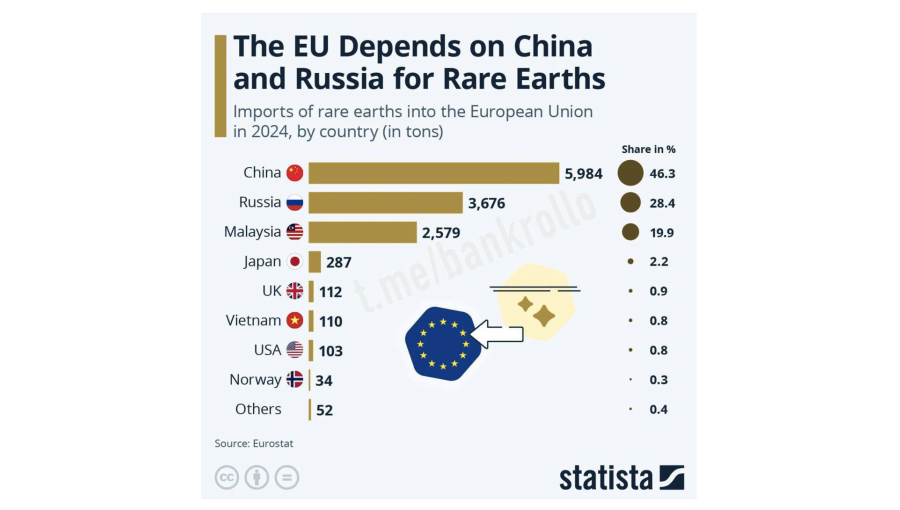

The European Union remains heavily dependent on China and Russia for rare earth imports, with nearly three-quarters of its supply sourced from the two countries in 2024, according to data published by Eurostat and reported by Statista.

China accounted for 46% of the EU’s rare earth imports last year, while Russia supplied a further 28%, leaving the bloc significantly exposed to supply chain disruptions from geopolitical rivals.

“The EU is totally dependent on two countries it regards as adversaries for rare earths,” Eurostat noted.

Rare earth elements are critical to the production of a wide range of high-tech goods, including electric vehicles, wind turbines, semiconductors and military systems. As the EU pushes ahead with its green and digital transitions, the reliance on external—and politically antagonistic—suppliers has raised strategic concerns in Brussels.

The European Commission has repeatedly identified the diversification of critical raw material supply chains as a policy priority. Under the Critical Raw Materials Act, adopted in 2024, the EU aims to ensure that no more than 65% of any key raw material comes from a single non-EU country by 2030.

However, the latest data suggests that in the case of rare earths, the bloc remains far from that goal. Despite efforts to strengthen partnerships with alternative producers in Canada, Australia and Africa, and to develop domestic refining capacity, progress has been limited.

Both China and Russia have previously used access to critical materials as a tool of political leverage. Analysts warn that any disruption—whether through export restrictions, conflict or sanctions—could severely impact EU manufacturing and clean energy sectors.

Why is China restricting rare earth exports and how will the EU respond?

European Commission President Ursula von der Leyen says the EU is ready to use "all tools" in response to Chinese export controls of rare earths as industry suffers.

Global tensions are escalating over rare earth minerals after China applied severe export controls on critical minerals required to manufacture almost everything - from cars to weapons. The move has also sparked concerns about the global supply chain.

Strategic meetings will be held between European Union officials and Chinese representatives, starting with a videoconference Monday, to be followed by a meeting in Brussels the following day.

Meanwhile, US President Donald Trump will meet his Chinese counterpart Xi Jinping on Thursday in South Korea, with financial markets attentive to whether the world’s two largest economic powers can bury the hatchet in their trade war.

At the heart of the dispute is China’s 9 October decision to restrict exports of rare earth elements. While these controls were initially a response to US tariffs, the EU has become collateral damage in the dispute and is considering ways to respond.

Why is China restricting rare earth exports?

Tensions first emerged between the US and China after Donald Trump returned to the White House and carried through an aggressive tariff policy - which the administration argues is needed to narrow a growing trade deficit - on allies and rivals alike.

On 2 April 2025 — coinciding with what Trump defined as US' "Liberation Day” — Washington announced a 34% tariff on Chinese goods imported into the country, which, added to the existing 20%, brought total duties to 54%.

The trade war escalated after China responded with counter-tariffs, which surpassed the 100% threshold, making trade between the two practically impossible. Beyond the tariffs, to hit back, China looked to weaponise its monopoly over rare earth elements, imposing additional export restrictions on 4 April that have since remained in place.

Rare earths are a group of 17 elements used across the defence, electric vehicle, energy and electronics industries.

The world, including the EU, is heavily dependent on China, as the country controls 60% of global production and 90% of their refining, according to the International Energy Agency (IEA).

After a short truce, the dispute flared up again in September, and on 9 October 2025, China decided to extend its control over rare earth elements from seven to 12. The announcement was seen as China building leverage over the United States. The meeting between the two sides this week is crucial in dictating the path forward.

Meanwhile, the EU is caught between the two. While these restrictions aimed mostly at the US, it has also impacted the European industry. The controls take the form of licenses that are difficult to obtain, with European companies bearing the brunt, as European Commisisioner for Trade Maroš Šefčovič has repeatedly pointed out.

How is the EU responding?

In a speech over the weekend, European Commission President Ursula von der Leyen, said the Union is prepared to use all the tools at its disposal to combat what some European leaders, including French President Emmanuel Macron, have described as economic coercion from China.

The remarks from the Commission president alluded to what is known as the anti-coercion instrument - designed with China in mind but never used.

The ACI, adopted in 2023, would allow the EU hit back at a third country by imposing tariffs or even restricting access to public procurement, licenses, or intellectual property rights.

“In the short term, we are focusing on finding solutions with our Chinese counterparts,” Commission president Ursula von der Leyen said on Saturday, warning, however, “But we are ready to use all of the instruments in our toolbox to respond if needed.”

European Council President António Costa met on Monday with Chinese Premier Li Qiang on the sidelines of the ASEAN Summit in Kuala Lumpur.

“I shared my strong concern about China’s expanding export controls on critical raw materials and related goods and technologies,” Costa said after the meeting, adding: “I urged him to restore as soon as possible fluid, reliable and predictable supply chains.”

Yet, tensions persist.

A planned meeting between Šefčovič and his Chinese counterpart Wang Wentao was cancelled and replaced by high-level talks between Chinese and European experts, a Commission spokesperson has confirmed. A video conference took place on Monday, and Chinese officials are set to arrive in Brussels for a meeting on Thursday.

While Brussels insists it wants to achieve a constructive solution without escalating, the Commission is pursuing a "de-risking" strategy to reduce its dependence on Chinese minerals. In addition, Germany and France have also suggested they would support stronger trade measures if a comprehensive solution cannot be found.

On Saturday, Von der Leyen announced a new plan - RESourceEU - exploring joint purchasing and stockpiling of rare earths, as well as “strategic” projects for the production and processing of critical raw materials here in Europe.

The EU also hopes to diversify its suppliers worldwide.

“We will speed up work on critical raw materials partnerships with countries like Ukraine and Australia, Canada, Kazakhstan, Uzbekistan, Chile or Greenland,” von der Leyen said.

No comments:

Post a Comment