MINING.COM Staff Writer | March 24, 2023 |

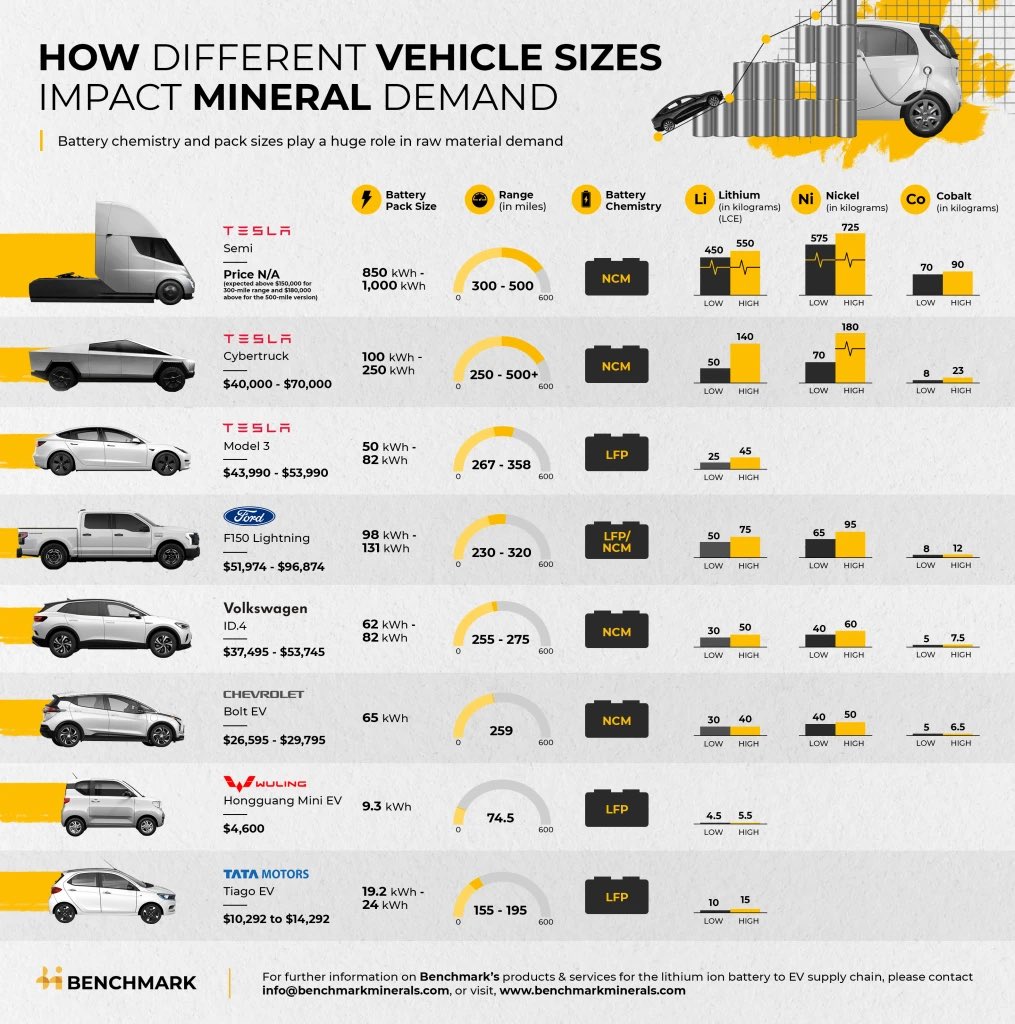

Source: Benchmark Mineral Intelligence

As the electric vehicles (EV) market grows, a debate is developing about the amount of minerals needed to supply the demand for EV batteries.

Following the US’ push for electrification with the Inflation Reduction Act, the European Union recently unveiled its Critical Raw Materials Act to “significantly improve” domestic extraction, processing, and recycling capacity for metals such as lithium and rare earths.

Other nations like Canada and South American countries are also discussing how to benefit from the expanding market.

The infographic above by Benchmark Mineral Intelligence demonstrates how different models and battery types impact critical mineral demand.

While a Tata Motors Tiago battery contains only 1.1kg of lithium carbonate equivalent (LCE), a Tesla Semi truck requires over 500kg of LCE to operate.

As the electric vehicles (EV) market grows, a debate is developing about the amount of minerals needed to supply the demand for EV batteries.

Following the US’ push for electrification with the Inflation Reduction Act, the European Union recently unveiled its Critical Raw Materials Act to “significantly improve” domestic extraction, processing, and recycling capacity for metals such as lithium and rare earths.

Other nations like Canada and South American countries are also discussing how to benefit from the expanding market.

The infographic above by Benchmark Mineral Intelligence demonstrates how different models and battery types impact critical mineral demand.

While a Tata Motors Tiago battery contains only 1.1kg of lithium carbonate equivalent (LCE), a Tesla Semi truck requires over 500kg of LCE to operate.

No comments:

Post a Comment