US offers to buy stakes in Australian critical minerals companies

The US government has offered to buy equity in Australian critical minerals companies as part of a funding package to expand its supply and cut its reliance on China, executives recently returned from Washington said.

The push is part of a plan to establish alternative mineral supply chains after China, the dominant producer of most critical minerals, responded to US tariffs by restricting exports of rare earths and related permanent magnets, which impacted US and European carmakers.

Critical minerals include lithium, cobalt and rare earths, which are essential to technologies used in a variety of sectors, including clean energy, semiconductors and weapons.

US government officials were “saying to companies, you come to us with a proposal and we’ll assess it and try and make it work through those various funding channels and programs that we have available to us,” Andrew Worland, CEO of International Graphite, which is building a mine and processing plant in Western Australia, told Reuters.

Worland was part of an Australian delegation of 15 critical minerals companies that visited Washington and New York last month to meet senior administration officials.

The officials they met included former mining executive David Copley, who heads an office at the US National Security Council focused on strengthening supply chains, and Joshua Kroon, a deputy assistant secretary for critical minerals and metals at the International Trade Administration, Worland said.

Funding pathways could include traditional debt, debt and equity models, which would be debt financing with an “equity kicker,” and also offtakes, where the US could potentially prepay for supply to add to a defence stockpile, Worland said, adding the focus was on getting projects ready for 2027.

The White House did not immediately respond to a request for comment on the discussions with the Australian companies.

The US government has already taken equity holdings in US-listed critical minerals companies. On Tuesday, Reuters reported the US Department of Energy will take a 5% stake in Lithium Americas and a separate 5% stake in the company’s Thacker Pass lithium mine joint venture with General Motors.

The US government will acquire the stakes in Lithium Americas via no-cost warrants, the latest private sector investment by the Trump administration after recent purchases of parts of Intel and MP Materials to boost industries seen as vital to US national security.

Reuters also reported on Tuesday Australia is willing to sell shares in its new strategic reserve of critical minerals to allies including Britain to reduce their dependence on China.

The reserve is expected to be a bargaining chip for Prime Minister Anthony Albanese when he meets President Trump in Washington on October 20. The Trump administration is reviewing the Australia, UK, US (AUKUS) defence pact, which includes a multi-billion-dollar plan to provide Australia with nuclear-powered attack submarines to counter China in the Indo-Pacific.

“The big takeaway message is the US government is open for business and they will use whatever financial instruments are appropriate or suitable on a case-by-case basis,” said CEO Andrew Tong of Cobalt Blue, who was also part of the delegation.

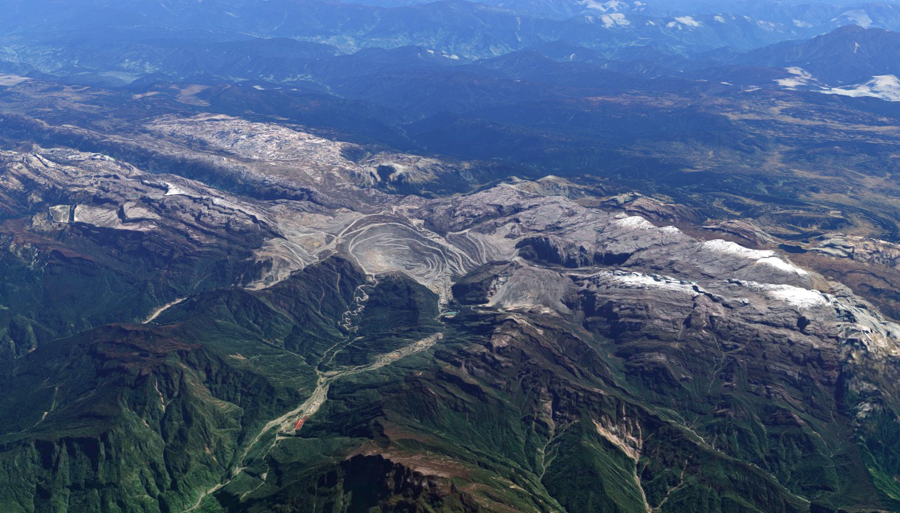

Cobalt Blue is seeking funding for its Australian cobalt mine and a cobalt refinery in Western Australia, which it is looking to integrate into the US supply chain, he said.

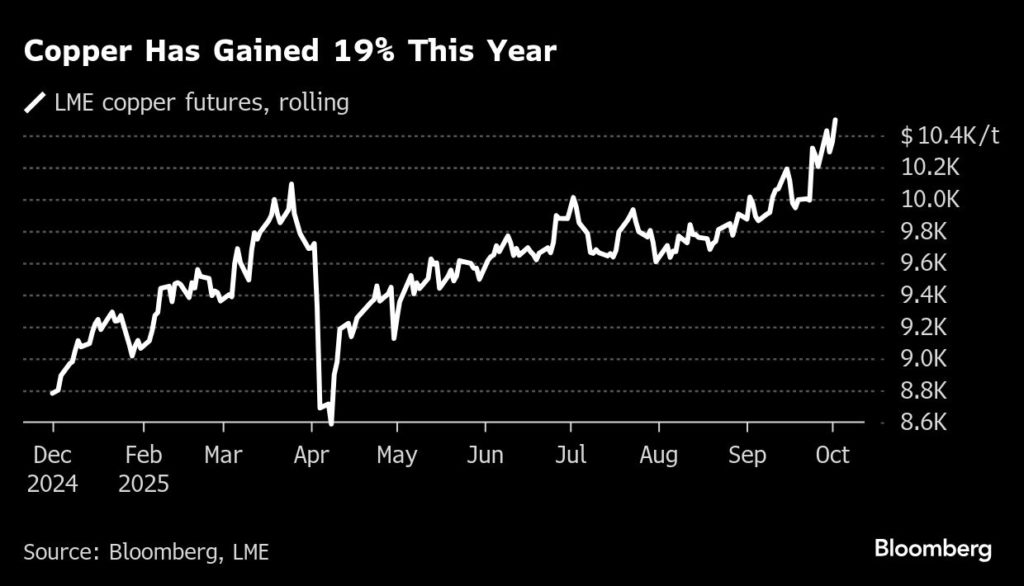

Financing has been difficult for critical minerals projects because their product markets are small and prices can be volatile, making valuations difficult and investments risky. But government backing, including the potential US role, has derisked projects and ignited investor interest.

(By Melanie Burton and Jarrett Renshaw; Editing by Christian Schmollinger)