It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Saturday, January 08, 2022

Thu, January 6, 2022

By Andy Home

LONDON, Jan 6 (Reuters) - It's turning into a winter of discontent for Europe's aluminium smelters as they struggle to cope with rocketing power prices across the region.

Four operators have announced curtailments totalling over half a million tonnes of annual production capacity, with others flexing output to mitigate power-load price spikes.

European aluminium consumers are already paying the price. Physical premiums have surged, the CME's duty-paid spot contract jumping from $290 per tonne at the start of December to a current $423.

That's over and above the London Metal Exchange (LME) aluminium price, which has also opened 2022 with a bang, hitting a two-month high of $2,938.50 per tonne on Wednesday.

Aluminium was the second best performer among the core LME industrial metals last year as the market priced in power-related curtailments in China.

The market's power problems have now spread to Europe.

POWERING DOWN

Smelting aluminium is an energy-intensive process, power typically representing at least 30% of total production costs, albeit with significant variability depending on source, supplier structure and local energy market.

European power prices have hit multiple record highs over recent months and the regional energy crunch https://www.reuters.com/markets/commodities/weak-winds-worsened-europes-power-crunch-utilities-need-better-storage-2021-12-22 is now morphing into an aluminium smelter crisis.

"Exorbitant energy prices" were cited by U.S producer Alcoa as the reason for a two-year curtailment https://investors.alcoa.com/news-releases/news-release-details/2021/Alcoa-Reaches-Agreement-on-Future-of-San-CiprinSmelter/default.aspx of its 228,000-tonne per year San Ciprian smelter in Spain.

The plant will be out of action by the end of this month, returning in January 2024 with renewable power contracts https://www.reuters.com/business/energy/alcoa-signs-renewable-energy-deals-spanish-plant-2021-12-30

Another casualty is the KAP smelter in Montenegro, which began powering down https://seenews.com/news/montenegros-uniprom-to-shut-down-smelter-kap-by-dec-30-report-767241 its 120,000 tonnes of annual capacity in the middle of December.

The plant's owner Uniprom was facing a jump in its power bill from 45 euros ($50.89) to 120 euros per megawatt hour at the start of 2022.

The "exceptional situation on the energy and gas markets" is why Romanian producer Alro is reducing output https://www.alro.ro/en/article/communique-production-activity-primary-aluminum-will-be-reduced from five to two potlines at its Slatina smelter, it said.

The 265,000-tonne-per-year plant will be operating at around one-third capacity until further notice.

Norway's Hydro has also doubled down https://www.reuters.com/markets/commodities/norways-hydro-cut-slovakia-aluminium-output-due-power-cost-2021-12-30 on the amount of capacity it is idling at its Slovalco smelter in Slovakia, citing "very high energy prices (which) show no sign of improvement in the short term".

Production will be reduced to 60% of the plant's annual capacity of 175,000 tonnes per year.

All four operations will maintain remelt and cast house operations, but the combined annualised hit on primary metal production will be around 550,000 tonnes.

Other European smelters are navigating the power price crunch by tweaking amperage and run-rates, meaning there is considerable creep to any production loss estimate.

PREMIUM SPLIT

Europe is already a net importer of primary aluminium, with the regional supply deficit set to widen as the list of smelter casualties lengthens. The sharp jump in physical premiums attests to that changing dynamic.

The U.S. Midwest physical premium has leapt higher in sympathy, the CME spot contract up from $550 per tonne at the start of December to a current $666.

The United States is also a net importer of primary aluminium and is now facing increased competition from Europe for spare metal.

And both are in competition with China, which is importing significant volumes after a run of power-related curtailments across its huge smelter network.

China's imports of primary aluminium totalled 1.5 million tonnes in the first 11 months of 2021, up 60% year-on-year.

The world's largest aluminium producer turned net importer in 2020 and it seems set to stay that way.

That, ironically, has benefitted Japanese buyers, who have just negotiated a 20% reduction https://www.reuters.com/markets/commodities/japan-q1-aluminium-premium-falls-20-177t-sources-2022-01-05 to $177 per tonne in the premium for first-quarter deliveries.

One of the factors working in their favour has been the relocation of accessible stock to Asia to feed China's new-found hunger for imports.

LME warehouses held 926,800 tonnes of registered inventory as of Tuesday, with just 34,675 tonnes located in Europe and 19,425 tonnes in the United States. The balance 94% is in Asia.

Asian locations also accounted for 79% of the 449,000 tonnes of aluminium sitting in the LME's off-warrant shadows at the end of October.

That regional availability is cushioning Japanese buyers but exacerbating supply issues outside of Asia.

Europe's smelter problems are accentuating the growing regional divergence in global premiums.

ALUMINIUM PARADOX - EUROPEAN VERSION

The European Union has historically shielded its aluminium smelter sector through import tariffs, much to the annoyance of regional consumers.

The bloc is now also committed to what it terms "open strategic autonomy" in its green industrial plan, particularly when it comes to securing metals critical to the energy transition.

Those ambitions are now at risk, not just in aluminium but in other industrial metal sectors such as zinc.

The Achilles heel in the supply chain is the high energy intensity of the smelting process, exposing producers to the sort of power crunch now roiling Europe.

Power supply stresses will only become more acute as the continent tries to pivot away from coal in line with its carbon commitments.

China started grappling with the same metals-power conundrum last year.

Although China's power problems are in part down to natural causes - last year's drought in hydro-rich Yunnan province - they are also a consequence of energy efficiency goals aligned with a pledge to hit peak coal generation by 2025.

Power-hungry aluminium smelters have been easy targets for regional governments looking to improve their energy usage and efficiency targets.

China's production of primary aluminium has stalled as production lines have been closed and new projects have been deferred.

Such is the aluminium paradox.

It's a metal that is core to the energy transition, but can only be produced in virgin form using very large amounts of energy, which is increasingly at a premium due to decarbonisation.

The paradox has just extended from China to Europe.

($1 = 0.8843 euros)

(Editing by Jan Harvey)

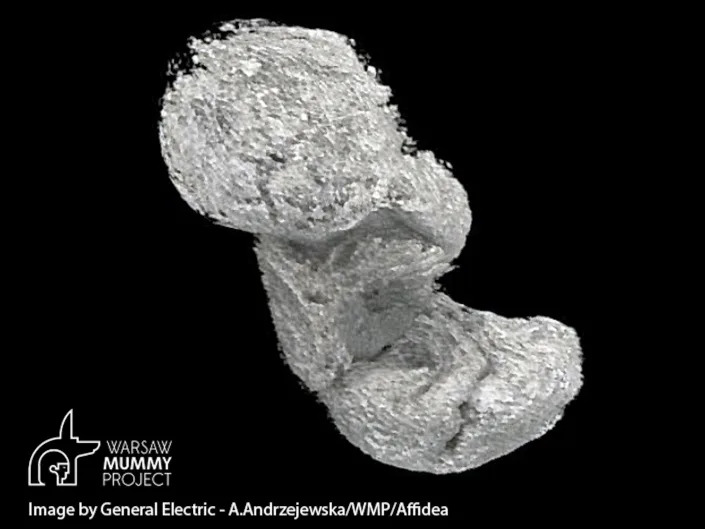

Scientists looking at the first pregnant Egyptian mummy think they figured out why none were ever found before

Scientists who examined a pregnant mummy explained why they think no others had been found.

It might have to do with a chemical reaction that dissolves the bones of unborn children.

It makes them almost invisible to X-rays and could mean other pregnant mummies just weren't noticed.

Scientists working on mummified remains from Egypt recently made a huge discovery: a set of remains they thought was a man was actually a woman — and a woman who was pregnant.

Before the Warsaw Mummy Project analyzed the remains, no one had ever spotted a fetus in a mummified body before.

Wojciech Ejsmond, a Warsaw Mummy Project scientist who led the study, told Insider on Friday that this had always seemed weird.

"Women in reproductive age were maybe not constantly pregnant, but every few years they would have been pregnant," he said. So why was there no proof of pregnant women who died being mummified?

Fetal skeletons — the usual way to spot a developing baby in this kind of case — never appeared on X-ray scans. It took the scientists developing a technology that wasn't looking for bones.

"Radiologists were looking for bones, and our case shows that, actually, you shouldn't. You should look for the soft tissue with a unique shape," he said

In a letter published on December 30 in the peer-reviewed Journal of Archaeological Science, the researchers gave a hypothesis for why the fetus might have disappeared from scans. It essentially comes down to pickling.

"It's like an experiment with an egg. You put an egg with an acid, the eggshell is dissolving, leaving only the inside of the egg," Ejsmond said.

"When the acid is evaporated, you have a pot with just an egg covered in minerals," he said.

Something similar probably happened in the mummy's body.

As the body decomposes, it starts naturally acidifying. "Formic acid is appearing in the blood, which makes the environment in the body more acid," Ejsmond said.

When that acidic environment hit the dead fetus, the bones almost all dissolved. The remnants of the chemical reaction, a bunch of minerals, were scattered in the water that was left in the uterus, the scientists hypothesized.

This made the little body virtually invisible to X-ray scanners.

"One way to explain it is that it pickled it, basically," Ejsmond said.

So why then did the mother's bones not dissolve?

That is because, during the mummification, the body is covered with natron salt to dry out the body. The act of drying it out captured the minerals in place, Ejsmond said, so the bones could still be spotted.

So far, the mummy studied by the Warsaw Mummy Project is the only one to be believed to have been mummified pregnant.

"But further research may show that it's more common than we think," Ejsmond said.

Christina Bu

Fri, January 7, 2022

Electric Cars In Oslo As Global Gasoline Consumption Has All But Peaked

Electric vehicles (EV) sit parked at charging stations at Kongens gate near Akershus festning in Oslo, Norway, on Monday, Nov. 21, 2016. The International Energy Agency forecasts that global gasoline consumption has all but peaked as more efficient cars and the advent of electric vehicles from new players such as Tesla Motors Inc. halt demand growth in the next 25 years. Credit - Fredrik Bjerknes—Bloomberg/Get—© 2016 Bloomberg Finance LP

I live in a country far north, stretching way above the Arctic Circle, with long driving distances, rugged mountains and a very cold climate. Norway is not the most likely place to start a transportation revolution, but electric vehicles (EVs) are suddenly the new normal here. I would claim that if Norway can do it, any country can.

The shift won’t happen overnight, but the speed of the transition here has surprised everyone. Almost sixty-five percent of new passenger cars sold in Norway in 2021 were electric; in addition, 22% were plug-in hybrids. Put differently, only 14% of new cars were sold without a plug. Now that there are many models to choose from and the range has improved, EVs are purchased all over the country. It took us only 10 years to move from 1% to 65%, and next year I believe we will pass 80%. The U.S. and other governments should use 2022 to enact policies that incentivize a similar shift.

So, how did Norway become the world’s top-selling electric-vehicle market per capita? Not because of suitable conditions, and definitely not because Norwegians are more environmentally friendly or concerned about climate change. We can instead credit strong demand-side policies kept in place for a long time. After all, it takes time to electrify all the cars on the road. Most cars are purchased secondhand, and people in the secondhand market are dependent on the choices made by new-car buyers. The government therefore taxes the sales of new polluting cars heavily but does not tax EVs at all, making EVs, which are more expensive because of their production costs, a competitive and appealing option. The Norwegian parliament has also decided that all sales of new cars and vans shall be zero emission by 2025. The faster we get to 100% EV new sales, the faster we get there with all cars on the road.

Read More: Electric Cars Can Sound Like Anything. That’s a Huge Opportunity to Craft the Soundscape of the Future

Half a million people in Norway now drive EVs. I met one of them recently. His name is Kåre, and he had just turned 100 years old. He bought his first EV when he was 99 and uses it to take his 103-year-old sister on Sunday trips. If Kåre can do it, everyone can do it.

It’s not as if the rest of the world isn’t interested. Norway’s progress has, of course, been helped by important emission restrictions directed at car manufacturers internationally, and we have seen the start of a global rollout of charging infrastructure. Did you see the final Super Bowl ad from GM? Will Ferrell told us he hated Norway because of the high uptake of EVs and that GM and the U.S. were going to catch up. And the U.S. has started! President Biden’s infrastructure bill includes $7.5 billion for a nationwide charging network.

But the U.S. can go further in 2022, as can other countries, and implement policies directed at the demand side. This can be done in different ways; the key is to start taxing new sales of at least the most polluting car models and use this money to subsidize EVs. This is a fair way to implement climate policies as it is aimed at people buying a new car, rather than an indiscriminate tax at the gas pump. Consumers are given an option when buying a new car; they could, for instance, choose a model with lower emissions like a plug-in hybrid, which is not taxed, or even an EV that is subsidized. (To be clear, tax policies on purchase alone won’t get where we need to be fast enough – in Norway, there are also several incentives in place such as lower road tolls, partial access to bus lanes and cheaper public parking for those who drive EVs – but it is the most important and effective step that countries around the world can take.)

Yes, the transition to EVs might be more politically difficult in some countries than others, but several, like Sweden and New Zealand, have already started, with good results after implementing EV tax policies. New markets are also helped with better technology and massive investments in electric mobility. In fact, some countries are moving even faster than Norway. While Norway took 2.5 years to move from 2% to 10% EV market share, UK took 1.5 years and Germany only one.

2022 is also the year that all governments should join the first 38 countries that signed the COP26 declaration on accelerating the transition to 100% zero-emission cars and vans. It states that they will work toward all sales of new cars and vans being zero emission globally by 2040, and by no later than 2035 in leading markets.

Frankly, I don’t think any manufacturer will produce cars with internal combustion engines after 2035. Still, I cannot stress enough that the transition to EVs must be fast and strong policies are urgently needed. The United Nations’ last climate report was called “code red for humanity.” We are in a hurry when it comes to cutting emissions. So, when there are alternatives that are more than good enough, why not speed things up?

This essay is part of a series on concrete goals the world should aim for in 2022 in order to put us on track to avert climate change-related disaster. Read the rest here.

Diane Haithman

Sat, January 8, 2022, 3:39 PM·3 min read

Dave Ramsey, personal finance radio host and outspoken evangelical Christian, was the target of social media criticism Saturday, as outraged individuals slammed him for saying that if tenants at his residential properties are displaced because he raised rental rates to meet market price, it does not make him “a bad Christian.”

Ramsey, who hosts the nationally syndicated three-hour radio program and podcast “The Ramsey Show,” is once again the center of controversy, this time for these words about tenants forced from buildings that he owns because of rent increases:

“The ratio of the income that they earned to their housing expense displaced them,” Ramsey said on the air. “I didn’t cause any of that. And so you are not displacing them, you’re taking too much credit for what’s going on. If they need to move to a cheaper house, because they can’t afford they’re gonna move to a lesser house because if they move they’re gonna pay market rent. Okay, I own rental property, single family homes, among many other properties that we own. And if I raised my rent to be market rate that does not make me a bad Christian. I did not displace the person out of that house if they can no longer afford it.”

Ramsey’s comment caused enough outrage — or at least, strong opinions — to make him a trending topic on Twitter on Saturday, racking up more than 5,000 tweets on the matter. Some samples:

However, not all comments were negative, including this weigh-in from one Michael Partyka:

“Being a Christian no more obligates you to rent out your property at a loss than it obligates you to rent out your labor at a loss.”

Wrote another Ramsey supporter:

Ramsey is not noted for compassion about the concerns of the average citizen. He was sued in December for requiring employees at his company to disregard COVID-19 work-from-home orders and attend in-person gatherings of more than 900 workers who were encouraged not to wear masks or maintain social distance.

Employees at Ramsey Solutions – the Franklin, Tennessee, headquarters for the evangelical Christian bestselling author and media mogul – who wanted to work from home instead of coming to office were guilty of “weakness of spirit,” Ramsey said, according to the lawsuit.

Brad Amos, who filed the federal workplace discrimination lawsuit in U.S. District Court in Nashville, said in the suit that he had asked to work from home out of concern about workplace transmission of the coronavirus because he has a young son with Coats’ disease, a rare affliction that can restrict blood and oxygen to the retina. His wife is also a high-risk person “with a predisposition for pneumonia,” he said.

People need to spend ‘more time fixing the climate’ than ‘getting into the metaverse’: iPod inventor

Aspirational visions of the metaverse peppered discussion at this week's Consumer Electronics Show in Las Vegas, where companies showed off products like a $270 body-tracking suit and an accessory that mimics heat and cold.

The conference demonstrates the rush of industry momentum behind the metaverse, an immersive online experience across tech platforms that has become a key focus of Facebook (FB), renamed Meta in October. By now, all the tech giants are investing in the metaverse, Axios reports.

But one top tech figure doesn't believe the hype. In a new interview, former Apple (AAPL) engineer Tony Fadell — who's credited with inventing the iPod and helping design the iPhone — slammed the metaverse as a distraction from efforts to address existential problems in the physical world like climate change.

Moreover, the metaverse fails to address a clear need for consumers, and likely will not gain wide social acceptance for a long time, Fadell said.

"We need to spend more time on fixing the climate than we need to worry about getting into the metaverse," says Fadell, who now serves as a board member at Dice, an app-based ticket sale platform.

"So let's make sure you have an environment we live in before we find another environment that keeps us in refrigerated chambers so that we can breathe and eat," he adds.

"We've got a lot of fish to fry," he says. "And we are frying ourselves."

Some tech leaders have predicted that activities in the metaverse will come to rival — and even exceed — the importance of those experienced in physical reality. Nvidia (NVDA) CEO Jensen Huang last June said the economy of the metaverse will someday grow larger than that of the physical world.

But climate advocates have warned that the metaverse may provide a false sense of escape from the physical environment as it becomes less hospitable. "Climate change is already here," author and climate justice leader Andreas Karelas wrote in The Hill in November. "You can’t create a metaverse where climate change doesn’t exist."

Fadell isn't the only tech figure who questions the appeal of the metaverse. Last month, Tesla (TSLA) CEO Elon Musk told conservative satirical site The Babylon Bee that he doubts the potential for widespread adoption of the metaverse.

“I don’t see someone strapping a frigging screen to their face all day and not wanting to ever leave. That seems — no way," Musk said. “I currently am unable to see a compelling metaverse situation.”

Speaking to Yahoo Finance, Fadell echoed such skepticism about consumer uptake of the metaverse.

"You need the technology, and then you have to understand that the consumers want it," he says. "And they want to live in that it."

"It's social acceptance — not just you accepting it, but the people around you accepting it," he adds. "What I've learned all the time is the technology might be right, but is the social timing right? Is there a social acceptance?"

"We don't see the need yet for the metaverse," he says.

The crater fire named "Gates of Hell" is seen near Darvaza, Turkmenistan, Saturday, July 11, 2020. The president of Turkmenistan is calling for an end to one of the country's most notable but infernal sights — the blazing desert natural gas crater widely referred to as the “Gates of Hell.” The crater, about 260 kilometers (160 miles) north of the capital Ashgabat, has been on fire for decades and is a popular sight for the small number of tourists who come to Turkmenistan, which is difficult to enter. (AP Photo/Alexander Vershinin)

Sat, January 8, 2022, 9:14 AM·1 min read

ASHGABAT, Turkmenistan (AP) — The president of Turkmenistan is calling for an end to one of the country’s most notable but infernal sights — the blazing natural gas crater widely referred to as the “Gates of Hell.”

The desert crater located about 260 kilometers (160 miles) north of the capital, Ashgabat, has burned for decades and is a popular sight for the small number of tourists who come to Turkmenistan, a country which is difficult to enter.

The Turkmen news site Turkmenportal said a 1971 gas-drilling collapse formed the crater, which is about 60 meters (190 feet) in diameter and 20 meters (70 feet) deep. To prevent the spread of gas, geologists set a fire, expecting the gas to burn off in a few weeks.

The spectacular if unwelcome fire that has burned ever since is so renowned that state TV showed President Gurbanguly Berdymukhamedov speeding around it in an off-road truck in 2019.

But Berdymukhamedov has ordered his government to look for ways to put the fire out because it is causing ecological damage and affecting the health of people living in the area, state newspaper Neitralny Turkmenistan reported Saturday.

Airbus faces $339 million class action suit in the Netherlands, lawyers say

Toby Sterling and Tim Hepher

Fri, January 7, 2022

FILE PHOTO: An Airbus A380 takes off after Airbus makes

By Toby Sterling and Tim Hepher

AMSTERDAM (Reuters) - Lawyers who say they are representing "a hundred" institutional investors have filed a class action lawsuit against Airbus in a Dutch court, saying they suffered at least 300 million euros ($339 million) in damages as a result of company misconduct.

The suit, filed by the Foundation for Investor Loss Compensation on Jan. 3 at The Hague District Court, says investors suffered losses after buying shares in Airbus SE that were overpriced because the company withheld information about corruption at the company. The suit also names accountants KMPG and Ernst & Young as defendants.

A spokesperson for Airbus, which disclosed it was facing civil claims in the Netherlands in its third quarter 2021 earnings report, said the company would not comment on ongoing litigation. In its earnings report, Airbus said it believed it had "solid grounds to defend itself against the allegations."

KMPG and Ernst & Young did not immediately respond to requests for comment.

Dutch newspaper Het Financieele Dagblad first reported the filing against Airbus, which has its head office in Toulouse, France and registered headquarters in the Dutch city of Leiden.

The planemaker agreed in 2020 to a $4 billion fine in a deal with French, British and U.S. authorities to settle a three-year investigation into bribery and corruption over sales practices.

"More than 100 institutional investors have now joined the Foundation, and the expectation is that that number will rise," the filing said.

"The damage suffered by current participants is around 300 million euros. As more participants join, this number will rise," it said.

The Dutch filing calls on the defendants' representatives to appear at a court sitting on April 6.

($1 = 0.8846 euros)

(Reporting by Toby Sterling, Stephanie van den Berg, Tim Hepher; Editing by Edmund Blair)

Alexandra Semenova

·Reporter

Fri, January 7, 2022

The pandemic bore a new era for markets — one of a more powerful and influential retail investor. With extra cash and more free time as pandemic lockdowns ensued, droves of individuals betting on stocks showed Wall Street a year of reckoning and changed investing forever.

Even as the frenzy has let up, young retail investors have no plans to stop. In fact, 20- and 30-something year old investors want to allocate more of their money to riskier investments in pursuit of greater returns as markets rise towards records.

A recent survey of retail investors conducted by U.K.-based investment management firm Schroders found that younger age groups comprised a significant portion of respondents who reported plans to be more active in volatile, higher-risk sectors. Schroders asserted that people don’t seem to be more bullish than before. Instead, amid volatile conditions, they know they have more to gain.

The study found a number of people exhibiting riskier investment behavior as a result of the pandemic, with one-third of retail investors expressing plans to invest in high-risk assets, including ones they haven’t previously considered. Of respondents in the study who appeared to have a greater appetite for risk, 44% were between the ages of 18-37.

“Younger people theoretically have longer in terms of their investing horizon until they retire, so on the one hand, investing in riskier assets makes a lot of sense for them.” Lesley-Ann Morgan, head of multi-asset strategy at Schroders, told Yahoo Finance. “I think where it becomes more difficult is when the amount they've got tied up in this is not appropriate for their financial means.”

Luis Viceira, an expert on investment management and professor at Harvard Business School, argues that the greater capacity among young investors to take on more investment risk is no reason to actually do so.

“I think the more important question is — they do have more capacity to take on risk — but do they have more capacity to absorb that investment risk?” he said in an interview with Yahoo Finance. “You may want to take on more generous levels of risk, but how do you make good use of it?”

Individual stock investing

Younger investors with more generous risk budgets can benefit from making smarter use of them by allocating to professionally-managed investment vehicles, such at mutual funds and ETFs, and still see those investments pay off, according to Viceira, who also said he believed that retail investors, especially young and inexperienced ones, have no business investing in individual stocks.

Investors who trade on top of their separate, full-time jobs do not have the time — or resources — to properly research securities the way that an analyst at a professional firm does, he added.

“There will be a few that get lucky and invest in stocks that perform well, but the vast majority are kind of wasting that risk budget that they have,” Viceira said.

In its study, Schroders found that the younger investor bracket had more diversified portfolios across various sectors and asset classes, especially favoring industries deemed to be more volatile, such as electric vehicles, biotechnology or cryptocurrencies.

‘Seeking a chance to reach their aspirations’

Investors between 18-37 years of age reported significantly higher return expectations than their older counterparts, though Schroders indicated those projections had more to do with the younger age group having a significantly more diversified portfolio than the suspected idea that older investors have more realistic expectations.

Specifically, internet and tech securities held the greatest appeal among retail investors, and particularly for the 18-37 age bracket, with 61% in this group investing in internet and technology stocks or funds in the past year. Cryptocurrencies were the next most popular for the 18-37 age group at 51% reporting that they have allocated to the digital assets.

“I often say that risk is the price we pay for a chance to reach our aspirations,’ Meir Statman, one of the founding fathers of behavioral finance and a professor at Santa Clara University’s Leavey School of Business, told Yahoo Finance in an email.

In his work, he has indicated that investors who dabble in speculative assets such as crypto are not seeking risk, but “seeking a chance to reach their aspirations” and hoping such investments could lift them up the economic ranks, retire early, or quit boring jobs to pursue careers they are passionate about.

“It is generally the case that, especially for young people, aspirations are higher than their current position, so they are willing to take risks,” he said.

All about perception

Dan Egan, director of behavioral finance and investing at Betterment, said the problem exists not necessarily in particular higher-risk asset classes themselves, but in the other unknowns that come with investing in them such as uncertainty around the clearing process of online brokerages and prematurely allocating and trading capital that hasn’t settled, as opposed to investing in traditional custodial brokerages that are more conservative and cautious about letting the clearing period on investments pass.

WallStreetBets forum on the Reddit displayed on a phone screen and a illustrative stock chart in the background are seen in this illustration photo. (Photo illustration by Jakub Porzycki/NurPhoto via Getty Images)

Egan also told Yahoo Finance that the anecdotal perception of young retail investors pursuing only high-risk, speculative assets appears to be greater than the actual reality of it.

“A good way of thinking about this is, I go to the gym five days a week, but the stories I am going to tell my friends are actually about when I go out to the bar and the good times that I’ve had,” Egan said.

“I think it’s a similar thing among retail investors who have the vast majority of their money in 401(k)s, retirement funds, or other more normal investments like index funds and mutual funds, but because there is more diversity in speculative asset class, we’re hearing a lot more about them, even if they still make up the minority of people’s money.”

Schroders’ study, which surveyed 23,950 people who invest across 33 locations around the globe, suggested a similar point. Although, one-third of respondents, the group that outlined plans to foray into more high-risk investments was sizable, almost half of survey participants said they will put “more” or “much more” money into general savings or low-risk investments, with those in the younger cohort among the 46% who intend to put more towards savings and 46% in low-risk investments.

Excess savings and more time to experiment with investing contributed to the more active retail investors that emerged in the past one to two years, but Egan predicted that as the pandemic winds down and people begin to socialize and spend money again, fewer young investors will have the time for active trading.

“It's not like a collapse or anything, it’s just like letting out pressure from a balloon over time,” he said. “I think it will drift down.”

Thu, January 6, 2022

Man walks past a wall carrying the logo of Shimao Group,

SHANGHAI/HONG KONG (Reuters) -China will make it easier for state-backed property developers to buy up distressed assets of debt-laden private peers, a source with direct knowledge said on Friday, another step by policymakers to avert a liquidity crisis in the sector.

State-owned developers acquiring distressed assets will not have those loans counted as debt under rules that cap borrowing. The "three red lines" policy restricts the amount of new borrowing property developers can raise each year by placing caps on their debt ratios.

The authorities have encouraged state-owned builders to look at the assets of private peers struggling with liquidity issues, as an increasing number have failed to meet their debt obligations, sending shockwaves to the financial markets.

Chinese developers are facing an unprecedented liquidity squeeze due to years of regulatory curbs on borrowing.

Banks have told state-owned developers about the exclusion of M&A loans in calculating their debt ratios, the source said, but added that the appetite to acquire assets is not high.

The looser debt rules for state-owned developers was first reported by financial intelligence provider REDD, who said local governments including Shanghai and Guangdong held meetings with the developers last week to facilitate the M&A process.

REDD added policymakers asked the firms in mid-December to acquire assets from 11 private developers with liquidity issues to ease their financial stress.

Chinese property shares gained on Friday, with state-owned China Overseas Land listed in Hong Kong jumping 9% and state-backed China Resources Land rising over 7%.

Shimao Group was one of the few property stocks trading in the red, however, after the Shanghai-based developer defaulted on a trust loan payment and entered discussion to delay payments on asset-backed securities, underscoring the continued stress in China's property sector.

Shimao Group's unit Shanghai Shimao Construction has proposed extensions on maturities for two asset-backed securities (ABS) due this month totalling 1.17 billion yuan ($183.50 million), three sources with knowledge of the matter told Reuters.

The proposals would see the company repay 10% of the principal in January, 5% each month from February through November, and the remaining 40% in December, the three sources said.

One of the sources said that the company and ABS holders were currently in negotiations, but that the proposals were not likely to meet with approval from holders without credit enhancements.

"If the negotiations are not successful it will trigger cross-default clauses involving other bonds," the source said.

Shimao declined to comment.

News of attempts to delay ABS maturities, first reported by REDD, comes a day after a trust company, China Credit Trust Co, said that Shimao had defaulted on a loan after missing a 645 million yuan ($101.10 million) payment.

Shanghai Shimao Construction said in a filing on Friday that it was in talks with China Credit Trust to resolve the outstanding payment, and that the missed payment would not accelerate payment requests in the open bond market.

Shimao's Group's Hong Kong shares closed down 5.4%.

Shanghai exchange-traded bonds issued by its unit Shanghai Shimao Co tumbled more than 20%, triggering trading pauses over what the Shanghai Stock Exchange said was "abnormal fluctuations".

Its dollar bonds due Sept 2023, Feb 2024 and Jan 2025 fell between 9% to 11.6% in Asia afternoon hours.

($1 = 6.3760 yuan)

(Reporting by Shuyan Wang in Beijing, Steven Bian and Andrew Galbraith in Shanghai, and Clare Jim in Hong Kong; Editing by Edwina Gibbs and Jacqueline Wong)

Sat, January 8, 2022

Jobs growth in manufacturing slowed again in December, adding 26,000 new hires after a consensus estimate of 35,000, despite the overall pandemic-era unemployment rate being at 3.9%.

Since the pandemic began, manufacturing companies have brought back nearly 1.2 million jobs out of the 1.4 million jobs lost. In other words, according to the Bureau of Labor Statistics, the industry employs 219,000 fewer people today than it did in February 2020.

Manufacturing jobs in the U.S. have not yet caught up after the pandemic-induced recession. (Source: FRED)

Exacerbating the problem going forward, the industry is evolving rapidly and skilled workers are increasingly scarce.

"Manufacturing has an identity crisis," Paul Wellener, Vice Chairman, US Industrial Products & Construction Leader at Deloitte LLP, told Yahoo Finance (video above). "It's not your father or mother's dirty, dark and dangerous manufacturing anymore. It's really a high tech world out there with no jobs getting less technical."

Consequently, Wellener explained, the manufacturing industry "really does have some challenges as it relates to employment and workers. The jobs are there, but the question is: Where are the people?"

A worker arranges slabs in the factory at IceStone, a manufacturer of recycled glass countertops and surfaces, in New York City, New York, U.S., June 3, 2021. REUTERS/Andrew Kelly

'An opportunity for manufacturers'

Overall, with a record 4.5 million Americans voluntarily leaving their jobs in November and vacancies totaling to 10.562 million in the U.S., suggesting a lingering struggle for employers across industries to retain talent and find new workers.

At the same time, a skyrocketing demand for goods in 2021 caused ongoing supply chain disruptions and put even more pressure on manufacturers to find labor.

"The challenge for manufacturers I believe is to really make manufacturing attractive to the next generation to diverse populations that may not know about manufacturing as an opportunity," Wellener said adding that the situation is actually "an opportunity for manufacturers to continue to sell their business to the employee population out there."

A worker pours hot metal at the Kirsh Foundry in Beaver Dam, Wisconsin, U.S., April 12, 2018. Picture taken April 12, 2018.

A recent survey by Deloitte found that 38% of executives reported that attracting new workers is their top priority for the production workforce in 2022, followed by retention (31%) and re-skilling (13%).

"Number one, for manufacturers, they need to put their arms around their employees and hug them and tell them how great they are and help them get the skills that are needed for the next set of jobs here into the late 2020s and early 2030s," Wellener said.

A previous report last year by Deloitte found as many as 2.1 million manufacturing jobs will be unfilled through 2030, warning that the worker shortage would hurt revenue, production and could ultimately cost the US economy up to $1 trillion by 2030.

"We've gotta think about is how we prepare the workers that aren't in manufacturing, whether it's through apprentice programs or other kinds of programs," Wellener said. "How do we prepare them for this technologically determined future?"

Alan Ramadan, a refugee from Syria who came to Germany in 2012, attends a job training program as an industrial mechanic at a manufacturing plant of U.S. company Johnson Controls International on April 30, 2019 in Hanover, Germany.

Manufacturing companies are also doubling down on technological investments: New orders of manufacturing technology totaled $571.5 million in October 2021, according to the data from AMT– The Association for Manufacturing Technology.

"This is all really positive automation," Chris Snyder, equity analyst at UBS Bank, told Yahoo Finance in a phone interview. "Companies are investing in supply chain resiliency."

Snyder added that "on the margin, this incentivizes companies to reshore because you're like, okay, well, What's the cost of producing in China?"

That rise in domestic production leads to further demand for skilled workers in the U.S.

"That's gonna be a continued trend," Wellener said. "It is gonna be bringing back jobs that are frankly more highly skilled, more technical, and there are gonna be jobs that are gonna be those well-paying long-term jobs that fit into our manufacturing society."