White House Press Secretary Karoline Leavitt. REUTERS/Evelyn Hockstein

The Bureau of Labor Statistics (BLS) said Tuesday the U.S. created 911,000 fewer jobs between April 2024 and March 2025 than previously estimated — the largest revision on record. This unexpected adjustment has intensified scrutiny of both the data itself and the political narrative surrounding it, given a recent move by the president.

Last month, President Donald Trump abruptly fired BLS Commissioner Erika McEntarfer, who had been confirmed in 2024, after a dismal jobs report and steep downward revisions to May and June figures.

Trump accused the BLS of having “rigged" the data, though economists underscored that such revisions are routine as more complete information arrives, raising concerns about politicization of economic reporting.

Meanwhile, the White House seized on Tuesday's revised data to lash out at multiple targets. Press Secretary Karoline Leavitt claimed it proved “that President Trump was right: Biden’s economy was a disaster and the BLS is broken”, calling for new leadership at the statistical agency.

The administration also revived calls for the Federal Reserve, led by Jerome Powell, to cut interest rates, branding him “Too Late” for not acting sooner to shore up the economy.

Reacting to the White House's statement, journalist Jin Roberts wrote on the social platform X: "You own it, dude."

Podcaster Jim Stewartson wrote: "Trump gets a bad jobs report. Fires the BLS commissioner. BLS immediately revises Biden’s last year down by 911,000 jobs. lol."

Writer Andy Ostroy said in a post on X: "I’m no conspiracy theorist, but if I was… Trump fires the BLS commissioner last month after he didn’t like the job numbers…then put in his own commissioner…and now Biden‘s final year numbers get the largest downward revision in history?"

Reporter Roger Sollenberger wrote: "Missing context: This annual revision comes after Trump’s political firing of the head of BLS."

Matthew Chapman

September 9, 2025

FILE PHOTO: U.S. President Donald Trump speaks in the Oval Office at the White House in Washington, D.C., U.S., August 6, 2025. REUTERS/Jonathan Ernst/File Photo

President Donald Trump's ability to blame his predecessor for the deteriorating economic conditions in the United States is running out, the Wall Street Journal editorial board wrote on Tuesday.

This follows a major revision by the Bureau of Labor Statistics of the period from April 2024 to March 2025, deleting nearly 1 million jobs that were believed to have been created, which mostly covered the final year of former President Joe Biden's administration but also two months of Trump's second term. It also comes after Trump fired the BLS director in a fit of rage about the most recent monthly jobs numbers being sluggish.

"Mr. Trump has good reason to be frustrated with the reliability of the monthly surveys, though there’s no evidence they were 'rigged,' as he has claimed," wrote the board, which, despite its conservative slant, has come down hard on the president in recent months amid frustration over his tariff policies. "As we’ve pointed out, BLS has overestimated job growth in recent years owing to declining survey response rates. Only 43% of employers respond to the survey, down from 60% before the pandemic."

As for the latest numbers, the Trump administration claims they inherited an economy "even weaker than we thought" — however, the board wrote, "blaming Joe Biden for bad economic news won’t work as an excuse for much longer."

The reason Americans elected Trump, the board continued, is "To lift real wages as he did during his first term with tax cuts and deregulation. His border taxes and deportations are doing the opposite. Job growth stalled this summer amid his tariff barrage. The BLS establishment survey showed that an average of 27,000 jobs were created over the last four months. The number of Americans not in the labor force has increased by 1.2 million since April, more than half of whom said they want a job. The share of teens who are employed has fallen 2.1 percentage points since April, and they are usually the first let go when employers do layoffs."

The upshot, the board concluded, is that "the President could do far more to help businesses, workers and consumers by dropping his anti-growth policies. He may have inherited a weak economy, but he’s in charge now."

Robert Davis

September 9, 2025

FILE PHOTO: U.S. President Donald Trump delivers remarks on tariffs in the Rose Garden at the White House in Washington, D.C., U.S., April 2, 2025. REUTERS/Carlos Barria/File Photo

CNN contributor and New York Times podcast host Lulu Garcia-Navarro warned on Tuesday that President Donald Trump is taking a "double-edged" sword to the economy, as evidenced by the latest job numbers.

The Department of Labor published data on Tuesday that revised the previous quarter's job numbers downward by 900,000, which was the largest downward revision in the agency's history. The revision came about a month after Trump removed the Bureau of Labor Statistics commissioner because the agency published what he described as unreliable data.

Garcia-Navarro said the data BLS published shows there are "real problems" surfacing in Trump's economy.

"To me, what's most interesting about these numbers is manufacturing," Garcia-Navarro said. "There are some real problems in manufacturing."

Trump has made it a goal of his second administration to re-establish America's manufacturing base. To that end, he has implemented numerous tariffs that seek to protect American manufacturers from foreign competition.

"This whole idea that somehow manufacturing is going to be resurgent, I think, is showing a lot of weakness," Garcia-Navarro said.

The data also adds to the growing skepticism about the state of the U.S. economy. Trump has repeatedly said the U.S. economy is in good health, although some experts like J.P. Morgan CEO Jamie Dimon have their doubts.

“I think the economy is weakening,” Dimon told CNBC on Tuesday. “Whether it’s on the way to recession or just weakening, I don’t know.”

Garcia-Navarro said part of the economic weakness is being driven by decreased federal spending.

"You're seeing a double-edged sword here, where they are actually limiting the economy in two different ways that are showing," she added. "I think the word recession is a word that we haven't seen in a while, but we might be due for it."

"As Americans plead for their government to help with soaring costs," one expert said, "Trump is not just ignoring their struggles, he's actively making them worse with reckless policies that drive up prices on essentials."

A customer prepares to check out at a grocery store on January 15, 2025 in Chicago, Illinois.

(Photo by Scott Olson/Getty Images)

Jessica Corbett

Sep 09, 2025

COMMON DREAMS

Yet another poll exposes the pain that working-class Americans are enduring thanks to US President Donald Trump's policies, the economic justice advocates behind the new survey said Tuesday.

Polling released in recent months has highlighted how most Americans don't believe that merely working hard is enough to get ahead, a majority blames Trump for the country's economic woes, and large shares are concerned about the price of groceries, housing, and unexpected medical expenses.

The new survey—conducted by Data for Progress less than two weeks ago for Groundwork Collaborative and Protect Borrowers—shows that "American families are trapped in a cycle of debt," the groups said.

Specifically, the Data for Progress found that 55% of likely voters have at least some credit card debt, and another 18% said that they "had this type of debt in the past, but not anymore." Additionally, over half have or previously had car loan or medical debt, more than 40% have or had student debt, and over 35% are or used to be behind on utility payments.

More than two-thirds of respondents said that the federal government's resumption of student loan collections had an impact on their family's finances, and almost a quarter said they would need a one-time infusion of cash, "such as from inheritance, lottery, government assistance, etc.," to be able to pay off all of their debt.

The pollsters also found nearly 30% have or had "buy now, pay later" debt. Nearly 1-in-3 said they had taken out this type of loan—through options such as Afterpay or Klarna—in the past year to pay for basic needs and monthly expenses.

"Today's poll reveals a troubling rise in families relying on buy now, pay later loans just to stay afloat, trapping hardworking Americans in a cycle of debt that some fear will take years to climb out of," said Groundwork's executive director, Lindsay Owens. "As Americans plead for their government to help with soaring costs, President Trump is not just ignoring their struggles, he's actively making them worse with reckless policies that drive up prices on essentials like food and energy."

Trump's legally dubious tariffs—which are headed to the US Supreme Court after another legal loss last month—have negatively impacted Americans' wallets by elevating the costs of basics while also failing to deliver on his campaign promise to turn the United States back into a "manufacturing powerhouse."

"Today's poll exposes a startling new reality in Donald Trump's economy: As prices climb and money gets tight, Americans are going into debt to buy groceries, make rent, get healthcare, and even make payments on other debt," said Protect Borrowers executive director Mike Pierce. "Driving families into debt is a policy choice—voters across party lines are demanding lawmakers act now to deliver debt relief and help working families make ends meet."

The GOP controls both chambers of Congress and the White House. This summer, Republicans on Capitol Hill passed and Trump signed their so-called One Big Beautiful Bill Act, which is expected to further imperil working-class families by kicking millions of people off their healthcare and federal food assistance to give more tax cuts to the ultrarich.

To combat that agenda, "fight for families in debt, and hold corporations and corrupt politicians accountable," Protect Borrowers officially relaunched on Tuesday, rebranding from the Student Borrower Protection Center, which focused on educational debt.

"As the Trump administration turns its back on working-class families," said Pierce, "Protect Borrowers will fight back—exposing the greedy financial companies cutting backroom deals with regulators, taking corrupt government officials and corporations to court, and advancing new laws to hold the system accountable to working people."

Protect Borrowers announced 17 new members of its advisory board, including people who previously served in the Consumer Financial Protection Bureau (CFPB), Federal Trade Commission, National Labor Relations Board, and White House.

The group is also backed by US Sen. Elizabeth Warren (D-Mass.), a bankruptcy expert and the mastermind behind the CFPB.

"With wages flat and costs skyrocketing, families are drowning in debt—mortgages, credit cards, student loans, buy now, pay later, you name it," Warren said in a statement to Politico. "Protect Borrowers is exposing how rigged our economy is, and how the Trump administration is making it worse. I'm glad to stand with them in this fight."

U.S. Container Imports Are Projecte to Decline for the Remainder of 2025

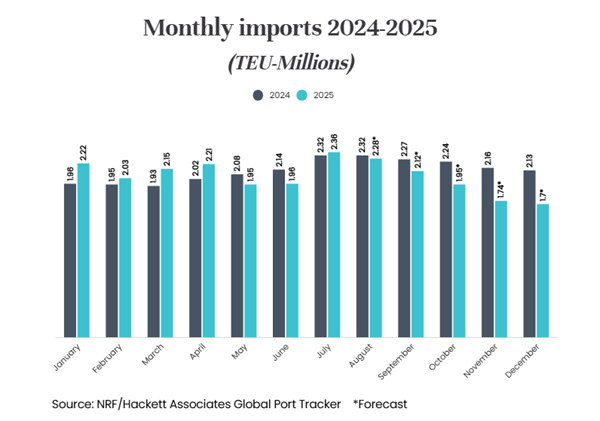

The start of the U.S.’s reciprocal tariffs and the continued uncertainty over longer-term trade policies have begun to weigh on imports, report both the National Retail Federation and Descartes Systems Group, a software provider for logistics-intensive industries. The latest monthly forecasts highlight a peak in July with a steady decline forecasted for monthly import volumes in the remainder of 2025.

“Retailers have stocked up as much as they can ahead of tariff increases, but the uncertainty of U.S. trade policy is making it impossible to make the long-term plans that are critical to future business success,” explains Jonathan Gold, the NRF’s Vice President for Supply Chain and Customs Policy. “These tariffs and disruptions to the supply chain are adding costs that will ultimately lead to higher prices for American consumers.”

The NRF, in its monthly Global Port Tracker, reports August volumes were likely down about 1.7 percent from a year ago and at a projected final total of 2.28 million TEU, off nearly 3.4 percent from the 2.38 million TEU in July. They note that July was up 20 percent over June, making it the second-busiest month on record as retailers brought merchandise in ahead of the August start of reciprocal tariffs and a looming deadline for tariffs on China.

Total container imports at U.S. seaports measured by Descartes were at 2.52 million TEU in August, which it says was up 1.6 percent year-over-year. However, it points to a nearly 4 percent year-over-year decline, highlighting the impact of “fast-shifting trade policy.”

The biggest year-over-year drops came in aluminum, apparel, and footwear, reports Descartes. It notes that furniture, toys, and electrical machinery imports also fell in August. It warns that “policy remains the wildcard.”

Imports are uncertain after Trump doubled the tariffs on India to a total of 50 percent at the end of August. Further, while the deadline for a trade deal with China was pushed back a further 90 days to November 10, it looms over imports.

With the delay coming as retailers head into the busiest season of the year, the NRF actually raised its forecast slightly from last month. The forecast for September calls for the strongest increase, with NRF forecasting 2.12 million TEU, up from its prior forecast of 1.83 million TEU. However, it sees an accelerating month decline as imports move into the fourth quarter of 2025. It expects volumes will level off at just over 1.7 million TEU per month in November and December.

For the full year, the NRF forecasts imports of 24.7 million TEU, which would be down 3.4 percent from 2024. It, however, will still be the fourth-highest year on record, following the peaks during the pandemic and in 2024.

The retailers also released their first forecast for 2026, projecting that January will be at 1.8 million TEU. They expect the new year to start at a level 19 percent below January 2025.

No comments:

Post a Comment