How Maritime Businesses Can Navigate a New Carbon Regulatory Landscape

On June 5, 2023, a legislative amendment came into force for the maritime industry that – for many shipowners, charterers, and managers – will transform the operational landscape as they know it.

The amendment to the EU Emissions Trading Directive brings the maritime sector under the coverage of the EU’s Emissions Trading Scheme (ETS), a carbon market introduced in 2005 to reduce greenhouse gas (GHG) emissions. It builds on the revised GHG strategy already set in motion by the International Maritime Organisation (IMO), which has committed to ensuring net-zero in GHG emissions by 2050, and a significant uptake in alternative zero and near-zero GHG fuels by 2030.

After extensive deliberation, the implementation of the new rules brings some certainty to the industry. However, businesses still face a changed regulatory landscape and must adapt. Only with a rich understanding of the carbon market they now operate in, a functional carbon strategy, and the technology to apply this efficiently, will they be able to chart a more sustainable and profitable course for the future.

Changing regulations

Starting with an EU member state vote in September 2020, the journey to including the maritime industry under the ETS has not been easy. The new amendment was submitted as part of a “Fit for 55” package of proposals, which aimed to reduce GHG emissions across the EU by at least 55% (compared to 1990 levels) by 2030. Negotiation between the European Commission, the Council of the EU and the European Parliament eventually yielded the amendment’s present form, which entered into force last June and will affect businesses from January onwards.

Under the amendment, shipping companies with ships equal to or exceeding a gross tonnage of 5,000 – approximately 24,000 ships – will fall under the ETS. As a result, they will be required to purchase and surrender ETS emission allowances for each tonne of reported CO2 emissions they produce. While ships between 400 and 5000 GT are technically exempt, this remains up for review in the future.

The new regulation caps maritime transport emissions across three categories: (1) the total emissions from intra-EU maritime voyages; (2) the total emissions from ships at berth in EU ports; and (3), half of emissions from voyages which start or end at EU ports, where the other destination is outside of the EU. Even the traditional definition of ‘port of call’ will change to some extent, now excluding stops at any neighbouring container transhipment port less than 300 nautical miles from a port inside the EU. This will deter ships from calling at a local, non-EU port and surrendering fewer allowances in respect of the short voyage from the nearby port to the EU.

The outcome is positive: creating a price signal that incentivizes improvements in energy efficiency and low-carbon solutions while reducing the price difference between alternative and traditional maritime fuels.

New adaptations

The adaptations required of the average business – relevant to shipowners, managers, operators, and all others responsible for the choice of fuel, route, and speed of their ships – are complex.

Businesses need to install rigorous emissions-reporting processes, at cost, to manage the extensive administrative element of ETS compliance. Processes such as calculating, forecasting and monitoring CO2 emissions are critical. This involves efficiently checking your allowances against your free allocation so that you can confidently judge the need to buy surplus in case of more emissions. Having the capability to forecast emissions based on your fuel and chosen route ensures this can be hedged via futures in the market – avoiding adverse earnings effects so that your business is not exposed to dramatic swings in European Union Allowance (EUA) pricing.

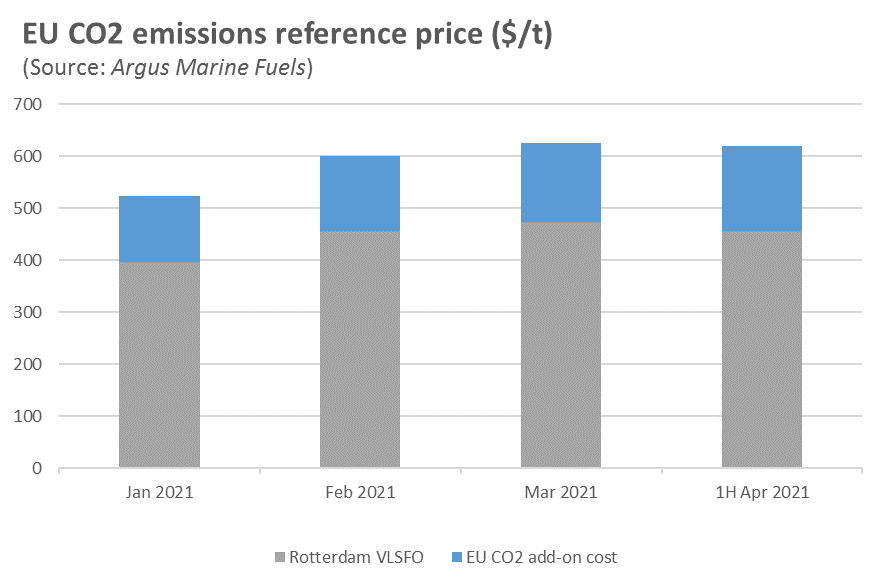

Legacy operational systems can be tempting to retain, but the new regulations call for automation and analysis far beyond the average spreadsheet. Carbon costs, for example, will now contribute a significant share of a ship’s final fuel costs while exhibiting a different volatility pattern, linked more to electricity generation than anything else. The result? Fuel costs will become far riskier and more complex to predict without the right tools.

Tools for success

Implementing an effective reporting, forecasting, and risk management system can be difficult. Tailored technology is key.

To develop a proper hedging strategy based on estimated yearly consumption, free allocation, and additional purchasing or selling needs, the best option for businesses is to automate their reporting and hedging processes. Automation begets greater transparency, which helps hugely in assessing the most suitable risk position in terms of size. Businesses can then make a more informed decision on whether to hedge back-to-back or leave their positions partially open based on two key considerations: minimizing carbon costs while staying compliant.

Careful consideration should be afforded to the choice of fuel. Sustainable fuels are less carbon intensive, alleviating the need for carbon certificates. They may, however, be difficult to obtain in the short term and can come with complexities – such as managing the associated environmental certificates throughout their lifecycle. Dedicated processes, tools, and automation are necessary to manage this part of renewable fuel sourcing and prevent compliance from developing into a highly labor-intensive task.

Innovative businesses are already seizing the growth opportunities in active or voluntary carbon-neutral strategies. Increasingly, ready-made technology models are emerging that can view what needs to be hedged, track how many allowances or credits need to be bought, create visibility of forecasted and actual emissions, and compare high-carbon and low-carbon (bunker) fuels.

Looking ahead

While the inclusion of maritime under the ETS has been a long time coming, businesses are likely to have questions and concerns. As seen in other industries, carbon measures bring complexity. The evolving nature of compliance, reporting and profit generation means they require something beyond the manual systems of before.

Shipping companies that invest in a functional carbon strategy, supported by modern technology, will stand apart from the rest. This is how they can save time and ensure compliance while forging new avenues for profit and opportunity.

Franziska Danz is VP Product Management at ION Commodities.

No comments:

Post a Comment