CU

US copper industry seeks export curbs instead of tariffs

Major players in the US copper industry have called on President Donald Trump to restrict exports of ore and scrap metal rather than imposing tariffs on imports, in his efforts to boost domestic production.

Trump’s executive order in February ordering an investigation into possible copper tariffs has upended the global market, driving US prices to a huge premium to international benchmarks and spurring a global race to get copper into the country before any potential tariffs are imposed.

The order called on the secretary of commerce to make recommendations on actions “including potential tariffs, export controls, or incentives to increase domestic production.”

In public comments in response to the US government’s section 232 investigation on copper, leading companies including miner Rio Tinto Group, fabricator Southwire Co. and trader Trafigura Group suggested that the administration should instead impose restrictions on exports of copper rather than tariffs on imports.

“The Trump administration should consider implementing export restrictions on domestically produced copper concentrate and copper scrap,” wrote Rio Tinto.

Southwire, which is the US’s largest manufacturer of copper wire, said: “The administration should focus on regulatory reform and restrictions on US copper exports as the primary tools to grow the US industry.”

Significant Importer

The US is the world’s largest exporter of copper scrap and also an exporter of copper ore, known as concentrates. However, a lack of sufficient domestic processing capacity means it is also a significant importer of refined copper metal.

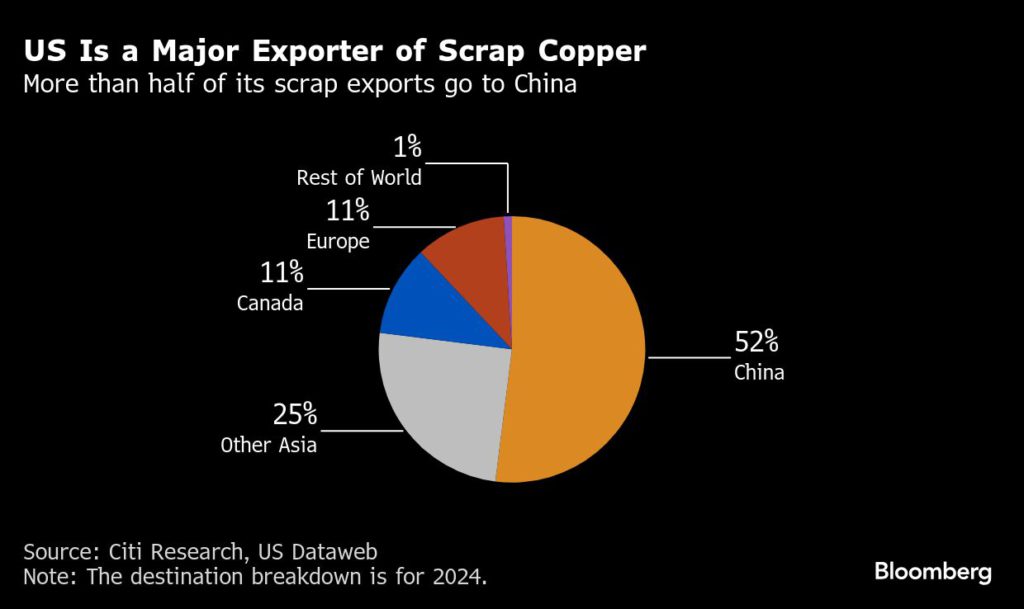

Any serious curbs on US scrap supplies would redraw the market for scrap, which accounts for almost a third of copper supply. US shipments of waste copper were about 600,000 tons last year, according to research from Citigroup Inc. — an amount equivalent to some of the world’s largest copper mines. More than half of that goes directly to China for processing.

While several responses called for the US to impose restrictions on exports of copper scrap, and in some cases copper concentrates, many urged the administration not to place import tariffs on copper metal.

The Copper Development Association, the trade association for the US copper industry, called for exemptions from import tariffs for raw materials “including refined copper cathodes and scrap copper.”

Trafigura, the world’s largest copper trader, argued that import tariffs should be imposed on manufactured copper products like wire rod, tube and strip, but that the administration should “keep refined copper imports free from tariffs for now, until new mining and smelting capacity has been constructed.”

US copper miner Freeport-McMoRan Inc. didn’t make any direct recommendation about tariffs, but argued the US should support free trade.

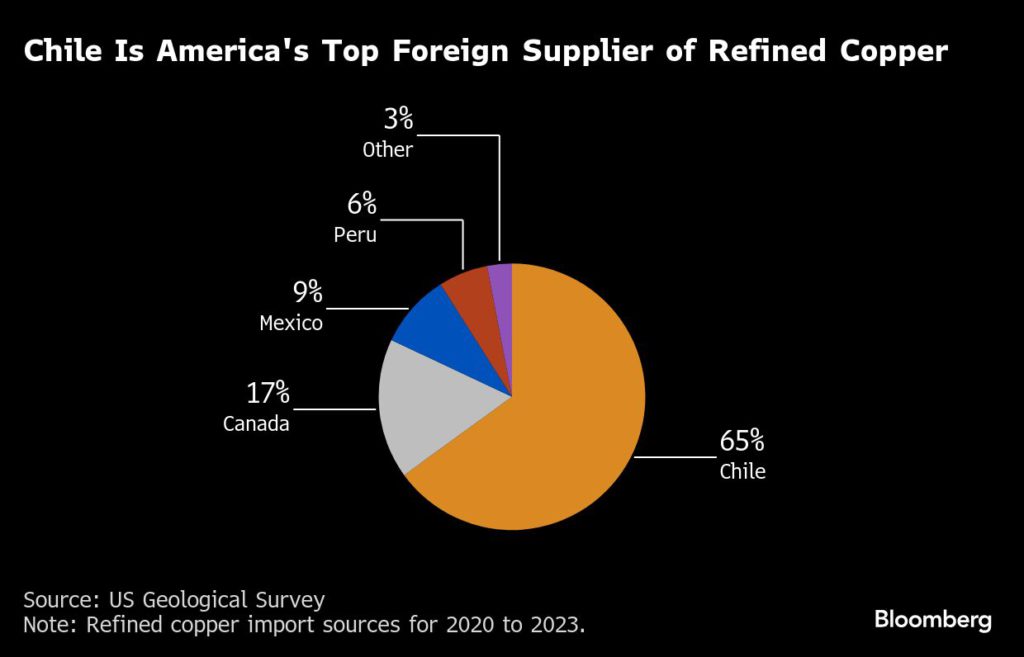

“In 2024, the US imported approximately 50% of its copper cathode demand from Chile, Canada, Peru and other countries, which is necessary to meet current demand because there is no US latent production capacity,” the miner wrote. “Promoting free and fair trade with US allies will ensure US copper supply requirements are satisfied.”

To be sure, the industry’s lobbying push doesn’t mean that the Trump administration will heed its calls.

The threat of tariffs has pushed US copper prices to large premiums to international benchmarks as traders bet that the president would impose tariffs of up to 25% on copper imports. While still large by historical standards, the premium has decreased in the past few weeks in a possible reflection of how unpredictable Trump’s tariff policies have proven.

In late March, for example, December Comex copper was trading as much as 20% above copper for delivery in December on the London Metal Exchange. As of Tuesday, that premium had narrowed to around 13%.

The industry responses included a range of other suggestions for boosting the US copper industry, including introducing tax credits, streamlining the permitting process for new mines, and imposing tariffs on imports of semi-fabricated products containing copper.

Several respondents highlighted the challenge of incentivizing investments into new US smelting capacity. There are only three copper smelters in the US, and one of them is the mothballed Hayden plant. In its submission, Asarco LLC, which owns the Hayden plant, asked for emissions testing requirements to be relaxed in order to allow it to reopen.

New Jersey warehouse filled with copper shows Trump tariff risk

Jay Richman, the owner of E.W. Berger & Bro, has been loading up on copper plumbing parts to get ahead of possible US import tariffs — filling his warehouse with extra fasteners, fittings and tubing made from the red metal.

The New Jersey wholesaler, which sells to mom-and-pop tradesmen as well as larger-scale builders, is taking a risk that it’ll be stuck with excess inventory if the economy takes a turn and buyers disappear. But Richman didn’t feel like he has much choice given the outlook for costs.

He’s already paying more for copper items because suppliers to his family-run business boosted prices as much as 12% in the past couple months in anticipation of tariffs. Richman — like others in his shoes — is passing on those higher costs to all but his most loyal customers.

“The consumer is the one who’s losing,” he said in an interview.

Richman’s situation is similar to what many businesses across the US are going through as President Donald Trump mulls imposing tariffs on copper imports, possibly within weeks. The levies threaten to inflict pain across a broad section of the US economy because of the myriad industries and applications that rely on the metal — everything from automobiles and data centers to home construction and consumer electronics.

Its widespread usage is the reason why the metal is dubbed “Doctor Copper” — a barometer for the health of the economy.

“At the end of the day, tariffs will make US copper more costly for consumers,” said Ewa Manthey, commodity strategist at ING Bank NV. “Higher copper prices might also feed into higher inflation.”

It isn’t certain they’ll be imposed, but Trump first talked about copper tariffs in late January. On Feb. 25, he ordered officials to consider trade measures on the metal, and days later, in a speech to Congress, the president suggested copper imports could be subject to a 25% tariff.

The US consumed 1.6 million metric tons of refined copper last year, with about half coming from abroad, according to US Geological Survey estimates. Chile, Canada and Mexico are the biggest foreign suppliers. Major metals producers including Freeport-McMoRan Inc. and Rio Tinto Group also fill US demand through mines in southwestern states including Arizona and Utah.

US copper prices already reflect the threat of tariffs — they started surging after Trump first floated the idea, with the price on New York’s Comex reaching an all-time high in late March.

Prices have since retreated amid a broad selloff across markets as Trump’s tariffs stoke concern that a recession is coming. Still, Comex copper is about 14% higher this year and carries more than a $700-a-ton premium to contracts on the London Metal Exchange.

RM-Metals, a distributor based in South Plainfield, New Jersey, has seen sales slow over the past two months with customers reluctant to pay higher costs, according to Vice President Sam Desai. The company imports copper wire, rod and strips from Asia and sells to US buyers such as appliance makers.

“For the short term, prices go up — that means everybody has to pay extra,” Desai said.

A 25% copper import tariff would add $68 to $275 in incremental raw material costs to the price of a car sold in the US, with electric vehicles particularly affected because they have about four times as much of the metal, according to Bloomberg Intelligence.

Data centers that help fill rising demand for artificial intelligence computing are also reacting to the tariff threat. DataBank, a data-center developer, is locking in contracts for copper cable, wiring, pipes and fittings earlier than it planned for projects that are still on the drawing board, and favoring local sources over foreign suppliers.

“This is definitely a high focus point,” said Tony Qorri, who’s vice president of construction at the firm. “Any trade uncertainty will inevitably cloud the outlook of AI development in the US.”

Since copper is a key input for so many products, adding import tariffs is bound to make things more expensive, according to Bart Melek, global head of commodity strategy at TD Securities.

“It ultimately means consumers consume less stuff with copper in it,” Melek said in an interview. “This whole tariff business is reducing consumer confidence broadly.”

First Quantum buys into Aussie explorer to boost Zambia copper

Canada’s First Quantum Minerals (TSX: FM) is acquiring a 15% stake in Prospect Resources (ASX: PSC), a battery and electrification metals developer based in Australia, as it deepens its presence in Zambia’s copper belt.

The deal sees First Quantum invest A$15.2 million ($9.7m) in a share placement at A$0.15 per share — a 36% premium to Prospect’s last closing price. The investment also gives First Quantum a seat on Prospect’s board and a role as technical partner.

Shares in Prospect soared on the news, closing 32% higher in Sydney at A$0.14 each, capitalizing the junior at A$83 million ($53m).

Prospect’s Mumbezhi copper project sits just 25km east of First Quantum’s Trident project, which includes the Sentinel and Enterprise mines. The funds will help accelerate exploration at Mumbezhi, aligning with Zambia’s push to triple annual copper output to 3 million tonnes by 2031.

Prospect recently secured two mining licences covering its entire 356 km² landholding at Mumbezhi for an initial 25-year term. It has announced a maiden mineral resource estimate of 514,600 tonnes of contained copper for the project.

In a parallel move, Prospect has entered a placement agreement with long-time shareholder Eagle Eye, subject to shareholder approval. The A$2.8 million raise, also at A$0.15 per share, allows Eagle Eye to maintain its 15.3% stake.

“This investment in Prospect supports our exploration strategy in Zambia and signals our continued commitment to the country,” First Quantum’s Zambia Director, Anthony Mukutuma, said. “With the upcoming launch of the Kansanshi S3 expansion, we’re reinforcing our long-term presence.”

Prospect chief executive Sam Hosack said the deal offers “considerable funding runway and serious regional exploration expertise” to advance the Mumbezhi program.

First Quantum has operated in Zambia for nearly three decades. It runs the Kansanshi mine and smelter in Solwezi, and the Sentinel and Enterprise mines in Kalumbila.

The $1.3 billion Kansanshi S3 expansion, set to open later this year, will boost ore processing by 25 million tonnes annually— up from 30 million — and extend mine life by over two decades.

First Quantum, with assets in Zambia, Spain, Mauritania, Australia, Finland, Turkey, Panama, Argentina and Peru, produced last year 431,004 tonnes of copper, 139,040 ounces of gold and 23,718 tonnes of nickel.

Antofagasta to invest $200M advancing Cachorro copper project

Chilean miner Antofagasta (LON: ANTO) has earmarked $200 million over seven years for a new exploration phase at its Cachorro copper project in the country’s north.

The move follows the submission in January of an Environmental Impact Statement (DIA) for the project, which sits between the company’s Centinela and Antucoya operations. This proximity could create synergies with existing infrastructure and processing facilities, the largest pure-play copper miner listed in London said.

If regulators approve the DIA, Antofagasta will move ahead with surface and underground exploration to better define the deposit. The work will include over 700 drill holes, infill drilling to improve geological modelling, and construction of a horizontal tunnel reaching 300 metres deep.

As part of the environmental assessment process, Antofagasta will conduct baseline studies to protect nearby ecosystems, monitor groundwater, carry out archaeological surveys, and promote local employment and procurement.

Cachorro is located in the western Atacama Desert at an elevation of 1,500 metres, 100 km north-east of the city of Antofagasta. It is also situated 1,100 km north of the capital, Santiago. Since exploration began in 2017, Antofagasta has outlined a mineral resource of 255 million tonnes grading 1.26% copper, with silver as a by-product at 4 grams per tonne.

S&P Global Market Intelligence lists Cachorro as one of the largest greenfield copper discoveries of the past decade and one of the most significant manto-type deposits in Chile’s coastal belt.

No comments:

Post a Comment