China, Russia Present Master Plan For New World Order At SCO Summit

- China and Russia used the Tianjin SCO summit to pitch a “Global South–first” economic and security order.

- Beijing is pushing more local-currency settlement to cut dollar reliance.

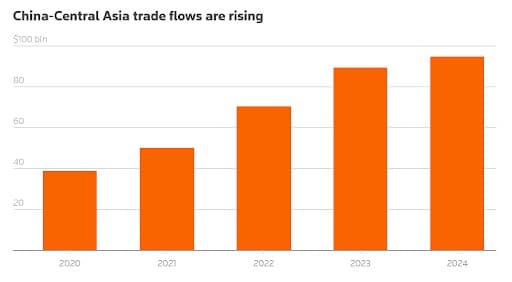

- China–Central Asia trade is up about 150% since 2020 and China–SCO trade reached roughly $512 billion in 2024.

China and Russia presented their masterplan for a new global order at the Shanghai Cooperation Organisation (SCO) summit currently underway in China’s port city of Tianjin, highlighting China's growing ties with Central Asia. China’s President Xi Jinping called for a new global economic and security order that prioritizes the "Global South" in what is considered a direct challenge to the West and the United States’ hegemony.

"We must continue to take a clear stand against hegemonism and power politics, and practise true multilateralism," Xi said, in a thinly veiled swipe at President Donald Trump's tariff policies."Global governance has reached a new crossroads," he added. The meeting was attended by more than 20 leaders of non-Western countries. Xi also called for the creation of an SCO development bank, and pledged to provide 2 billion yuan ($280 million) in grants to SCO members this year alone.

Widely regarded as an alternative power structure to U.S.-led international institutions, the 10-member SCO is an intergovernmental organization established in 2001 by China, Russia, Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan to promote cooperation and peace among member states, and foster “a new democratic, fair, and rational international political and economic order.’’ First seen as largely symbolic, China has increasingly been using the regional body to strengthen ties with Asia’s economic giants and bolster its regional influence, as Al Jazeera reports.

Related: Petronas-Operated Tartaruga Verde Draws Interest from Brazilian Offshore Players

China’s trade flows with Central Asia have grown nearly 150% since 2020 to $94.8 billion in 2024, while China-SCO trade hit a record $512.4 billion in the same year. China exports automobiles, machinery, chemicals, and garments to its SCO partners, showcasing its manufacturing prowess. In return, China imports energy commodities including oil, gas, and coal, minerals, and agricultural goods from resource-rich countries like Russia, Iran, and Kazakhstan. China is also investing in SCO countries, with the country’s FDI into SCO countries surpassing $40 billion by mid-2025. These investments mostly span traditional sectors like energy and mining, but are increasingly venturing into renewable energy, digital infrastructure and smart cities.

Source: Reuters

Chinese firms like the state-owned Southern Power Grid and polysilicon giant GCL have been ramping up projects in Central Asia, betting on a "green energy corridor" wherein cheap electricity produced in places like Tibet and Uzbekistan will be sold to power-hungry regions such as Europe and Southeast Asia. Two years ago, Chinese firm Universal Energy announced plans to invest in two 250 MW wind farms, totaling a 500 MW capacity, in Uzbekistan's Samarkand and Jizzakh regions. Investment agreements for these projects, which include power transmission lines and a total investment of $500 million, were signed in January 2024. The electricity generated will be sold to the National Electric Networks of Uzbekistan under a 25-year purchase obligation.

Experts are predicting that yuan-based settlements are likely to become more common in China-SCO trade as electric vehicles and AI drive up power demand in the region. More usage of the Chinese currency would drive the region’s de-dollarization efforts and would arguably be Xi's biggest win against the United States and the West. China has been actively pushing the SCO to de-dollarize by encouraging member states to use local currencies in trade and finance, with the goal of reducing dependence on the U.S. dollar, mitigating risks from sanctions, and fostering regional economic integration. This initiative aligns with China's broader strategy to create a more multipolar global order. This is likely to draw Trump’s ire: Last December, Trump threatened BRICS nations with 100% tariffs if they decided to challenge the U.S. dollar’s dominance in the global economy. BRICS is an acronym denoting the emerging national economies of Brazil, Russia, India, China, and South Africa.

“The idea that the BRICS countries are trying to move away from the dollar while we stand by and watch is OVER.,” Trump wrote in a social media post.

“We require a commitment from these countries that they will neither create a new BRICS currency nor back any other currency to replace the mighty U.S. dollar, or they will face 100 per cent tariffs and should expect to say goodbye to selling into the wonderful U.S. economy. They can go find another ‘sucker!’ There is no chance that the BRICS will replace the U.S. dollar in international trade, and any country that tries should wave goodbye to America,” the president-elect said.

While SCO is not as widely known as BRICS, the region’s rapidly growing trade ties between member nations, as well as the security implications of growing cooperation between the West’s biggest rivals, will no doubt have the United States and its allies concerned. On Tuesday, Trump accused Xi Jinping of conspiring against the U.S. with Russia and North Korea, "Please give my warmest regards to Vladimir Putin and Kim Jong Un as you conspire against the United States of America," Trump wrote on Truth Social. However, Trump has downplayed SCO’s significance, replying, "No. Not at all. China needs us," after the BBC asked if he believed that China and its allies were forming an international coalition to oppose the U.S.

By Alex Kimani for Oilprice.com