Bloomberg News | March 31, 2023 |

Credit: Rock Tech Lithium

For 47 years, a chemicals producer in London’s commuter belt has been running a small lithium refinery that’s the only one of its kind in Europe. Now Leverton Lithium is expanding as the rush to secure supplies of the key battery metal intensifies.

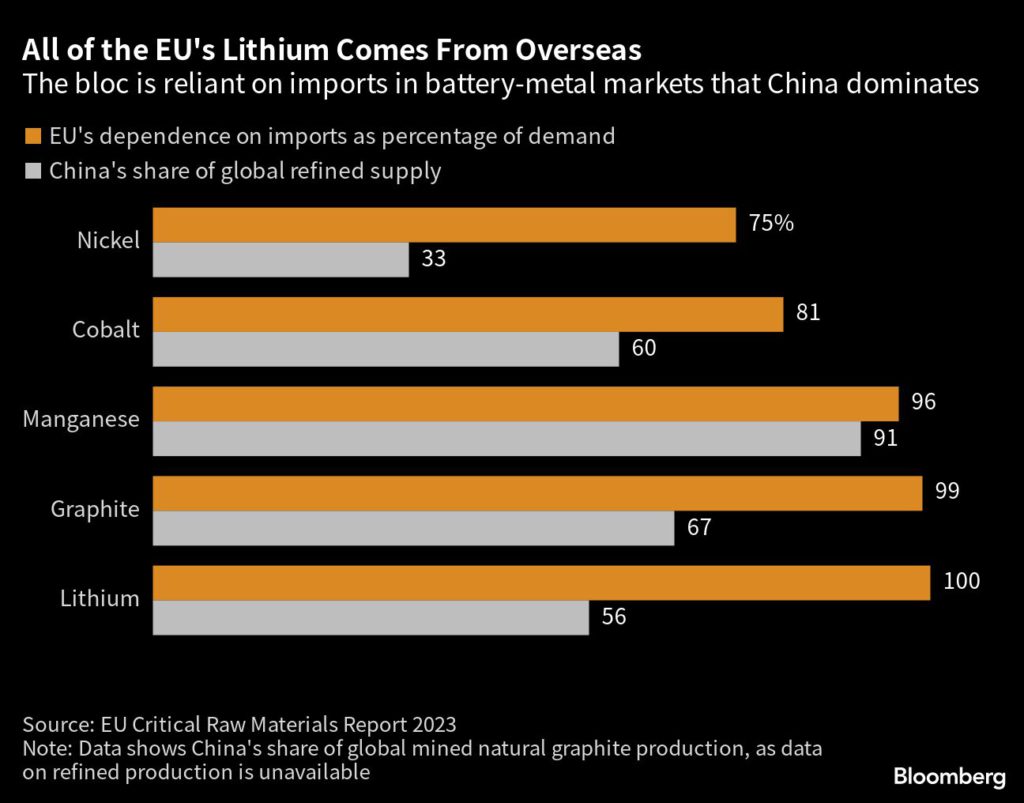

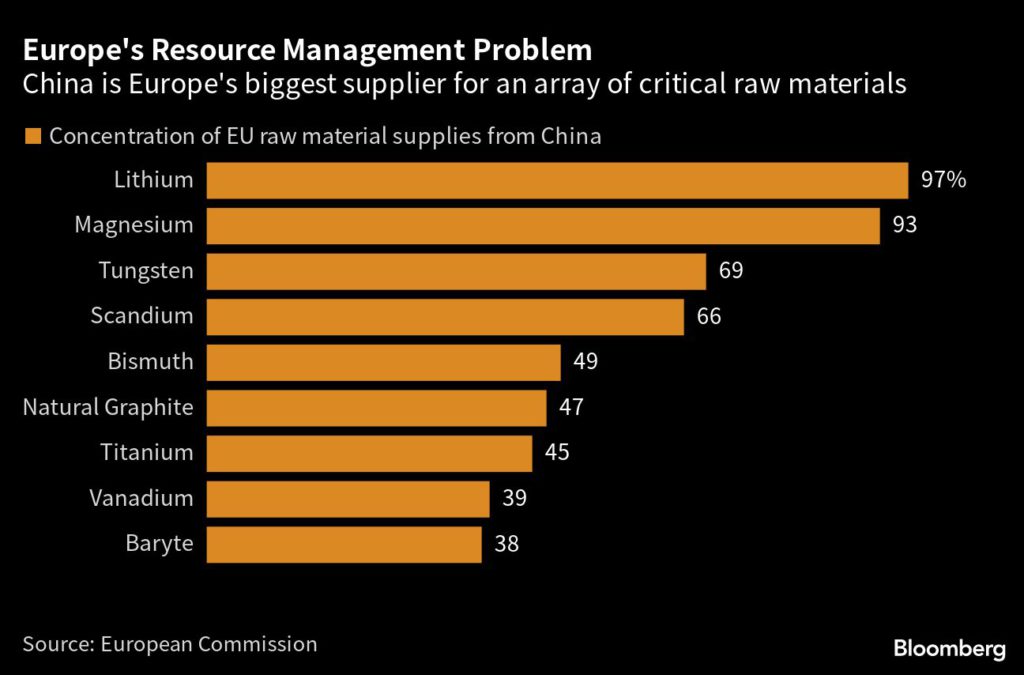

The pivotal role of lithium-ion batteries in the electric-vehicle revolution is driving the construction of about half a dozen refinery projects across Europe. At the same time, the strategic importance of those developments has been underlined by the European Union’s initiative to cut its dependence on China for critical raw materials.

Lithium prices surged last year as electric-vehicle demand took off, creating bonanza margins for miners and refiners. While prices have fallen sharply over the past few months, European refinery executives are confident the boom in demand will create a lucrative market that’s big enough to accommodate all of the projects under construction.

“Every Western automaker has a lot of interest in our product,” Dirk Harbeke, chief executive officer of Rock Tech Lithium, said in a Bloomberg TV interview. “We assume that by the end of this decade we will need around 10 converters of the size that we are currently building.”

On Monday, Rock Tech Lithium broke ground on its refinery in Brandenburg, Germany, which is set to come online in 2025. About 115 miles (185 kilometers) away in Bitterfeld, AMG Advanced Metallurgical Group NV said it will begin producing lithium hydroxide in the fourth quarter of this year, initially with an annual output that’s enough for 500,000 electric vehicle batteries. That would make it the first lithium refinery in mainland Europe.

“Everyone is now trying to get hold of these materials,” said Heinz Schimmelbusch, AMG’s CEO.

At an industrial port in the northeast of the UK, Tees Valley Lithium and Green Lithium are planning to build two separate refineries within a few miles of each other. In Finland — a critical industrial hub in Europe’s nascent battery supply chain — South African miner Sibanye Stillwater Ltd. is building a €588 million ($616 million) refinery.

Back in Basingstoke — a small town southwest of London — Leverton has teamed up with German chemicals giant HELM AG to fund a massive expansion of its own. That investment of several hundred million euros could include new plants in Europe.

Still, the barriers for new entrants is high, with feedstock costs alone set to exceed a $1 billion a year for large plants, according to Martin Kuzaj, an executive board member of HELM and a director of Leverton.

“You need to have deep pockets,” he said. “Everyone is saying they will build, but you need to look at how many are actually building,” he said by phone.

The EU is looking to boost production by speeding up permitting and opening up new sources of funding under landmark legislation introduced this month. Brussels is negotiating a deal with Washington in a bid to reduce their dependence on China for critical minerals. In return the US may offer EU companies greater access to some of the Inflation Reduction Act’s subsidies and tax credits.

The US wants to create a club of like-minded countries that agree to reduce their reliance on China for key green metals like lithium, cobalt and nickel. With demand for lithium projected to jump 17-fold by 2050, European Commission President Ursula von der Leyen is aware of the challenge.

“We know this is an era where we rely on one single supplier — China,” von der Leyen said in a speech on Thursday. “We will need more independence and diversity when it come to the key inputs needed for our competitiveness.”

Ultimately, the plants will need more than government backing to thrive, and the focus in Europe’s embryonic lithium industry is on shoring up supplies to feed the plants and striking deals with car-makers who were caught short by last year’s supply squeeze. Tesla CEO Elon Musk said during last year’s boom that lithium refining is a “license to print money,” but the steep decline in prices seen since then offers a reminder of the commercial risks involved.

While some of the refiners are building mines to lock in some of their raw materials, others will be buying purely from the open market, in a strategy that could leave them exposed if there’s another supply squeeze.

Refiners’ profits can quickly wither if the cost of raw materials rises faster than the price of the lithium chemicals they sell, in a trend that started to play out toward the end of last year’s boom. That serves as a reminder that the plants — and the entire electric-vehicle supply chain — are at the mercy of the miners and their ability to bring on new production quickly enough to meet spiraling demand.

“You need to think about who can finance these projects, and who has the backup as a company,” said Kuzaj. “You need to have the right partners with you.”

(By Mark Burton, Oliver Crook, Carolynn Look and Petra Sorge, with assistance from Bryce Baschuk)

No comments:

Post a Comment