India's top court orders probe of Adani business group

Thu, March 2, 2023

NEW DELHI (AP) — India’s top court on Thursday ordered an expert committee to investigate any regulatory failures related to the country's second-largest conglomerate, the Adani Group.

The investigation was prompted by allegations made by U.S. short-seller Hindenburg Research in a report that accused Adani companies of engaging in market manipulation and other fraudulent practices.

Shares in the group's flagship, Adani Enterprises, and other affiliated companies have lost tens of billions of dollars in market value since Hindenburg issued its report.

The Adani Group has denied any wrongdoing, defending itself against the allegations in a 413 page rebuttal. In a tweet Thursday, it welcomed the court order.

"It will bring finality in a time-bound manner. Truth will prevail,” the company said.

The expert committee will submit its findings to the Supreme Court within two months, said Chief Justice D.Y. Chandrachud and justices P.S. Narasimha and J.B. Pardiwala.

The top court also directed the government-run Securities and Exchange Board of India to investigate whether there had been a violation of rules or manipulation of stock prices by the Adani Group.

The court acted on petitions filed by some activists and lawyers.

Apart from investigating allegations against Adani, the expert committee is to suggest measures to improve regulatory oversight and protections for investors.

Adani Enterprises canceled a share offering meant to raise $2.5 billion last month after Hindenburg issued its report and its share price plummeted.

Opposition lawmakers blocked parliamentary proceedings last month demanding a probe into the business dealings of coal tycoon Gautam Adani, who is said to enjoy close ties with Prime Minister Narendra Modi.

___

This article corrects the word used in the company's tweet to “Truth” from “Trust.”

Ashok Sharma, The Associated Press

Thu, March 2, 2023

NEW DELHI (AP) — India’s top court on Thursday ordered an expert committee to investigate any regulatory failures related to the country's second-largest conglomerate, the Adani Group.

The investigation was prompted by allegations made by U.S. short-seller Hindenburg Research in a report that accused Adani companies of engaging in market manipulation and other fraudulent practices.

Shares in the group's flagship, Adani Enterprises, and other affiliated companies have lost tens of billions of dollars in market value since Hindenburg issued its report.

The Adani Group has denied any wrongdoing, defending itself against the allegations in a 413 page rebuttal. In a tweet Thursday, it welcomed the court order.

"It will bring finality in a time-bound manner. Truth will prevail,” the company said.

The expert committee will submit its findings to the Supreme Court within two months, said Chief Justice D.Y. Chandrachud and justices P.S. Narasimha and J.B. Pardiwala.

The top court also directed the government-run Securities and Exchange Board of India to investigate whether there had been a violation of rules or manipulation of stock prices by the Adani Group.

The court acted on petitions filed by some activists and lawyers.

Apart from investigating allegations against Adani, the expert committee is to suggest measures to improve regulatory oversight and protections for investors.

Adani Enterprises canceled a share offering meant to raise $2.5 billion last month after Hindenburg issued its report and its share price plummeted.

Opposition lawmakers blocked parliamentary proceedings last month demanding a probe into the business dealings of coal tycoon Gautam Adani, who is said to enjoy close ties with Prime Minister Narendra Modi.

___

This article corrects the word used in the company's tweet to “Truth” from “Trust.”

Ashok Sharma, The Associated Press

As Adani Group saga casts a shadow over Modi and India’s economy, will both emerge unscathed?

Questions have been raised about India’s regulatory standards and levels of corporate governance following the Adani Group’s stock wipeout

Modi’s opponents will seek to use the episode to hurt his electoral chances, analysts say – but the implications reach far beyond politics

Biman Mukherji

Published 4 Mar, 2023

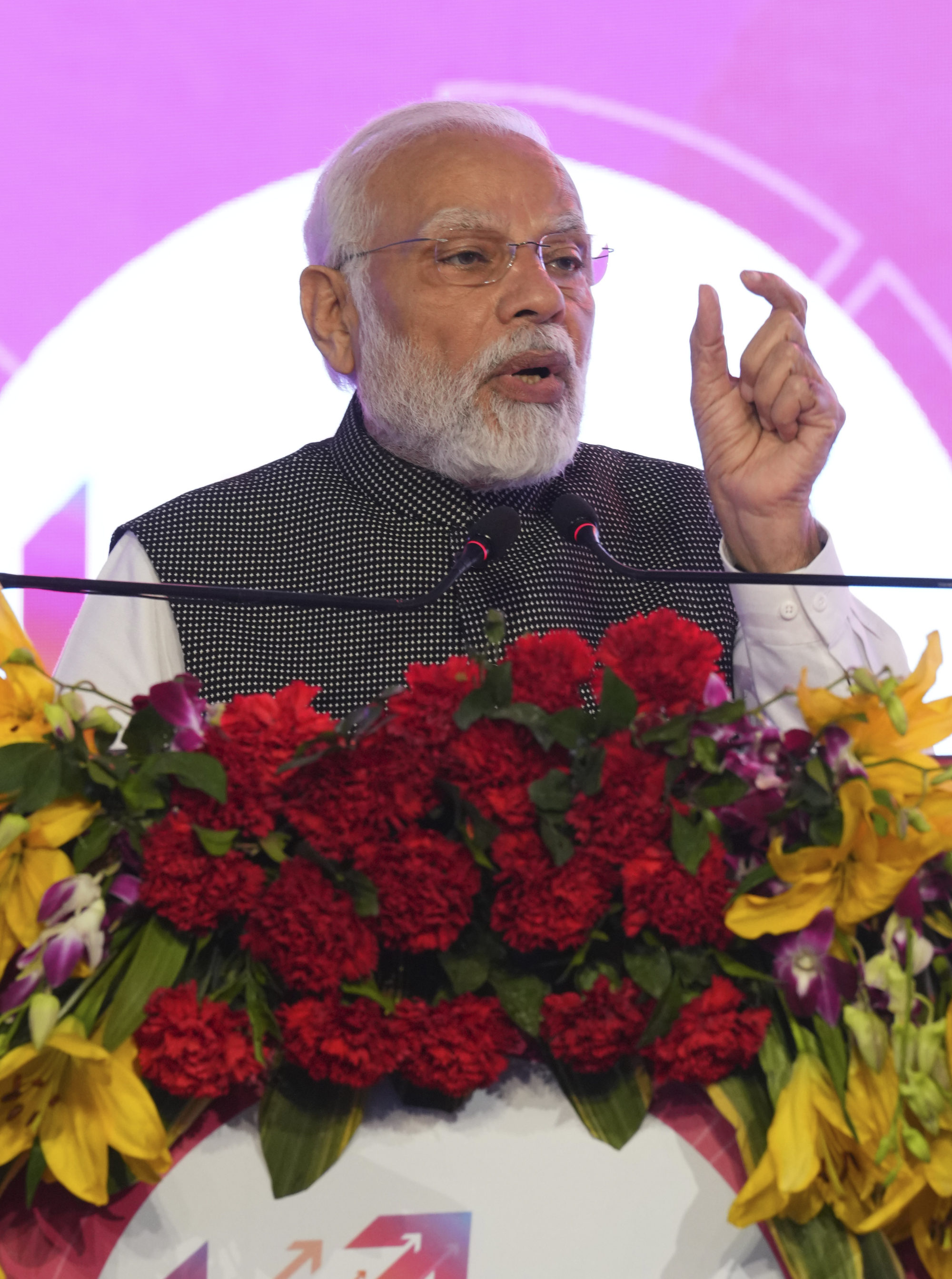

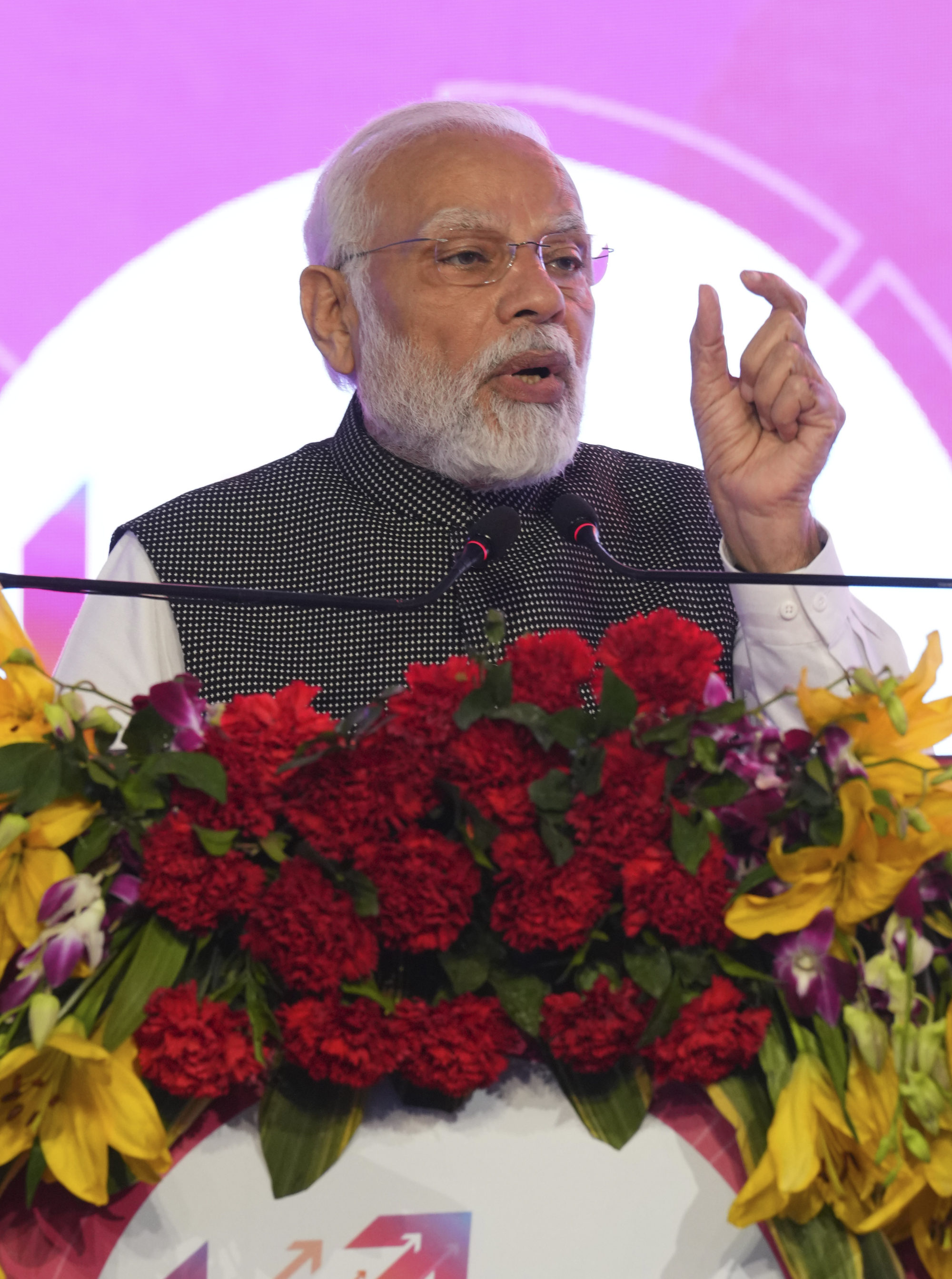

The Adani affair raises broader questions about regulatory standards in India’s markets and could hurt Prime Minister Narendra Modi electorally. Photo: Reuters

Gautam Adani’s fall from grace as Asia’s richest man was swift and sharp. Since short-seller Hindenburg’s price-rigging allegations in late January, shares of the billionaire’s conglomerate have halved in price and seven of the group’s listed firms have lost US$140 billion in market value.

The Adani Group’s stock wipeout hit some of India’s biggest ports, airports and power stations, raising broader questions about regulatory standards in Indian markets and casting a shadow over Prime Minister Narendra Modi’s reign ahead of crucial state elections.

Rahul Gandhi, a leading figure in the main opposition Congress party, has accused Modi’s government of advancing the Adani Group’s business interests – a charge the ruling Bharatiya Janata Party (BJP) denies

While the accusation has not as yet triggered a public backlash against the government, India’s Supreme Court on Thursday set up a six-member panel to investigate allegations against the Adani Group, including the exposure of and risk to public money through public-sector undertakings. Opposition leaders have demanded a parliamentary probe as well.

Activists from the youth wing of India’s Congress party hold placards and shout slogans as they protest outside the regional headquarters of the Life Insurance Corporation of India in New Delhi last month. Photo: AFP

The stock wipeout hurt the middle class, too. Shares in the country’s largest insurer – the state-run Life Insurance Corporation of India (LIC), which holds around 4 per cent of flagship company Adani Enterprises – took a beating in the aftermath. About one-quarter of India’s population have investments and policies with LIC.

Analysts say the BJP is likely to be hard-pressed over the issue in state elections this year, three of which were held this week. Defeat could mar the ruling party’s prospects in next year’s general election, where it seeks a historic third mandate.

“It has been only a month since the [Hindenburg] report came out and … more and more people will be talking about the very fact that the shares have fallen so much,” said Nilanjan Mukhopadhyay, author of the book Narendra Modi: The Man, The Times.

“There is a very strong possibility that this will have a negative fallout on the BJP. At the moment, it has not caught the public eye, but there is a history of corporate scams having a negative impact on the ruling establishment,” he said.

Adani Group seeks to reassure Hong Kong investors after short-seller allegations

28 Feb 2023

Still, “the opposition has a lot of work to do” to make the issue relatable to voters, Mukhopadhyay said. “They have to take it up in a language which is understood by people.”

Yet the Adani affair is likely to invite scrutiny of regulators’ earnestness in protecting small investors, especially from the millions of India’s young people who have flocked to invest in stock markets over the past decade rather than keep their savings in banks.

Modi’s popularity tested

The episode could prove to be the opposition’s strongest weapon against Modi’s government if capitalised upon, analysts say.

“Even before the Hindenburg report on the Adani Group came out, our surveys in the last couple of years show that people believe that the government has been more pro-business rather than [pro-]the common man,” said Yashwant Deshmukh, founder of research firm C-Voter.

He said much of the negative impact on Modi’s government had been mitigated by a popular budget, unveiled last month, which offered a slew of tax breaks – including raising the level after which income tax is payable from 500,000 rupees to 700,000 rupees (from US$6,060 to US$8,490).

“Effectively, the government has bought some insurance for itself,” Deshmukh said.

Conventional wisdom says this kind of thing should be working against the ruling par

Meanwhile, the approval rating of his main rival, the Congress’ Gandhi, has improved to 15 per cent from a low of 9 per cent in September last year, bolstered by his United India March a 3,500km cross-country trek to challenge the Hindu nationalist BJP.

But Gandhi’s gain in popularity had come at the expense of other leading figures, including his mother Sonia, rather than eaten into Modi’s share, Deshmukh said.

Narendra Modi speaks at a global investors summit in Lucknow last month. The Indian prime minister’s popularity has appeared resilient amid the Adani Group affair. Photo: AP

“Conventional wisdom says this kind of thing [the Adani crisis] should be working against the ruling party, but Modi has been a gravity defier in popularity ratings. Somewhere down the line, public anger and their vote are not going in the same direction,” he said.

“It is not resulting in an anti-incumbency sentiment probably because personal trust in Modi has superseded everything else.”

Gandhi’s march may have salvaged some of his own party’s plummeting fortunes, but it failed to unite opposition leaders to challenge Modi. Only nine of 23 “like-minded parties” invited by Congress turned up to join an event marking the end of the march in Kashmir at the end of January.

A challenge for regulators

How India deals with the allegations against the Adani Group will have implications far more significant than politics alone, analysts say, as Modi tries to woo foreign investors to advance his goal of growing the country into a US

“The Adani crisis comes at a time when businesses are looking at diversifying their supply chains into India, and [it] could affect how foreign investors see the country,” said Bernard Aw, chief APAC economist at Coface, a global credit insurer.

“An official investigation into the allegations is important to restore investor confidence,” he said. “The forming of a joint parliamentary committee to investigate could also help.”

Opposition leaders have made little progress so far in their demands for a parliamentary probe.

India’s Adani hits back at Hindenburg report, says it made all disclosures

30 Jan 2023

The Adani Group issued a detailed rebuttal of the Hindenburg report, which it called a “calculated attack on India”, but analysts say it would be foolish for policymakers to let themselves be swayed by emotions as the matter needs to be investigated by a regulator.

Hindenburg Research is a short seller – meaning it thrives on selling stocks and buying them back cheaper later – and its charges are likely to have been financially motivated, analysts say.

It has attacked other companies in the past but the Adani Group’s staggering market loss was without precedent globally, said Salvatore Cantale, a finance professor at the International Institute for Management Development in Lausanne, Switzerland.

“I think the Indian regulators should take stock of this and say, ‘hey, is there anything we can do with this? [Is there] any merit in this case?’,” he said.

The Adani Group’s assets range from power infrastructure to ports and airports, and represent about 6 per cent of India’s existing renewable energy capacity. Photo: Reuters

India’s economy, already the fifth largest globally, is projected by the International Monetary Fund to remain the fastest-growing major economy in the world this year. But its corporate governance lagged behind its rising economic power, Cantale said.

“It’s an important moment for India to step up corporate governance … It means not only better returns, but also … better protection of minority shareholders and more accountability for its board of directors and executive directors,” he said.

India’s market regulator, the Securities and Exchange Board of India, has said that it is looking into the Hindenburg allegations, while the Reserve Bank of India has tried to allay concerns about retail banks’ exposure to Adani stocks.

But analysts say Indian regulators need to move swiftly and be transparent.

“The clearer the regulator is about the action it will take [then] the more will investors – and more so foreign investors – have trust.”

Wider economic effects

Foreign investors have pulled their money out of Indian markets in recent weeks, partly because of concerns about the Adani issue and Indian shares being overvalued, with the benchmark Bombay Stock Exchange index declining by close to 7 per cent since December.

Since the start of the year, no company has launched an initial public offering, in contrast to the 17 that did in November and December. “We were expecting that activity to continue into this year,” said Pranav Haldea, managing director of Prime Database, a capital-market data provider.

To shore up the economy, create more jobs and boost investments in energy, roads and other infrastructure, Finance Minister Nirmala Sitharaman raised the government’s capital expenditure by 33 per cent to 10 trillion rupees (US$121 billion) in the budget for the next financial year starting from April 1.

Meanwhile, the Adani Group was facing questions about its reduced ability to raise capital and refinance debt in the short term due to the recent “adverse developments”, said Abhishek Tyagi, vice-president at Moody’s Investors Service. Moody’s ratings recently changed its outlook on four Adani companies to negative from stable in the wake of the stocks slide.

India’s Finance Minister Nirmala Sitharaman raised the government’s capital expenditure by 33 per cent to shore up the economy. Photo: Reuters

The group has told creditors that it secured a US$3 billion loan from a sovereign wealth fund that could be increased to US$5 billion, Reuters reported on Wednesday. The management also said that it expected to prepay or repay share-backed loans worth between US$690 million and US$790 million by the end of March, according to the report.

US boutique investment firm GQG Partners Inc has bought shares worth US$1.87 billion in four Adani Group companies, marking the first major investment in the Indian conglomerate since a short seller’s critical report sparked a stock rout.

Ten Adani Group stocks closed higher on Wednesday for the first time since the Hindenburg report’s release in late January, but bearish sentiment in global markets means it is too early to say whether they are out of the woods yet, traders say.

The Adani Group’s share-market volatility has also created uncertainty around India’s clean-energy ambitions.

Two years ago, Modi vowed that half the nation’s energy needs would come from renewable sources by 2030, an important step to reach its target of net-zero emissions by 2070. Subsequently, Adani unveiled plans to spend US$70 billion on green investments, such as making electric batteries and solar panels, and producing green hydrogen.

Adani Group woes threaten Modi’s dream of a self-reliant India

16 Feb 2023

“The Adani Group is unlikely to be able to access any material amount of new capital to complete the proposed green-investment pipeline beyond the existing new facilities already financed and under development,” said Tim Buckley, director of Climate Energy Finance.

The group’s assets represented about 6 per cent of India’s existing renewable-energy capacity, he said, adding that other companies such as NTPC, Tata Renewables, Greenko and Renew Power could also help India decarbonise.

The government’s recent boost to capital expenditure could help support its green push, analysts say, but it will also rely on strong private partners.

“I expect the government’s commitment to infrastructure will continue,” said Biswajit Dhar, an independent economist. “But the big question is whether they will be able to replace the Adanis if their stocks really sour.”

Biman Mukherji

has more than two decades of reporting and editing experience in Asia, focusing on Indian and Asia business.

Questions have been raised about India’s regulatory standards and levels of corporate governance following the Adani Group’s stock wipeout

Modi’s opponents will seek to use the episode to hurt his electoral chances, analysts say – but the implications reach far beyond politics

Biman Mukherji

Published 4 Mar, 2023

The Adani affair raises broader questions about regulatory standards in India’s markets and could hurt Prime Minister Narendra Modi electorally. Photo: Reuters

Gautam Adani’s fall from grace as Asia’s richest man was swift and sharp. Since short-seller Hindenburg’s price-rigging allegations in late January, shares of the billionaire’s conglomerate have halved in price and seven of the group’s listed firms have lost US$140 billion in market value.

The Adani Group’s stock wipeout hit some of India’s biggest ports, airports and power stations, raising broader questions about regulatory standards in Indian markets and casting a shadow over Prime Minister Narendra Modi’s reign ahead of crucial state elections.

Rahul Gandhi, a leading figure in the main opposition Congress party, has accused Modi’s government of advancing the Adani Group’s business interests – a charge the ruling Bharatiya Janata Party (BJP) denies

While the accusation has not as yet triggered a public backlash against the government, India’s Supreme Court on Thursday set up a six-member panel to investigate allegations against the Adani Group, including the exposure of and risk to public money through public-sector undertakings. Opposition leaders have demanded a parliamentary probe as well.

Activists from the youth wing of India’s Congress party hold placards and shout slogans as they protest outside the regional headquarters of the Life Insurance Corporation of India in New Delhi last month. Photo: AFP

The stock wipeout hurt the middle class, too. Shares in the country’s largest insurer – the state-run Life Insurance Corporation of India (LIC), which holds around 4 per cent of flagship company Adani Enterprises – took a beating in the aftermath. About one-quarter of India’s population have investments and policies with LIC.

Analysts say the BJP is likely to be hard-pressed over the issue in state elections this year, three of which were held this week. Defeat could mar the ruling party’s prospects in next year’s general election, where it seeks a historic third mandate.

“It has been only a month since the [Hindenburg] report came out and … more and more people will be talking about the very fact that the shares have fallen so much,” said Nilanjan Mukhopadhyay, author of the book Narendra Modi: The Man, The Times.

“There is a very strong possibility that this will have a negative fallout on the BJP. At the moment, it has not caught the public eye, but there is a history of corporate scams having a negative impact on the ruling establishment,” he said.

Adani Group seeks to reassure Hong Kong investors after short-seller allegations

28 Feb 2023

Still, “the opposition has a lot of work to do” to make the issue relatable to voters, Mukhopadhyay said. “They have to take it up in a language which is understood by people.”

Yet the Adani affair is likely to invite scrutiny of regulators’ earnestness in protecting small investors, especially from the millions of India’s young people who have flocked to invest in stock markets over the past decade rather than keep their savings in banks.

Modi’s popularity tested

The episode could prove to be the opposition’s strongest weapon against Modi’s government if capitalised upon, analysts say.

“Even before the Hindenburg report on the Adani Group came out, our surveys in the last couple of years show that people believe that the government has been more pro-business rather than [pro-]the common man,” said Yashwant Deshmukh, founder of research firm C-Voter.

He said much of the negative impact on Modi’s government had been mitigated by a popular budget, unveiled last month, which offered a slew of tax breaks – including raising the level after which income tax is payable from 500,000 rupees to 700,000 rupees (from US$6,060 to US$8,490).

“Effectively, the government has bought some insurance for itself,” Deshmukh said.

Conventional wisdom says this kind of thing should be working against the ruling par

Meanwhile, the approval rating of his main rival, the Congress’ Gandhi, has improved to 15 per cent from a low of 9 per cent in September last year, bolstered by his United India March a 3,500km cross-country trek to challenge the Hindu nationalist BJP.

But Gandhi’s gain in popularity had come at the expense of other leading figures, including his mother Sonia, rather than eaten into Modi’s share, Deshmukh said.

Narendra Modi speaks at a global investors summit in Lucknow last month. The Indian prime minister’s popularity has appeared resilient amid the Adani Group affair. Photo: AP

“Conventional wisdom says this kind of thing [the Adani crisis] should be working against the ruling party, but Modi has been a gravity defier in popularity ratings. Somewhere down the line, public anger and their vote are not going in the same direction,” he said.

“It is not resulting in an anti-incumbency sentiment probably because personal trust in Modi has superseded everything else.”

Gandhi’s march may have salvaged some of his own party’s plummeting fortunes, but it failed to unite opposition leaders to challenge Modi. Only nine of 23 “like-minded parties” invited by Congress turned up to join an event marking the end of the march in Kashmir at the end of January.

A challenge for regulators

How India deals with the allegations against the Adani Group will have implications far more significant than politics alone, analysts say, as Modi tries to woo foreign investors to advance his goal of growing the country into a US

“The Adani crisis comes at a time when businesses are looking at diversifying their supply chains into India, and [it] could affect how foreign investors see the country,” said Bernard Aw, chief APAC economist at Coface, a global credit insurer.

“An official investigation into the allegations is important to restore investor confidence,” he said. “The forming of a joint parliamentary committee to investigate could also help.”

Opposition leaders have made little progress so far in their demands for a parliamentary probe.

India’s Adani hits back at Hindenburg report, says it made all disclosures

30 Jan 2023

The Adani Group issued a detailed rebuttal of the Hindenburg report, which it called a “calculated attack on India”, but analysts say it would be foolish for policymakers to let themselves be swayed by emotions as the matter needs to be investigated by a regulator.

Hindenburg Research is a short seller – meaning it thrives on selling stocks and buying them back cheaper later – and its charges are likely to have been financially motivated, analysts say.

It has attacked other companies in the past but the Adani Group’s staggering market loss was without precedent globally, said Salvatore Cantale, a finance professor at the International Institute for Management Development in Lausanne, Switzerland.

“I think the Indian regulators should take stock of this and say, ‘hey, is there anything we can do with this? [Is there] any merit in this case?’,” he said.

The Adani Group’s assets range from power infrastructure to ports and airports, and represent about 6 per cent of India’s existing renewable energy capacity. Photo: Reuters

India’s economy, already the fifth largest globally, is projected by the International Monetary Fund to remain the fastest-growing major economy in the world this year. But its corporate governance lagged behind its rising economic power, Cantale said.

“It’s an important moment for India to step up corporate governance … It means not only better returns, but also … better protection of minority shareholders and more accountability for its board of directors and executive directors,” he said.

India’s market regulator, the Securities and Exchange Board of India, has said that it is looking into the Hindenburg allegations, while the Reserve Bank of India has tried to allay concerns about retail banks’ exposure to Adani stocks.

But analysts say Indian regulators need to move swiftly and be transparent.

“The clearer the regulator is about the action it will take [then] the more will investors – and more so foreign investors – have trust.”

Wider economic effects

Foreign investors have pulled their money out of Indian markets in recent weeks, partly because of concerns about the Adani issue and Indian shares being overvalued, with the benchmark Bombay Stock Exchange index declining by close to 7 per cent since December.

Since the start of the year, no company has launched an initial public offering, in contrast to the 17 that did in November and December. “We were expecting that activity to continue into this year,” said Pranav Haldea, managing director of Prime Database, a capital-market data provider.

To shore up the economy, create more jobs and boost investments in energy, roads and other infrastructure, Finance Minister Nirmala Sitharaman raised the government’s capital expenditure by 33 per cent to 10 trillion rupees (US$121 billion) in the budget for the next financial year starting from April 1.

Meanwhile, the Adani Group was facing questions about its reduced ability to raise capital and refinance debt in the short term due to the recent “adverse developments”, said Abhishek Tyagi, vice-president at Moody’s Investors Service. Moody’s ratings recently changed its outlook on four Adani companies to negative from stable in the wake of the stocks slide.

India’s Finance Minister Nirmala Sitharaman raised the government’s capital expenditure by 33 per cent to shore up the economy. Photo: Reuters

The group has told creditors that it secured a US$3 billion loan from a sovereign wealth fund that could be increased to US$5 billion, Reuters reported on Wednesday. The management also said that it expected to prepay or repay share-backed loans worth between US$690 million and US$790 million by the end of March, according to the report.

US boutique investment firm GQG Partners Inc has bought shares worth US$1.87 billion in four Adani Group companies, marking the first major investment in the Indian conglomerate since a short seller’s critical report sparked a stock rout.

Ten Adani Group stocks closed higher on Wednesday for the first time since the Hindenburg report’s release in late January, but bearish sentiment in global markets means it is too early to say whether they are out of the woods yet, traders say.

The Adani Group’s share-market volatility has also created uncertainty around India’s clean-energy ambitions.

Two years ago, Modi vowed that half the nation’s energy needs would come from renewable sources by 2030, an important step to reach its target of net-zero emissions by 2070. Subsequently, Adani unveiled plans to spend US$70 billion on green investments, such as making electric batteries and solar panels, and producing green hydrogen.

Adani Group woes threaten Modi’s dream of a self-reliant India

16 Feb 2023

“The Adani Group is unlikely to be able to access any material amount of new capital to complete the proposed green-investment pipeline beyond the existing new facilities already financed and under development,” said Tim Buckley, director of Climate Energy Finance.

The group’s assets represented about 6 per cent of India’s existing renewable-energy capacity, he said, adding that other companies such as NTPC, Tata Renewables, Greenko and Renew Power could also help India decarbonise.

The government’s recent boost to capital expenditure could help support its green push, analysts say, but it will also rely on strong private partners.

“I expect the government’s commitment to infrastructure will continue,” said Biswajit Dhar, an independent economist. “But the big question is whether they will be able to replace the Adanis if their stocks really sour.”

Biman Mukherji

has more than two decades of reporting and editing experience in Asia, focusing on Indian and Asia business.

No comments:

Post a Comment