Net zero is hard work, so companies are going ‘carbon neutral’

Bloomberg News | July 19, 2021 |

Projects that truly reduce deforestation are key to climate change. Stock image.

Companies are buying carbon offsets like never before. They’re also facing unprecedented scrutiny over whether helping to fund green projects elsewhere really makes up for their heat-trapping emissions.

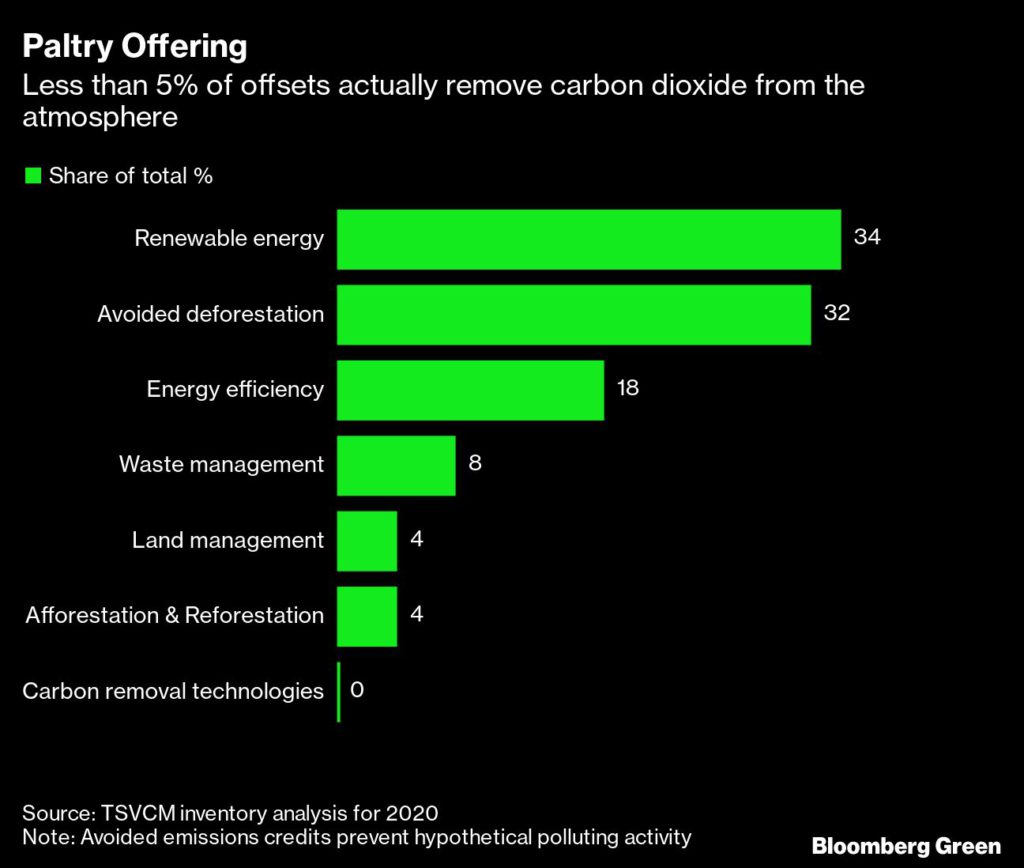

The most common offsets are based on avoiding the release of additional carbon dioxide into the atmosphere, for example by preventing deforestation or supporting renewable energy projects. The other, much more expensive, option is to fund programs that actually remove CO₂ by planting forests or employing machines that capture greenhouse gas from the air and store them away. Should companies be allowed to use cheaper “avoided emissions” to deliver on their promises to eliminate pollution?

The Science Based Targets initiative, a group of well-respected experts on corporate claims, says no. A company cannot offset its way to net-zero emissions because it undermines the need for investment in structural changes to cut pollution, according to its guidance. Instead, the group says, carbon-removal credits should only be bought once all other possible practical angles have been explored, such as switching to cleaner fuels or investing in new technology. Companies can still buy all the avoided-emissions offsets they want — they just can’t use them to balance their carbon ledgers.

That is too high a bar for some companies, which argue they should get some kind of recognition for purchasing offsets. If the credits can’t be used to improve their green credentials, then what’s the point of having them at all? That’s why some are proposing a compromise. Maybe companies can use offsets to claim “carbon neutrality” rather than “net zero.”

The idea is backed by Mark Carney, the former governor of the Bank of England, who is spearheading the Taskforce for Scaling Voluntary Carbon Markets. The group’s final recommendations on July 9 suggested an offset buyer could be described as “carbon neutral” or “carbon neutral on the path to net zero.”

“There’s a difference between carbon neutrality and net zero,” Carney told members of the British Parliament earlier this month. “The company should be compensating for its emissions on that pathway to net zero as well.”

Yet the two terms are indistinguishable to anyone who isn’t familiar with the intricacies of carbon accounting — itself a nascent financial tool. The push to adopt the “carbon neutral” label is causing concern among climate experts, who fear it creates a watered-down definition for those who are more interested in greenwashing than genuinely seeking to reach net zero.

“There will be some companies that try to scrape by with avoided-emission offsets,” said Eli Mitchell-Larson, an Oxford University environmental scientist who sits on the taskforce. “There needs to be a term for them.” But both “net zero” and “carbon neutral” are defined by the United Nations and scientists as the balance of emissions with removals, he said, “so carbon neutral is technically just shorthand for net zero.”

RELATED: Carbon offset trading is taking off before any rules are set

Owen Hewlett, another taskforce member and chief technology officer of Gold Standard, an offset registry, said there’s no consensus over what “carbon neutral” means. Still, he said, it would be good to find a way to differentiate between faraway milestones like “net zero” and shorter-term claims that are based on supporting programs that avoid more emissions.

Environmentalists broadly agree that well-run projects that, say, truly reduce deforestation are a key climate solution. Many are eager for more money to flow to these avoided-emissions programs, which are often underfunded in developing countries. What they struggle with is how to move large amounts of corporate money through a voluntary carbon market in return for some sort of credit to the company.

Assuming the projects are effective at avoiding emissions, should customers and investors accept the credits as suitable penance for a company’s climate sins? The answer could have ripple effects for years to come on efforts to slow global warming. If we agree that avoided emissions are sufficient to cancel out ongoing pollution, we give companies a license to keep polluting as long as they purchase these credits.

Perhaps a better label for companies using avoided-emissions offsets should be something closer to “carbon responsible.”

Only a small fraction of corporations has a climate plan. An even smaller group has science-based targets endorsed by SBTi. If companies want to atone for their climate sins, they can begin by taking responsibility for their pollution by funding avoided-emissions programs. That doesn’t write off emissions from their carbon ledgers, but it could earn them a “carbon responsible” tag that gives them credit for being ahead of the vast majority of firms that don’t even have a roadmap for reducing emissions.

If these companies really want to cancel out emissions with offsets, they would have to purchase more expensive carbon-removal credits that actually draw down greenhouse gases. Only when companies have achieved all the reductions they possibly can, and balanced the rest with carbon removals, would they achieve “carbon-neutrality” or reach “net zero.”

(By Jess Shankleman and Akshat Rathi)

No comments:

Post a Comment