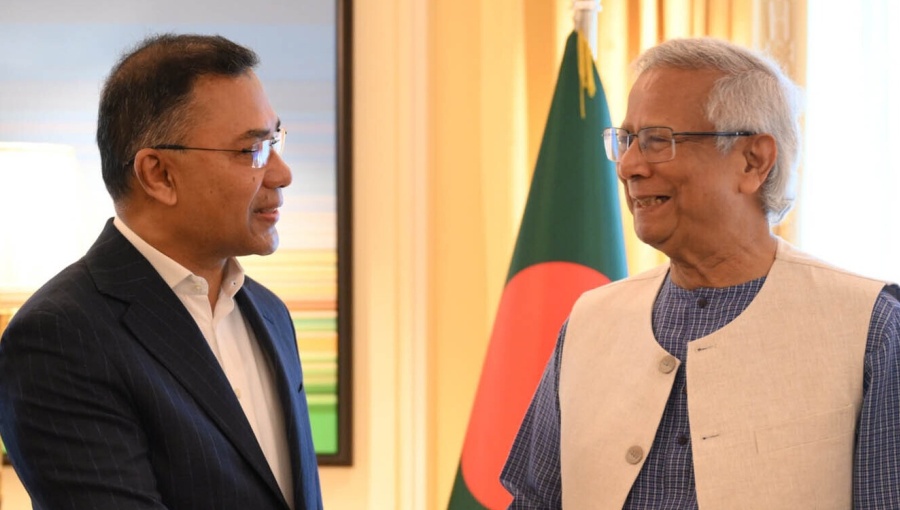

Tarique Rahman’s announcement of his imminent return to Bangladesh has overnight redefined the country’s political narrative after nearly two decades of exile. As acting chairman of the Bangladesh Nationalist Party (BNP), his statement to the FT that the “time is very close” for his return signals the beginning of a high-stakes political transition ahead of the general elections expected in February 2026.

The BNP’s resurgence, following the downfall of Sheikh Hasina’s Awami League government in 2024, will reshape Bangladesh’s domestic governance, its foreign alignments, and its relationships with neighbours like India and Pakistan. Tarique Rahman’s re-emergence marks the most significant leadership shift in Bangladeshi politics since his mother Khaleda Zia’s decline from active politics due to health issues. In his interviews with the FT and BBC Bangla, Tarique projected confidence that the BNP could “form the government alone,” but also suggested openness to alliances with new political movements that arose during the 2024 uprising that ended Hasina’s rule. His framing of the BNP as a unifying force for democracy draws heavily on public fatigue with authoritarianism and political violence. However, Tarique’s own history complicates his reformist image.

During BNP’s 2001–2006 tenure, Transparency International ranked Bangladesh the most corrupt country globally for five consecutive years. A 2008 US diplomatic cable described Tarique as a “symbol of kleptocratic governance.” Though he argues these accusations were politically motivated and all charges have been legally dismissed, the challenge lies in convincing domestic and international stakeholders that the BNP has undergone credible institutional reform. His claim that around 7,000 party members were disciplined for retaliatory conduct since 2024 is likely intended to present this image of internal cleansing.

If Tarique returns to power as prime minister, governance in Bangladesh will hinge on two competing expectations, popular optimism for stability after political unrest, and concerns over the BNP’s record and Tarique’s credibility. Rahman’s repeated references to “Bangladesh before all” suggest an emphasis on economic nationalism and institutional sovereignty. The BNP could accelerate diversification of the export base, reduce Dhaka’s dependence on India for energy and transit access, and court investment from the Middle East and China. However, its approach will need to balance this economic pragmatism with assurances of political inclusivity, especially if the Awami League remains legally marginalised and unable to contest elections.

For India, BNP’s return represents both an opportunity and a diplomatic challenge. Successive Indian governments, particularly under Prime Minister Narendra Modi, developed a robust partnership with Sheikh Hasina, built around counterterrorism coordination, connectivity, and border management. Under Hasina, Dhaka curbed cross-border insurgency support and approved transit links that enhanced India’s access to its northeastern states.

A BNP-led government could recalibrate this equation. Tarique has explicitly described the India–Bangladesh relationship as “one-sided,” signalling a desire for symmetrical engagement rather than dependency. He has also stressed the need to “reset” the bilateral partnership while maintaining a pragmatic tone that prioritises trade and energy cooperation.

Still, New Delhi remains cautious. Indian Foreign Secretary Vikram Misri recently reiterated that India has “no favourites” in Bangladesh’s internal politics, but also indicated that Sheikh Hasina’s presence in India is a “legal matter” requiring bilateral dialogue, a statement reflecting India’s discomfort in being seen as sheltering the ousted leader of a longtime ally. If BNP adopts a more assertive regional stance, for instance revisiting water-sharing negotiations over the Teesta River or revising port and power project terms, India could perceive a gradual erosion of its established strategic leverage.

Conversely, BNP’s nationalist rhetoric may strengthen its domestic legitimacy by appealing to constituencies that view India’s relationship with Hasina as too close. Islamabad on the other hand views BNP’s resurgence as a chance for a subtle diplomatic thaw after years of estrangement. The Awami League’s historical emphasis on the 1971 Liberation War and its continued denunciation of Pakistan’s wartime atrocities had long constrained meaningful engagement.

The BNP, though not openly pro-Pakistan, traditionally supports a more neutral foreign policy orientation that is less steeped in liberation-era narratives. Pakistan may attempt to revive trade and defence cooperation under the guise of South Asian regionalism through platforms like the South Asian Association for Regional Cooperation (SAARC).

However, Tarique has clarified that his administration will not overlook controversial historical roles, indirectly referring to the islamist Jamaat-e-Islami party’s wartime legacy. This suggests that while Pakistan could find greater diplomatic access, BNP’s primary focus will be internal stability and restoring Bangladesh’s global credit standing rather than ideological alignment.

The region’s geopolitical balance depends on how Bangladesh navigates its post-Hasina realignment. With the US States keenly observing events, having previously criticised the Awami League’s democratic backsliding, a BNP government perceived as elected through a fair contest could earn early Western goodwill.

Washington and the European Union have both signalled interest in deepening ties with a pluralistic Dhaka that safeguards labour rights and democratic reforms, especially as Western brands increasingly diversify sourcing away from China. China’s calculus is more transactional. It built strong infrastructure and energy links under Hasina, including projects within the Belt and Road Initiative framework. Tarique’s pledge of “Bangladesh before all” may translate into renegotiations of Chinese project loans to reduce debt exposure, but he is unlikely to sever ties given Bangladesh’s industrial reliance on Chinese machinery and capital inputs.

The strategic outcome could be a more balanced foreign policy, maintaining ties with Beijing while restoring credibility with Western donors and India alike. While Tarique Rahman seeks to symbolise closure after a turbulent political era, his return carries inherent volatility. His polarising image, long period abroad, and limited organisational control over provincial branches may hinder rapid consolidation. Moreover, the question of whether the Awami League will be allowed to contest the 2026 election remains sensitive. Tarique’s evasive remarks in the interview with FT and BBC, suggesting those “convicted as criminals” cannot contest, has triggered concerns over reciprocation of political exclusion, particularly towards Awami League.

If BNP governance begins with vengeful prosecutions or overreach, Bangladesh risks re-entering the cycle of political vendetta it has endured for decades. Institutional credibility will also depend on how the BNP manages security agencies that were restructured under Hasina’s centralisation of power. Reasserting civilian supremacy, depoliticising the police, and advancing judicial independence will determine whether Tarique can transform rhetoric into durable governance.

.jpeg)