Zijin Mining sees ‘unprecedented’ global risks

China’s Zijin Mining Group Co., the world’s third-biggest metals miner by market value, said geopolitical confrontation and resource nationalism will pose challenges to its overseas projects.

“Global uncertainties have become unprecedented,” the copper-gold giant said after reporting record quarterly earnings. “The competition for critical minerals among major powers has entered a high-intensity confrontation phase” that could affect the company’s revenue, profits and new overseas projects, it said.

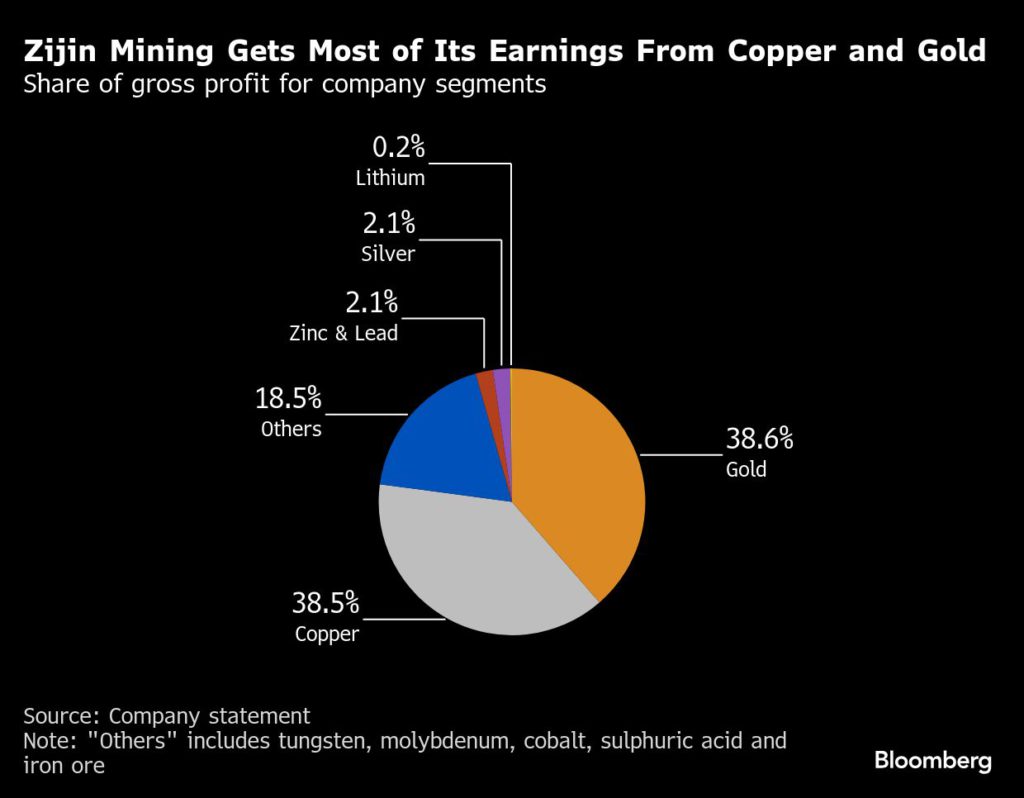

Zijin has become one of the world’s most important mining companies thanks to rapid growth — largely in Africa — and a focus on two lucrative metals, copper and gold. Its first-half net income went up 54% to 23.3 billion yuan ($3.3 billion) thanks to higher output and prices, and its shares rallied to a record in Hong Kong on Wednesday.

The US under President Donald Trump has begun a push to secure American control of resources around the world, with an eye to tackling China’s dominance. For example, a peace deal brokered by Trump between Rwanda and Democratic Republic of Congo was seen as a way to ease US access to the region’s mineral riches.

Critical minerals include a wide range of materials deemed vital to national security because of their important industrial or defense applications. But moves to reshape supply chains risk subjecting prices to volatility and supply disruption, as was the case with Trump’s introduction of copper tariffs earlier this year.

Zijin also highlighted other challenges for the mining industry, from rising costs to trade upheaval and nations seeking to protect their own resources. “Differences in politics, policies and laws among various countries and regions, as well as resource nationalism sentiments, may pose certain challenges to construction and production operations,” Zijin said.

The comments on geopolitics and jurisdictional risks offered a note of caution in an otherwise upbeat earnings report for Zijin, which is now valued at more than $80 billion — behind only Rio Tinto Group and BHP Group in the ranks of global metals miners. Its shares are up more than 75% this year.

On copper, Zijin noted “extremely strong demand resilience” in China, with apparent consumption rising more than 10% in the first half. Demand has been boosted in China by the country’s waves of investments in renewable energy and electrification.

The roll-out of US tariffs on copper, combined with low global inventories, “may trigger market volatility in the short term as trade flows are reshaped,” it said. Copper is up about 12% on the London Metal Exchange this year.

Zijin said its first-half copper output from mines that it owns or part—owns rose 9% from a year earlier to 566,853 tons.

(By Annie Lee)

No comments:

Post a Comment