Bloomberg News | February 15, 2023\

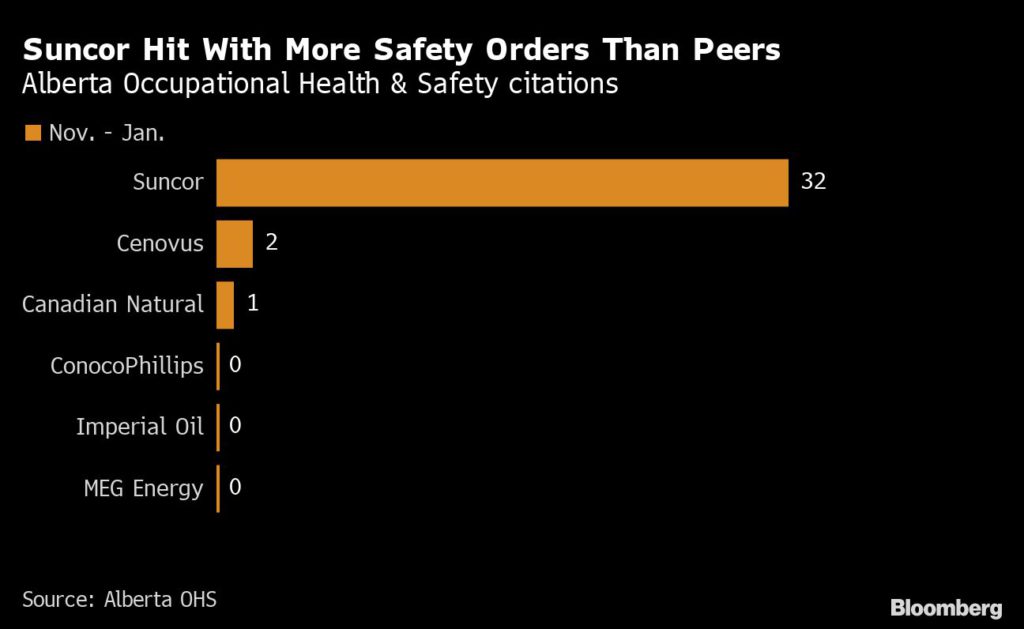

Suncor Energy Inc. — the Canadian oil producer that’s being targeted by activist Elliott Investment Management LP — has racked up 32 safety violations in the past three months amid a special regulatory probe of its sites.

The province’s Occupational Health & Safety division stepped up inspections of Suncor late last year, and that resulted in increased citations, spokeswoman Kristjanna Grimmelt said in an email. The agency’s orders cite problems ranging from general housekeeping matters to fire and explosion dangers.

By contrast, just three orders were issued against the five other largest oil-sands producers in the same period, including two against Cenovus Energy Inc. and one against Canadian Natural Resources Ltd.

Suncor is “committed to improving our safety performance,” Sneh Seetal, a spokeswoman for the Calgary-based company, said by email.

“We met with OHS in the fall and are working to support them in their inspections,” Seetal said. “Initial inspections took place in November and December 2022, and the inspection plan is expected to continue through 2023.”

Many of the compliance orders have been closed, and the remainder are in progress to be resolved, she said. None required Suncor to stop work, she said.

While some of the orders pertained to issues like chemical and biological hazards, many were for concerns including scaffold design, guardrails, specifications and certifications, as well as log books for cranes, hoists and lifting devices, according to OHS records.

Suncor Base Plant. Credit: Suncor Energy

Suncor’s safety record has been a central theme of Elliott’s campaign against the company, which it took public in April, about three months after a truck accident killed a contractor and injured two others at its Base Plant mine. In June 2021, a person was killed at a Syncrude mine, and two deaths occurred in December 2020 at the Fort Hills mine.

(By Robert Tuttle)

Suncor's fourth-quarter profits increase 76 per cent to $2.74 billion

The Canadian Press

Suncor Energy Inc. says it earned $2.74 billion in the fourth quarter of 2022, a 76 per cent increase from the $1.55 billion it earned in the same three months of 2021.

The Calgary-based company says its increased profit was due to the higher price of crude and refined product realizations as well as higher upstream production, partially offset by increased operating expenses.

On an adjusted basis, Suncor says it earned $2.43 billion, or $1.81 per common share, compared to $1.30 billion or 89 cents per common share in the prior year's quarter.

The energy giant says its total upstream production increased to 763,100 barrels of oil equivalent per day (boe/d) in the fourth quarter of 2022, compared to 743,300 boe/d in the prior year quarter, primarily driven by increased production from the company's oilsands assets.

Suncor's refinery crude throughput was 440,000 barrels per day and its refinery utilization was 94 per cent in the fourth quarter of 2022, compared to 447,000 bbls/d and 96 per cent in the prior-year quarter.

It attributes the decrease in part to unexpected maintenance that occurred in the quarter, including that required as a result of bad weather at the company's Commerce City refinery.

This report by The Canadian Press was first published Feb. 14, 2023.

, The Canadian Press

Suncor Energy Inc. did not announce the name of its new CEO on its fourth-quarter earnings call Wednesday, though interim chief executive Kris Smith said a decision is expected "very soon."

The Calgary-based oil producer and refiner has been on the hunt for a new CEO ever since former chief executive Mark Little resigned last July, under pressure from an aggressive activist investor and in the wake of a spate of workplace deaths and safety incidents.

Smith, who was formerly executive vice-president of Suncor's Downstream division, has been serving as interim CEO since that time. Suncor had previously indicated a permanent CEO would be named by mid-February, and Smith told analysts on a conference call Wednesday that a decision is imminent.

"The board is going through a very diligent process, ensuring that they make the decision that's going to take this company forward," Smith said.

"I mean, we're sitting here at Feb. 15, so I expect the decision and the announcement will be coming fairly soon."

Two of the board directors serving on the CEO search committee were named to Suncor's board in July, as part of a deal the company struck to appease U.S.-based activist investor Elliott Investment Management.

Elliott publicly expressed frustration last spring at what it called a recent decline in performance at the energy producer. At Elliott's urging, Suncor recently completed a strategic review of its downstream retail business, a review that considered possibly selling off the Petro-Canada chain. However, the company ultimately decided to keep the retail business.

In the eight months since being named interim CEO, Smith has implemented a number of changes aimed at improving worker safety at Suncor sites, which had been another problem area flagged by Elliott. At least 12 workers have died at the company's oilsands operations in northern Alberta since 2014, and former CEO Little resigned just one day after the most recent fatality.

Smith told analysts that collision awareness systems are scheduled to go live at Syncrude's Aurora mine by the end of the first quarter, and Suncor is also on track to complete implementation of collision awareness and fatigue management technology systems across all nine of its oilsands sites.

The company is also reducing the size of its contractor work force by 20 per cent, a move Smith said will reduce the number of exposure hours that put the company at risk for workplace injuries or fatalities, while also lowering costs.

"We are making progress on contractor workforce reductions in our mining and upgrading business and remain on track to achieve a 20 per cent reduction by mid-2023," Smith said.

"And to be clear, these reductions will not be replaced by our in-house workforce."

Smith told analysts that he is pleased with the progress that has been made on workplace safety so far.

"I always say, this is a journey, and you don't measure this thing in days and months," he said.

"But what I would say is since I've taken the interim CEO role, I've been pleased with the direction I've seen in safety performance, both in personal safety and process safety. And we've seen a reduction in the number of incidents over that period of time."

Suncor reported Tuesday evening that it earned $2.74 billion in the fourth quarter of 2022, a 76 per cent increase from the $1.55 billion it earned in the same three months of 2021.

The company said its increased profit was due to the higher price of crude and refined product realizations as well as higher upstream production, partially offset by increased operating expenses.

On an adjusted basis, Suncor says it earned $2.43 billion, or $1.81 per common share, compared to $1.30 billion or 89 cents per common share in the prior year's quarter.

The energy giant said its total upstream production increased to 763,100 barrels of oil equivalent per day (boe/d) in the fourth quarter of 2022, compared to 743,300 boe/d in the prior year quarter, primarily driven by increased production from the company's oilsands assets.

Suncor's refinery crude throughput was 440,000 barrels per day and its refinery utilization was 94 per cent in the fourth quarter of 2022, compared to 447,000 bbls/d and 96 per cent in the prior-year quarter.

It attributed the decrease in part to unexpected maintenance that occurred in the quarter, including that required as a result of bad weather at the company's Commerce City refinery.

No comments:

Post a Comment