Ni

Major Indonesia nickel plant cuts output as waste piles up

A majority Chinese-owned plant at Indonesia’s most important nickel site is cutting back production as its tailings site is nearly full, according to people familiar with the matter, highlighting the industry’s growing waste management challenge.

Output at PT QMB New Energy Materials Co. Ltd. will be lower for at least two weeks, according to the people, who asked not to be named as they’re not authorized to speak publicly. QMB counts China’s GEM Co. and Tsingshan Holding Group Co. among its shareholders.

A representative of Indonesia Morawali Industrial Park on Sulawesi island, the country’s largest such facility and home to QMB, confirmed the reduction in run rates. The plant’s tailings storage inside the park is almost full, and paperwork for another location is still being processed, the representative added.

GEM, QMB’s biggest investor, did not immediately respond to requests for comment.

Indonesia accounts for more than half of the world’s output of nickel, a metal used in electric-vehicle batteries and stainless steel, thanks to a surge in production that’s been driven by investment from China. The high-pressure acid leaching method used by the plants allows the use of lower-grade ore and is relatively cheap, but it results in high volumes of waste, which is typically dried and compacted before being stored.

The rapid expansion of the nickel industry is facing greater local scrutiny in Indonesia, partly due to waste-related concerns. Experts have questioned whether the HPAL method can ever be used safely and sustainably in the tropical archipelago, where torrential rain and earthquakes are frequent. A deadly landslide at QMB’s tailings site at the Morawali park resulted in disruptions to output earlier this year.

HPAL producers have also been contending with the higher cost of sulfur, a chemical used to produce acid.

Still, demand for mixed hydroxide precipitate – a form of nickel produced at the HPAL plants that also contains cobalt – has benefited from a tailwind this year following the imposition of cobalt export controls by the Democratic Republic of Congo.

(By Annie Lee)

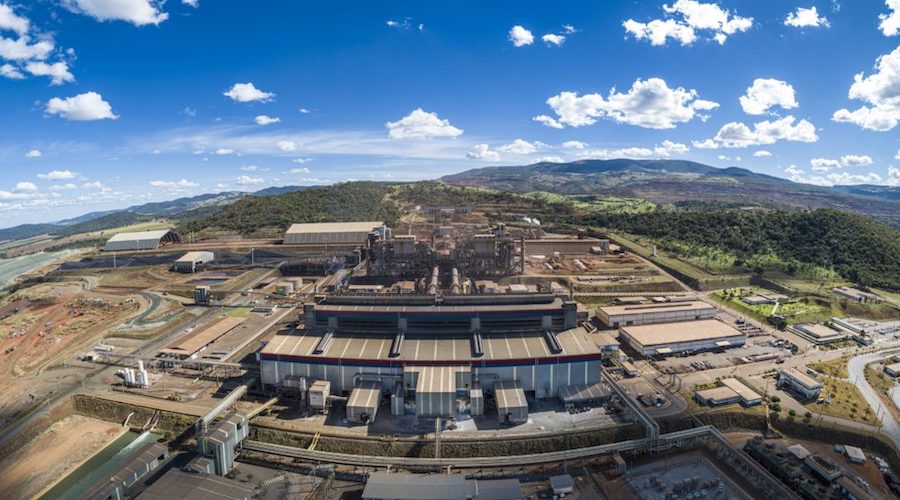

MMG’s deal to buy Anglo’s Brazil nickel assets faces EU regulatory delay

Hong Kong-listed mining and metals company MMG said on Monday that the European Commission had extended the review of its deal to purchase Anglo-American’s nickel business in Brazil.

The Commission, which acts as the EU competition enforcer, had initiated the phase II merger investigation in early November.

However, it is unclear how long the European Commission may require to complete its review, MMG said on Monday.

The extension underscores regulatory caution and heightened scrutiny of resource deals with China.

Anglo American announced the sale in February, which includes two ferronickel and two greenfield projects in Brazil.

The Commission had warned earlier this month that the deal could enable MMG to divert ferronickel from Europe and hurt European stainless steel production.

While awaiting the Commission’s review, the parties have agreed to extend the deadline for meeting all deal obligations to June 30, 2026, from the previously planned November 18, 2025, MMG said.

MMG will continue to work with Anglo-American and the European Commission to assist the Commission in its review, it added.

(By Sherin Sunny; Editing by Rashmi Aich)

No comments:

Post a Comment