Sybilla Gross and Mumbi Gitau, Bloomberg News

Commodities Our nitrogen business can handle the spike in natural gas prices: Nutrien CEO

Mayo Schmidt, president and CEO of Nutrien, the world's biggest fertilizer company tells BNN Bloomberg how he is navigating the price surge in natural gas, a key input for his company.

The market for manure -- from pigs, horses, cattle and even humans -- has never been so hot, thanks to a global shortage of chemical fertilizers.

Just ask Andrew Whitelaw, a grains analyst at Thomas Elder Markets based in Melbourne, Australia who runs a commercial pig farm in his spare time. Whitelaw said that he’s completely sold clean of animal waste, as farmers hunt for alternatives to the more commonly used phosphate- and nitrogen-based fertilizers that are vital to boosting crop yields.

“We don’t have any left,” he said. “In a normal year, you’d probably get a couple phone calls a year, not a couple of phone calls a week.”

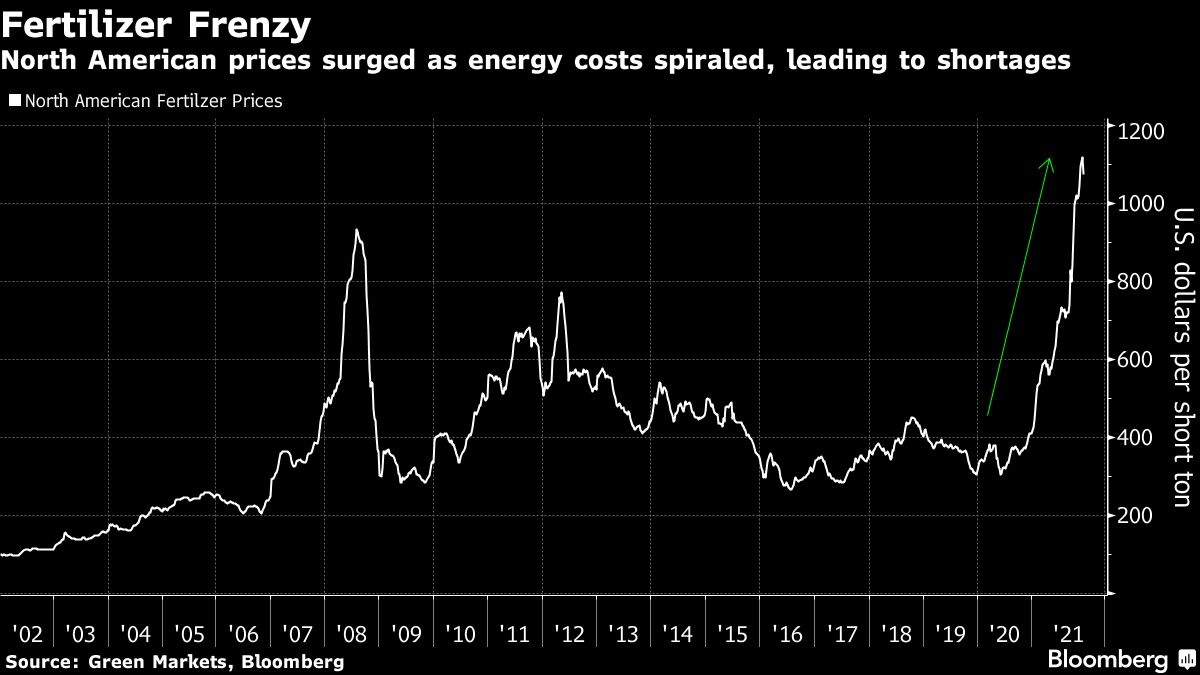

It may be some time before he sees the interest in pig poop taper. Prices of synthetic fertilizer, which rely on natural gas and coal as raw materials, have soared amid an energy shortage and export restrictions by Russia and China. That’s adding to challenges for agricultural supply chains at a time when global food costs are near a record high and farmers scramble for fertilizers to prevent losses to global crop yields for staples.

The Green Markets North American Fertilizer Price Index is hovering around an all-time high at US$1,072.87 per short ton, while in China, spot urea has soared more than 200 per cent this year to a record.

The demand for dung is playing out globally. In Iowa, manure is selling for between US$40 to US$70 per short ton, up about US$10 from a year ago and the highest levels since 2012, according to Daniel Anderson, assistant professor at Iowa State University and a specialist on manure.

Manure is mostly a local market and truckloads won’t go further than 50 miles (80 kilometers), Anderson said. When crop, fertilizer and manure prices soared about a decade ago, more farmers reintroduced animals such as hogs and cattle onto their land, in part for their manure. That option could again be on farmers’ minds as fertilizer costs soar.

In Australia’s Queensland state, Brian Mclean, general manager of an organic fertilizer company, said that sales of his poultry manure compost are going through the roof. If interest keeps up at the same rate, people seeking ready-treated manure in the area would soon miss out.

“There wouldn’t be enough in total,” he said. In just the last few months he’s sold about 15,000 tons of the stuff, compared to around 2,000 tons the same time last year, though some of the renewed fervor has been driven by a bounce-back in weather conditions after years of drought, Mclean added.

In the U.K., not only are farmers scrambling for animal compost, but many are even trying to get their hands on treated sewage sludge containing human excrement, or biosolids. David Butler, who farms wheat, oats and peas in Wiltshire in the southwest of England, has traditionally relied on his own herd of cows to produce animal waste that he uses for his crops.

“The arable area still requires significant tonnage of synthetic fertilizer, but this is reduced by the use of manures,” Butler said. Since the animal waste from his farm is not enough, he has been buying biosolids from utility Thames Water, which produces over 750,000 meters squared of sludge each year for farmers across Britain’s southeast.

However, Butler said that it’s increasingly difficult to source human excrement as “there is more demand than supply for biosolid materials.”

In the U.S., biosolids are regulated by the Environmental Protection Agency, and in Europe, biosolids have been in use since 1986 when it received regulatory approval from the European Union.

While manure is an inexpensive alternative to pricey synthetic fertilizers, it is a “poor replacement for those accustomed to traditional fertilizer products,” said Alexis Maxwell, an analyst at Bloomberg’s Green Markets. For example, the fertilizer diammonium phosphate has six times the nitrogen and 15 times the phosphate as manure on a per ton basis.

Commercial fertilizers, invented over a century ago, are among the technologies credited for raising crop yields to feeding billions of people on the planet. But even before prices for chemical fertilizers started surging, organic products had seen increased attention as proponents argue that the potent chemicals found in commercial materials can have a corrosive effect on soil health. Green manure and composting techniques, meanwhile, can boost crop nutrients with sufficient planning ahead around some natural variability in the greener products compared to their synthetic counterparts.

The recent price spike is likely to have turned more farmers into longer-term converts, even if fertilizer prices start to cool, said Mclean, the Queensland organic fertilizer seller.

“They’ve now realized how much better off they are using the organic products,” he said. “They’ll be making it a permanent thing in their rotations.”

No comments:

Post a Comment