Boy Genius No More: Sam Bankman-Fried Convicted on All 7 Counts

Noah Kirsch, Emily Shugerman

Thu, November 2, 2023

Drew Angerer/Getty

After four weeks of brutal testimony detailing his sex life, his alleged financial crimes, and his glory days as a multibillionaire, Sam Bankman-Fried earned a new title on Thursday: convicted fraudster.

A federal jury in Manhattan deliberated for less than a day before finding the former cryptocurrency whiz kid guilty on all seven counts. He faces more than 100 years of possible prison time at his sentencing—which is set to take place in March.

“We respect the jury’s decision, but we are very disappointed with the result,” Bankman-Fried’s attorney, Mark Cohen, said outside the courthouse.

“My client... maintains his innocence and will continue to vigorously fight the charges against him.”

U.S. Attorney Damian Williams said the swift conviction should serve as a warning to financial flim-flam artists.

“While the cryptocurrency industry might be new and the players like Sam Bankman-Fried might be new, this kind of corruption is as old as time. This case has always been about lying, cheating, and stealing, and we have no patience for it,” he said in a statement.

“This case is also a warning to every fraudster who thinks they’re untouchable, that their crimes are too complex for us to catch, that they are too powerful to prosecute, or that they are clever enough to talk their way out of it if caught. Those folks should think again, and cut it out. And if they don’t, I promise we’ll have enough handcuffs for all of them.”

The verdict capped a precipitous fall from grace for Bankman-Fried, who just two years ago was named by Forbes one of the youngest newcomers ever to its list of the country’s richest people, with a net worth of $22.5 billion. He mingled with Bill Clinton, Tony Blair, and Tom Brady, courted U.S. senators from both parties, and splashed out on luxury real estate.

Bankman-Fried, 31, was arrested in the Bahamas in December 2022 following the sudden collapse of his crypto exchange, FTX, and his crypto trading firm, Alameda Research. Federal prosecutors in the U.S. unsealed an eight-count indictment soon after, including charges of wire fraud and conspiracy to commit money laundering.

Prosecutors later added other counts, such as attempting to bribe a foreign government. Because of legal technicalities related to his extradition, five of the charges were eventually severed (he could be tried on those next year).

The government’s case centered on FTX’s decision to loan billions of dollars of customer deposits to Alameda, which then used the money to make risky investments and pay off its debts. In the fall of 2022, amid turbulence in the crypto markets, customers sought to withdraw their funds en masse. But the money was no longer there.

Four of Bankman-Fried’s former executives—Nishad Singh, Gary Wang, Ryan Salame, and his ex-girlfriend Caroline Ellison—later pleaded guilty to federal charges. Singh, Wang, and Ellison all testified during his trial.

“He directed me to commit these crimes,” said Ellison, who was Alameda’s CEO. She told the jury she created inaccurate balance sheets, which she shared with Bankman-Fried, in an effort to deceive investors about the amount of risk they were taking on.

Caroline Ellison leaves Manhattan Federal Court after testifying.

Michael M Santiago/Getty Images

When Alameda collapsed, Ellison held an all-hands meeting with her staffers. Asked who was responsible for the mess, she giggled uncomfortably and said, “Sam, I guess.”

Singh testified that the group had engaged in “heinously criminal” activity.

According to Ellison, the executives exhibited a total disregard for global regulation. In one case, she said, they sent $150 million to Chinese officials to gain access to frozen accounts. They later referred to the debacle as “the thing.”

Ellison said they had considered crackpot alternatives, like moving money to accounts in the name of Thai sex workers. Bribery, she explained, was their backup plan.

Even before the trial, Judge Lewis Kaplan expressed frustration with Bankman-Fried, who was originally allowed to remain under home confinement at his parents’ California house. Kaplan warned Bankman-Fried to abide by the court’s instructions after he used a virtual private network—or VPN—in February, supposedly to watch the Super Bowl. Prosecutors argued that he may have been trying to use the internet without oversight.

In August, Kaplan sent Bankman-Fried to jail when he leaked Ellison’s personal writings to The New York Times, prompting accusations that he was trying to intimidate her before she testified.

Once the trial started, it was Bankman-Fried’s attorneys who appeared to irk the judge. He repeatedly admonished them for their slow and repetitive approach to cross-examination. By the time the defense started presenting its case on Oct. 26, Bankman-Fried seemed to be facing an uphill battle, and in a highly risky move, he decided to testify himself.

Bankman-Fried seemed to struggle. During cross-examination, he at times came off evasive, frequently telling Assistant U.S. Attorney Danielle Sassoon that he could not recall making statements to the press about the company’s operations and approach to risk management. Time and again, she would then call up exhibits showing Bankman-Fried saying exactly what she’d described.

Sassoon also challenged Bankman-Fried’s assertion that he knew little about Alameda’s massive debts. For example, she probed one instance from the summer of 2022, when it appeared that Alameda faced a massive financial hole; Bankman-Fried said he didn’t investigate the matter in depth. (The issue turned out to be partially attributable to a software bug.)

“It’s your testimony that as CEO, some unknown people spent $8 billion without your knowledge?” Sassoon questioned. She asked why he hadn’t demanded that his deputies fill him in.

“I was told they were busy and I should stop asking questions,” he said.

Bankman-Fried admitted to the jury that he had made “significant oversights” and that he had deep “regret” for not better safeguarding his customers’ money. But he insisted that his behavior wasn’t criminal.

Evidently, the jury didn’t buy it.

Kate Gibson

Thu, November 2, 2023 at 5:46 PM MDT·3 min read

FTX founder Sam Bankman-Fried has been found guilty on all seven counts of fraud, conspiracy and money laundering following more than two weeks of testimony in one of the highest-profile financial crime cases in years.

The 31-year-old former cryptocurrency billionaire was convicted of two counts of wire fraud conspiracy, two counts of wire fraud and one count of conspiracy to commit money laundering, charges that each carry a maximum sentence of 20 years in prison. He was also convicted of conspiracy to commit commodities fraud and conspiracy to commit securities fraud, which each carry a five-year maximum sentence.

"Sam Bankman-Fried perpetrated one of the biggest frauds in American history, a multibillion-dollar scheme designed to make him the king of crypto," Damian Williams, U.S. attorney for the Southern District of New York, said in a news briefing following the verdict. "Here's the thing: the cryptocurrency industry might be new. The players like Sam Bankman-Fried might be new. This kind of fraud, this kind of corruption, is as old as time, and we have no patience for it."

The MIT graduate steadfastly maintained his innocence since his arrest late last year after the startling implosion of FTX, the crypto exchange he co-founded, amid an $8 billion shortfall in funds and allegations he had used customer money to prop up his struggling hedge fund, Alameda Research.

Bankman-Fried was accused of using some of that money to buy real estate, make political contributions and finance pet charitable projects, among other purposes unconnected to FTX's business of letting people buy and trade digital currencies.

More broadly, FTX's bankruptcy in November of 2022 cast a cloud over the entire crypto industry, as the sudden collapse of other major industry players vaporized billions in client wealth.

Bankman-Fried's attorney and federal prosecutors made closing arguments to a New York City juror on Wednesday after more than four weeks of testimony.

Witnesses for the prosecution included Caroline Ellison, Nishad Singh and Gary Wang, all of whom once worked for Bankman-Fried at FTX or Alameda and all of whom pleaded guilty to multiple charges including participating in an alleged scheme to defraud millions of customers.

The three accused him of orchestrating the use of FTX customer money to make purchases ranging from a luxury condo in the Bahamas to covering losses at Alameda, Bankman-Fried's cryptocurrency hedge fund.

Ellison testified that Bankman-Fried directed her to siphon money from FTX customer accounts to fund investments and trading strategies at Alameda, where she was CEO until it and FTX collapsed. FTX co-founder Wang detailed how he and the defendant engaged in financial crimes and lied about it, while Singh, FTX's former director of engineering, detailed how Bankman-Fried spent FTX money.

Defense attorneys sought to portray Bankman-Fried as a math nerd who made poor management decisions at FTX, but who had nothing criminal in mind while building his crypto empire.

Bankman-Fried testified that he believed Alameda's spending came from corporate, not customer, funds, and that any mistakes he made were not ill-intentioned.

FTX was intended to "move the ecosystem forward," he testified during the proceedings. "It turned out the opposite of that."

Kaplan appeared skeptical of the arguments presented by Bankman-Fried's lawyers. Kaplan also repeatedly interrupted Bankman-Fried's testimony, at one point admonishing him to "just answer the question."

"Jurors take their direction, whether it's explicit or implicit, from a judge and [Kaplan] has also been pretty harsh with Sam Bankman-Fried's lawyers. The jury doesn't miss that," according to CBS legal analyst Rikki Klieman, a former defense lawyer.

Prosecutors called 16 witnesses while the defense called three, including Bankman-Fried, who appeared close to tears as his lawyer wrapped up closing arguments, according to multiple news outlets.

FTX Crypto King Sam Bankman-Fried Guilty Of Seven Counts Of Fraud, Faces Potential Long Prison Sentence

Bruce Haring

Thu, November 2, 2023

Jurors took only a half-day of deliberations today to find former FTX founder Sam Bankman-Fried guilty of seven counts of fraud in a scheme that cost customers an estimated $10 billion to $14 billion. His crypto exchange, FTX, collapsed into bankruptcy last year.

He now faces a March 28 sentencing date that could result in decades of prison time. The 2009 prosecution of Bernard Madoff, whose Ponzi scheme bilked about $20 billion. resulted in a sentence of 150 years in prison.

More from Deadline

'Fortun3': T.J. Miller & Jon Heder To Lead Web3 Animated Workplace Comedy Series Inspired By Sam Bankman-Fried's Crypto Firm Collapse

Anthony Scaramucci To Dish On His "Protégé", Fallen Bitcoin King Sam Bankman-Fried In 'Tales From The Crypto' Podcast Series From Audio Up

Netflix, Fox, Bleacher Report, Coachella Music Festival On Very Long List Of FTX Creditors In Crypto Firm Bankruptcy

U.S. Attorney Damian Williams told reporters after the verdict that Bankman-Fried “perpetrated one of the biggest financial frauds in American history, a multibillion dollar scheme designed to make him the king of crypto..

“But here’s the thing: The cryptocurrency industry might be new. The players like Sam Bankman-Fried might be new. This kind of fraud, this kind of corruption, is as old as time, and we have no patience for it,” he said.

Bankman-Fried’s attorneys said they were disappointed with the verdict. Bankman-Fried himself took the witness stand for four days, a rare gambit by a defendant. He said that he never intended to commit fraud or cheat customers during his testimony.

“His crimes caught up to him. His crimes have been exposed,” Assistant U.S. Attorney Danielle Sassoon told the jury just before they began deliberations. Sassoon said Bankman-Fried turned his customers’ accounts into his “personal piggy bank,” as up to $14 billion disappeared.

Bankman-Fried, 31, was one of the top players in the emerging industry of cryptocurrency. He lived the part, as he frequently spoke at industry conferences and lived with a group of young executives in their 20s in the Bahamas.

Private jets, Super Bowl tickets, and celebrity hangs were all part of their world, Bankman-Fried was also the No. 2 Democratic party donor for the 2022 elections, donating more than $40 million. Hollywood also pursued him, hoping to get exclusives on his story.

The government relied on the testimony of three former members of Bankman-Fried’s inner circle, including his former girlfriend, Caroline Ellison. They detailed how he used customer money from FTX to prop up his hedge fund, Alameda Research.

FTX cofounder Gary Wang, who was FTX’s chief technology officer, testified that Bankman-Fried directed him to insert code into FTX’s operations so that Alameda Research could make unlimited withdrawals from FTX and have a credit line up to $65 billion. Wang said the money came from customers.

Ellison, Wang and Singh all pleaded guilty to fraud charges and testified against Bankman-Fried in the hopes of leniency at sentencing.

Bankman-Fried was arrested last December and extradited to the United States. He remained free on a $250 million personal recognizance bond with electronic monitoring at the home of his parents in Palo Alto, California. But he was jailed in August when a judge found he was trying to influence the media and others.

Associated Press contributed to this report.

Sam Bankman-Fried found guilty on all counts as jury returns swift verdict

Tara Suter

Thu, November 2, 2023

Beleaguered cryptocurrency king and FTX founder Sam Bankman-Fried was convicted on seven counts in his fraud trial in New York Thursday, ending a storied ascent that brought in millions in political donations and sparked criminal probes across agencies when FTX collapsed.

Bankman-Fried was convicted of charges including wire fraud and conspiracy to commit securities fraud in his case tried in the Southern District of New York.

Bankman-Fried, 31, faced several charges over allegations that he defrauded his customers and investors of billions of dollars in a scheme that prosecutors have called “one of the biggest financial frauds in American history.”

“[It was] a multibillion-dollar scheme designed to make him the King of Crypto – but while the cryptocurrency industry might be new and the players like Sam Bankman-Fried might be new, this kind of corruption is as old as time,” Damian Williams, the U.S. attorney for the Southern District of New York, said in a statement.

“This case has always been about lying, cheating, and stealing, and we have no patience for it,” Williams continued.

The jury reportedly deliberated for just over four hours in the case after being ordered to stay after hours by the judge in the case.

CEO of the Crypto Council for Innovation Sheila Warren told The Hill that Bankman-Fried’s case “was always about fraud, and this outcome confirms that the jury understood who and what was on trial here.”

“The jury heard evidence that Sam Bankman-Fried was out for himself, and that’s reflected in the verdict,” Warren said. “This case serves as a reminder that rules that have existed for a long time created a path to accountability for these crimes.”

Following the collapse of FTX cryptocurrency exchange last year, Bankman-Fried was arrested in the Bahamas last December and is facing charges for wire fraud, conspiracy to commit wire fraud, securities fraud, money laundering and conspiracy to make unlawful political contributions and defraud the Federal Election Commission.

The trial kicked off on Oct. 2 in a Manhattan courthouse, with the jury hearing testimony from several members of his executive team, including his ex-girlfriend and former Alameda Research CEO Caroline Ellison.

Bankman-Fried took the stand starting last week, testifying in front of just the trial judge and lawyers on Thursday and the jury on Friday.

Prosecutors began cross-examining Bankman-Fried in front of the jury on Monday, bringing up his public statements before and after FTX filed for bankruptcy last year when it could not process the billions in withdrawals, according to The Associated Press.

Bankman-Fried was arrested in the Bahamas in 2022.

“My hope is that we can turn the focus to the victims here rather than continuing to give airtime to the latest person who committed one of the oldest crimes on the books: fraud,” Warren said.

Additional reporting from Miranda Nazzaro

Sam Bankman-Fried found guilty of defrauding FTX customers out of billions

Victoria Bekiempis in New York

Thu, November 2, 2023

Photograph: Ed Jones/AFP/Getty Images

Sam Bankman-Fried, the founder of now-bankrupt crypto exchange FTX, was found guilty on all counts of defrauding his customers on Thursday in Manhattan federal court.

The one-time mogul stood with his hands clasped facing the jury as he was found guilty on seven counts of wire fraud and conspiracy to launder money. He faces decades in prison at a sentencing hearing that US district Judge Lewis Kaplan set for 28 March 2024. The verdict, reached after just four hours of jury deliberation, brought an end to nearly a month of court proceedings that featured stunning testimony from his closest allies and the disgraced entrepreneur himself. He maintained his innocence until the end.

Related: Sam Bankman-Fried’s fraud trial testimony: six key takeaways

“We respect the jury’s decision. But we are very disappointed with the result. Mr Bankman-Fried maintains his innocence and will continue to vigorously fight the charges against him,” read a statement from Mark Cohen, Bankman-Fried’s lawyer.

His parents, the Stanford Law School professors Joseph Bankman and Barbara Fried, sat in the courtroom’s second row, holding each other’s hands. Bankman sat with his head in hands after the verdict was read.

After Kaplan left the courtroom, Cohen put his arm around Bankman-Fried as they spoke at the defense table.

As Bankman-Fried was led out of the courtroom by members of the US Marshals service, he turned around, looked at his parents in the courtroom audience and nodded. Fried looked toward him and crossed her arms across her chest.

Following Bankman-Fried’s conviction, Manhattan US attorney Damian Williams warned that other would-be fraudsters should take note of the convicted mogul’s fate.

“Sam Bankman-Fried perpetrated one of the biggest financial frauds in American history – a multibillion-dollar scheme designed to make him the King of Crypto – but while the cryptocurrency industry might be new and the players like Sam Bankman-Fried might be new, this kind of corruption is as old as time,” Williams said. “This case has always been about lying, cheating, and stealing and we have no patience for it.”

“When I became US attorney, I promised we would be relentless in rooting out corruption in our financial markets. This is what relentless looks like. This case moved at lightning speed – that was not a coincidence, that was a choice,” he said. “This case is also a warning to every fraudster who thinks they’re untouchable, that their crimes are too complex for us to catch, that they are too powerful to prosecute, or that they are clever enough to talk their way out of it if caught. Those folks should think again and cut it out. And if they don’t, I promise we’ll have enough handcuffs for all of them.”

Bankman-Fried is also set to go on trial on a second set of charges brought by prosecutors earlier this year, including for alleged foreign bribery and bank fraud conspiracies.

Bankman-Fried was accused of swindling FTX customers out of some $10bn. Prosecutors said that his fraud extended from 2019 to November 2022, when FTX collapsed under the weight of a liquidity crisis, caused by the lending of customer funds to Alameda Research, FTX’s sister hedge fund, without telling them.

Barbara Fried and Joseph Bankman, parents of FTX founder Sam Bankman-Fried, react after the verdict is read.

Bankman-Fried admitted to “large mistakes” in his management of the exchange during his testimony, including never putting a risk management team in place. He attempted to evade prosecutors’ questions with many statements of “I don’t recall” only to be confronted with on-the-record statements he had made during his extensive post-collapse media tour. When asked whether he had ever sent the message “Fuck regulators” to a journalist, he admitted: “I said that once.”

Bankman-Fried siphoned “stolen funds” to make himself rich and cover Alameda’s high-risk investments, prosecutors said. He boosted his luxe lifestyle with “exorbitant spending unrelated” to FTX operations like $100m in political contributions and A-list celebrity endorsements, according to the indictment. This also included footing the bill for personal expenses such as $200m in Bahamas property and repaying loans given to Alameda, which faced an $8bn budget shortfall as the crypto market cratered in 2022.

He came to court with a haircut, a significant gesture for a man whose chaotic mane became part of his signature look as a tech innovator. The prosecution grilled him on his appearance and public persona, asking him whether he used them to woo investors and customers. He likewise faced questions about his co-living arrangement with other FTX executives.

Caroline Ellison, Bankman-Fried’s on-again, off-again girlfriend and the CEO of Alameda, served as the star prosecution witness. Within moments of taking the stand, Ellison said that Bankman-Fried “directed me to commit these crimes”. She also said his unkempt appearance was a carefully curated act.

Other members of his inner circle repeatedly implicated him in financial wrongdoing. Gary Wang, Bankman-Fried’s longtime friend and roommate at the Massachusetts Institute of Technology and a FTX co-founder, and Nishad Singh, an executive at the exchange, also testified for the government.

FTX founder Sam Bankman-Fried stands as the jury foreperson reads the verdict. Photograph: Jane Rosenberg/Reuters

Ellison, who pleaded guilty in December 2022 to her involvement in FTX and Alameda’s collapse, described her uneasy relationship with Bankman-Fried. She cast him as hubristic and ready to blame others for his mistakes. Bankman-Fried directed Ellison to shuttle customer funds into Alameda following the spring 2022 drop in crypto, she said. Alameda was saddled with billions of dollars in open-term loans – meaning that lenders could demand their money back at any point – and started to call them that summer. But Alameda couldn’t repay the loans – and Bankman-Fried blamed Ellison for not hedging the fund’s money earlier that year.

“Sam started saying … it was a big mistake, and that it was my fault, and that I was largely responsible for the financial situation Alameda found itself in,” Ellison testified. Bankman-Fried said it was “Sam’s decision” to use FTX customer funds to cover Alameda’s shortfall – without telling them.

Wang similarly implicated his former friend. The prosecution asked: “Who are the main people you committed these crimes with?” Wang replied: “Sam Bankman-Fried, Nishad Singh and Caroline Ellison.”

Wang had also told jurors that Bankman-Fried wasn’t shocked by FTX’s massive debt. After apprising Bankman-Fried of this debt, he said “that sounds correct” and that he “had a neutral demeanor”, Wang testified.

Over the course of trial, Bankman-Fried’s attorneys tried to cast him as a “math nerd” who was in over his head. “Sam didn’t defraud anyone. Sam didn’t intend to defraud anyone,” lawyer Mark Cohen told jurors. “Sam acted in good faith in trying to build and run FTX and Alameda,.” The defense also tried to blame Ellison and rival cryptocurrency exchange Binance for FTX’s collapse.

“Some things got overlooked, some things were still in progress, things a more mature company, an older company would have built out over time,” Cohen argued. “But at FTX they were still works in progress.”

Carl Tobias, the chair of the University of Richmond law school, said on Thursday evening that he was not surprised the jury returned a verdict so quickly.

“It was a compelling case that prosecutors assembled and put on,” he said. “I don’t think anything that Bankman-Fried said undermined their case or gave the jury much pause. They came in with a strong verdict.

“The southern district played it right by portraying it as a fraud case, not as a complicated cryptocurrency notion that was more complex than it needed to be. That’s clearly the way the jury saw it, and that was compelling to them.”

FTX founder Sam Bankman-Fried convicted of defrauding cryptocurrency customers

LARRY NEUMEISTER

Updated Thu, November 2, 2023

NEW YORK (AP) — FTX founder Sam Bankman-Fried’s spectacular rise and fall in the cryptocurrency industry — a journey that included his testimony before Congress, a Super Bowl advertisement and dreams of a future run for president — hit rock bottom Thursday when a New York jury convicted him of fraud for stealing at least $10 billion from customer and investors.

After the monthlong trial, jurors rejected Bankman-Fried’s claim during testimony in Manhattan federal court that he never committed fraud or meant to cheat customers before FTX, once the world’s second-largest crypto exchange, collapsed into bankruptcy a year ago.

“Mr. Bankman-Fried. Please rise and face the jury,” Judge Lewis A. Kaplan commanded just before a jury forewoman responded “guilty” seven times to two counts of wire fraud, two counts of wire fraud conspiracy and three other conspiracy charges, which carry potential penalties adding up to 110 years in prison. Bankman-Fried is likely to face far less than the maximum at a sentencing set for March 28.

As the verdict was read, Bankman-Fried seemed stunned, appearing stone-faced, his hands clasped before him, as his lawyers remained sitting beside him. When he sat down, he looked down for several minutes.

His lawyer, Mark Cohen, later read a statement outside court to say they “respect the jury’s decision. But we are very disappointed with the result.”

“Mr. Bankman Fried maintains his innocence and will continue to vigorously fight the charges against him,” Cohen said.

U.S. Attorney Damian Williams, who sat in the front row of the spectator section during the verdict, stood before cameras outside the courthouse and said Bankman-Fried “perpetrated one of the biggest financial frauds in American history, a multibillion dollar scheme designed to make him the king of crypto.”

“But here’s the thing: The cryptocurrency industry might be new. The players like Sam Bankman-Fried might be new. This kind of fraud, this kind of corruption is as old as time and we have no patience for it,” he said.

He said the case should serve as a warning to every other fraudster who “thinks they're untouchable, that their crimes are too complex,” that they are too powerful to prosecute or can talk their way out of their crimes because “I promise we'll have enough handcuffs for all of them.”

The jury rejected Bankman-Fried insistence during three days of testimony that he never committed fraud or plotted to steal from customers, investors and lenders and didn’t realize his companies were at least $10 billion in debt until October 2022.

After the jury left the room, Bankman-Fried's parents, both Stanford University law professors, moved to the front row behind him. His father put his arm around his wife. As Bankman-Fried was led out of the courtroom, he looked back and nodded toward his mother, who nodded back and then became emotional, wiping her hand over her face after he left the room.

The trial attracted intense interest with its focus on a fraud on a scale not seen since the 2009 prosecution of Bernard Madoff, whose Ponzi scheme over decades cheated thousands of investors out of about $20 billion. Madoff pleaded guilty and was sentenced to 150 years in prison, where he died in 2021.

The prosecution of Bankman-Fried, 31, put a spotlight on the emerging industry of cryptocurrency and a group of young executives in their 20s who lived together in a $30 million luxury apartment in the Bahamas as they dreamed of becoming the most powerful player in a new financial field.

Prosecutors made sure jurors knew that the defendant they saw in court with short hair and a suit was not the man with big messy hair and shorts that became his trademark appearance after he started his cryptocurrency hedge fund, Alameda Research, in 2017 and FTX, his cryptocurrency exchange, two years later.

They showed the jury pictures of Bankman-Fried sleeping on a private jet, sitting with a deck of cards and mingling at the Super Bowl with celebrities including the singer Katy Perry. Assistant U.S. Attorney Nicolas Roos called Bankman-Fried someone who liked “celebrity chasing.”

In a closing argument, Cohen said prosecutors were trying to turn “Sam into some sort of villain, some sort of monster.”

“It’s both wrong and unfair, and I hope and believe that you have seen that it’s simply not true,” he said. “According to the government, everything Sam ever touched and said was fraudulent.”

The government relied heavily on the testimony of three former members of Bankman-Fried’s inner circle, his top executives including his former girlfriend, Caroline Ellison, to explain how Bankman-Fried used Alameda Research to siphon billions of dollars from customer accounts at FTX.

With that money, prosecutors said, the Massachusetts Institute of Technology graduate gained influence and power through investments, contributions, tens of millions of dollars in political contributions, Congressional testimony and a publicity campaign that enlisted celebrities like comedian Larry David and football quarterback Tom Brady.

Ellison, 28, testified that Bankman-Fried directed her while she was chief executive of Alameda Research to commit fraud as he pursued ambitions to lead huge companies, spend money influentially and run for U.S. president someday. She said he thought he had a 5% chance to eventually be U.S. president.

Becoming tearful as she described the collapse of the cryptocurrency empire last November, Ellison said the revelations that caused customers collectively to demand their money back, exposing the fraud, brought a “relief that I didn’t have to lie anymore.”

FTX cofounder Gary Wang, who was FTX’s chief technology officer, revealed in his testimony that Bankman-Fried directed him to insert code into FTX’s operations so that Alameda Research could make unlimited withdrawals from FTX and have a credit line up to $65 billion. Wang said the money came from customers.

Nishad Singh, the former head of engineering at FTX, testified that he felt “blindsided and horrified” at the result of the actions of a man he once admired when he saw the extent of the fraud. He said the collapse last November left him suicidal.

Ellison, Wang and Singh all pleaded guilty to fraud charges and testified against Bankman-Fried in the hopes of leniency at sentencing.

Bankman-Fried was arrested in the Bahamas last December and extradited to the United States, where he was freed on a $250 million personal recognizance bond with electronic monitoring and a requirement that he remain at the home of his parents in Palo Alto, California.

His communications, including hundreds of phone calls with journalists and internet influencers, along with emails and texts, eventually got him in trouble when the judge concluded he was trying to influence prospective trial witnesses and ordered him jailed in August.

During the trial, prosecutors used Bankman-Fried’s public statements, online announcements and his Congressional testimony against him, showing how the entrepreneur repeatedly promised customers that their deposits were safe and secure as late as last Nov. 7 when he tweeted “FTX is fine. Assets are fine” as customers furiously tried to withdraw their money. He deleted the tweet the next day. FTX filed for bankruptcy four days later.

In his closing, Roos mocked Bankman-Fried’s testimony, saying that under questioning from his lawyer, the defendant’s words were “smooth, like it had been rehearsed a bunch of times?”

But under cross examination, “he was a different person,” the prosecutor said. “Suddenly on cross-examination he couldn’t remember a single detail about his company or what he said publicly. It was uncomfortable to hear. He never said he couldn’t recall during his direct examination, but it happened over 140 times during his cross-examination.”

Former federal prosecutors said the quick verdict — after only half a day of deliberation — showed how well the government tried the case.

“The government tried the case as we expected," said Joshua A. Naftalis, a partner at Pallas Partners LLP and a former Manhattan prosecutor. “It was a massive fraud, but that doesn’t mean it had to be a complicated fraud, and I think the jury understood that argument.”

___

Associated Press reporter Ken Sweet contributed from Palm Springs, California.

Alexis Keenan

·Reporter

Thu, November 2, 2023

A Manhattan federal jury found FTX co-founder Sam Bankman-Fried guilty of defrauding his customers, investors and lenders, concluding a dramatic fall for a 31-year-old entrepreneur who presided over the largest crypto collapse in history.

Jury members deliberated for a period of hours after Bankman-Fried's criminal trial wrapped up Thursday. They concluded he was guilty on all seven criminal charges, ranging from wire fraud to money laundering.

His sentencing is scheduled for March 28; the counts carry a maximum sentence of 110 years.

Bankman-Fried was stoic while his verdict was read in the courtroom, and he didn’t look back at his parents. His father dipped his head, and his mother took off her glasses and rubbed her eyes.

Bankman-Fried faces even more potential legal jeopardy in the year ahead. He is scheduled to face a separate set of criminal charges that allege he committed bank fraud and bribed Chinese officials in another trial due to begin in March.

FTX founder Sam Bankman-Fried is questioned by prosecutor Danielle Sassoon during his fraud trial. REUTERS/Jane Rosenberg (JANE ROSENBERG / reuters)

Prosecutors argued that Bankman-Fried deliberately stole $14 billion in customer deposits from his cryptocurrency exchange in a scheme that he carried out with three of his top executives: Alameda CEO Caroline Ellison, FTX co-founder Gary Wang and FTX engineering director Nishad Singh.

All three pleaded guilty to fraud charges after FTX’s collapse and testified against Bankman-Fried under plea agreements with the government.

The group, prosecutors claimed, allowed Bankman-Fried’s sister crypto trading firm Alameda Research "secret" backdoor access to FTX’s customer deposits, then spent the money on investments, loan repayments, political donations, and real estate.

"He spent his customers' money and he lied to them about it," prosecutor Nicolas Roos said in the government’s closing argument.

"Where did the money go? The money went to pay for investments, to repay loans, to cover expenses, to purchase property, and to make political donations."

Bankman-Fried testified that poor business decisions and management screwups — and not fraud — were to blame for the undoing of his cryptocurrency exchange.

"Did you defraud anyone?" Bankman-Fried’s lawyer asked him during his risky gamble to take the stand in his own defense.

"No, I did not," Bankman-Fried answered.

"Did you take customer funds?" Cohen clarified.

"No," he said.

'Borrows'

At the heart of the charges against Bankman-Fried were accusations that he and FTX falsely represented that customer deposits were safely in the exchange’s custody. Prosecutors said this happened in public Tweets, on FTX’s website, and in private communications with customers, lenders, and investors.

In FTX’s terms of service, the government pointed out, account holders were told that their funds were owned by them and available to withdraw.

Bankman-Fried argued those same terms of service instead supported his position that Alameda, as a customer on the exchange, could borrow from FTX deposits so long as the funds were held in accounts that opted into FTX's margin-trading program.

"At FTX, the way it was set up, margin customers could use the funds they borrowed from the exchange for any purpose," Bankman-Fried’s attorney Mark Cohen said in his closing argument.

"At the time, no one thought this was a problem because the customers who borrowed funds on margin had to post collateral to support their borrowing. And if a customer's position lost money, which means risk of going down, the collateral could be used to liquidate their position before it went under water."

Sam Bankman-Fried's defense lawyer Mark Cohen. REUTERS/Brendan McDermid (Brendan McDermid / reuters)

But prosecutors said what Bankman-Fried and his deputies did secretly was tinker with FTX’s computer code to let Alameda access billions in customer funds characterized as "borrows," or loans from FTX.

Alameda was also allowed special privileges not available to other accounts, they said. Loans made to Alameda were exempt from any collateral requirements, and from liquidation, and could carry negative balances on the exchange.

Bankman-Fried testified that it was his deputies that created this computer code. And Alameda's privileges, he told the jury, also had legitimate purposes so that Alameda could function as a market maker, a payment processor, and a backstop liquidity provider for FTX.

He also said it wasn’t until October 2022 that he knew that FTX was facing what he called a liquidity crisis. FTX filed for bankruptcy just one month later, in November 2022.

Prosecutors contested that timeline, saying that Bankman-Fried and his three executives knew as early as June of that year. That's when they all worked on a project that revealed that Alameda had an $8 billion deficit owed to FTX.

One of the most dramatic moments in the trial came near the end when Assistant US Attorney Danielle Sassoon asked Bankman-Fried to explain what he did in 2022 when it became clear FTX customer funds had been used to pay off Alameda loans and trading debts.

In this courtroom sketch, FTX founder Sam Bankman-Fried, right, is cross examined by Assistant US Attorney Danielle Sassoon, left, while Judge Lewis Kaplan listens, center, in Manhattan federal court. (Elizabeth Williams via AP) (ASSOCIATED PRESS)

"Did you fire anyone for spending $8 billion of customer deposits?" Sassoon asked.

"No," Bankman-Fried said.

SBF tells jury he didn't take FTX customer money but 'a lot of people got hurt'

Sam Bankman-Fried tells judge he relied on advice from lawyers at FTX

Sam Bankman-Fried to testify in his own defense in FTX trial

Another member of SBF's inner circle says crimes were committed at FTX

Prosecutors’ challenge in FTX trial: A scant paper trail left by SBF

SBF's ex-girlfriend: He 'directed me' to steal billions from FTX

SBF's problem in FTX trial is evidence from his closest friends

A social worker, nurse, and librarian will help determine SBF’s fate in FTX trial

SBF defense in FTX trial: 'There was no theft'

Sam Bankman-Fried faces crypto-crash fatigue with potential jurors in FTX trial

Sam Bankman-Fried begins the fight for his freedom in FTX fraud trial

Andrew R. Chow

Thu, November 2, 2023

Sam Bankman-Fried arrives at Manhattan Federal Court in July 2023.

From accusations of bribing officials and falsifying financial documents to shadowy political influence campaigns and penthouse confrontations between billionaires: the criminal federal trial of Sam Bankman-Fried has covered an immense amount of ground over the last month. All of these details stemmed out of testimony delivered by three of Bankman-Fried’s former closest collaborators, who allege that he stole more than $8 billion from the customers of his cryptocurrency exchange FTX and directed them to commit fraud.

Bankman-Fried, who voluntarily took the stand for three days, conversely testified that his collaborators made massive mistakes that led to the downfall of FTX and that they had committed crimes without his guidance or knowledge. The defense then rested, and on Nov. 1, both sets of lawyers made their closing arguments. Now, the jury of nine women and three men will decide Sam Bankman-Fried’s fate. If he’s found guilty, Bankman-Fried faces up to 120 years in prison.

With all of the evidence in, here are the biggest bombshell allegations about Sam Bankman-Fried and FTX to emerge from the trial.

Alameda Research had been taking FTX customer deposits for years.

A little less than a year ago, the cryptocurrency exchange FTX collapsed, as its users tried to collectively withdraw billions of dollars but were unable to do so. It was soon revealed that the money had ended up in the coffers of Alameda Research, Bankman-Fried’s trading firm, which made enormous bets on various parts of the crypto ecosystem.

This was nothing new. In fact, FTX co-founder and executive Gary Wang testified that, from FTX’s inception in 2019, customer funds had always flowed straight to bank accounts owned by Alameda, which was then able to do as it pleased with the money. That year, Wang hard-coded an exception into FTX that made Alameda the only user on the exchange allowed to have a negative balance—i.e., to borrow from customer funds. Wang says that Bankman-Fried directed him to create that exception.

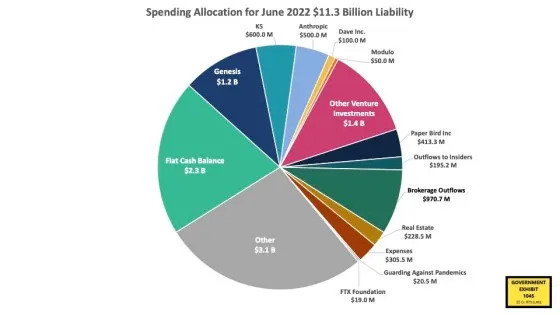

This borrowed money was then deployed across the world, alleged Professor Peter Easton, an accounting professor at Notre Dame and expert witness called by the prosecution. During his testimony, Easton displayed analysis that appeared to show that billions of customer funds were taken and reinvested in Bahamian real estate (including the $30 million penthouse Bankman-Fried lived in), crypto startups, and political contributions. (On Oct. 31, however, Bankman-Fried said he didn’t “necessarily agree” with the veracity of the exhibit.)

Bankman-Fried has conceded that Alameda borrowed FTX customer funds—and has stated that he believed Alameda was allowed to do so, as long as its value was net-positive.

When FTX crashed, Bankman-Fried allegedly misled users about the financial state of the company.

On Nov. 7, 2022, Bankman-Fried tried to reassure his customers of his flailing exchange by tweeting out, “FTX is fine. Assets are fine. FTX has enough to cover all client holdings.”

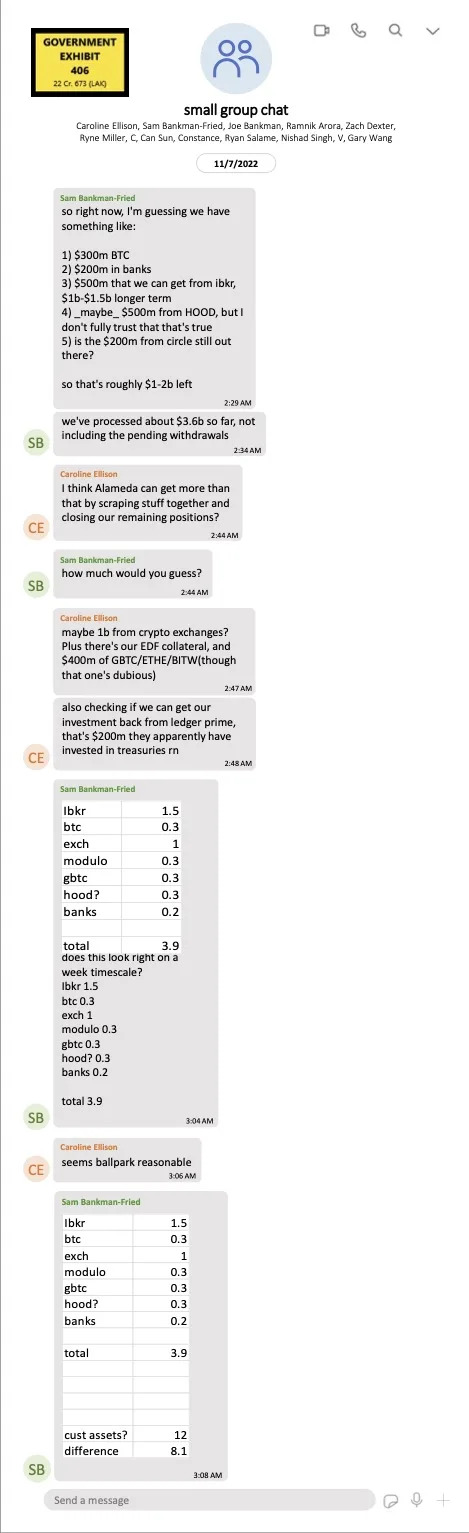

But the previous day, Bankman-Fried had created a Google Doc, which was presented in evidence, in which he wrote that FTX had “enough to process ⅓ of remaining client assets.” And on the morning of Nov. 7, he sent a Signal message to FTX’s inner circle in which he calculated the financial state of the company. While he estimated that FTX could likely scrounge up $3.9 billion worth of assets over the course of a week, he wrote that there would still be a shortfall of $8.1 billion in terms of deliverable customer assets.

Neither Bankman-Fried nor his lawyer addressed the Google Doc or the message thread in court. Instead, Bankman-Fried defended the original Tweet: “My view at the time was that the exchange was okay and that there was no hole in terms of assets.” He has maintained that the issue was about liquidity as opposed to solvency—as in that he had the funds, but not in a way that he could immediately pay out.

Meanwhile, his collaborators testified that FTX had previously given outsiders a misleading view of their finances. Former FTX engineering director Nishad Singh said that at the end of 2021, Bankman-Fried had asked him to create backdated financial statements in order to get the exchange’s yearly revenue over $1 billion. Bankman-Fried denied directing him to backdate documents, but admitted to signing his name to a related contract many months after the contract’s listed date. Bankman-Fried’s lawyer Cohen defended his actions in that instance in his closing argument, saying: “The fact that he signed an agreement that others prepared for him doesn't move the needle.”

Wang said that FTX lied to the public about the size of its insurance fund, which was designed to protect customers from absorbing losses. Wang alleged that the company used a random number generator to make the insurance fund appear to be bigger than it was, and then published that number on the FTX website.

Caroline Ellison says she warned Bankman-Fried that the company was in trouble months before it crashed.

Bankman-Fried has long maintained that FTX’s collapse came as a complete surprise to him. But former Alameda CEO Caroline Ellison presented several spreadsheets that she had shown to Bankman-Fried over 2021 and 2022, which showed the devastating impact that a crypto crash could have on the company, which she wrote was borrowing billions from FTX. Bankman-Fried appeared to agree: “Yup, and could also get worse,” he commented on the Google Doc.

In the Google Doc, Bankman-Fried asked Ellison how an additional $3 billion in investments might impact Alameda’s financial health. The answer from Ellison’s numbers was clearly bleak—but Bankman-Fried went ahead and started a $2 billion venture fund anyway.

Former executives attacked Bankman-Fried mercilessly.

The top executives of FTX and Alameda Research had once been a tight-knit unit. Bankman-Fried and Ellison dated on and off. Bankman-Fried was on a group chat with Wang and Nishad Singh titled “the fantastic three.” For several months, all four of them shared the $30 million penthouse apartment in the Bahamas.

But Ellison, Singh and Wang all testified against Bankman-Fried under cooperation agreements with the government, and did not hold back in their criticism of FTX or Bankman-Fried. Singh said that by time FTX was on the brink of collapse, he had become suicidal and was feeling extreme guilt about his role in the organization: “I knew that I was becoming party and participating in something heinously criminal.”

Ellison said of Bankman-Fried: “He directed me to commit these crimes.” Wang admitted that he knew the actions he took with the company were wrong and that customers had not agreed for FTX to spend their funds. He added that Bankman-Fried had “said publicly that we would not use customer funds like this.”

Two more secondary players of the drama, FTX software developer Adam Yedidia and general counsel Can Sun also weighed in. “FTX defrauded all of its customers,” Yedidia said outright. (Judge Kaplan told the jury to strike that allegation from their minds.) Sun said he was “shocked” upon learning the special privileges that Alameda had on the platform.

Bankman-Fried does have at least two remaining allies: his parents Barbara Fried and Joe Bankman, who have shown up to the courthouse to support him every day. After Bankman-Fried’s first time on the stand, his father walked over to him to deliver a grin and a thumbs up.

SBF allegedly oversaw a $100 million bribe to the Chinese government.

One moment of the trial that drew audible gasps was when Ellison alleged that Bankman-Fried directed Alameda employees to pay a bribe to Chinese government officials in order to unfreeze $1 billion it had stored on two Chinese crypto exchanges. Bankman-Fried has been charged with foreign bribery related to this alleged incident, although it will be litigated in a separate trial scheduled for next year.

Ellison said that Alameda tried several methods of rescuing the money, including setting up trading accounts in the names of “Thai prostitutes.” After those attempts were unsuccessful, Ellison alleged that Bankman-Fried resorted to bribery—and that then she refused to write about the event directly in internal documents, instead labeling it “the thing.”

FTX’s political influence campaign was highly calculated and robust.

Bankman-Fried is not currently being tried for political finance violations: that charge is also part of next year’s trial. But prosecutors still presented evidence of Bankman-Fried’s attempts to curry favor with regulators and policymakers. They presented a text message from Ryan Salame, an FTX executive who was heavily involved with Bankman-Fried’s political efforts that described their strategy of surreptitiously donating to candidates of both parties: “Sam wants to donate to both [Democratic] and Republican candidates in the US but cause the worlds frankly lost its mind if you [donate] to a democrat no republicans will speak to you…We will be heavily putting money to weed out anti crypto dems for pro crypto dems and anti crypto repubs for pro crypto repubs.”

Singh testified how he reluctantly became the conduit for Bankman-Fried’s political donations to Democratic candidates. Singh alleged that Salame had access to Singh’s Prime Trust bank account and would use it to make millions of dollars of donations in his name, all of which flowed first from FTX customers. Singh himself was barely involved in that decision making, he claimed: "After some point in time, my role was to click a button," he said.

Bankman-Fried allegedly cultivated an image of himself.

When Bankman-Fried rose to fame in 2021 and 2022, he charmed many people in part thanks to his lack of pretense. Bankman-Fried almost always wore cargo shorts and an FTX t-shirt and rarely cut famously unkempt hair—even when onstage with former world leaders Bill Clinton and Tony Blair.

Ellison contended that this was an act. She testified that Bankman-Fried said his hair “was an important part of FTX's narrative and image.” She said that he opted not to drive the luxury car given to him by FTX because “it was better for his image to be driving a Toyota Corolla.”

Bankman-Fried denied these characterizations on the stand. He said that he wore a tee and shorts because they were “comfortable,” and that he didn’t cut his hair because he was “kind of busy and lazy.”

His friends said he had a mean streak.

Part of Bankman-Fried’s public image was his affable, earnest demeanor. But during testimony, his closest colleagues attempted to puncture this impression. Ellison told stories of Bankman-Fried angrily confronting her and blaming her for Alameda’s troubles, reducing her to tears.

Singh described in vivid detail a confrontation he had with Bankman-Fried in the fall of 2022, saying: “Sam has some physical tells for when he is thinking hard or is upset. He puffed out his chest…closing his eyes, grinding his teeth or tongue in his mouth. When he opened them to respond, he would sort of glare at me with some intensity.”

When Bankman-Fried took the stand and was questioned by his own lawyer Mark Cohen, he appeared relaxed and jovial. He was much more tense and even petulant when being cross-examined by prosecutor Danielle Sassoon. When confronted with tough questions, Bankman-Fried swayed side to side, furrowed his brow, and scratched his face.

No comments:

Post a Comment