Chinese copper maker an unlikely winner from Trump’s tariffs

One of China’s biggest copper fabricators is set to reap a windfall from President Donald Trump’s efforts to boost US production of the metal.

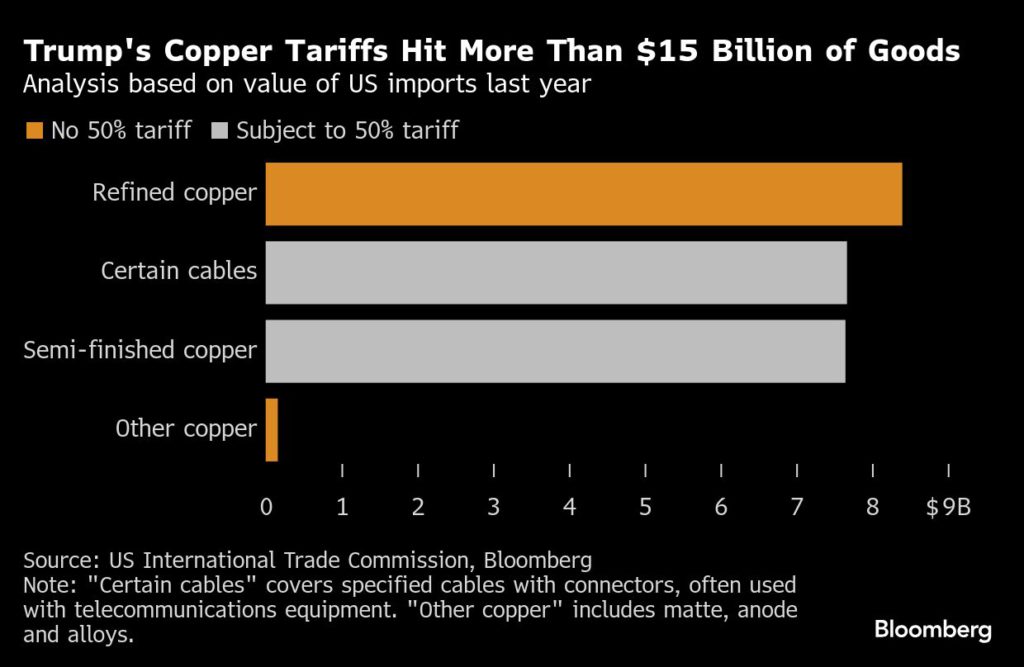

Zhejiang Hailiang Co., a major manufacturer of copper tubes used in autos, airconditioning and plumbing, might seem an unlikely winner from “America First” protectionism. But its stock has jumped nearly 20% since the Trump administration imposed tariffs at the end of July on imports valued at more than $15 billion last year.

While Washington and Beijing joust over trade, investors have zeroed in on Hailiang’s footprint in the US. The company said in 2020 it’s aiming for 100,000 tons of annual capacity at its plant in Houston. The factory had 30,000 tons as of last year. In an emailed response to questions, Hailiang said last week the expansion is proceeding, without elaborating.

The firm’s shares have outperformed other Chinese copper producers, as well as the broader CSI 300 Index, which has fallen slightly over the period. Hailiang’s total annual capacity is around 1.5 million tons.

The 50% duty on semi-finished copper, which will disrupt sales to the US while putting a premium on metal fashioned locally, may only be the first step in a Trump-led realignment of the global copper industry. The White House also ordered officials to come up with a plan in 90 days to slap tariffs on an array of other copper-intensive goods.

The US imported at least 600,000 tons of semi-finished copper last year. That’s nearly a third of its total demand, according to Citic Securities Co. As those imports become more costly, Hailiang’s US factory is expected to deliver “exceptional profits,” the brokerage said in a note.

The plant in Houston is part of a network that also includes bases in Indonesia and Morocco. Although China is the world’s biggest market for copper, the company has expanded internationally to hedge against a slowing economy at home and the risks posed by trade hostilities with western countries.

The effort may now be about to pay off after an earlier stumble. The Houston plant suffered a net loss of 35 million yuan ($4.9 million) last year due to higher labor and material costs, and expenses related to its expansion, according to Hailiang’s earnings report. That was a weight on companywide net income, which dropped 37% to 703 million yuan.

The company could also benefit from its proposed acquisition of a domestic peer. It said in December it planned to buy an undisclosed stake in Golden Dragon Precise Copper Tube Group, which also has a copper tube plant in Pine Hill, Alabama.

Barricks seeks $3.5B financing for Pakistan copper mine

Barrick Mining (NYSE: B)(TSX: ABX) aims to secure up to $3.5 billion in financing from the United States and other international lenders to build a massive copper-gold mine in Pakistan, after long-promised Saudi funding failed to materialize.

Chief executive Mark Bristow told the Financial Times on Monday that the company is working on a “G7-country financing package” for the Reko Diq project, in Balochistan province. Talks involve the World Bank’s International Finance Corporation (IFC), the US Export-Import Bank and Development Finance Corporation, the Asian Development Bank, and lenders in Germany, Canada and Japan.

“There is a lot of interest to support Pakistan,” Bristow told FT, adding the $9-billion project had “focused a spotlight” on the region.

Bristow said any US government backing would give the country access to copper concentrate from the mine, though the material would still need to be processed into metal. “The challenge for the US is smelting to capacity; it’s all spoken for,” he said, noting the country needs more domestic smelters to reduce its reliance on Chinese metal imports.

Reko Diq is considered one of the largest undeveloped copper-gold deposits in the world, projected to generate more than $70 billion in free cash flow over the next 37 years and $90 billion in operating cash flow over its lifetime. The project is jointly owned by Barrick and the governments of Pakistan and Balochistan.

Phase one, targeted to begin production in 2028, is under active financing negotiations. Project director Tim Cribb said earlier this year that the mine is seeking $650 million from the IFC and International Development Association, $500 million to $1 billion from the US Export-Import Bank, and $500 million from other development finance institutions, including the Asian Development Bank, Export Development Canada and the Japan Bank for International Cooperation.

Mine collapse weighs on Codelco debt even as output resumes

Codelco’s El Teniente copper mine partially resumed production over the weekend, but the fatal accident that closed it for a week is likely to weigh on the Chilean company’s bonds for far longer.

The July 31 tunnel collapse that killed six workers hit a new section of the mine, snarling plans to revive production at the 120-year-old operation. And while older parts of El Teniente are now operating again, the newer sections may be out of action for an extended period.

The reopening of the mine came sooner than many had expected, following a week that saw estimates of the damage caused by the landslide increase. The Public Prosecutor’s Office estimated on Thursday that 3.7 kilometers (2.3 miles) of tunnel was affected by the collapse, compared with an initial assessment of about 700 meters from the company. Investigators still need to use drones to reach the worst affected areas.

“There are many unknowns regarding the extent of the damage and the efforts that it could take not only to alleviate the safety issues, but also to make it fully operational again,” said William Snead, a strategist at Banco Bilbao Vizcaya Argentaria. “Maybe some of them are not being fully priced yet.”

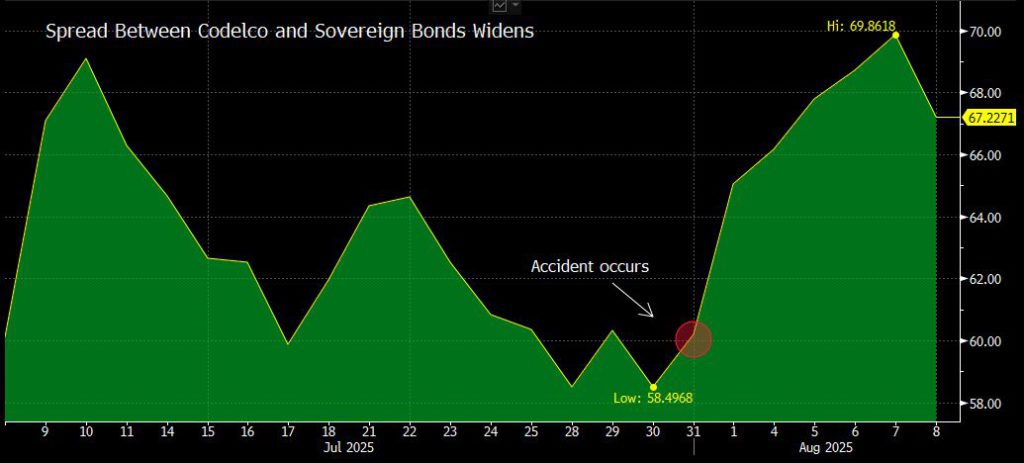

Investors had initially seen the accident as a human tragedy, with limited impact on finances long term. As a result, the market reaction was muted.

The extra yield investors demand to hold Codelco bonds over their Chilean sovereign counterparts widened about 10 basis points last week, but that only pushed it back to the levels seen a month earlier when President Donald Trump was threatening to put a tariff on raw copper imports. That threat was subsequently withdrawn.

Changing perceptions

Market perceptions began to shift on Tuesday, when S&P Global Ratings warned that the accident could push up the company’s already heavy debt burden and crimp its access to new borrowing. The report stoked pressure on Codelco’s bonds, which — while they didn’t fall — were the worst performing among major mining peers last week.

Codelco had originally said the collapse damaged a new area of the mine called Andesita, which is 900 meters underground and had only just started operating, limiting its impact on production. The prosecutor now says there was also damage to another level — Recursos Norte — that had been operating for five years.

“The restart of operations at El Teniente doesn’t deal with the structural problems exposed by this tragic episode,” said Juan Ignacio Guzman, who heads GEM, a mineral consulting firm in Chile.

El Teniente accounts for a quarter of Codelco’s production and a sizable chunk of its profit.

Revival plans

The accident comes as Codelco tries to recover from a years-long output slump driven by deteriorating ore quality at its aging mines. The company’s four big expansion projects have been bedeviled by problems, with all coming in above budget and behind schedule.

“This disruption comes at a time when Codelco was aiming to recover production levels, and some of its targets are likely to be delayed or revised downward,” Snead said. “Given ongoing safety concerns, it is unlikely that the mine will return to full operations in the near term.”

Yet reviving output at El Teniente is crucial if Codelco is to get back to pre-pandemic production levels of about 1.7 million tons a year from a current rate of about 1.4 million.

Codelco delayed reporting its quarterly results, including annual production guidance, on Aug. 1 as it deals with the accident. It also opened an investigation, including convening an international panel of experts. Chairman Maximo Pacheco has vowed to take “maximum measures” if any responsibility lies with the company’s supervisors or executives.

‘New approach’

Early indications are that the seismic event that caused the collapse was probably due to mining activity rather than a naturally occurring earth tremor, according to a person with direct knowledge of the matter. That could bring mining methods at El Teniente into question.

“Mining these deeper sections will require a new approach that will delay plans even further,” Guzman said.

Codelco is already among the world’s most indebted major mining companies with debt of about six times earnings before interest, taxes, depreciation, and amortisation.

“If the impact is higher than originally perceived that could drive some negative sentiment towards the credit,” Snead said.

Still, with Codelco’s borrowing backed by the Chilean state — one of the least indebted in Latin America — the company would only pay a moderate premium if it had to go back to the market now, said Josefina Valdivia, fixed income manager at Credicorp Capital.

Yet, S&P noted the reputational damage this accident could cause. Apart from the cost associated with the collapse, the company has debt payments of about $553 million and $1 billion this year and next, respectively, according to data compiled by Bloomberg.

“It is important for management to provide updates, transparency is key,” Snead said.

(By Carolina Gonzalez and James Attwood)

Codelco begins gradual restart at Chile copper mine hit by collapse

Codelco restarted underground and processing activities at its biggest copper mine, El Teniente, a little more than a week after suffering Chile’s deadliest mining accident in decades.

The state-owned company restarted operations over the weekend at eight underground areas deemed safe by mining and labor authorities, as well as at its smelter, Codelco said. Four other sections of the mine — near where the July 31 collapse occurred — will remain off limits as an investigation continues.

“The eight that are opening represent approximately 82% of production, and the recovery is gradual,” Mining Minister Aurora Williams said Monday in an interview with Radio ADN.

A return to work is a major boost for Codelco as the company grapples with the fallout from an incident that left six people dead and presents a sizable setback to the company’s efforts to recover from a years-long slump in production. The areas still closed include new parts of the deposit that are crucial for production in the years ahead.

On Thursday, the Public Prosecutor’s Office said inspections had shown damage to 3,700 meters (12,000 feet) of tunnel, which is about five times more than initial calculations given by Codelco.

On Monday, Codelco announced the departure of El Teniente boss Andrés Music, who will be replaced on an interim basis by operations manager Claudio Sougarret.

“This decision is not a response to the assignment of any responsibility, but rather stems exclusively from the need to focus the division’s attention on the challenges posed by the implementation of the Safe and Gradual Return Plan,” Codelco said.

(By James Attwood)

No comments:

Post a Comment