Cecilia Jamasmie | May 21, 2024 |

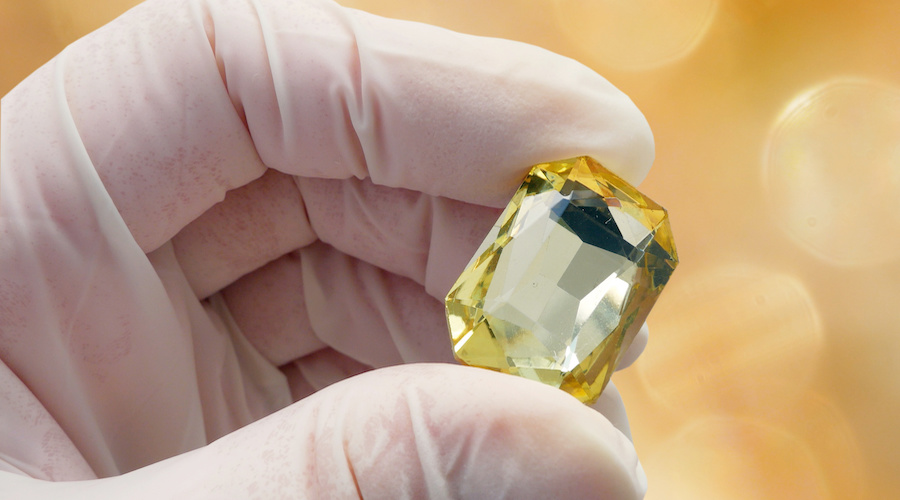

The Ellendale mine produced over 50% of the world’s fancy yellow diamonds (Stock image by lesslemon.)

Australia’s Gibb River Diamonds (ASX: GIB) is getting closer to restarting the mothballed Ellendale diamond mine in West Kimberley after being granted three mining leases that are key for the project.

The permits mark a significant step in reviving production at Ellendale, which was a major diamond producing mine. The operation was particularly know for being a source of fancy yellow diamonds, being responsible for more than 50% of the annual world’s supply until it was shut down in 2015.

The leases cover the main portions of the historic workings at the E4 and E9 pipes, as well as the extensively bulk-sampled E12 alluvials and their access, Gibb River said.

As part as the reopening steps, Gibb River said it is scheduled to conduct a heritage clearance survey in the first week of June. The company is also studying financing options for the project, including debt, equity, earn-in partner, joint venture partner, a North Australian Infrastructure Fund (NAIF) partnership, or other government funding schemes available.

The exploration and development company became Ellendale’s sole owner in March last year, after acquiring the project from Burgundy Diamonds.

Shares in the company soared on the news, closing 48% higher at 37 Australian cents each. This leaves Gibb River Diamonds with a market capitalization of A$6.52 million ($4.4m).

No comments:

Post a Comment