Staff Writer | March 22, 2023 |

Toyota Mirai, hydrogen-powered car.

(Reference image by Province of British Columbia, Flickr).

The water electrolyzer market for green hydrogen production is expected to grow to over $120 billion by 2033, a new report by IDTechEx forecasts.

Green hydrogen refers to the splitting of water via electrolyzers powered by renewable power sources. Its counterpart is blue hydrogen, which is produced from natural gas or coal but with carbon emissions captured.

Grey hydrogen, on the other hand, is created from natural gas or methane using steam methane reformation but without capturing the greenhouse gases made in the process. Black and brown hydrogen is produced using black or brown coal in a gasification process.

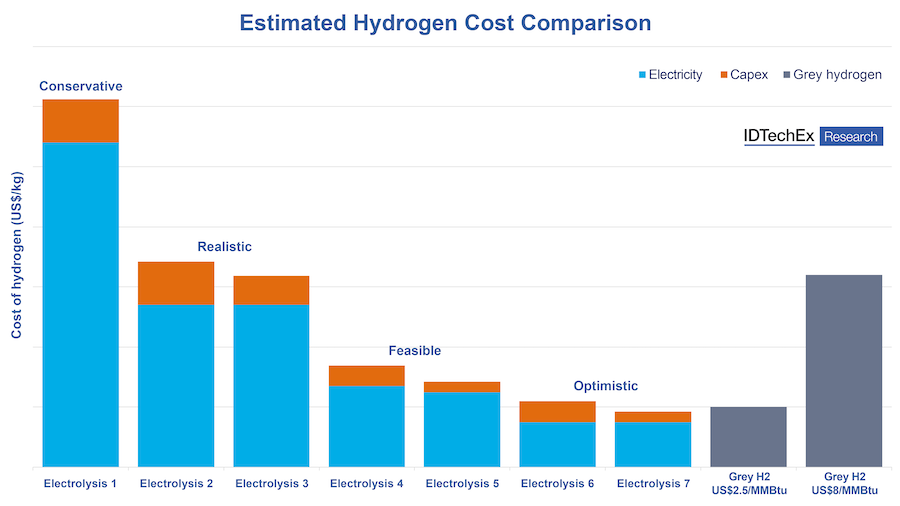

The key challenge for green and electrolytic hydrogen, however, is cost. Green hydrogen is generally more expensive than grey, black, or even blue hydrogen due to the relatively low cost of natural gas and low energy use for hydrogen production.

The Russia-Ukraine war led to increased natural gas prices across many regions of the world, leading Europe, in particular, to look at reducing its reliance on gas imports.

“While this pushed the economic case for green hydrogen in the short term, the long-term cost competitiveness of green hydrogen is still debatable,” IDTechEx’s report reads. “The high electricity consumption and cost limit the widespread adoption of green or electrolytic hydrogen.”

The water electrolyzer market for green hydrogen production is expected to grow to over $120 billion by 2033, a new report by IDTechEx forecasts.

Green hydrogen refers to the splitting of water via electrolyzers powered by renewable power sources. Its counterpart is blue hydrogen, which is produced from natural gas or coal but with carbon emissions captured.

Grey hydrogen, on the other hand, is created from natural gas or methane using steam methane reformation but without capturing the greenhouse gases made in the process. Black and brown hydrogen is produced using black or brown coal in a gasification process.

The key challenge for green and electrolytic hydrogen, however, is cost. Green hydrogen is generally more expensive than grey, black, or even blue hydrogen due to the relatively low cost of natural gas and low energy use for hydrogen production.

The Russia-Ukraine war led to increased natural gas prices across many regions of the world, leading Europe, in particular, to look at reducing its reliance on gas imports.

“While this pushed the economic case for green hydrogen in the short term, the long-term cost competitiveness of green hydrogen is still debatable,” IDTechEx’s report reads. “The high electricity consumption and cost limit the widespread adoption of green or electrolytic hydrogen.”

Capital costs

According to the market analyst, a reduction in the capital cost of electrolyzer systems, primarily for the electrolyzer stack itself, but also the balance of plant (such as the transformers, rectifiers, compressors, pumps, etc.) as well, will help to bring down the cost of hydrogen.

“The industry expects capex to come down as manufacturing capacity increases and capabilities improve through greater levels of automation,” the report notes. “Performance also has a significant impact. For example, the more efficient a system is, the lower the energy consumption. Solid-oxide electrolyzers are the most efficient type and can be improved further if waste heat can be utilized. Other key performance metrics for electrolyzer systems include operating lifetime, output pressure and purity, current and power density, start-up times, dynamic range, and minimum load levels.”

In the view of the experts at IDTechEx, electricity prices also need to drop for green hydrogen to get a boost.

They believe that at an electricity price of around $0.05/kWh, green hydrogen can start to become competitive with grey hydrogen on cost, given reasonable assumptions about electrolyzer capital cost and other operating costs.

“Levellized cost of energy for solar and onshore wind are starting to hit this price point, though this will not be everywhere, and further cost reductions would help strengthen the case for green hydrogen,” the document points out. “However, this also highlights the need to utilize variable power sources, necessitating additional energy storage systems to smooth out the power supply or an electrolyzer system capable of operational flexibility.”

The report explains that currently, electrolyzer systems are better suited to operating at a steady state. This is particularly true for solid-oxide and, to a lesser extent, alkaline systems too. Polymer electrolyte membrane (PEM) systems are the best suited to dynamic operation and, as such, are starting to gain popularity over the more developed and lower-cost alkaline electrolyzer as a result.

“For example, new electrolyzer cell designs that separate gas directly in the cell, as being developed by Next Hydrogen Solutions, could help improve the dynamic operability of alkaline systems,” the dossier reads. “Having an electrolyzer system capable and safe to operate at partial and variable loads will likely be key to the widespread success of green hydrogen.”

For the market research firm, although there are still a number of challenges in the development of economically competitive green hydrogen production, none of them are insurmountable. Yet, its experts believe that in the short-medium term, green hydrogen growth will likely remain reliant on government subsidies and incentives.

“Ultimately, green hydrogen can become cost-competitive, and the argument for electrolytic hydrogen, from a purely economic standpoint, will become stronger over the next ten years as electrolyzer systems become cheaper, their performance improves, and the cost of electricity comes down,” the report concludes.

According to the market analyst, a reduction in the capital cost of electrolyzer systems, primarily for the electrolyzer stack itself, but also the balance of plant (such as the transformers, rectifiers, compressors, pumps, etc.) as well, will help to bring down the cost of hydrogen.

“The industry expects capex to come down as manufacturing capacity increases and capabilities improve through greater levels of automation,” the report notes. “Performance also has a significant impact. For example, the more efficient a system is, the lower the energy consumption. Solid-oxide electrolyzers are the most efficient type and can be improved further if waste heat can be utilized. Other key performance metrics for electrolyzer systems include operating lifetime, output pressure and purity, current and power density, start-up times, dynamic range, and minimum load levels.”

In the view of the experts at IDTechEx, electricity prices also need to drop for green hydrogen to get a boost.

They believe that at an electricity price of around $0.05/kWh, green hydrogen can start to become competitive with grey hydrogen on cost, given reasonable assumptions about electrolyzer capital cost and other operating costs.

“Levellized cost of energy for solar and onshore wind are starting to hit this price point, though this will not be everywhere, and further cost reductions would help strengthen the case for green hydrogen,” the document points out. “However, this also highlights the need to utilize variable power sources, necessitating additional energy storage systems to smooth out the power supply or an electrolyzer system capable of operational flexibility.”

The report explains that currently, electrolyzer systems are better suited to operating at a steady state. This is particularly true for solid-oxide and, to a lesser extent, alkaline systems too. Polymer electrolyte membrane (PEM) systems are the best suited to dynamic operation and, as such, are starting to gain popularity over the more developed and lower-cost alkaline electrolyzer as a result.

“For example, new electrolyzer cell designs that separate gas directly in the cell, as being developed by Next Hydrogen Solutions, could help improve the dynamic operability of alkaline systems,” the dossier reads. “Having an electrolyzer system capable and safe to operate at partial and variable loads will likely be key to the widespread success of green hydrogen.”

For the market research firm, although there are still a number of challenges in the development of economically competitive green hydrogen production, none of them are insurmountable. Yet, its experts believe that in the short-medium term, green hydrogen growth will likely remain reliant on government subsidies and incentives.

“Ultimately, green hydrogen can become cost-competitive, and the argument for electrolytic hydrogen, from a purely economic standpoint, will become stronger over the next ten years as electrolyzer systems become cheaper, their performance improves, and the cost of electricity comes down,” the report concludes.

No comments:

Post a Comment