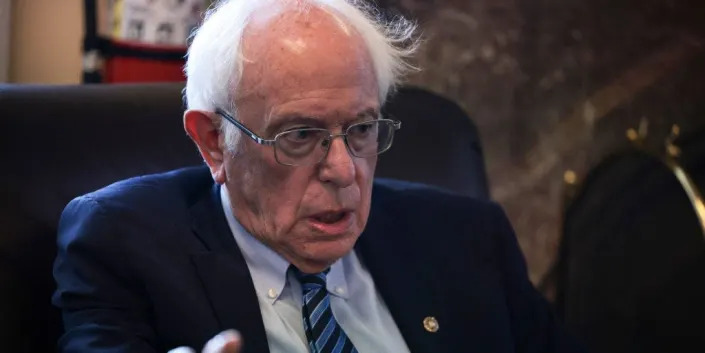

Bernie Sanders wants a 95% tax on big corporations' pandemic-era profits to bring down rising prices

Sanders wants to hit all large firms with a 95% windfall tax on their revenue.

Under the plan, Amazon would have paid $28.6 billion in 2021.

Its reach goes far beyond the oil and gas industry.

Bernie Sanders once again wants to tax big corporations. This time, he's proposing a 95% tax on the record profits firms are raking in amidst 40-year-high inflation, ballooning costs, and a pandemic.

On Friday, Sanders introduced the "Ending Corporate Greed Act," cosponsored by fellow progressive Senator Ed Markey, with New York Rep. Jamaal Bowman introducing the legislation in the House.

Under Sanders' plan, companies that make over $500 million in annual revenue would be taxed 95% on their "windfall profits." That amount would be calculated based on their average profit level in the five years leading up to the pandemic. Deemed a "temporary emergency measure," the tax would only be in place from 2022 to 2024. In a release, Sanders said the levy would bring in $400 billion in just one year.

"We cannot allow big oil companies and other large, profitable corporations to continue to use the war in Ukraine, the COVID-19 pandemic, and the specter of inflation to make obscene profits by price gouging Americans at the gas pump, the grocery store, or any other sector of our economy," Sanders said in a release.

The Sanders bill would pursue excess profits more aggressively than other Democratic proposals in Congress. That's due to its planned tax on every large US corporation, not just those in the oil and gas sector. Another windfall tax proposal from Rep. Ro Khanna of California and Sen. Sheldon Whitehouse of Rhode Island would target only oil and gas companies, and use the funds to provide direct payments.

Here's how much some firms would have paid in 2021, based on calculations from Sanders's office:

Berkshire Hathaway: $66.1 billion

Amazon: $28.6 billion

JP Morgan Chase: $18.8 billion

Chevron: $12.9 billion

It's not an unheard of measure: As Sanders notes, similar taxes were enacted during World War Two and the Korean War.

Windfall profit taxes have also historically targeted oil prices and profits. In fact, President Richard Nixon proposed such a tax on oil prices.

"It just isn't fair, for example, for millions of Americans to make sacrifices in order to deal with the crisis we confront and for a few to make excess profits or what we would call windfall profits," Nixon said in 1973.

It's not likely to get through Congress. Republicans tend to be averse to any tax increases and some centrist Democrats may also squirm at levying a tax on excess profits on every US company.

"During these troubling times, the working class cannot bear the brunt of this economic crisis, while corporate CEOs, wealthy shareholders, and the billionaire class make out like bandits," Sanders said.

No comments:

Post a Comment