Banks saddled with US$30B in unwanted debt in risk exodus

, Bloomberg News

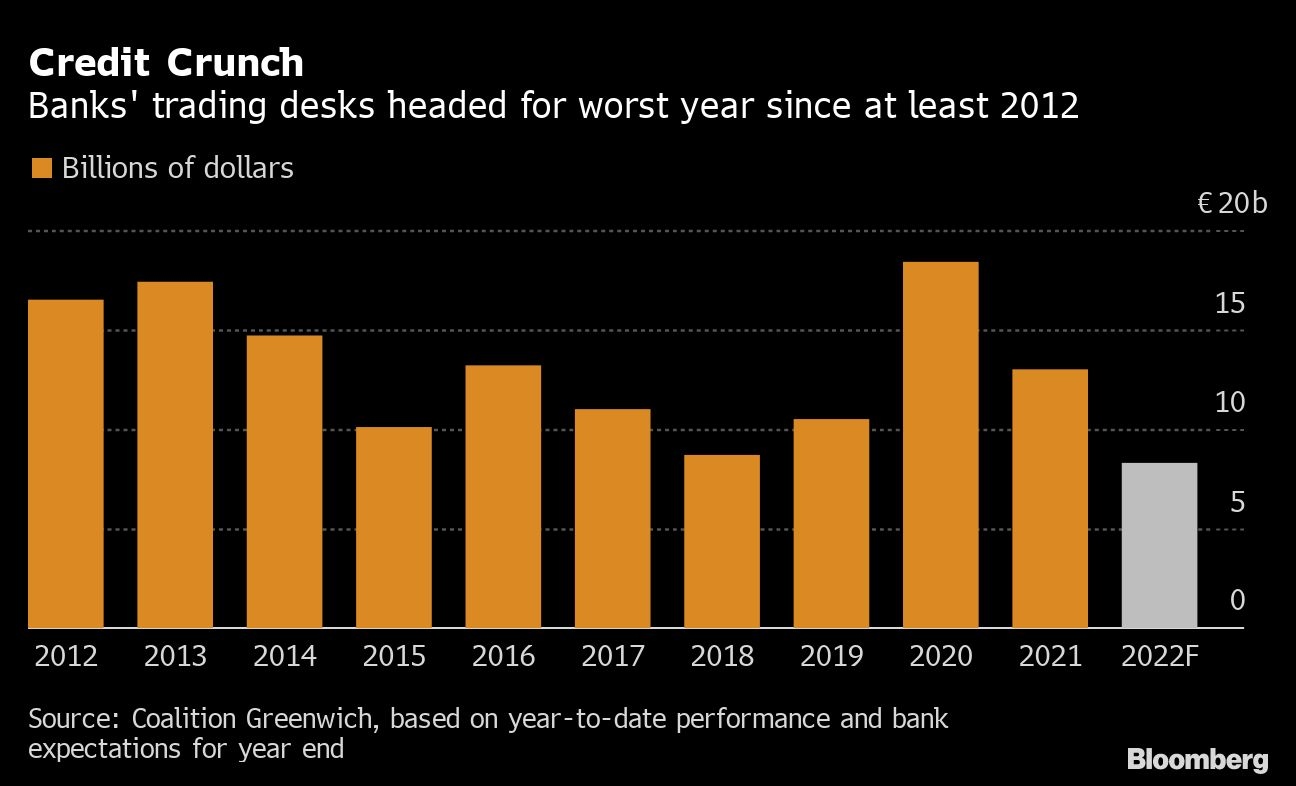

The world's biggest banks have already had to use about US$30 billion of their own cash this year to fund loans for acquisitions and buyouts that they weren't able to offload to investors.

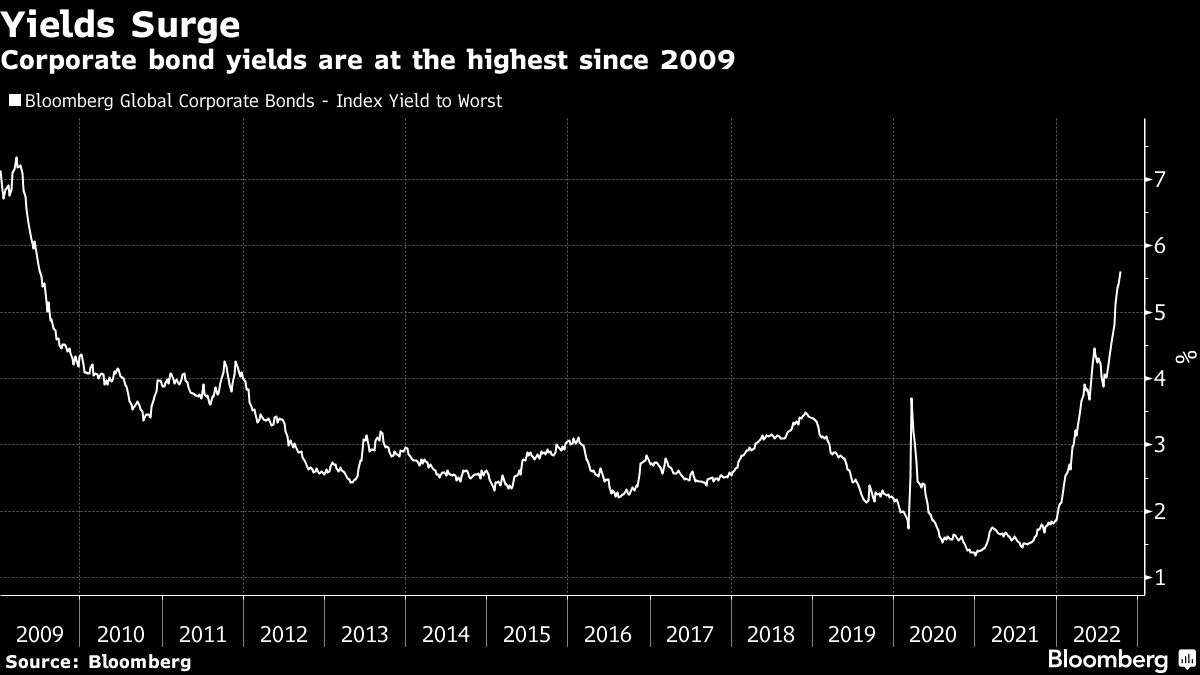

The lenders have been forced to fund at least 15 deals in the U.S. and Europe as inflation and risk of a recession evaporates investor appetite for risky corporate debt. The total tally, based on calculations using data sourced by Bloomberg, could nearly double over the coming months as more deals are scheduled to close.

While it's not uncommon for banks to self-fund deals when market sentiment sours, the sheer amount of hung debt -- including US$3.9 billion for Apollo Global Management Inc.'s purchase of Brightspeed and more than US$8 billion for a buyout of Nielsen Holdings Plc -- is deterring banks from making new financing commitments.

A US$28.7 Billion Pile of Hung Debt | Nielsen buyout among most notable deals stuck on banks' books in 2022

“Risk departments are going to be loathe to allow banks to make additional commitments and balance-sheet risks going forward,” said Steven Oh, global head of leveraged finance at Pinebridge Investments LLC. “There still are going to be some LBO transactions, but it's going to be hard because it's going to be more costly -- and the banks themselves are less likely to provide guaranteed underwriting.”

That's a problem as private-equity sponsors sit on a mountain of deployable capital and fear of a recession ripens public markets for takeovers. Private-equity funds had about US$1.2 trillion on hand as of mid-2022, according to data from Pitchbook.

Moreover, banks have about US$43 billion of U.S. high-yield bonds and leveraged loans in the pipeline, with about US$30 billion expected to launch by the end of the year, according to an Oct. 17 report by Deutsche Bank AG.

That includes the US$12.5 billion original financing package for Elon Musk's buyout of Twitter Inc., which banks led by Morgan Stanley are on the hook to fund, as well as US$5 billion of debt for Apollo's buyout of Tenneco Inc.

In Europe, underwriters are sitting on €1.5 billion (US$1.5 billion) of term loans to fund the buyout of Unilever's tea business Ekaterra, which has yet to launch. Earlier this month, banks led by ING Bank NV pulled a €274.3 million loan supporting Dutch-based artificial grass maker TenCate Grass Holding BV's takeover of Hellas Construction Inc.

Even as Asia's fledgling leveraged loan business booms, a takeover of Toshiba Corp. -- which could be the region's biggest buyout this year -- is at risk of slipping behind schedule. Bidding groups are struggling to secure financing commitments from banks, Bloomberg reported earlier this week.

LOOKING ELSEWHERE

With the amount of hung debt already in the tens of billions, some are looking to private credit markets to fill any gaps -- though there's also been some pullback there as well.

Still, the year is providing a once-in-a-generation opportunity for private credit to increase market share, said Todd Koretzky, a partner in the leveraged finance group at Allen & Overy.

“It's a perfect storm of opportunity and readiness,” he said. “The moment that the broadly-syndicated market was dislocated, the private credit funds were ready with large amounts of capital and the ability to write checks.”

Sponsors have also embraced other maneuvers. Private-equity firms have announced new acquisitions in recent weeks without debt financing in place, effectively backstopping the entire purchase price with cash from their own funds.

Elsewhere in credit markets:

EMEA

- There are five deals in Europe's primary market on Thursday, which will take the weekly sales tally beyond 27 billion euros.

- Among the day's issuers is Latvia with a euro note maturing in 2027 and a senior note from Cooperatieve Rabobank UA

- Bankers are starting to analyze all the ways in which climate change will affect the value of their trading operations, according to a joint study by the International Swaps and Derivatives Association and Ernst & Young

- UniCredit SpA has put a package of about €1.5 billion in unlikely-to-pay and non-performing loans up for sale, MF reports without citing anyone

Asia

- China's high-yield dollar bonds declined Thursday amid gains in sovereign-debt yields across Asia and falling equity prices as inflation worries persist.

- The cost of insuring bonds against default rose for a second day in Asia as debt yields climbed on concern that strong inflation and aggressive rate hikes will weigh on global economic growth

- Asia issuers still have strong interest in selling ESG notes despite the global bond rout that's curtailed supply this year, said Madhur Agarwal, JPMorgan's head of DCM origination for Asia ex-Japan. The bank said at a Wednesday press briefing it expects ESG notes to make up 35-40 per cent of the region's sovereign, corporate and bank issuance in 2023

Americas

- Three borrowers combined to price US$6.5 billion Wednesday, navigating a weaker broader backdrop compared with trading days earlier this week.

- Weekly volume in the US high-grade market has topped US$15 billion and the most in four weeks, as a rare thawing in the volatility-lashed debt market prompted well-known companies to rush to get deals done before things get even worse

- In the high-yield market, cruise line operator Carnival Corp. raised more money than first anticipated and at a lower cost. It pulled in nearly US$5 billion of orders for a US$2 billion note, with the deal pricing at the lower end of revised price talk