Charting the Global Economy: Factory Costs Surge From Russia War

, Bloomberg News

(Bloomberg) --

Manufacturers around the world are facing even higher costs as Russia’s war in Ukraine enters its second month, threatening to push decades-high inflation up even more.

With those kinds of price pressures, the standard of living in the U.K. is falling at the fastest pace in at least six decades. Russians are feeling the pain of Vladimir Putin’s war as prices for basic goods like sugar shot up 14% in just a week, and its economy is set to undo more than a decades-worth of growth by the end of next year.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

Factories from Australia to Europe are seeing already surging costs jump further as Russia’s war in Ukraine and the barrage of sanctions rolled out in response roil commodity markets and trade. While the relaxation of pandemic restrictions helped overall business activity weather the initial shock from the invasion, dwindling confidence is threatening economic growth in the coming months.

Workers in Europe’s biggest economies are among the least likely to be seeking pay rises in the next year, despite feeling some of the biggest pressures from rising prices. It may allay concerns at central banks about the potential for an inflationary spiral in wages.

Emerging Markets

The inflation shock upending Russia’s economy has shown little sign of letting up, increasingly spreading to basic goods from onions to tea after supply disruptions and the ruble’s collapse that followed the invasion of Ukraine. In a single week, the price of sugar increased as much as 37.1% in some Russian regions and rose nearly 14% on average nationwide.

Russia is set to erase 15 years of economic gains by the end of 2023 after its invasion of Ukraine spurred a multitude of sanctions and prompted companies to pull out of the country, according to the Institute of International Finance.

Mexico’s central bank confirmed its latest interest-rate hike hours after President Andres Manuel Lopez Obrador announced the half-point increase, an unprecedented disclosure that raised questions about Banxico’s independence.

U.S.

Where can the world quickly turn to for more oil? The answer, it turns out, isn’t the traditional powerhouse of OPEC or the promising new offshore fields of Brazil. Instead, the weight of the oil world is falling squarely on the shoulders of a few counties tucked into lonely corners of the U.S. Southwest.

The pandemic pushed millions of older Americans out of the labor force. It should have spawned a surge in Social Security benefits applications — but it hasn’t. Perhaps because they aren’t retired.

Europe

U.K. Chancellor of the Exchequer Rishi Sunak unleashed a set of tax cuts on Wednesday designed to appeal to his Conservative Party, but still left Britons facing the worst squeeze on living standards in at least six decades.

Asia

Congestion in the key Chinese ports of Shenzhen and Hong Kong due to Covid-19 lockdowns has risen to the highest level in five months, posing possible delays to goods heading to the U.S. this summer. There were approximately 174 vessels anchored or loading off the South China hubs, the largest number since Oct. 21, when the region dealt with the aftermath of Typhoon Kompasu.

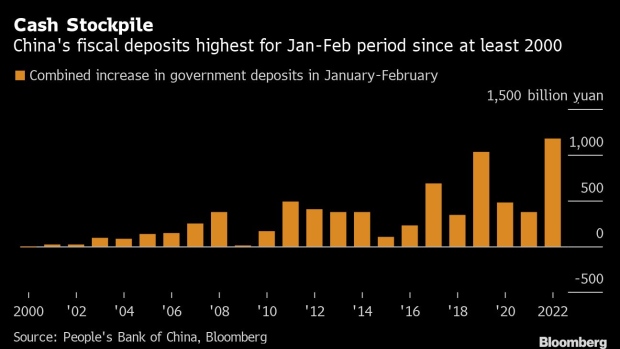

China’s government stockpiled a record amount of cash in the first two months of the year instead of spending it, despite numerous pledges by top officials to speed up fiscal stimulus to boost the economy.

Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

©2022 Bloomberg L.P.

No comments:

Post a Comment