Ni

Nickel price jumps as Indonesia’s top mine cuts output

Nickel prices rose for a fourth straight day Wednesday after Indonesia ordered the world’s largest nickel mine to sharply cut output in a move aimed at tightening global supply and lifting prices.

LME nickel climbed 2% to $17,835 a tonne as of 6:45 a.m. London time, after earlier touching $17,910, extending a rally of more than 20% since mid-December amid speculative buying and heightened geopolitical tensions.

Indonesia plans to issue production quotas of 260 million to 270 million tonnes of nickel ore this year, according to Bloomberg, slightly above an earlier estimate of 250 million to 260 million tonnes but far below the 379 million tonnes targeted for 2025. Authorities manage output through annual mining permits, known as RKABs, and can revise volumes mid-year.

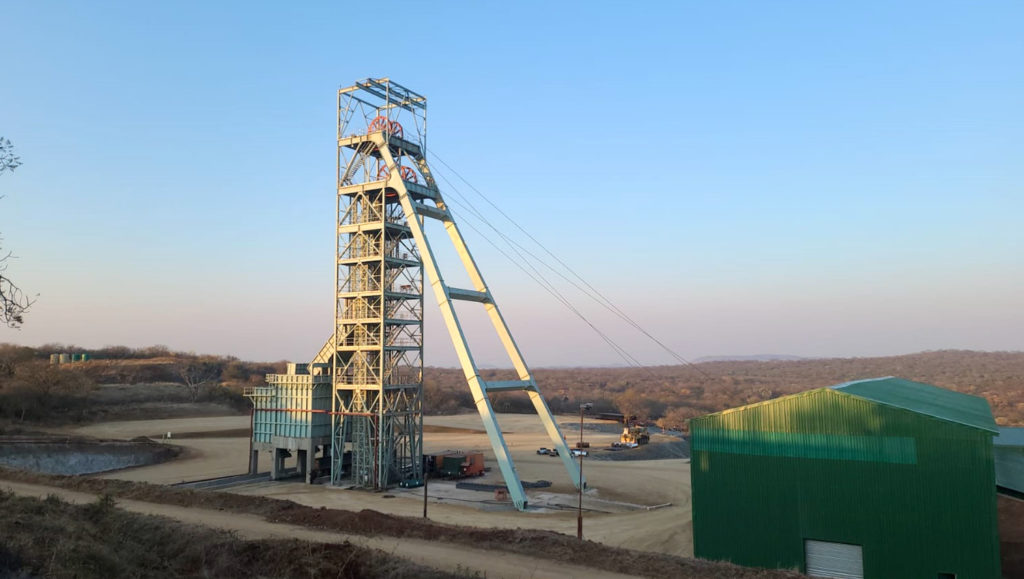

PT Weda Bay Nickel will receive a 12 million tonne ore quota this year, down from 42 million tonnes in 2025. The mine, located on Halmahera in North Maluku, is owned by Tsingshan Holding Group Co, France’s Eramet SA and PT Aneka Tambang. Eramet confirmed the reduced quota and said it plans to seek a revision, while the county’s Energy and Mineral Resources Ministry said quotas remain under evaluation.

Price control

Indonesia is trying to rein in a persistent global surplus after its production surged to about 65% of world supply, triggering a two-year price slump that forced higher-cost rivals in Australia and New Caledonia to shut down.

The quota cut will weigh heavily on Weda Bay, which had planned to expand output to more than 60 million tonnes of ore to support a nearby industrial park. Instead, it has imported large volumes of ore from the Philippines to offset local shortages.

Nickel, used in stainless steel and electric-vehicle batteries, has seen weaker-than-expected demand from the battery sector as some manufacturers shift to non-nickel chemistries.

In January, Macquarie Group raised its 2026 nickel price forecast by 18% to $17,750 a tonne on the LME, citing a sharp drop in the expected surplus due to tighter Indonesian quotas.

Curbing coal

Indonesia is also curbing thermal coal output, with mining quotas in the world’s largest exporter set to fall by nearly 25% from a year earlier. The Indonesian Coal Mining Association said the cuts could force some operations to close and leave overseas buyers scrambling for alternative supplies.

(With files from Bloomberg)

Nornickel reports 36% rise in net profit

Russian metal producer Nornickel’s 2025 net profit rose by 36% year-on-year to $2.47 billion, following higher prices for some metals and foreign‑exchange effects, the company said on Wednesday.

The major producer of refined nickel and palladium said 2025 revenue increased by 10% to $13.76 billion while earnings before interest, tax, depreciation and amortization rose 9% to $5.67 billion.

Platinum, palladium and copper were among metals that gained last year, but Nornickel said the LME nickel average price fell by 10% year-on-year.

Other headwinds included Western sanctions on Russia, high interest rates and a strong rouble.

Targets delivered despite headwinds

Despite the difficulties, CEO Vladimir Potanin said: “Nornickel’s management has delivered on its annual targets, primarily on production and sales.”

In a statement, he added the company expected the major macroeconomic challenges for its business to persist into 2026.

Nornickel is not subject to direct Western sanctions over Russia’s actions in Ukraine, but the measures have prompted some producers to avoid buying Russian metal. They have also complicated the process of making payments and restricted access to Western equipment.

Nornickel did not disclose its sales volumes or sales destinations. Revenue from metal sales rose 10% to $12.983 billion, mainly because of higher prices.

In response to global restrictions, the producer redirected its sales flows to Asia, which became the company’s largest market.

Nornickel’s CFO Sergei Malyshev said the company last year reduced its inventories that had accumulated because of sanctions.

Capital expenditure amounted to $2.6 billion in 2025, and the company expects a similar level in 2026.

Adjusted free cash flow was $1.5 billion.

Malyshev said Nornickel’s dividend payout will depend on its debt metrics, the economic situation, and the cash flow generated by the Bystrinsky copper and gold mine, which has been operating at capacity since around 2020. Earlier, Potanin said dividends for 2025 were unlikely

The company said it expects the global nickel market surplus to reach 275,000 metric tons in 2026, assuming Indonesia maintains the status quo, and anticipates the palladium market will be balanced in the medium term.

(By Anastasia Lyrchikova; Editing by Vladimir Soldatkin and Barbara Lewis)