Chevron Returns to Iraq with New Deal Covering Exploration and Field Development

Iraqi Prime Minister Mohammed Shia Al-Sudani on Tuesday attended the signing of a principles agreement between the Ministry of Oil and U.S. energy company Chevron. The deal marks a major step in reviving Chevron’s presence in Iraq after years of limited engagement.

The agreement covers four exploration blocks within the Nasiriyah Project, the development of the Balad oilfield in central Iraq, and potential additional fields and projects. During a meeting in Baghdad, Al-Sudani welcomed Chevron Vice President Frank Mount and his delegation, stressing Iraq’s new approach to partnerships with leading international oil firms, especially U.S. companies.

Al-Sudani highlighted Chevron’s role in technology transfer, job creation, and adherence to environmental standards, noting that such collaborations align with Iraq’s wider strategy to expand oil production, strengthen refining capacity, and utilize natural gas more effectively. The Prime Minister also emphasized that the government sees U.S. energy companies as long-term strategic partners.

Chevron, in turn, praised the agreement as a milestone in Iraq’s energy sector. “Iraq is a major producer of crude oil and holds substantial oil and gas resources,” Mount said. “We are confident that Chevron, with its proven track record and expertise, has the resources and technology to help Iraq further develop new energy resources.”

The agreement follows other recent deals with U.S. energy firms. In July, Iraq signed a contract with SLB (formerly Schlumberger) to boost gas production at the Akkas field, aiming to reach 100 million standard cubic feet per day. Earlier this year, Al-Sudani also held talks with Baker Hughes CEO Lorenzo Simonelli to discuss expanding energy technology projects in the country.

Oilprice.com

U.S. And Great Britain Move To Secure Strategic Advantage In Syria and Libya

- With Russia distracted by Ukraine, Washington and London are working to ensure Moscow cannot easily reassert influence in its former Middle East and North Africa strongholds.

- Both countries are lifting sanctions and backing investment plans to stabilize local economies and secure energy assets.

- The U.S. has lifted major oil and transport sanctions, paving the way for companies like Baker Hughes, Hunt Energy, and Argent LNG to lead projects in key oil regions.

With Russia focused on Ukraine, Washington is stepping up its efforts to ensure that Moscow cannot re-establish itself so easily in its previously vital strategic Middle East and North Africa strongholds of Syria and Libya. The U.S. and Great Britain were instrumental in the removal from power of longtime Libyan leader Muammar Gaddafi in 2011 and in the similar ousting of Syria’s long-term president Bashar al-Assad in 2024. Over the 23 years, Washington and London appear to have learned that quickly putting into place a plan to ensure economic health of the country involved in an effective coup d’etat is a good idea from every angle. It minimises the chances of cultural and economic destruction wrought by unfettered migration of affected populations into Europe, it secures valuable energy rights for those countries helping to shape the new regime, and it prevents chief geopolitical rivals Russia and China from adding to their global sphere of influence. It is also crucial to note that major oil and gas projects legally entitle the international companies undertaking them to safeguard these assets in a foreign country by whatever security means they think appropriate, as agreed with the host nation. Given all this, the last few weeks have seen major moves by the U.S. and Great Britain to make sure that this time around the strategic advantage that they have engineered is both countries is not lost.

For Syria, the beginning of July saw the U.S. remove Syria’s Ministry of Oil and Mineral Resources from its sanctions list, together with the country’s General Authority for Maritime Transport, and its two main refineries too. These actions augmented the removal of a broad range of sanctions on the country just a day earlier, including those preventing the importation of Syrian oil and oil products into the U.S. Together, the lifting of these sanctions are aimed at opening the way for the country to realise the still high potential of its oil and gas sector so that it can build a robust economy that is, according to the sanctions removal order: “stable, unified and at peace with itself and its neighbors”. In this context it is apposite to note that before Syria’s civil war began in March 2011 as part of the wider Arab Spring movement, it was a major oil producer, with output of around 400,000 barrels per day (bpd) of crude oil from proved reserves of 2.5 billion barrels. Prior to that – before the recovery rate started to decline due to a lack of enhanced oil recovery techniques being employed at the major fields -- it had been producing nearly 600,000 bpd. Europe imported over US$3 billion of oil per year from Syria up to the beginning of 2011, and many European refineries were configured to process the heavy, sour ‘Souedie’ crude oil that makes up much of Syria’s output, with the remainder being the sweet and lighter ‘Syrian Light’ grade. Most of this – some 150,000-bpd combined – went to Germany, Italy, and France, from one of Syria’s three Mediterranean export terminals: Banias, Tartus, and Latakia.

As an adjunct to this, a multitude of international oil companies were operating in Syria’s energy sector, including Great Britain’s Shell, Petrofac and Gulfsands Petroleum, France’s then-Total, the China National Petroleum Corporation, India’s Oil and Natural Gas Corp, Canada’s Suncor Energy, and Russia’s Tatneft and Stroytransgaz. Russia was quick to expand its on-the-ground presence in the country’s oil and gas sector as an adjunct to its launching full military support for al-Assad’s regime from 30 September 2015, at the Syrian president’s request, as analysed in full in my latest book on the new global oil market order. Heavy investment especially in the gas sector, allowed Moscow to leverage its influence across the country to such a degree that it became the Kremlin’s key Middle Eastern outpost, with several militarily vital bases. These included the naval base at Tartus (Russia’s only Mediterranean port), the air force base at Khmeimim, and the listening station just outside Latakia). However, following the 30 June and 1 July removal of sanctions on Syria by the U.S., American firms including Baker Hughes, Hunt Energy, and Argent LNG are working to revitalise the country’s oil, gas and power sector, according to a senior source working in the European Union’s security complex. “They will be taking the lead here, [in Syria] alongside local [Middle Eastern] firms focusing on power generation, with British and European firms to step in after that initial work has been done,” he exclusively told OilPrice.com last week. “The initial focus [for the U.S.] will be on key oil-producing areas west of the Euphrates currently under control of the new Syrian government,” he added.

It is a similar story for Libya, although British firms have adopted the lead role here in recent weeks. Before 2011 -- when the Arab Spring movement led to the removal of its own leader, Gaddafi -- Libya had easily been able to produce around 1.65 million barrels per day (bpd) of mostly high-quality light, sweet crude oil. Production had also been on a rising production trend at that point, up from about 1.4 million bpd in 2000. Although this output level was well below the peak levels of more than 3 million bpd achieved in the late 1960s, its National Oil Corporation (NOC) had plans in place before 2011 to roll out enhanced oil recovery techniques to increase crude oil production at maturing oil fields. There had also been plenty of interest from a slew of international oil companies to be involved in expanding production on existing fields and exploring new opportunities in oil and gas (after all, Libya still has 48 billion barrels of proved crude oil reserves – the largest in Africa). Russia was one such country, although the more chaotic conditions across the country resulting from fragmented political leadership meant Moscow was less able to cement firm control over it. Nonetheless, September 2023 saw General Khalifa Haftar – commander of the Libyan National Army (LNA) – travel to Moscow for talks with Russian President Vladimir Putin, whose Wagner mercenary soldiers provide support for LNA forces in Libya. Further talks between Haftar and senior Russian political and military figures have occurred at several points since then, according to the E.U. security source. As an adjunct to this, last year saw the arrest of Saddam Haftar -- General Haftar’s son -- at Naples airport after his name appeared on an E.U. database over an arrest warrant issued in Spain for alleged weapons smuggling. This followed comments from former U.N. special envoy to Libya, Abdoulaye Bathily, that the country was becoming a mafia state dominated by gangs involved in smuggling operations, especially for arms.

That said, earlier this year saw British oil giants BP and Shell sign a range of agreements with Libya’s National Oil Company (NOC) aimed at boosting the country’s oil and gas output recovery. BP said on 8 July that it had signed a memorandum of understanding (MoU) to evaluate options for redeveloping the giant Sarir and Messla onshore fields in the Sirte basin, and to assess potential unconventional oil and gas development. The firm’s executive vice president for gas and low carbon, William Lin, stated that the agreement, “reflects our strong interest in deepening our partnership with NOC and supporting the future of Libya’s energy sector.” In the meantime, Shell is focused on exploring development possibilities for the Atshan oil field and other NOC-owned assets. Shortly afterwards during a visit to Tripoli by U.S. President Donald Trump’s senior adviser for Africa, Massad Boulos, a cooperation agreement was signed between Mellitah Oil and Gas (a joint venture between the NOC and Italy’s Eni), and U.S. construction consulting firm Hill International to manage a project which aims to boost Libya's gas output. More specifically, it involves the development from 2026 of two gas fields located offshore Libya with combined gas reach 750 million cubic feet per day. Perhaps the biggest sign of the U.S.’s high hopes for a new Libya was the announcement earlier this month that supermajor ExxonMobil had signed an MoU with the NOC to identify hydrocarbon resources in four offshore blocks located off Libya’s northwest coast and its Sirte Basin. All of these on the-ground-developments in Libya and Syria will be very hard for Russia or China to undermine.

Qatar to Supply 40% of New Global LNG by 2030 Amid Geopolitical Tug-of-War

- Qatar is undertaking one of the world’s largest LNG expansion programs, set to boost output from 77 mtpy today to 142 mtpy by 2030.

- Qatar is set to account for 40% of new global supply.

- The emirate has carefully balanced ties between East and West, first leaning toward China with long-term LNG contracts, but later signing major deals with Germany, the U.S., and European allies.

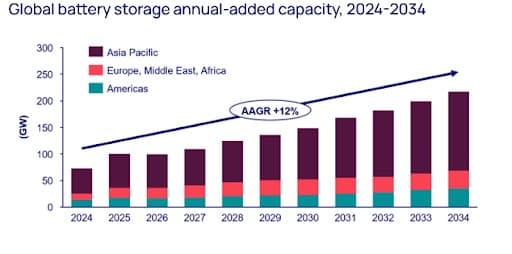

Liquefied natural gas (LNG) became the key global emergency energy source from the moment that Russia invaded Ukraine on 24 February 2022. Unlike pipelined energy that requires time-consuming infrastructure build-out and contract negotiations before it can be moved anywhere, LNG can be bought in the spot market when required and move swiftly to wherever it is needed. As increasing sanctions have hit Russia’s previously enormous global oil and gas exports, LNG’s crucial importance to the world’s energy balance has, if anything, increased. Against this backdrop, the centrality of the small Middle Eastern emirate of Qatar in the global energy market has dramatically expanded and is set to do so further. Its position as one of the world’s top LNG exporters will be bolstered as from the middle of next year by the first LNG exports from Phase 1 of the giant North Field East (NFE) expansion project. This is part of a broader output expansion programme that will see the emirate’s LNG production jump from the current 77 million metric tonnes per year (mtpy) to 110 million mtpy by end-2026, to 126 million mtpy by end-2027 and to 142 million mtpy by end-2030. By that time it is forecast that Qatar will account for at least 40% of all new LNG supplies across the globe. The geopolitical importance is not lost on any of the world’s major powers.

Qatar’s geographical positioning between the two great Middle Eastern powers (Saudi Arabia and Iran) and their principal superpower sponsors (respectively, the U.S., China, and Russia) has long required it to play a delicate diplomatic balancing act between the competing sides. However, from around a year before Russia’s 2022 invasion of Ukraine, the emirate appeared to be veering more towards the China-Russia sphere of influence, given the flurry of new long-term LNG contracts signed with Beijing’s firms during that period. This began in March 2021, with the signing of a 10-year purchase and sales agreement by the China Petroleum & Chemical Corp (Sinopec) and Qatar Petroleum (QP) for 2 million mtpy of LNG. December 2021 saw another major long-term contract for Qatar to supply China with LNG, on that occasion, a deal between QatarEnergy and Guangdong Energy Group Natural Gas Co for 1 million mtpy of LNG, starting in 2024 and ending in 2034, although it could be extended. Several other major deals followed. China and Russia had always thought that Qatar might be predisposed towards joining their bloc, given that the emirate shared its principal gas reservoir asset (North Field, or ‘North Dome’) with neighbouring Iran (South Pars), a key ally of both major powers. This 9,700 square kilometre reservoir was, and remains, by far the biggest gas resource in the world, holding an estimated 51 trillion cubic metres (tcm) of non-associated natural gas and at least 50 billion barrels of natural gas condensates. Following the U.S.’s unilateral withdrawal from the Joint Comprehensive Plan of Action (JCPOA, or ‘nuclear deal’) with Iran in May 2018, senior figures from Iran’s Petroleum Ministry and Qatar’s Energy Ministry began a series of meetings to agree a new North Dome-South Pars joint development plan. This made sense, as both Qatar and Iran were founding members of the Gas Exporting Countries Forum (GECF), together with Russia, the key customer of which remained China. Information received around the time by OilPrice.com from impeccable security sources indicated that China had been broadly told by Russia of its plans for a ‘large-scale special operation’ in Ukraine months before it happened, not just prior to the 4 February 2022 start of the Beijing Winter Olympics, as many reports have it, as analysed in full in my latest book on the new global oil market order. The implication for Washington at that stage was that Qatar might have been complicit in enabling Beijing to weather the storm of energy supply shortfalls and rocketing prices that followed the 2022 invasion.

That said, Qatar quickly found itself on the wrong end of growing pressure from the U.S., U.K., and France to take a step back from China and to start signing major long-term deals with European countries instead, most notably the European Union’s (E.U.) de facto economic leader ,Germany. Berlin’s intransigence in reducing its imports of cheap Russian gas and oil following Moscow’s forced annexation of Ukraine’s Crimea region in 2014 was widely seen in Washington, London, and Paris as the key reason why President Vladimir Putin thought he could launch the full invasion of Ukraine in 2022 with little or no meaningful consequences for Russia again. Given mounting pressure from these countries on Doha, the end of March 2022 saw the first in a series of strategically crucial meetings for Washington and its allies with senior representatives from Qatar aimed at securing vital LNG supplies urgently for the West. Following one such meeting that month -- between Qatar’s Emir, Sheikh Tamim bin Hamad Al Thani, German economy minister, Robert Habeck, and a representative presence by the U.S. – then-U.S. President Joe Biden stated his view of Qatar as a “major non-NATO ally”, as also detailed in my latest book. May 2022 saw Qatar sign a declaration of intent on energy cooperation with Germany aimed at becoming its key supplier of LNG. These plans would run in parallel with, but were likely to be finished significantly sooner than, the plans for Qatar to also make available to Germany sizeable supplies of LNG from the Golden Pass terminal on the Gulf Coast of Texas. QatarEnergy holds a 70% stake in the project, with the U.S.’s ExxonMobil holding the remainder. Following on from these developments, December 2022 saw two sales and purchase agreements signed between QatarEnergy and the U.S.’s ConocoPhillips to export LNG to Germany for at least 15 years from 2026.

So far, Qatar appears to have successfully maintained its delicate balancing act between East and West, albeit perhaps with a slightly greater tilt to the latter in the past two years or so. This has accompanied an even greater role for it as a key ally of Washington’s in highly sensitive negotiations in the Middle East, most notably recently in matters connected to the Israel-Iran conflict. That said, nothing can be taken for granted, as the E.U. found out recently when Qatar threatened to halt LNG supplies to it on the basis of the unworkability to Doha of ‘Corporate Sustainability Due Diligence Directive’, as analysed in full by OilPrice.com recently. Nonetheless, according to a very senior source in the E.U.’s security apparatus, spoken to exclusively by OilPrice.com recently, the E.U.is working on ways to circumvent the application of this directive in certain circumstances, such that it will not be a practical problem for Qatar. Nor will Washington allow this to derail its monumental efforts to finally wean Germany – and the broader E.U. – off Russian gas and oil supplies, the source added. “This sanction strategy against Russia is vital to degrading its financial ability to keep fighting in Ukraine and then to move further west,” he said, “and depriving China of free access to as much of Qatar’s LNG as it wants is also key to making its plans to invade Taiwan more difficult over the long term,” he underlined. As it currently stands, investment in Qatar’s overall North Field expansion project total around US$83 billion, with much of the foreign input to that having come from Western firms including the U.S.’s ExxonMobil and ConocoPhillips, the U.K.’s Shell, France’s TotalEnergies, and Italy’s Eni.

By Simon Watkins for Oilprice.com