The new India–EU free-trade agreement grants India near universal preferential access across EU tariff lines, significantly lifting export competitiveness. It strengthens India’s diversification away from the US, supports much-needed FDI inflows, and boosts job creation in labour-intensive sectors.

The India-EU FTA has been signed

The long–awaited India–EU free trade agreement has finally been sealed, and the timing couldn’t be more meaningful. Across Asia, economies have been actively looking to diversify their export markets beyond the US. In fact, this strategic shift was one of the key reasons Asia’s export growth held up so well last year. The India–EU deal further strengthens this momentum.

Some are calling it the “mother of all deals”, not just for its scale, but because it signals what could be the start of a broader shift in global trade alignments. It also highlights the EU’s willingness to take a patient, pragmatic approach to accommodating India’s sensitivities regarding the opening of certain sectors, an approach on which the US arguably been less flexible.

Overall, the agreement marks a significant milestone for both India’s trade diversification ambitions and Asia’s evolving export landscape. Below, we discuss what the deal means for India.

What the deal includes

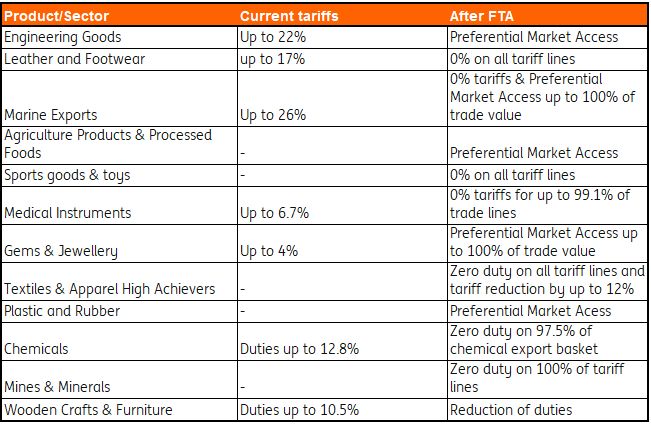

India gains preferential access across 97% of EU tariff lines, covering 99.5% of trade value, with a large chunk eligible for immediate duty elimination. This is especially the case for labour-intensive sectors that account for close to 2% of India’s GDP in exports.

India remains a net exporter of both goods and services to the US. Bilateral merchandise trade has been on a steady rise, reaching around $137bn in FY2024–25, with India exporting $76bn to the EU. Services trade is equally robust. In 2024, India–EU services trade reached $83bn.

Big gains for India from tariff elimination

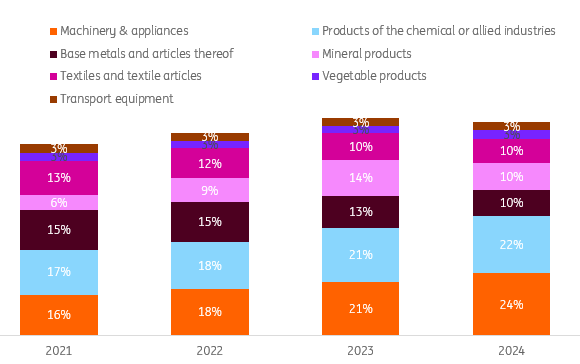

India stands to benefit significantly from the elimination of tariffs under the new trade agreement. Today, more than 60% of India’s merchandise exports to the EU come from a few key categories, including petroleum products, pharmaceuticals, electronics, and minerals, as well as important contributors such as auto components and textiles. The FTA offers India a few clear advantages on the goods side, plus a major boost for services.

1. A chance to diversify away from the US

The EU already accounts for 17% of India’s exports, just behind the US at 21%. Notably, the EU’s share has risen by about 3 percentage points since the pandemic. India’s export basket to both markets looks similar, except that petroleum products have a much larger weight in exports to the EU.

If high US tariffs on Indian goods persist, India can increasingly pivot toward the EU without overhauling its export mix, thereby reducing reliance on the US market.

2. Employment generation in labour intensive sectors

The EU will eliminate tariffs across a wide spectrum of Indian exports, including marine products (especially shrimp), leather and footwear, textiles and garments, handicrafts, gems and jewellery, plastics and toys

These sectors are highly labour-intensive and low-value-added, exactly where India competes directly with China, Bangladesh, and Vietnam. They’ve also been disproportionately hurt by US tariffs in recent years. Lower barriers in the EU market can give Indian exporters a meaningful advantage, strengthening job creation in some of the country’s largest employment-generating industries.

3. Limited, but strategic market access in sensitive areas

India has protected its most sensitive sectors, such as agriculture and dairy, while still agreeing to reduce tariffs on goods such as food, beverages, and automobiles. This allows India to expand market access where feasible without compromising domestic interests.

4. Potential for higher FDI inflows

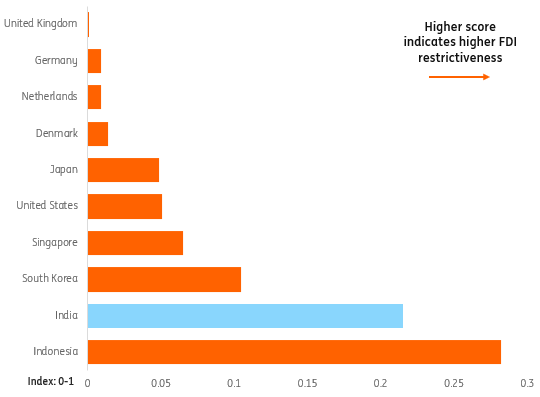

Deeper EU–India economic integration should translate into stronger foreign investment flows. The EU already accounts for around 15% of India’s FDI inflows, with the Netherlands leading, followed by Germany, Belgium, and France. Historically, most EU investments have gone into services, especially IT and software, while manufacturing industries like autos and chemicals have lagged.

Given the recent softening in India’s net FDI inflows, the FTA could help revive investment momentum, particularly in goods sectors such as automobiles, chemicals, and construction. Over time, this can strengthen supply chain linkages and support India’s external balances.

5. Not just about goods—services will benefit, too

On the services side, India already exports about 1% of GDP in services to the EU and enjoys a roughly 0.2% of GDP surplus. The new agreement brings “broader and deeper” commitments from the EU across 144 services subsectors, covering IT and Information Technology Enabled Services (ITeS), professional services, education, and a wide range of business services.

This creates a more stable and predictable policy environment for Indian service providers, particularly in high-tech and knowledge-based sectors where India is globally competitive. At the same time, EU businesses and consumers gain better access to India’s high-quality, cost-efficient services.

Conclusion:

The legal vetting and formal signing of the FTA may still take several months. Yet its ultimate success will hinge on two key factors.

First, India’s ability to meet the EU’s stringent health, safety, and product standards will be critical. India’s manufacturing sector may not be fully prepared to meet these requirements, and smaller manufacturers in particular may need substantial upgrading to comply.

Second, the ease of doing business, particularly around approvals and regulatory processes, will play an equally important role. While India has made progress by gradually liberalising FDI in various sectors, it continues to rank relatively high on the FDI Regulatory Restrictiveness Index. This means more reforms may be needed to truly unlock the FTA’s potential.

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

No comments:

Post a Comment