Scandal erupts in Iraq over HIV infected blood transfusions to children

A four-year-old girl has died from AIDS-related complications after allegedly receiving contaminated blood at a medical facility in Basra, whilst a 14-year-old boy has also been infected with the disease, local Baghdad Alyoum reported on October 5.

This death appears to be a growing issue in the country, which has historically low rates of blood donations and has relied on the Iraqi National Centre for Blood Donation (INCBD) for blood transfusions and collections, according to a previous document by the WHO.

It is currently unknown if these were paid blood donations, which has been the case of some infections of HIV and AIDS related diseases in other countries.

Mahdi al-Tamimi, director of the Human Rights Commission office, confirmed the girl's death resulted from complications of AIDS infection.

She contracted the disease after receiving contaminated blood at a currently unnamed healthcare institution in Basra.

Al-Tamimi said that a 14-year-old boy has also been infected with the same contaminated blood, raising concern across the city of infected batches of blood being sent to different hospitals.

The case has sparked widespread debate about the state of health services in the province, prompting the Human Rights Commission to intervene and stress the necessity of conducting a comprehensive investigation to uncover the circumstances of the incident and ensure the safety of medical procedures.

"The commission is following this file closely and is keen on reaching the truth within the framework of its concern for the lives of citizens in Basra and monitoring all issues related to their constitutional rights," al-Tamimi said.

Donors in Iraq are generally expected to be in good health, though specific national criteria are still being standardised due to ongoing challenges in the blood transfusion system.

Currently, due to the state of destruction of institutions due to years of war and emigration, formal guidelines are still being developed.

Donors are typically required to be at least 18 years old and weigh a minimum of 50 kg (approximately 110 pounds) to donate 450 ml of blood, consistent with regional standards.

Iraq officially maintains a low HIV prevalence rate of 0.1% among adults aged 15–49, with an estimated 3,400 people living with the virus nationwide as of 2022, according to World Bank and UNAIDS data.

Iraq’s Vote Pits Oil Wealth Against Superpower Rivalry

- Iraq’s upcoming November 11 parliamentary elections could reshape its post-2003 political order.

- Geopolitical stakes are enormous, with China now managing two-thirds of Iraq’s oil production and the U.S. and allies ramping up multi-billion-dollar energy investments to counter Beijing’s dominance.

- Prime Minister Mohammed Shia’ al-Sudani is the frontrunner.\

Iraq’s 11 November parliamentary elections could mark the key turning point in the country’s history since the ousting of former president Saddam Hussein in April 2003. The nationwide ballot of around 21 million registered voters will determine the occupants of its 329-seat Council of Representatives (the de facto parliament), which will then elect a president. He will subsequently nominate a prime minister, who in turn will have to be approved by an absolute majority of the Council. Each step of this process is likely to be complicated by the absence of a clear-cut electoral result, as the system is based on proportional representation spread across 18 governorate-based constituencies designed to produce no outright single-party winner. With Iraq’s pivotal geopolitical importance in the centre of the Middle East, together with its massive oil and gas resources, the result of the vote and its subsequent political jostling for the three key roles in the country – president, prime minister, speaker of parliament -- will be crucial not just to Iraq but to all the world’s major powers for years to come. In short, with official campaigning having started on Friday (3 October), everything is to play for.

Working from the outside in, both the U.S. and China have big stakes already on the table, as evidenced in the scale and scope of their investments in the country’s principal economic driver of energy. Broadly speaking, Washington increasingly lost ground in the battle for influence across the country the longer it stayed in Iraq after the removal of Hussein, while China (with the help of Russia and Iran) broadly benefited at its expense, as analysed in full in my latest book on the new global oil market order. This shift in positive engagement by Iraq away from the U.S. and towards Beijing was expedited in 2018 after Washington’s unilateral withdrawal from the Joint Comprehensive Plan of Action with Iran, which took the brakes off Tehran’s anti-U.S. insurgency based in Iraq. It was further accelerated after Washington’s end of combat mission in Iraq in December 2021, which – coinciding with heightened Trade War tensions between the U.S. and China – also prompted Beijing to take the brakes off its own investment-led push further across Iraqi territory. This has resulted in the current position in which Chinese companies manage over two-thirds of Iraq’s current oil production, and exercise control over more than one-third of its total proven oil reserves. It also holds controlling interest in several of Iraq’s key oil and gas infrastructure, including ports and refineries. On the other side of the superpower balance equation, the U.S. and its allies – most notably the U.K., and France – have in recent months begun to meaningfully counter this Chinese advance, investing in massive oil and gas projects after years of eschewing such investment due to corruption concerns. These include TotalEnergies’ US$27 billion four-pronged project and BP’s US$25 billion five field exploration and development commitment. Russia, in the meantime, has continued to play its Beijing-mandated role of sowing discord between the Federal Government of Iraq in the south and the semi-autonomous region of Kurdistan in the north.

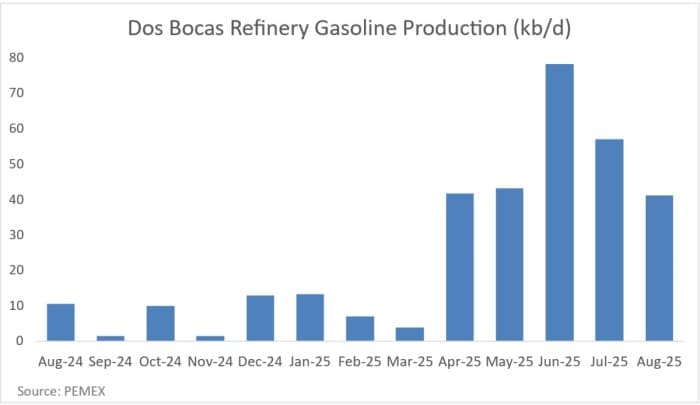

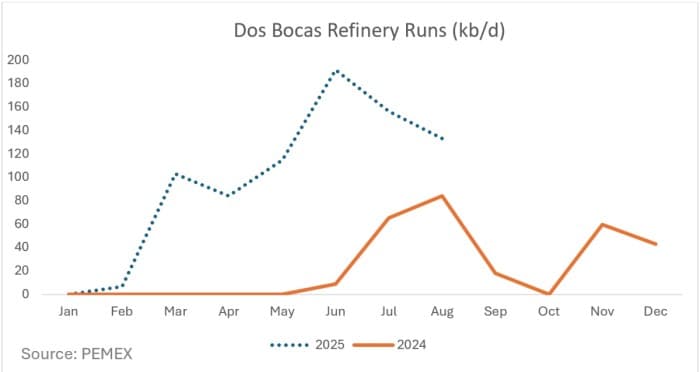

Related: Pemex’s Dos Bocas Turns Into Mexico’s Refinery Nightmare

All these competing pressures have fallen on current Prime Minister Mohammed Shia’ al-Sudani, currently the favourite to retain his position. This is based on the broadly accurate popular perception that he has so far managed to maintain this exceptionally delicate balancing act without upsetting any of the participating powers to a dangerous degree. He has done this by adopting a primarily pragmatic approach, regardless of his being part of the broader ‘Shiite’ bloc of Iraqi politics, albeit the most moderate of the three main factions in it. And it is from this broad collective that the new prime minister will likely emerge. Sudani’s approach has been characterised by small steps of progress in several areas, including the addition of major energy projects spread between the two superpower sides, and the construction of major new road and refinery projects. The same can be seen in countering corruption, the positive effects of which have been seen from the renewed participation of major Western oil and gas firms in the energy sector. Indeed, sources close to Iraq’s Oil Ministry have exclusively told OilPrice.com in recent months that Western firms are broadly currently satisfied with those elements of their contracts that have in the past been a source of concern over transparency issues. “He [Sudani] is seen by many [Iraqis] as occupying the middle ground in the Shiite grouping – more nationalist than the Iran-leaning al-Itar al-Tanseqi [Coordination Framework] and less religious than the followers of [cleric] Moqtada al-Sadr,” one senior source close to the Oil Ministry said last week. “The hope of these voters is that his electoral alliance [the Reconstruction and Development Coalition] can win enough extra seats – another 50 might do it in key areas, like Baghdad – to have major influence on the post-election negotiations that determine the presidency and then the prime ministerial selection,” he added.

That said, even among his own broad Shiite grouping, Sudani’s alliance does not enjoy a clear electoral run. In some ways helpful for him and his coalition, Sadr’s Al-Tayyar al-Watani al-Shiite (National Shiite Movement) has announced that it is boycotting the elections, despite being the dominant Shiite force in the 2021 vote, winning 73 seats -- more than any other single bloc. This leaves his entire nationalist Shiite-centric electoral base up for grabs, and even if Sadr makes no electoral recommendation then these voters would more likely side with al-Sudani’s moderate nationalist agenda than with the Iran-leaning movement within the broad Shiite Coordination Framework. Several factions in this movement share ideological, financial, and strategic ties with Tehran, and many are linked to the Popular Mobilisation Forces (PMF) run to all intents and purposes by Iran’s Islamic Revolutionary Guards Corps (IRGC). “To many in the country, especially in the younger generation, the desire to have such deep links continue with Iran has diminished in recent years,” said the Oil Ministry source.

However, beneficial to al-Sudani in this regard is potential support from Qais al-Khazali and his Asa’ib Ahl al-Haqq network, who – although his bloc has links to the PMF – publicly backed al-Sudani’s right to pursue re-election at the same time former prime minister Nouri al-Maliki tried to stop this. Maliki’s criticism of Sudani has been broadly seen as pre-electoral posturing, given his own ambitions to become prime minister again. A frontrunner in the Etihad Dawlat al-Qanun Shiite faction, he is not seen as a credible challenge to Sudani, as his 2006–2014 premiership has been widely regarded as being responsible for deepening sectarian divides, and in particular marginalising Sunni communities. His policies have also been seen by many Iraqis as being key in the rise of Islamic State in 2014, and he is also associated at home and abroad with a period of profound corruption in many of Iraq’s key areas, including oil and gas.

Nonetheless, Khazali’s supportive approach to Sudani has been frequently demonstrated since the recent ‘eavesdropping scandal’ in which members of Sudani’s cabinet were implicated in hacking the devices of a number of Coordination Framework politicians, including Khazali himself. This holds out the possibility that Khazali could more definitely align with Sudani in the post-election bartering, if the latter’s grouping gains a significant number of seats. Khazali’s backing would also be useful for Sudani in dealing with the Kurdish bloc, as he is known to have good relationship with Bafel Talabani, leader of the Patriotic Union of Kurdistan (PUK), one of the two dominant Kurdish political parties in Iraq. Indeed, the two men’s closely coordinated efforts during the 2023 municipal elections were instrumental in boosting the PUK’s position in Kirkuk. It is likely, therefore, that a deal will be done to extend this support for Sudani as prime minister, given the continuation of the recent tradition that the presidency of Iraq remains with a Kurdish politician. The same tradition holds that the speaker of parliament role goes to a Sunni bloc politician, and Sudani is best placed to be able to forge a mutual deal of support with the leading candidates – most notably, Mohammed al-Halbousi, the incumbent Speaker and head of the Taqaddum (Progress Party), who is seeking re-election. Habousi recently reaffirmed his party’s backing for Sudani’s efforts to implement a comprehensive development programme, emphasising reforms that strengthen state institutions and address displacement, compensation for victims of terrorism, and economic recovery.

For the U.S. and its Western allies, the emergence from this process of al-Sudani as prime minister again would be seen as a positive, according to a senior Washington-based legal source connected to the Treasury and exclusively spoken to by OilPrice.com last week. “He’s someone we can work with,” he underlined.

By Simon Watkins for Oilprice.com