One oil cargo's odd journey highlights global market strains

, Bloomberg News

A dearth of heavy crude is forcing one of the world’s biggest buyers to go the extra mile to get the barrels it needs, offering another example of how sanctions and OPEC+ curbs are recasting the supply chain.

Reliance Industries Ltd., India’s largest private refiner, purchased about 2 million barrels of Canada’s Access Western Blend crude from the recently expanded Trans Mountain pipeline, its first such cargo. And although that grade suits processors with sophisticated refineries such as Reliance, there were plenty of unusual logistical complexities that came with the deal.

To get the shipment delivered, Reliance is first having to load it onto four smaller tankers from Burnaby port because of local depth restrictions, according to people with knowledge of the matter. The quartet of cargoes will then be transferred onto a single very large crude carrier, before that vessel makes the more-than-19,000-kilometer voyage to India via the Pacific, they said. An alternative, possible route via the Atlantic would be longer still.

Reliance didn’t respond to a request for comment.

The complex journey reflects underlying changes in the global market that have combined to make supplies of dense and sulfurous crude harder to find. First, U.S. sanctions against Venezuela have been reimposed, cutting that nation’s supplies of heavy crude. At the same time, OPEC+ cutbacks have crimped flows of similar grades, while Mexico, another supplier, is also exporting less. Rounding it off, more heavier barrels from the Middle East are getting used locally for power generation during the hot summer months.

The increased availability from Canada, “is welcome news given that India has lost access to Venezuelan crude,” said Dylan Sim, senior oil market analyst at FGE. Still, given other options remain available, the economics of the arrangement have to be extremely favorable for the flow to stay, he said.

Some similar-quality varieties are pumped in countries including Iraq, Brazil, Colombia and Mexico.

While some Indian buyers have performed multiple ship-to-ship transfers in the past in waters off the U.S. Gulf Coast for cargoes from America and Canada, using four tankers is rare as it’s time-consuming and costly, said the people, who asked not to be identified as the information is private.

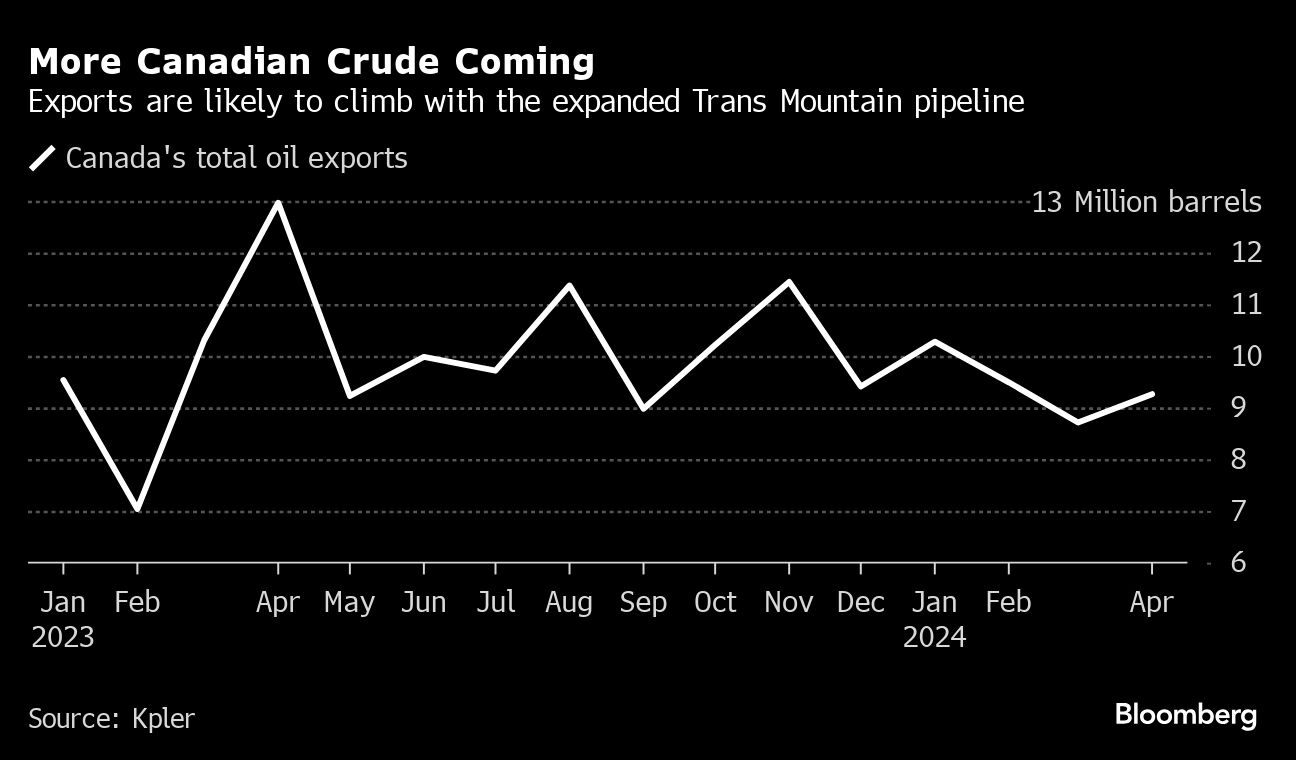

The expanded Trans Mountain began operating earlier this month after years of delays. The upgrade more than triples the capacity of the only export conduit from Alberta to the British Columbia Coast, allowing an extra 590,000 barrels a day of exports to Asia or the western U.S.

Besides India, cargoes via the pipeline have already been scheduled to go to China and California.

No comments:

Post a Comment