Nuclear Stocks Sell Off After U.S. Army Launches Microreactor Program

- The U.S. Army launched the Janus Program, aiming to deploy portable microreactors generating up to 20 MW by 2028 to power remote military bases.

- Despite the long-term potential, nuclear stocks sold off on profit-taking after massive gains.

- Analysts warn the nuclear sector may be overheating, as investor enthusiasm has driven up valuations of early-stage firms like Oklo and NuScale with little or no revenue,

The U.S. nuclear sector has been on a tear over the past couple of years, fueled by the global energy crisis, the clean energy revolution, and the AI boom, even as global electricity demand soars. Meanwhile, the uranium market is experiencing a structural supply deficit, creating potential challenges for nuclear operators. Unlike many commodities, uranium trading usually involves small volumes with specialized participants, making the nuclear fuel susceptible to significant uranium market volatility. Governments across the globe are repositioning nuclear as critical infrastructure rather than transitional tech. Nuclear stocks have gone ballistic, with nuclear and uranium equities re-rating sharply. The sector is on the move again after the U.S. Army unveiled the Janus Program on Wednesday, aiming to supply portable microreactors to military bases by 2028. The Janus microreactors will generate up to 20 megawatts of electricity without the need to be refueled constantly, an invaluable feature when operating in hard-to-reach areas. The energy capacity of these tiny reactors will be multiples higher than the ~800 kilowatts supplied by the biggest portable generators for the U.S. military.

“The U.S. Army is leading the way on fielding innovative and disruptive technology,” said Secretary of the Army Dan Driscoll. “We are shredding red tape and incubating next-generation capabilities in a variety of critical sectors, including nuclear power.”

Nuclear stocks have been selling off on the news, probably driven by profit taking after a wild run. Oklo Inc. (NYSE:OKLO) was trading -6.2% lower at 12.50 pm ET on Thursday, but has tucked on 1,285% over the past 52 weeks; Centrus Energy (NYSE:LEU) shed -4.1% on the day but +530.8% YTD, Energy Fuels Inc. (NYSE:UUUU) -7.0% but +349.9% YTD , NuScale Power Corp. (NYSE:SMR) -6.5% on the day but +181.% YTD, Uranium Energy Corp. (NYSE:UEC) -1.6% but +148.7% YTD, BWX Technologies (NYSE:BWXT) +2.8% on the day and +88.6% YTD, Cameco Corp. (NYSE:CCJ) -1.8% but 78.7% YTD, NANO Nuclear Energy (NASDAQ:NNE) -9.6% on the day but +93.0% YTD while Vistra Corp. (NYSE:VST) was flat on the day but has returned +53.4% YTD. Meanwhile, the nuclear energy benchmark, VanEck Uranium and Nuclear ETF (NYSEARCA:NLR) fell -2.3% in Thursday’s session but has returned 96.0% in the year-to-date, incomparable to the -0.3% YTD return by the oil and gas benchmark, the Energy Select Sector SPDR Fund (NYSEARCA:XLE).

While the Energy Department and the U.S. Army will be responsible for supplying uranium fuel for the Janus program, the microreactors will be owned and operated commercially. This will benefit companies like BWX Technologies (NYSE:BWXT). Eventually, small nuclear reactors may be licensed to other sectors, like power-hungry AI data centers. BWX Technologies designs, manufactures, and services nuclear components and provides nuclear solutions for a variety of sectors and uses, including naval nuclear propulsion, clean energy, environmental restoration, nuclear medicine, and space exploration, and they supply components, fuel, and services for both commercial and government-related nuclear applications.

That said, Wall Street is warning that the nuclear sector could be overheating. For instance, the market has bid up shares of Oklo, Nano Nuclear, and NuScale despite the fact that they are all development-stage companies with zero revenues. In July, Oklo unveiled a partnership with Liberty Energy (NYSE:LBRT)wherein they will develop an integrated power solution for data center applications, incorporating Oklo's Aurora powerhouse with Liberty's natural gas generation. The power plan will start with Liberty’s natural gas systems delivering quick energy. before shifting to Oklo’s clean nuclear generation over the long-term.

Around the same time, Oklo announced a partnership with Vertiv (NYSE:VRT) that will see them join forces to revolutionize data center operations. “This agreement is about delivering clean power, energy-efficient cooling, and infrastructure solutions purpose-built for AI factories, data centers, and high-density computers,” said Oklo CEO and co-founder Jacob DeWitte. Last week, Oklo revealed that it was selected for three of the U.S. Department of Energy’s reactor pilot projects, part of the DoE’s initiative to modernize and streamline nuclear licensing.

Bank of America has downgraded Centrus' shares to Neutral from Buy but raised its price target to $285 from $210, citing valuation concerns after the huge runup. Centrus supplies low-enriched uranium (LEU) for existing reactors and is a leading developer of high-assay, low-enriched uranium (HALEU) for advanced reactors. Additionally, Centrus offers its technical and manufacturing capabilities for applications in advanced reactors, aerospace, and other sectors.

By Alex Kimani for Oilprice.com

US Army launches advanced reactor programme

The US Department of Army has announced the launch of the Janus Program, a next-generation nuclear power programme aimed at delivering "resilient, secure, and assured energy to support national defence installations and critical missions".

_50195.jpg)

Executive Order 14299 - Deploying Advanced Nuclear Reactor Technologies for National Security - was signed by President Donald Trump in May this year. It directs the Department of War to commence operation of an Army-regulated nuclear reactor at a domestic military installation no later than 30 September 2028. The Department of Army, designated by the Secretary of War as the Executive Agent for this mission, will lead the Janus Program on behalf of the Department of War.

The launch of the programme was announced on 14 October at an Association of the United States Army (AUSA) Annual Meeting Warriors Corner panel, where Army leaders were joined by the US Secretary of Energy Chris Wright to highlight this milestone initiative.

"The Janus Program will leverage the Army's nuclear regulatory authorities in close partnership with the Department of Energy (DOE) to ensure the highest standards of safety, oversight, and transparency," US Army Public Affairs said.

The programme will build commercial microreactors through a "nimble, milestone-based contracting model" in partnership with the Defense Innovation Unit (DIU). The reactors will be commercially owned and operated, with the milestone payments intended to help companies close their business cases as they seek "nth-of-a-kind" production. The Army and DIU will be modelling this contracting mechanism off NASA's Commercial Orbital Transportation Services programme. The Army will provide technical oversight and assistance, including support to the full uranium fuel cycle and broader nuclear supply chain, ensuring the programme strengthens both defence and US industrial capabilities.

The Janus Program will build on lessons learned from Project Pele, a transportable nuclear reactor for electricity production. The DOE laboratory teams which partnered on the technical, legal, and policy aspects of Project Pele will also be working closely on the Janus Program.

"The US Army is leading the way on fielding innovative and disruptive technology," said Secretary of the Army Dan Driscoll. "We are shredding red tape and incubating next-generation capabilities in a variety of critical sectors, including nuclear power."

"Since the Manhattan Project, the Department of Energy and the Department of War have forged one of the defining partnerships in American history - advancing the science, engineering, and industrial capability that power our national security," Wright said. "What began as a wartime effort became the backbone of America's peacetime strength. Under President Trump's leadership, we're extending that legacy through initiatives like the Janus Program, accelerating next-generation reactor deployment and strengthening the nuclear foundations of American energy and defence."

In May 2024, the US Administration announced a programme to deploy advanced reactors to power multiple military sites in the USA. At the time, it said small modular reactors (SMRs) and microreactors could provide defence installations with energy that is resilient to challenges such as physical or cyberattacks, extreme weather, or pandemic biothreats that can disrupt commercial energy networks. The US Army was exploring the deployment of advanced reactors to help meet its energy needs and "will soon release a Request for Information to inform a deployment programme for advanced reactors to power multiple Army sites in the United States", the White House said.

The Army's effort - alongside two current defence reactor programmes, the Department of the Air Force microreactor pathfinder at Eielson Air Force Base in Alaska, and the Office of the Secretary of Defense Strategic Capabilities Office Project Pele prototype transportable microreactor project - "will help inform the regulatory and supply chain pathways that will pave the path for additional deployments of advanced nuclear technology to provide clean, reliable energy for federal installations and other critical infrastructure", it said.

Newcleo and Oklo to partner on advanced fuel

Oklo is developing its sodium-cooled fast-reactor Aurora powerhouses, while Newcleo and Blykalla are both developing lead-cooled small modular reactor technology, with Newcleo aiming to use reprocessed nuclear fuel to power its reactors, helping to close the nuclear fuel cycle.

Newcleo is planning to invest up to USD2 billion "via an affiliated investment vehicle", with the investment spanning "multiple projects under US oversight" and aiming to "foster transatlantic cooperation that enhances energy security, and focus on creating a robust and resilient fuel ecosystem. Specific projects and investment amounts will be detailed in forthcoming definitive agreements".

The announcement said "the partnership strengthens all parties' abilities to supply the growing global demand for energy. This effort includes co-investment into, and co-location of, fuel fabrication facilities and could include repurposing surplus plutonium in a manner consistent with established US safety and security requirements".

It added that Blykalla "is also considering co-investing in the same projects, and procuring fuel-related services from the projects".

Stefano Buono, founder and CEO of Newcleo, said: "This strategic partnership proves that energy independence relies on advanced fuels and promotes an integrated closed-loop fuel cycle. Newcleo and its partners are ready to add value to the transatlantic cooperation in providing clean, safe and secure energy."

Jacob DeWitte, co-founder and CEO of Oklo, said: "Fissioning surplus plutonium is the best way to eliminate a legacy liability while creating an abundant near-term fuel source. It can accelerate the deployment of multiple gigawatts of advanced reactors and serve as a bridge fuel until uranium enrichment and recycling scale up."

Secretary of the Interior and Chairman of the USA's National Energy Dominance Council, Doug Burgum, said the "agreement to implement Newcleo's advanced fuel expertise into Oklo's powerhouses and invest USD2 billion into American infrastructure and advanced fuel solutions is yet another win" for US President Donald Trump's "American Energy Dominance Agenda".

Background

Oklo's Aurora powerhouse is a fast neutron reactor that uses heat pipes to transport heat from the reactor core to a supercritical carbon dioxide power conversion system to generate electricity. Building on the design and operating heritage of the Experimental Breeder Reactor II (EBR-II), which ran in Idaho from 1964 to 1994, it uses metallic fuel to produce electricity and usable heat, and can operate on fuel made from fresh HALEU or used nuclear fuel.

Newcleo is developing its Small Modular Lead-cooled Fast Reactor (SM-LFR) technology. According to Paris-headquartered Newcleo's delivery roadmap, the first non-nuclear pre-cursor prototype of its reactor is expected to be ready by 2026 in Italy, the first reactor operational in France by the end of 2031, while the final investment decision for the first commercial power plant is expected around 2029.

Blykalla - formerly called LeadCold - is a spin-off from the KTH Royal Institute of Technology in Stockholm, where lead-cooled reactor systems have been under development since 1996. The company - founded in 2013 as a joint stock company - is developing the SEALER (Swedish Advanced Lead Reactor) lead-cooled SMR.

The three companies already have some existing partnerships between them.

A Joint Technology Development Agreement signed last month saw Oklo and Blykalla agree to share insights on materials, components, non-nuclear supply chain sourcing, fuel fabrication, and licensing best practices across the USA and Sweden.

Together the two companies will examine shared suppliers for reactor-agnostic equipment to improve availability, schedules, and cost. Under the agreement, Oklo may also supply select components for Blykalla's direct use to strengthen a vertically integrated, potentially cross-border, supply chain. Oklo may also provide fuel fabrication services to Blykalla. In parallel, Oklo and Blykalla will pursue targeted R&D and regulatory analysis to boost reliability and lower lifecycle costs without requiring design changes.

The agreement includes Oklo co-leading Blykalla's next investment round through a commitment of about USD5 million.

And in February this year Blykalla and Newcleo signed an agreement for the joint research and development of materials for lead-cooled fast reactors (LFRs). The partnership entails the exchange of materials, results, and associated data to assist the respective R&D programmes of each party.

Oklo is a listed company on the New York Stock Exchange where its share price has increased from around USD16 a year ago to USD164 as of Friday morning, giving it a valuation of more than USD24 billion.

Last Energy microreactor planned at Texas university

_31063.jpg)

The pilot will feature Last Energy's PWR-5 reactor - a scaled version of its larger, commercial PWR-20 design. The 5-megawatt reactor will be built to initially demonstrate safe, low-power criticality and, then in later phases, the ability to generate electricity for the grid. The project is fully financed with private capital and is expected to begin testing in the summer of next year.

Last Energy - which moved its corporate headquarters to Austin, Texas in May - has secured a lease agreement at Texas A&M-RELLIS, procured a full-core load of fuel, signed an Other Transaction Agreement (OTA) with the US Department of Energy (DOE), and begun formal licensing submissions. The company said the initiative will "complement Texas A&M's leadership in creating the environment to rapidly scale nuclear power innovation".

In August, the project was among the DOE's initial selection of 11 advanced reactor projects for the Nuclear Reactor Pilot Program. The pilot programme, announced in June, aims to expedite the testing of advanced reactor designs that will be authorised by the DOE at sites located outside of the national laboratories. Part of the Reforming Nuclear Reactor Testing at the Department of Energy executive order signed by President Donald Trump in May, its goal is "to construct, operate, and achieve criticality of at least three test reactors using the DOE authorisation process by July 4, 2026".

"We're partnering with Texas A&M to usher in the next Atomic Era," said Last Energy founder and CEO Bret Kugelmass. "With fuel in hand, an optimal site at RELLIS, and DOE authorisation underway, we have the ideal conditions to demonstrate a standardised, scalable microreactor product in the United States."

"This is exactly the kind of project we had in mind when we built Texas A&M-RELLIS. It's bold, it's forward-looking, and it brings together private innovation and public research to solve today's energy challenges," said Glenn Hegar, Chancellor of The Texas A&M University System. "We're proud to work with Last Energy to help shape the future of nuclear power, and we are even prouder that it's happening right here at Texas A&M-RELLIS."

The Texas A&M University System has a network of 12 universities across Texas and educates nearly 170,000 students each year.

In February this year, Texas A&M University System signed agreements with four small modular reactor (SMR) developers - Kairos Power, Natura Resources, Terrestrial Energy and Aalo Atomics - to bring their reactors to Texas A&M-RELLIS. Land has been offered to the four companies to build their SMRs at the site, with an application already started for an Early Site Permit with the US Nuclear Regulatory Commission. The proposed site is projected to accommodate multiple SMRs with a combined electrical output of more than one gigawatt.

This initiative with Texas A&M University System marks Last Energy's first US reactor deployment. In October last year, Last Energy announced plans for four microreactor power plants at the site of the decommissioned Llynfi coal-fired plant in South Wales. In July, Last Energy said it remains on track to obtain a site licence decision by December 2027 for its project after successfully completing a Preliminary Design Review for its PWR-20 power plant design by UK nuclear regulators.

A Last Energy plant, referred to as the PWR-20, is comprised of a few dozen modules. The PWR-20 is designed to be fabricated, transported, and assembled within 24 months, and is sized to serve private industrial customers. Under its development model, Last Energy owns and operates its plug-and-play power plant on the customer's site, bypassing the decade-long development timelines of electric transmission grid upgrade requirements.

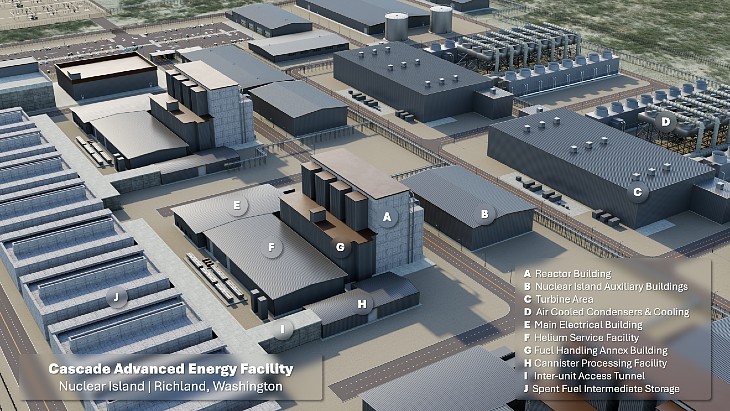

Amazon updates SMR progress, with new images of proposed plant

The online shopping and web services giant, together with Washington state utility Energy Northwest and technology developer X-energy aim to build up to 12 small modular reactors (SMRs) near Energy Northwest's Columbia Generating Station.

Amazon is one of a growing number of data centre operators - including Microsoft, Google and Meta - choosing nuclear energy as a way to get reliable energy that is carbon-free.

The first phase is for four SMRs to make up the initial 320 MW block - in a blog post Amazon says that construction is "currently expected to start by the end of this decade, with operations targeted to start in the 2030s".

The eventual aim is to have three blocks totalling 960 MW of capacity (Image: Amazon/X-energy)

Kara Hurst, Amazon’s chief sustainability officer, said: "This project isn't just about new technology; it's about creating a reliable source of carbon-free energy that will support our growing digital world. I'm excited about the potential of SMRs and the positive impact they will have on both the environment and local communities."

Clay Sell, CEO of X-energy said: "One year ago, we set out with Amazon to reimagine the way in which we advance new energy projects in the United States, and how we power technologies like AI that are driving our economy forward. Over the past year, the support of Amazon has enabled us to accelerate progress on our technology, grow our team with world-class talent and expertise, and position the Cascade Advanced Energy Center at the forefront of energy innovation. The scale of this work is historic, and we are privileged to have world-class partners like Amazon and Energy Northwest in this effort."

(Image: Amazon/X-energy)

The Cascade Advanced Energy Center project is part of Amazon's aim to bring more than 5 GW of new nuclear energy in the USA by 2039. The company and X-energy recently signed an agreement with South Korea’s Doosan Enerbility and Korea Hydro & Nuclear Power to accelerate the deployment of new SMRs.

The Xe-100 is a Generation IV advanced reactor design which X-energy says is based on decades of high temperature gas-cooled reactor operation, research, and development. Designed to operate as a standard 320 MWe four-pack power plant or scaled in units of 80 MWe. At 200 MWt of 565°C steam, the Xe-100 is also suitable for other power applications including mining and heavy industry. The Xe-100 uses tri-structural isotropic (TRISO) particle fuel, which has additional safety benefits because it can withstand very high temperatures without melting,

X-energy says its design makes it road-shippable with accelerated construction timelines and more predictable and manageable construction costs, and is well-suited to meet the requirements of energy-intensive data centres. The initial Xe-100 plant is being developed at Dow Inc's UCC Seadrift Operations site on the Texas Gulf Coast, which would be the first nuclear reactor deployed to serve an industrial site in the USA.

Amazon estimates that the Cascade Advanced Energy Center will provide at least 1,000 jobs during construction and more than 100 permanent ones. It says that Columbia Basin College in Pasco, Washington, has secured US government funding to launch the Energy Learning Center which will include a training simulator that replicates the Xe-100 control room.

Under the agreement announced a year ago, Amazon would have the right to purchase electricity from the first phase, while Energy Northwest will have the option to build the further eight modules, with the additional power being available to Amazon and utilities in the area.

PGE to take full ownership of nuclear project company

_59291.jpg)

In October 2022, Poland's Ministry of State Assets, South Korea's Ministry of Trade, Industry and Energy, ZE PAK and PGE, and Korea Hydro & Nuclear Power signed a letter of intent to develop plans for a nuclear power plant in Pątnów.

PGE PAK Energia Jądrowa is a 50/50 joint venture special purpose vehicle formed in April 2023 by ZE PAK and PGE to implement the project. The joint company will represent the Polish side at all stages of the project, including the execution of the siting and environmental studies, acquiring financing, and the preparation of a detailed investment schedule together with the Korean side, but also in the subsequent stages, obtaining permits and administrative decisions.

PGE - the largest power producing company in Poland - has now signed a preliminary conditional agreement with ZE PAK for the purchase of its 50% stake in PGE PAK Energia Jądrowa.

"The provisions of the Preliminary Agreement stipulate that the transaction, as a result of which PGE will become the sole shareholder of PGE PAK EJ, will be completed after the condition precedent is met, which is PGE receiving an unconditional decision of the minister responsible for energy resources management regarding the consent for PGE to achieve a dominant position in PGE PAK EJ, consisting in PGE taking control of PGE PAK EJ, in accordance with Article 3f Section 1 of the Act of June 29, 2011 on the preparation and implementation of investments in nuclear power facilities and associated investments," the agreement states. "The conclusion of the final agreement for the sale ... should take place no later than 27 November 2025."

In a post on X, PGE President Dariusz Marzec said: "The acquisition by PGE of 50% of the shares in PGE PAK EJ, and thus PGE obtaining 100% ownership, gives us full control over its operations and enables the undertaking of actions and decisions related to conducting research and analyses concerning the second nuclear power plant. The knowledge and expertise possessed by the team of specialists gathered in the company are key to implementing tasks related to assessing the possibilities of locating a nuclear power plant in Bełchatów and an SMR reactor in Turow."

In November 2022, the Polish government announced the first plant, with a capacity of 3750 MWe, would be built in Pomerania using AP1000 technology from the US company Westinghouse. A decision-in-principle for that project was issued in July the year.

PGE PAK Energia Jądrowa submitted an application for Poland's second nuclear power plant to the Ministry of Climate and Environment in August 2023. The application included a description of project characteristics, indicating the maximum installed capacity, the planned operating period and details of the APR1400 technology to be used in the construction of the plant. According to the application, the two units will generate 22 TWh of electricity annually, which corresponds to 12% of the current electricity demand in Poland. The ministry issued a decision-in-principle for the project later that year.

Tepco considering fate of oldest Kashiwazaki-Kariwa units

_75351.jpg)

"We informed the assembly that deliberations are under way in regard to the direction of decommissioning of Kashiwazaki-Kariwa Nuclear Power Station units 1 and 2," Tepco said in a statement. "Decisions related to this matter shall be made after ascertaining the impact that it will have on overall business management, including the restart of unit 6, and upon giving explanations to stakeholders, and obtaining their understanding and cooperation."

Kashiwazaki-Kariwa units 1 and 2 are 1,067 MW boiling water reactors that began supplying power in February 1985 and February 1990, respectively.

Kashiwazaki-Kariwa was unaffected by the March 2011 earthquake and tsunami which damaged the Fukushima Daiichi plant, although the plant's reactors were previously all offline for up to three years following the 2007 Niigata-Chuetsu earthquake, which caused damage to the site but did not damage the reactors themselves. While the units were offline, work was carried out to improve the plant's earthquake resistance. All units have remained offline since the Fukushima Daichii accident.

Although it has worked on the other units at the Kashiwazaki-Kariwa site, Tepco is concentrating its resources on units 6 and 7 while it deals with the clean-up at Fukushima Daiichi. Restarting those two Kashiwazaki-Kariwa units - which have been offline for periodic inspections since March 2012 and August 2011, respectively - would increase the company's earnings by an estimated JPY100 billion (USD670 million) per year.

Tepco is now prioritising restarting Kashiwazaki-Kariwa unit 6, where fuel loading was completed in June. The company has until September 2029 to implement anti-terrorism safety measures at unit 6, and it could operate until that time, pending local approval. However, Tepco has yet to obtain the Niigata prefectural government's consent.

In June 2017, Kashiwazaki Mayor Masahiro Sakurai requested Tepco submit a decommissioning plan for at least one of Kashiwazaki-Kariwa units 1-5 within two years as a precondition for approving the restart of units 6 and 7. In August 2019, Tepco submitted a report setting out the basic policy for the restart of the operation and decommissioning of units at the Kashiwazaki-Kariwa plant. The company said at that time it could not predict when it would be able to secure non-fossil fuel power sources of sufficient scale to meet long-term demand. However, it said that when it is able to predict when it can secure sufficient non-fossil fuel power sources, "decommissioning of one or more of units 1-5" will be an option, within five years of the restart of units 6 and 7.