithium supply chain, striving to provide a locally sourced, high-purity lithium hydroxide for American battery manufacturers. A secure, reliable source of domestic lithium minimizes geopolitical risk, reduces transportation costs, and provides a shorter, more transparent supply chain, which is highly valued by EV makers in the U.S.

The company's primary effort is focused on advancing the permitting and regulatory approval process for its flagship Carolina Lithium project. Simultaneously, Piedmont is working with its international partners to bring other projects online sooner, allowing it to become an earlier revenue generator and supplier to the battery industry.

Nouveau Monde Graphite Inc. (NYSE: NMG) is a company dedicated to becoming a key contributor to the electric vehicle and energy transition through the development of a fully integrated natural graphite production line. It is focused on its Matawinie Mine and its downstream processing facilities in Quebec, Canada, with a goal of producing high-purity, spherical graphite—the main component in the anode of lithium-ion batteries.

Graphite is the single largest material by weight in any lithium-ion battery, making Nouveau Monde's efforts critically important for the massive ramp-up of EV and energy storage manufacturing in North America. The vast majority of processed battery-grade graphite currently comes from China.

Nouveau Monde is actively progressing the construction and commissioning of its facilities, moving from pilot-scale production to commercial readiness. The company has secured key strategic partnerships and investments, which are aimed at de-risking its development and validating its purified graphite products with potential customers.

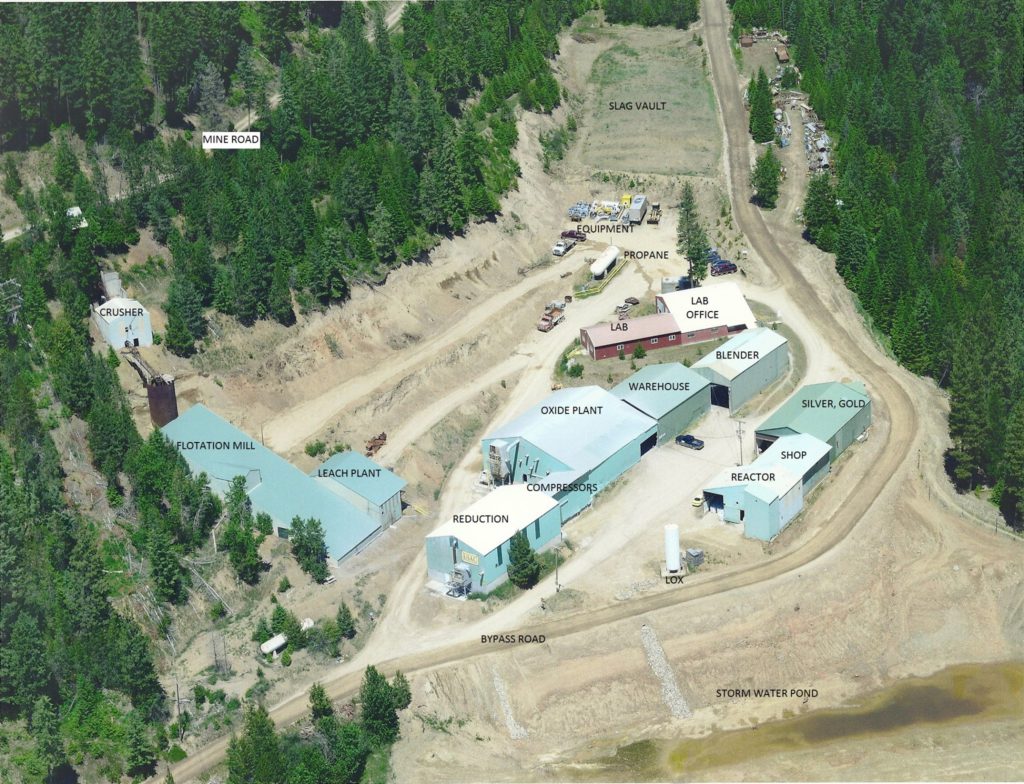

Perpetua Resources Corp. (NASDAQ: PPTA) is focused on the redevelopment of the Stibnite Gold Project in Idaho, which, in addition to gold, has one of the largest deposits of antimony in the world outside of China. Antimony is a U.S. critical mineral primarily used in defense applications (e.g., small arms ammunition, tracer rounds) and in specialized fire retardants.

Perpetua's project is of vital national security importance due to the near-total reliance of the United States on foreign sources for antimony metal. The Stibnite project has received direct support from the U.S. government through the Department of Defense, recognizing its potential to restore a secure, domestic supply of this strategic metal that is essential for the defense industrial base.

The company is in the final stages of the federal permitting process for its Stibnite project, a major hurdle for any large-scale U.S. mining operation. Perpetua has also been securing funding, including grants from the U.S. Army, to expedite the development of its antimony production capabilities.

By. Michael Scott