The Oil Industry Jumps On The Low Carbon Bandwagon

Ed Hirs Contributor

Energy

Feb 8, 2021

FILE - In this Thursday, April 29, 2010 file photo,

a pair of coal trains idle on the tracks ASSOCIATED PRESS

There are two main roads leading to a low-carbon future. The first involves decreasing our combustion of fossil fuels via conservation and a switch to renewable energy.

There are two main roads leading to a low-carbon future. The first involves decreasing our combustion of fossil fuels via conservation and a switch to renewable energy.

The second is via the increased capture of carbon dioxide out of the air.

Big fossil fuel providers are not in the business of decreasing the use of their products, which is why it is unsurprising that oil giant ExxonMobil XOM +3.9% XOM +3.9% announced its plan to accelerate carbon capture and to invest $3 billion over the next five years to advance 20 new opportunities. In doing so, they unveiled an initial plan for how they can continue to operate their core business in a carbon constrained world. Theirs is just the latest in a series of responses from oil and gas companies starting to answer this crucial question.

It’s easy to be cynical about oil companies aiming to reduce carbon emissions, but the truth is that many, including BP, Total and Occidental Petroleum have been moving in that direction for years.

The recently published BDO 2021 Energy CFO Outlook Survey is an annual, anonymous survey of chief financial officers across the energy spectrum including the industry sectors of primary energy producers—oil and gas, renewable liquids fuels, solar and wind—and the secondary energy producers, the electric utilities including generators, transmission companies, and local distribution firms. A majority of the respondents expect that the shift to renewable energy resources will accelerate through 2021—similar to their pre-pandemic view—and this is no surprise. It probably does come as a surprise to many that a supermajority of the CFOs is planning to finance renewable energy projects in 2021 including those designed to lower the carbon footprint of the company’s own activities. For example, electricity from wind and solar is used to power oilfield pumps and pipeline compressor stations.

Research and New Technologies

While oil companies typically loathe discussing proprietary research, recent filings and public announcements of investments and projects by OXY, ExxonMobil, BP, and Chevron CVX +2.2% CVX +2.2% pull back the curtain for carbon capture and the use of low carbon fuels such as renewable diesel. Universities and entrepreneurs are the source of the leading edge technologies in the press today.

In the spirit of the Orteig Prize, won by Charles Lindbergh for his flight across the Atlantic Ocean, the Carbon XPrize competition began in 2015 and has now reached the finals for ten companies. The winners will be announced in late 2021. The finalists are competing on two criteria: 1) the quantity CO2 is converted, and 2) the net value of products manufactured. Four of the finalists are U.S. companies:

· Air Company utilizes CO2 from the atmosphere to produce impurity-free ethanol for award winning vodka, fragrances, cleaning, and, potentially, rocket fuel for NASA.

· Carbon Corp. collects CO2 at the emission point to manufacture carbon nanotubes for industrial and commercial use.

· CO2Concrete converts flue gases into CO2Concrete, stable minerals used for building products, with a 75% smaller CO2 footprint than traditionally manufactured concrete. The target market includes cement plants and electricity generators that use coal or natural gas.

· Dimensional Energy focuses sunlight into a photocatalytic reactor to directly convert captured CO2 into fuel.

The other finalists from India, China, UK, and Canada represent the breadth of interest and level of competition. The lead sponsors for the competition are the U.S. utility NRG and COSIA, Canada’s Oil Sands Innovation Alliance. Prize partners range from oil companies to Google.

What’s the prize for everyone else?

The IRS issued the final regulations for “45Q” on January 6. Under 45Q, companies that capture CO2 and other greenhouse gas emissions can qualify for a tax credit of up to $50 per metric ton of carbon that is sequestered but not otherwise used or sold. If the CO2 is used in processes or the production of other products such as injection into old oilfields to increase oil production, the maximum credit is $35 per metric ton.

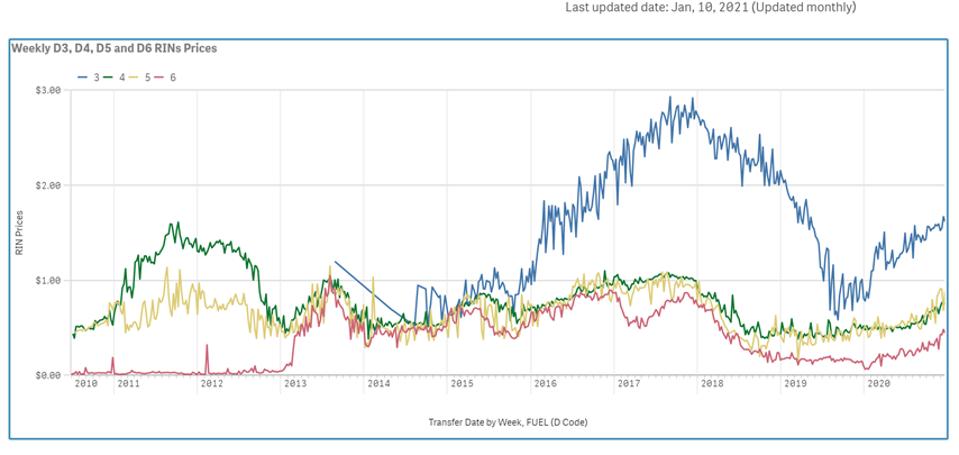

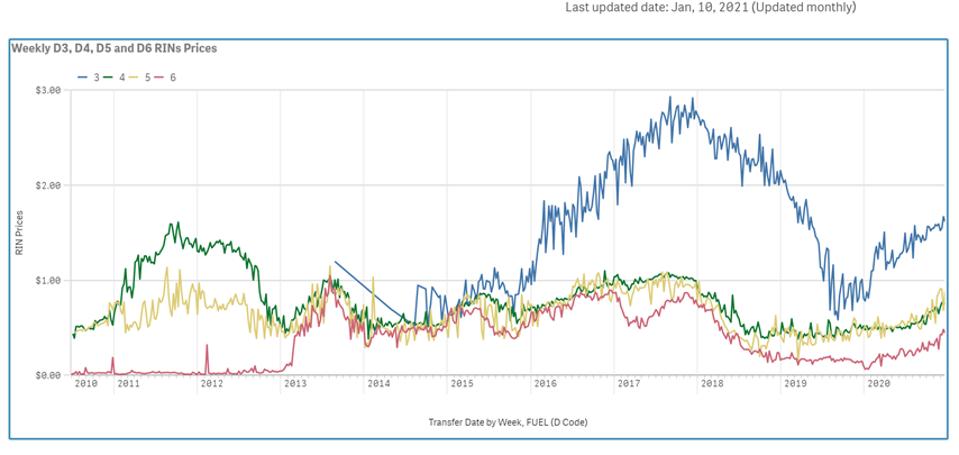

The federal Renewable Fuels Standards program established under the administration of President George W. Bush requires refineries to blend in renewable fuels such as ethanol, renewable diesel, and biodiesel. Economic incentives, and disincentives due to the required use of renewable fuels, are traded in the RINs market. RINs, or Renewable Identification Numbers, are assigned to renewable fuels against a benchmark of a gallon of ethanol and currently provide an economic incentive of between $1.50 per gallon for D3 (such as cellulosic biofuel) to $0.50 per gallon for D6 (total renewable fuel). In this way, refiners’ required purchases of renewable fuels provide price floors for the renewable fuels producers.

EPA's market for RINs prices EPA.GOV

State incentives vary, and California leads the way with low carbon fuel credits that are currently trading at the equivalent of $200 per metric ton of carbon (or about $1.88 per gallon of gasoline). Voluntary carbon offsets are now a thing, and CMEGroup CME +0.7% CME +0.7% is launching a trading vehicle for Global Emissions Offsets to accommodate that demand on March 1. The wave of the low carbon future has reached global hedge funds that are putting their money into carbon instruments. These incentives are now front and center, and with the support of the Biden administration, not going to leave the markets. Consumers and producers alike are adjusting to the new paradigm, or, as the old stock market saying goes: “Don’t fight the tape.”

This latest initiative by ExxonMobil is a big step toward a low-carbon future for the company, the industry, and the consumer.

Follow me on Twitter or LinkedIn. Check out my website.

Ed Hirs UH Energy Fellow at the University of Houston

Big fossil fuel providers are not in the business of decreasing the use of their products, which is why it is unsurprising that oil giant ExxonMobil XOM +3.9% XOM +3.9% announced its plan to accelerate carbon capture and to invest $3 billion over the next five years to advance 20 new opportunities. In doing so, they unveiled an initial plan for how they can continue to operate their core business in a carbon constrained world. Theirs is just the latest in a series of responses from oil and gas companies starting to answer this crucial question.

It’s easy to be cynical about oil companies aiming to reduce carbon emissions, but the truth is that many, including BP, Total and Occidental Petroleum have been moving in that direction for years.

The recently published BDO 2021 Energy CFO Outlook Survey is an annual, anonymous survey of chief financial officers across the energy spectrum including the industry sectors of primary energy producers—oil and gas, renewable liquids fuels, solar and wind—and the secondary energy producers, the electric utilities including generators, transmission companies, and local distribution firms. A majority of the respondents expect that the shift to renewable energy resources will accelerate through 2021—similar to their pre-pandemic view—and this is no surprise. It probably does come as a surprise to many that a supermajority of the CFOs is planning to finance renewable energy projects in 2021 including those designed to lower the carbon footprint of the company’s own activities. For example, electricity from wind and solar is used to power oilfield pumps and pipeline compressor stations.

Research and New Technologies

While oil companies typically loathe discussing proprietary research, recent filings and public announcements of investments and projects by OXY, ExxonMobil, BP, and Chevron CVX +2.2% CVX +2.2% pull back the curtain for carbon capture and the use of low carbon fuels such as renewable diesel. Universities and entrepreneurs are the source of the leading edge technologies in the press today.

In the spirit of the Orteig Prize, won by Charles Lindbergh for his flight across the Atlantic Ocean, the Carbon XPrize competition began in 2015 and has now reached the finals for ten companies. The winners will be announced in late 2021. The finalists are competing on two criteria: 1) the quantity CO2 is converted, and 2) the net value of products manufactured. Four of the finalists are U.S. companies:

· Air Company utilizes CO2 from the atmosphere to produce impurity-free ethanol for award winning vodka, fragrances, cleaning, and, potentially, rocket fuel for NASA.

· Carbon Corp. collects CO2 at the emission point to manufacture carbon nanotubes for industrial and commercial use.

· CO2Concrete converts flue gases into CO2Concrete, stable minerals used for building products, with a 75% smaller CO2 footprint than traditionally manufactured concrete. The target market includes cement plants and electricity generators that use coal or natural gas.

· Dimensional Energy focuses sunlight into a photocatalytic reactor to directly convert captured CO2 into fuel.

The other finalists from India, China, UK, and Canada represent the breadth of interest and level of competition. The lead sponsors for the competition are the U.S. utility NRG and COSIA, Canada’s Oil Sands Innovation Alliance. Prize partners range from oil companies to Google.

What’s the prize for everyone else?

The IRS issued the final regulations for “45Q” on January 6. Under 45Q, companies that capture CO2 and other greenhouse gas emissions can qualify for a tax credit of up to $50 per metric ton of carbon that is sequestered but not otherwise used or sold. If the CO2 is used in processes or the production of other products such as injection into old oilfields to increase oil production, the maximum credit is $35 per metric ton.

The federal Renewable Fuels Standards program established under the administration of President George W. Bush requires refineries to blend in renewable fuels such as ethanol, renewable diesel, and biodiesel. Economic incentives, and disincentives due to the required use of renewable fuels, are traded in the RINs market. RINs, or Renewable Identification Numbers, are assigned to renewable fuels against a benchmark of a gallon of ethanol and currently provide an economic incentive of between $1.50 per gallon for D3 (such as cellulosic biofuel) to $0.50 per gallon for D6 (total renewable fuel). In this way, refiners’ required purchases of renewable fuels provide price floors for the renewable fuels producers.

EPA's market for RINs prices EPA.GOV

State incentives vary, and California leads the way with low carbon fuel credits that are currently trading at the equivalent of $200 per metric ton of carbon (or about $1.88 per gallon of gasoline). Voluntary carbon offsets are now a thing, and CMEGroup CME +0.7% CME +0.7% is launching a trading vehicle for Global Emissions Offsets to accommodate that demand on March 1. The wave of the low carbon future has reached global hedge funds that are putting their money into carbon instruments. These incentives are now front and center, and with the support of the Biden administration, not going to leave the markets. Consumers and producers alike are adjusting to the new paradigm, or, as the old stock market saying goes: “Don’t fight the tape.”

This latest initiative by ExxonMobil is a big step toward a low-carbon future for the company, the industry, and the consumer.

Follow me on Twitter or LinkedIn. Check out my website.

Ed Hirs UH Energy Fellow at the University of Houston

No comments:

Post a Comment