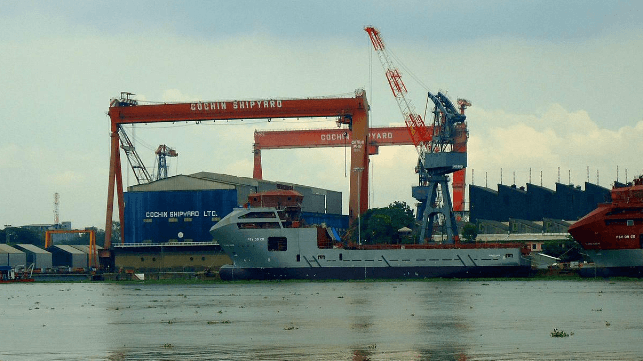

India is set to unveil a new policy aimed at incentivizing domestic shipbuilding. The ports, shipping and waterways ministry (MoPSW) is finalizing a cabinet note on incentives to promote domestic shipyards, reported the Indian business newspaper Mint. The proposed incentives are primarily focused on encouraging the development of fuel-efficient and technologically advanced vessels.

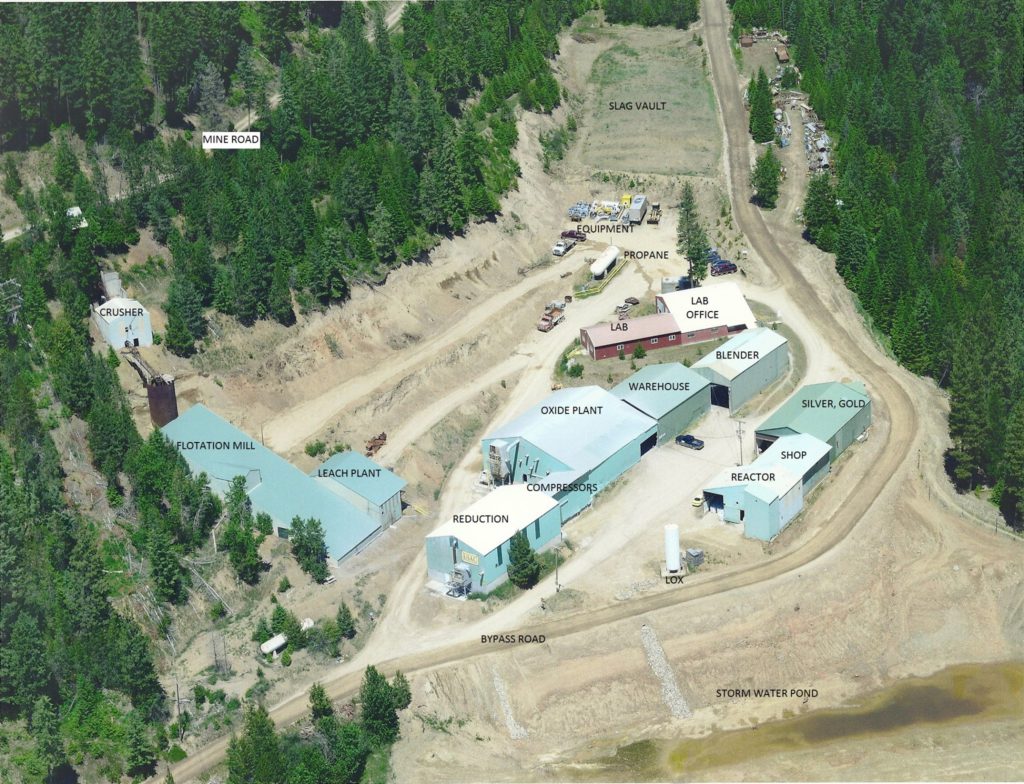

The new incentive program is the second phase of the existing Shipbuilding Financial Assistance Policy (SBFAP), which was adopted in 2016 and slated to expire in 2026. In the first phase of SBFAP, 313 vessel orders encompassing both domestic and export orders have been procured by 39 shipyards. So far, 135 vessels have been delivered.

During the second phase, the government reportedly wants to allocate $2.1 billion for the program. This will help provide a 25 percent subsidy for specialized vessels, rising to 30 percent for green and highly specialized vessels.

Another significant proposal is issuing credit notes worth 40 percent of a ship’s scrap value. After a demolition sale, the credit note could be reimbursed against the cost of constructing a new vessel at an Indian shipyard. Through this proposal, the government is hoping to encourage fleet renewal of Indian vessels. Around 44 percent of India’s merchant shipping fleet is above 20 years of age, data from MoPSW shows.

In addition, the government is also considering to introduce a purchase preference policy beginning in fiscal year 2031. This means vessels seeking new registration for coastal cargo transport in India would need to be built at a domestic shipyard.

India is targeting the shipbuilding industry as one of the critical pillars in achieving its Atmanirbhar Bharat vision (self-reliant India). The goal is to increase the percentage share of India-built ships in India’s fleet to seven percent by 2030 and 69 percent by 2047. The subsidy programs are key in making Indian yards as competitive as those of China and South Korea.

India is also in the process of giving the shipping industry infrastructure status for the first time. Currently, only shipbuilding and shipyards have infrastructure status, but the broader coverage will help reduce project costs for the shipping sector. Infrastructure status means a company can float infrastructure bonds, hence attracting investments from commercial banks and other kinds of concessions.

Estonia’s maritime sector offers a wealth of opportunities for shipowners and maritime entrepreneurs looking to establish a business in a digitally progressive, efficient, and entrepreneur-friendly environment. The Estonian Transport Administration initiative by the EST Flag, promoting an efficient and competitive environment for shipping companies with streamlined solutions tailored to the needs of today’s global maritime industry.

Estonia has garnered international attention and recognition for its e-solutions that empower citizens and businesses alike. As the world’s first fully digital country, Estonia offers 99 percent of government services online, 24/7. Key tools like the e-business register, e-notary, e-signature, and e-tax systems are just a few of the innovations that make conducting business here seamless. Estonia’s commitment to digital innovation extends to the maritime sector, where e-Residency unlocks powerful tools for shipowners.

Digital systems for maritime business owners: Seafarers information system & ship information system

Estonia’s e-Residency enables shipowners to access two specialized digital systems that transform how maritime business is managed:

Seafarers Information System: Allows seafarers to apply for and extend various documents without leaving home or ship. It securely stores all maritime documents such as qualification certificates, practice records, medical certificates, and endorsements. Additionally, the system provides a convenient option to verify the validity check for a certificate of competency, endorsement, or medical certificate.

Ship Information System: With 24/7 self-service and ship management capabilities one can operate a fleet remotely from anywhere in the world – order audits, apply for or update certificates, and access results and documents. The system also helps to keep track of payment obligations, so one never misses a fee.

e-Residency: A gateway to maritime business

Estonia’s pioneering e-Residency program, launched in 2014, offers entrepreneurs worldwide the opportunity to establish and manage an EU-based company remotely. Today’s statistics show that more than 118,500 e-residents have joined the program and over 32,500 Estonian companies have been established by e-residents.

With e-Residency, shipowners benefit from:

Easy EU Company Formation: Register an Estonian company online, unlocking access to the European market under the EU flag.

Digital Business Management: With a secure digital ID, e-residents can remotely manage key business functions, including signing contracts, filing taxes, and accessing government and bank services.

Flexible Financial Solutions: Estonian banks and fintech companies provide accessible business accounts for e-residents, facilitating easy financial management.

Applying for e-Residency is simple: submit an online application, pass a background check, and collect your digital ID card at an Estonian embassy or consulate. After your application has been approved, it can take 2-5 weeks for your e-Residency kit to arrive at your selected pickup location. This straightforward process provides maritime business owners with a stable and transparent EU business environment. Business consulting, accounting, and other trusted service providers can be found on the e-Residency website.

The EST Flag advantages for maritime entrepreneurs

Estonia offers respected value to shipowners through EST Flag, which supports a fast, solution-oriented approach to maritime operations. Recognizing that “every hour a vessel is in port costs”, the Estonian Transport Administration prioritizes rapid response times, ensuring that administrative processes are completed as quickly as possible with a focus on efficient and constructive solutions.

EST Flag offers shipowners competitive advantages, including:

Transparent Tax Benefits: Estonia’s tax system is transparent, efficient, and has simple tax rules and uniform tax rates, which keep compliance costs low. Tax filings take minimal time thanks to a fully digital tax environment. Estonia has the most competitive tax system in the OECD, and its deferred profit tax system encourages entrepreneurship and makes a company’s path to market much easier and less risky.

EU-Integrated Environment: Estonia’s combination of stable political course and EU membership ensures a reliable and compliant framework for maritime businesses seeking to expand internationally. All Estonian digital business services through e-Residency are available in English.

By choosing Estonia, maritime entrepreneurs gain access to a digitally advanced, EU-compliant, and supportive business ecosystem tailored to shipowners' needs. Whether registering a vessel under the Estonian flag, exploring marine technology, or expanding business in the EU, Estonia provides a streamlined, innovative path to success.

This article is sponsored by the Estonian Transport Administration. For additional information visit the website and its LinkedIn page.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

_0.jpg)