Jalees ANDRABI

Sat, February 18, 2023

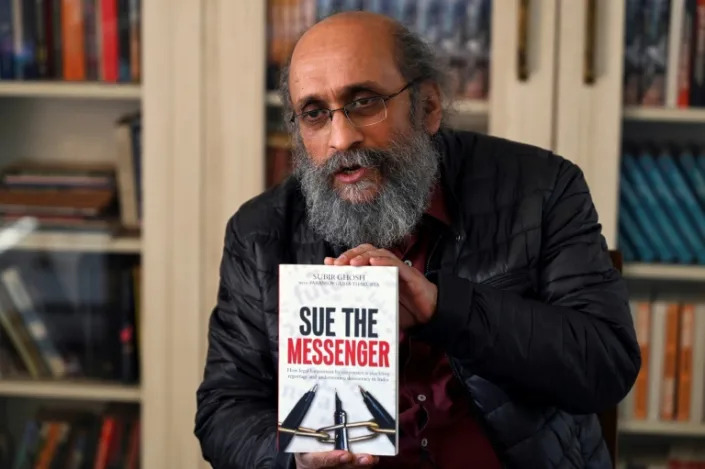

Independent Indian journalist Paranjoy Guha Thakurta is being sued by tycoon Gautam Adani's business empire in six different courts -- and he is not allowed to speak about the conglomerate or its owner.

US investment firm Hindenburg Research, whose explosive report on Adani Group last month triggered a stock rout that wiped $120 billion off its value, said the company had long used the threat of litigation to shield itself from greater scrutiny.

Hindenburg is a short-seller that not only tracks corporate wrongdoing but also makes money by betting on shares falling.

It accused the globe-spanning ports-to-power conglomerate of accounting fraud and stock manipulation, adding that "investors, journalists, citizens and even politicians have been afraid to speak out for fear of reprisal".

Thakurta, 67, was hit with six defamation actions -- three of them criminal -- after writing a series of reports on Adani that included accusations a top judge gave it preferential treatment.

He could be jailed if convicted and a court order prevents him from writing or speaking about the business or its owner.

"A gag order was served on me," he told AFP. "I was told that I could not comment on the activities of Mr Gautam Adani and his corporate conglomerate. So I don't want to commit contempt of court."

Legal costs and the need to attend hearings in three states "take a toll on us physically and mentally", said his colleague Abir Dasgupta, himself hit with three defamation suits.

"It takes up our time, it affects our families, it has led to a loss of time and loss of income for all of us."

Adani Group went into damage control mode last month after Hindenburg levelled its accusations.

The short-seller's report alleged the conglomerate had artificially inflated its market value using related-party transactions conducted through tax havens.

The stock market reaction sent the firm's billionaire founder, until then Asia's richest man, tumbling down the ranks of global rich-listers, though shares in the group's listed entities have since stabilised.

The firm denies the accusations and threatened to sue Hindenburg.

It has also launched legal action against other foreign critics: it is suing environmental activist Ben Pennings in Australia, claiming he cost it millions during his campaign against its coal mining project in Queensland.

Two journalists from broadcaster CNBC TV18 have been hit with criminal defamation cases by an Adani subsidiary accusing them of a "grossly malicious, defamatory and false" news report.

"Adani Group believes strongly in the freedom of the press and like all companies retains the right to defend itself against defamatory, misleading or false statements," a conglomerate spokesperson told AFP.

"In the past, Adani has at times exercised those rights. The group has always acted in accordance with all applicable laws."

- 'Financial terrorism' -

Hindenburg's allegations made headlines around the world, but many Indian media outlets have ignored or dismissed them, or denounced the authors.

Several echoed Adani Group's assertion that Hindenburg's report was a deliberate "attack on India", with one television panellist calling it an act of "financial terrorism" against the country.

The conglomerate's founder has a close relationship with Prime Minister Narendra Modi, and opposition lawmakers say both have benefitted from their mutual association.

Critics say Indian media's reluctance to probe the Adani allegations reflects the close ties between the two men.

"That's got a lot to do with Adani's story being linked to the Modi story," said journalist Manisha Pande of Newslaundry, a website known for critical coverage of India's media landscape.

India has nearly 400 television news channels but Modi's government generally benefits from enthusiastically positive coverage.

Hindenburg's report, according to Pande, was "seen as an attack on not just a corporate house, but an attack on Modi, his decision, his tenure".

- 'Subservient' -

Adani became a media owner himself in December after taking over broadcaster NDTV, which was previously known as one of the few media outlets willing to explicitly criticise India's leader.

The tycoon batted away press freedom fears and told the Financial Times that journalists should have the "courage" to say "when the government is doing the right thing every day".

Within hours of Adani's takeover, one of NDTV's most popular anchors stepped down.

Ravish Kumar, a vocal critic of Modi, later said he was "convinced" the purchase was aimed at silencing dissent.

"Adani does not promote questioning or criticism in any manner," he told online news portal The Wire.

Thakurta told AFP that numerous Indian business leaders had taken stakes in media houses to "shut out opinions and information that does not favour them".

He said Indian media acted as a "nexus" between corporate and state power.

"It should not be surprising that such a large section of media in India should be so subservient to big business interests."

ja/gle/slb/axn

Adani Credit Facilities Expose Collateral Web Full of Red Flags

Adani Credit Facilities Expose Collateral Web Full of Red Flags

Greg Ritchie

Sun, February 19, 2023

(Bloomberg) -- Financing arrangements across the Adani Group conglomerate have sent a fresh chill through ESG markets as investors wake up to a new risk.

Norway’s largest pension fund, KLP, recently dumped its entire holding of shares in Adani Green Energy Ltd., the renewables part of the empire, amid concerns that it might inadvertently have helped finance some of the world’s most polluting activities via the stake. A Feb. 10 public filing has since made clear that Adani is using stock from its Green companies as collateral in a credit facility that’s helping to finance the Carmichael coal mine in Australia, via Adani Enterprises Ltd.

KLP has blacklisted coal from its portfolio, so any indirect financing of the Carmichael project would represent a “breach of our commitments,” Kiran Aziz, KLP’s head of responsible investing, said in an interview.

Since short-seller Hindenburg Research published its critical report on Jan. 24, investors have responded to its allegations of fraud and market manipulation by selling Adani shares. But for investors with environmental, social and governance mandates, there’s an added layer of pain as they realize their green dollars were indirectly supporting the dirtiest of fossil fuels.

“Investments in other parts of the Adani Group are leaking into the funding of Carmichael,” said Ulf Erlandsson, chief executive of Anthropocene Fixed Income Institute, which has been tracking the Adani Group since mid-2020. “Investors who have restrictions on funding greenfield thermal coal mining should revisit potential exposures across the whole of Adani Group.”

More than 500 funds registered in the European Union as “promoting” ESG goals hold Adani stocks, either directly or indirectly, according to data compiled by Bloomberg.

An Adani spokesperson didn’t respond to a request for comment. The conglomerate has repeatedly denied the allegations in the Hindenburg report and threatened legal action.

Erlandsson at AFII said an equity investor pledging stock as collateral doesn’t necessarily contaminate other shareholders. But the “high concentration of stock ownership and other interrelationships” in the Adani conglomerate represent an extra layer of risk, he said. A higher price on Adani Green’s stock increases the value of the collateral, lowering the credit risk for SBI’s financing of the coal project, which then “hypothetically, materializes in the bank being able to offer a lower interest rate for Carmichael,” he said.

Adani Green’s stock price has fallen almost 70% this year, while its debt has also slumped. The company said on Feb. 7 it had won the backing of investors after reporting third-quarter net income that more than doubled from a year earlier. Adani Green CEO Vneet S. Jaain said the results proved the company has a “robust capital management program with leverage well aligned with the business model.”

On Feb 16, it emerged that the conglomerate is in talks with potential investors to raise as much as $1.5 billion through note sales by Adani Green, Adani Transmission Ltd. and Adani Ports & Special Economic Zone Ltd., according to the people familiar with the process.

Read More: Who Is Adani and What Are Hindenburg’s Allegations?: QuickTake

The Hindenburg report found that “Adani Group companies are intricately and distinctly linked and dependent upon one another. None of the listed entities are isolated from the performance, or failure, of the other group companies.”

The Carmichael coal mine, located inland from Australia’s iconic Great Barrier Reef in Queensland, has become a lightning rod for climate activists over the environmental destruction the facility represents. Pushback has also come from banks, insurers and investors, amid alarm at the mine’s carbon footprint.

MSCI Inc. gives Adani Green a rating of A, and the entity is included in several of its ESG and Climate indexes. S&P Global Inc. said this month it was removing Adani Enterprises from its Dow Jones Sustainability Indexes. Sustainalytics has downgraded the ESG scores of several Adani companies. MSCI said it will start reviewing holdings in ESG indexes more frequently, in response to questions about its approach.

Norway’s KLP, which manages around 765 billion Norwegian kroner ($75 billion), divested its position in Adani Green on Jan. 30, adding to five other Adani companies it had previously excluded from its investment universe.

“Adani’s corporate structure created an unacceptably high risk that ‘clean’ investment could be siphoned off towards coal mining,” Aziz said.

The largest external holder of Adani Green is TotalEnergies SE, which acquired a 20% stake in 2021. The French energy giant confirmed its withdrawal from coal production and marketing in 2015. CEO Patrick Pouyanne said earlier this month that Adani Green and Adani Total Gas Ltd., in which it has also invested, are “healthy” companies.

“The shares TotalEnergies owns in AGEL are not pledged nor used as collateral for any financing or any other project,” a company spokesperson said. “TotalEnergies has no involvement in the use of the shares held by other shareholders of AGEL for collateral or other purposes.”

--With assistance from Gina Turner, P R Sanjai and Saikat Das.

No comments:

Post a Comment