CRIMINAL CRYPTO-CAPITALI$M

Fallout from crypto exchange FTX's collapse shows importance of regulation: Experts

, The Canadian Press

The rapid collapse of crypto-exchange giant FTX shows the importance for the sector to be regulated, something that Canada has helped lead the way on, experts say.

Canada has numerous safeguards in place that would help prevent some of the alleged practices that went on at FTX, including the use of client funds for company trading, said Ryan Clements, chair in business law and regulation at the University of Calgary's Faculty of Law.

"We actually have in this country quite a robust regulatory framework that was created after Quadriga," said Clements, referring to the Canadian crypto exchange that collapsed in 2018, leading to $169 million in customer assets lost.

In an review compiled after Quadriga's downfall, the Ontario Securities Commission found its founder had committed fraud and the company operated like a Ponzi scheme.

"What happened at Quadriga was an old-fashioned fraud wrapped in modern technology," the OSC said in its 2020 report.

Clements said regulators rolled out changes after Quadriga's downfall, including rules around third parties holding crypto assets, the need for insurance and limits on what can be traded, all of which can benefit investors, said Clements.

"It's designed to provide both custodial and other prudential measures for crypto asset trading platforms, but also marketplace controls, also things like client cash segregation and conflict avoidance measures."

Canadian exchanges have been emphasizing their adherence to these measures in recent days as they try and distance themselves from the likes of FTX.

"Although some see regulation as overreaching, it plays a critical role in ensuring that these tragedies do not happen," said Coinsquare chief executive Martin Piszel in a statement.

"While we were working with regulators, building out regulatory technology and compliance infrastructure, our global competitors were launching products like 100x margin, unregulated derivatives products, and lending out client assets," he said, noting that Coinsquare is the first crypto trading platform registered through the Investment Industry Regulatory Organization of Canada.

"All of us have now seen the results of some of these experiments," Piszel said.

While Canadian efforts are ahead in some ways, regulators may need to put more effort into cracking down on access to international exchanges, said Clements, which provide riskier trades and less oversight.

"If you're a Canadian you should be using a registered trading platform. Because there are better controls for you. Right, the problem is these huge offshore platforms ... just because something bigger and just because something has celebrity endorsements doesn't necessarily mean it's safer."

The FTX issues show some clear flaws in the wider crypto sector, said Henry Kim, an associate professor at York University's Schulich School of Business and director of the school's Blockchain.Lab.

"It says there's not enough regulation. It says that it's too centralized. It says that it's basically we still don't have enough grown-ups in the room."

He advised that those in the crypto space should assess what their goals are, and if they're more of an investor where they'll buy and hold for the long term they should aim for the most established exchanges.

"If you're going to be an investor, then do your research and be at the most blue-chip exchanges."

The collapse of FTX, which was one of the world's crypto exchange before it fell apart, shows how difficult that research can be, and how much of a wider impact this development will have.

"There's a contagion effect because FTX was the gold standard, because they were heavily involved with investment," said Kim.

Several Canadian crypto companies have already announced some knock-on effects from FTX.

Calgary-based Bitvo Inc. announced in June that FTX was going to buy it for an undisclosed sum. On Monday, the company clarified that the transaction has not closed and it remains independent from the FTX group of companies.

The company also emphasized that it operates on a full reserve basis and in compliance with Canadian regulations.

For those who are losing faith in exchanges there is always the option of not holding cryptocurrency on an exchange, but Kim warns that with the risks of physical theft and lost passwords and other issues it's not to be taken casually either.

"For those that are really, really savvy, they can still hold crypto in their wallets, but you have to be pretty savvy. You have to know what you're doing. And I wouldn't advise that unless you do."

, The Canadian Press

The rapid collapse of crypto-exchange giant FTX shows the importance for the sector to be regulated, something that Canada has helped lead the way on, experts say.

Canada has numerous safeguards in place that would help prevent some of the alleged practices that went on at FTX, including the use of client funds for company trading, said Ryan Clements, chair in business law and regulation at the University of Calgary's Faculty of Law.

"We actually have in this country quite a robust regulatory framework that was created after Quadriga," said Clements, referring to the Canadian crypto exchange that collapsed in 2018, leading to $169 million in customer assets lost.

In an review compiled after Quadriga's downfall, the Ontario Securities Commission found its founder had committed fraud and the company operated like a Ponzi scheme.

"What happened at Quadriga was an old-fashioned fraud wrapped in modern technology," the OSC said in its 2020 report.

Clements said regulators rolled out changes after Quadriga's downfall, including rules around third parties holding crypto assets, the need for insurance and limits on what can be traded, all of which can benefit investors, said Clements.

"It's designed to provide both custodial and other prudential measures for crypto asset trading platforms, but also marketplace controls, also things like client cash segregation and conflict avoidance measures."

Canadian exchanges have been emphasizing their adherence to these measures in recent days as they try and distance themselves from the likes of FTX.

"Although some see regulation as overreaching, it plays a critical role in ensuring that these tragedies do not happen," said Coinsquare chief executive Martin Piszel in a statement.

"While we were working with regulators, building out regulatory technology and compliance infrastructure, our global competitors were launching products like 100x margin, unregulated derivatives products, and lending out client assets," he said, noting that Coinsquare is the first crypto trading platform registered through the Investment Industry Regulatory Organization of Canada.

"All of us have now seen the results of some of these experiments," Piszel said.

While Canadian efforts are ahead in some ways, regulators may need to put more effort into cracking down on access to international exchanges, said Clements, which provide riskier trades and less oversight.

"If you're a Canadian you should be using a registered trading platform. Because there are better controls for you. Right, the problem is these huge offshore platforms ... just because something bigger and just because something has celebrity endorsements doesn't necessarily mean it's safer."

The FTX issues show some clear flaws in the wider crypto sector, said Henry Kim, an associate professor at York University's Schulich School of Business and director of the school's Blockchain.Lab.

"It says there's not enough regulation. It says that it's too centralized. It says that it's basically we still don't have enough grown-ups in the room."

He advised that those in the crypto space should assess what their goals are, and if they're more of an investor where they'll buy and hold for the long term they should aim for the most established exchanges.

"If you're going to be an investor, then do your research and be at the most blue-chip exchanges."

The collapse of FTX, which was one of the world's crypto exchange before it fell apart, shows how difficult that research can be, and how much of a wider impact this development will have.

"There's a contagion effect because FTX was the gold standard, because they were heavily involved with investment," said Kim.

Several Canadian crypto companies have already announced some knock-on effects from FTX.

Calgary-based Bitvo Inc. announced in June that FTX was going to buy it for an undisclosed sum. On Monday, the company clarified that the transaction has not closed and it remains independent from the FTX group of companies.

The company also emphasized that it operates on a full reserve basis and in compliance with Canadian regulations.

For those who are losing faith in exchanges there is always the option of not holding cryptocurrency on an exchange, but Kim warns that with the risks of physical theft and lost passwords and other issues it's not to be taken casually either.

"For those that are really, really savvy, they can still hold crypto in their wallets, but you have to be pretty savvy. You have to know what you're doing. And I wouldn't advise that unless you do."

FTX fiasco sparks billions of dollars of outflows from exchanges

, Bloomberg News

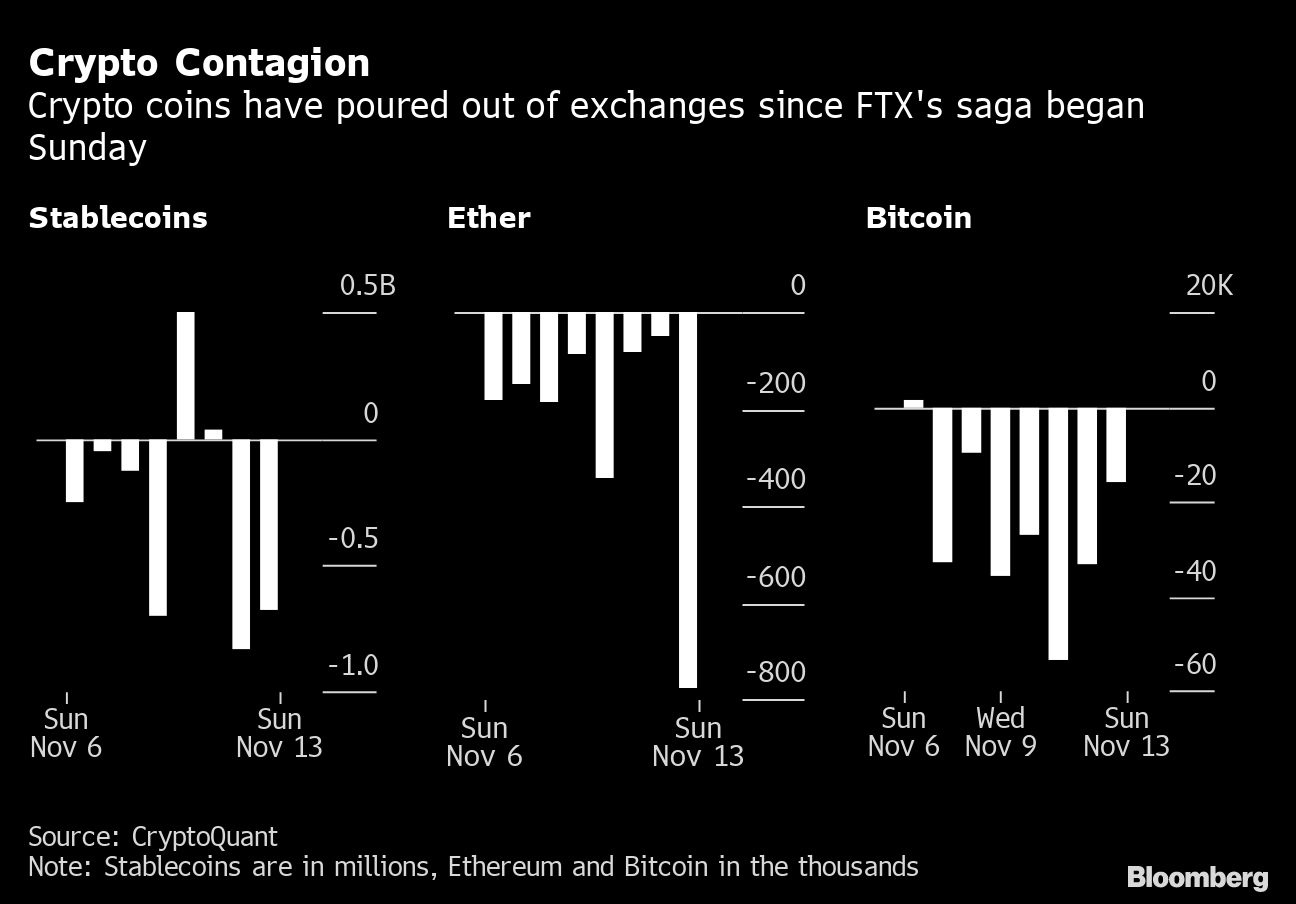

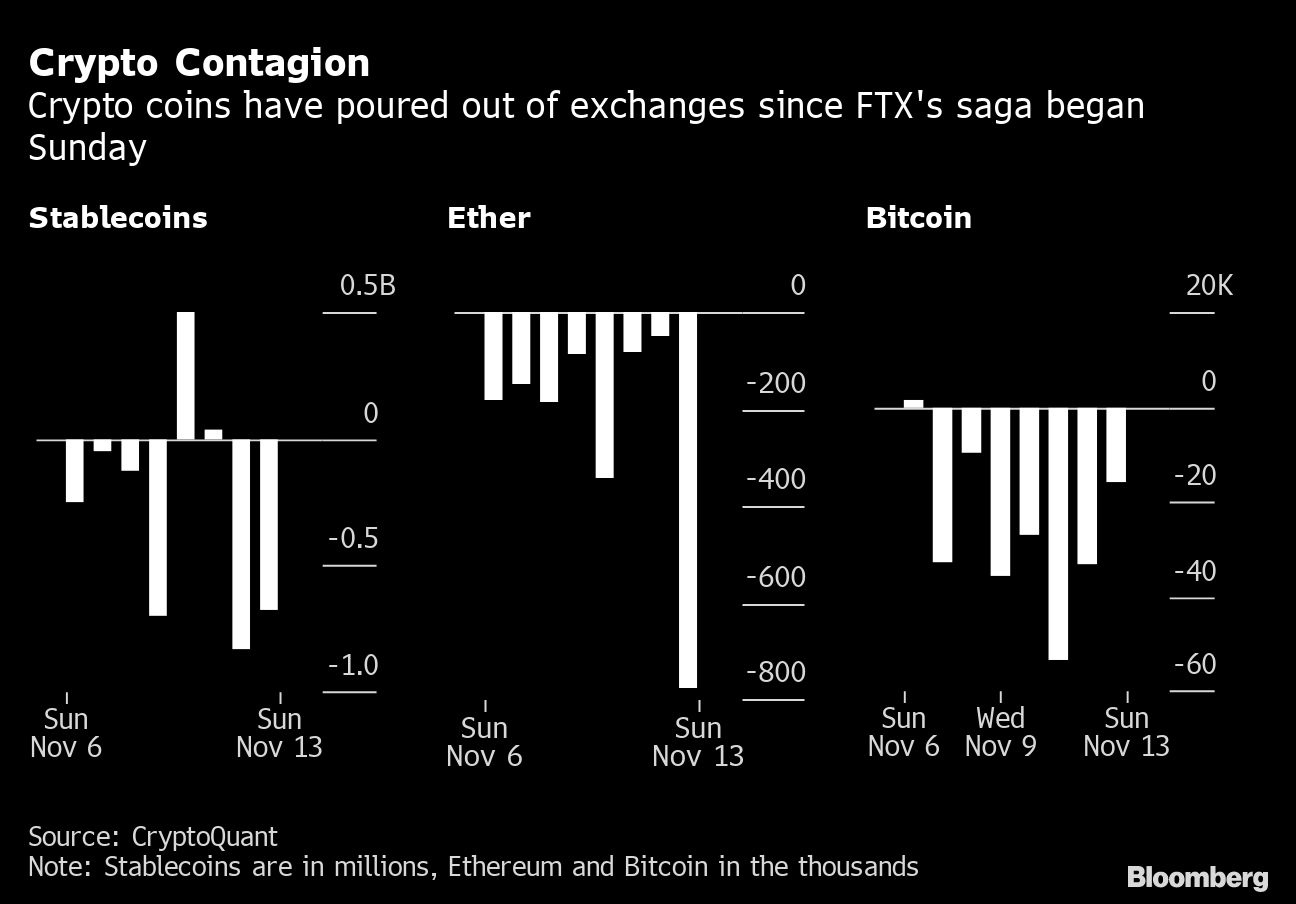

The spectacular collapse of 30-year-old Sam Bankman-Fried's crypto empire has fueled a spike in outflows across global crypto exchanges. Users yanked a net $3.7 billion worth of Bitcoin and $2.5 billion of Ether in the week from Sunday, Nov. 6 to Sunday, Nov. 13, according to data provider CryptoQuant.

They withdrew more than $2 billion worth of many of the largest stablecoins over the same timeframe, according to CryptoQuant, which tracks data from most major exchanges.

The past week has “undoubtedly been one of the darkest in the history of cryptocurrency,” said Sasha Ivanov, founder of blockchain platform Waves, in a statement. “It's disheartening to see the value of this fundamental technology diminished due to the collapse of what many felt was a leading exchange.”

The fall of Bahamas-based FTX, which just recently was widely perceived as among the most dependable names in the sector, has sparked fresh concerns over the loosely-regulated nature of crypto companies and what guardrails are in place to safely oversee clients' assets. FTX is the latest in a long list of large crypto businesses to come undone this year, including hedge fund Three Arrows Capital, crypto lender Celsius Network and broker Voyager Digital.

The saga started on Sunday, Nov. 6 when a tweet from Binance's “CZ” cast doubt on the strength of Alameda Research, the trading firm affiliated with Bankman-Fried's exchange. The ensuing panic among FTX.com's investors became so intense that they collectively pulled $430 million worth of Bitcoin from the three-year-old exchange in just four days. The company had held more than 20,000 Bitcoin going into Nov. 6, CryptoQuant data shows. That sank to nearly zero by Wednesday, Nov. 9 as customers fled over worries about FTX's financial health.

Binance proposing a tentative takeover of the exchange and then backtracking on the offer during this time didn't help matters. On Thursday, Bankman-Fried tweeted that Alameda Research would be shuttered and by Friday, FTX Group had begun bankruptcy proceedings.

The leveling of another centralized crypto player in 2022 is emboldening calls for users to hold their own assets, rather than entrusting them to third-parties.

“This is the latest and biggest failure of a centralized entity in crypto and it could mark the bitter end of their existence,” stated Ivanov. “The foundation of cryptocurrency is decentralized blockchain technology and I expect this downturn to result in the industry switching focus back to those core values.”

Since last week, crypto exchanges like OKX, KuCoin, Poloniex and Huobi have vowed to increase transparency and share their so-called “proof of reserves.” Binance published a list of some of its wallets and holdings on Thursday.

Cryptocurrency prices erased losses on Monday morning in London after Binance Holdings Ltd.'s Chief Executive Changpeng Zhao said his exchange plans to set up an industry recovery fund. Trading has been extremely volatile since FTX's unraveling began, erasing $244 billion of value since last Sunday, CoinGecko data shows.

, Bloomberg News

The spectacular collapse of 30-year-old Sam Bankman-Fried's crypto empire has fueled a spike in outflows across global crypto exchanges. Users yanked a net $3.7 billion worth of Bitcoin and $2.5 billion of Ether in the week from Sunday, Nov. 6 to Sunday, Nov. 13, according to data provider CryptoQuant.

They withdrew more than $2 billion worth of many of the largest stablecoins over the same timeframe, according to CryptoQuant, which tracks data from most major exchanges.

The past week has “undoubtedly been one of the darkest in the history of cryptocurrency,” said Sasha Ivanov, founder of blockchain platform Waves, in a statement. “It's disheartening to see the value of this fundamental technology diminished due to the collapse of what many felt was a leading exchange.”

The fall of Bahamas-based FTX, which just recently was widely perceived as among the most dependable names in the sector, has sparked fresh concerns over the loosely-regulated nature of crypto companies and what guardrails are in place to safely oversee clients' assets. FTX is the latest in a long list of large crypto businesses to come undone this year, including hedge fund Three Arrows Capital, crypto lender Celsius Network and broker Voyager Digital.

The saga started on Sunday, Nov. 6 when a tweet from Binance's “CZ” cast doubt on the strength of Alameda Research, the trading firm affiliated with Bankman-Fried's exchange. The ensuing panic among FTX.com's investors became so intense that they collectively pulled $430 million worth of Bitcoin from the three-year-old exchange in just four days. The company had held more than 20,000 Bitcoin going into Nov. 6, CryptoQuant data shows. That sank to nearly zero by Wednesday, Nov. 9 as customers fled over worries about FTX's financial health.

Binance proposing a tentative takeover of the exchange and then backtracking on the offer during this time didn't help matters. On Thursday, Bankman-Fried tweeted that Alameda Research would be shuttered and by Friday, FTX Group had begun bankruptcy proceedings.

The leveling of another centralized crypto player in 2022 is emboldening calls for users to hold their own assets, rather than entrusting them to third-parties.

“This is the latest and biggest failure of a centralized entity in crypto and it could mark the bitter end of their existence,” stated Ivanov. “The foundation of cryptocurrency is decentralized blockchain technology and I expect this downturn to result in the industry switching focus back to those core values.”

Since last week, crypto exchanges like OKX, KuCoin, Poloniex and Huobi have vowed to increase transparency and share their so-called “proof of reserves.” Binance published a list of some of its wallets and holdings on Thursday.

Cryptocurrency prices erased losses on Monday morning in London after Binance Holdings Ltd.'s Chief Executive Changpeng Zhao said his exchange plans to set up an industry recovery fund. Trading has been extremely volatile since FTX's unraveling began, erasing $244 billion of value since last Sunday, CoinGecko data shows.

Sam Bankman-Fried’s downfall sends shockwaves through crypto

THE ASSOCIATED PRESS

November 14, 2022

NEW YORK--Sam Bankman-Fried received numerous plaudits as he rapidly achieved superstar status as the head of cryptocurrency exchange FTX: the savior of crypto, the newest force in Democratic politics and potentially the world’s first trillionaire.

Now the comments about the 30-year-old Bankman-Fried aren’t so kind after FTX filed for bankruptcy protection Friday, leaving his investors and customers feeling duped and many others in the crypto world fearing the repercussions. Bankman-Fried himself could face civil or criminal charges.

“Sam what have you done?” tweeted Sean Ryan Evans, host of the cryptocurrency podcast Bankless, after the bankruptcy filing.

Under Bankman-Fried, FTX quickly grew to be the third-largest exchange by volume. The stunning collapse of this nascent empire has sent tsunami-like waves through the cryptocurrency industry, which has seen a fair share of volatility and turmoil this year, including a sharp decline in price for bitcoin and other digital assets. For some, the events are reminiscent of the domino-like failures of Wall Street firms during the 2008 financial crisis, particularly now that supposedly healthy firms like FTX are failing.

One venture capital fund wrote down investments in FTX worth over $200 million. The cryptocurrency lender BlockFi paused client withdrawals Friday after FTX sought bankruptcy protection. The Singapore-based exchange Crypto.com saw withdrawals increase this weekend for internal reasons but some of the action could be attributed to raw nerves from FTX.

Bankman-Fried and his company are under investigation by the Department of Justice and the Securities and Exchange Commission. The investigations likely center on the possibility that the firm may have used customers’ deposits to fund bets at Bankman-Fried’s hedge fund, Alameda Research, a violation of U.S. securities law.

“This is the direct result of a rogue actor breaking every single basic rule of fiscal responsibility,” said Patrick Hillman, chief strategy officer at Binance, FTX’s biggest competitor. Early last week Binance appeared ready to step in to bail out FTX but backed away after a review of FTX’s books.

The ultimate impact of FTX’s bankruptcy is uncertain, but its failure will likely result in the destruction of billions of dollars of wealth and even more skepticism for cryptocurrencies at a time when the industry could use a vote of confidence.

“I care because it’s retail investors who suffer the most, and because too many people still wrongly associate bitcoin with the scammy ‘crypto’ space,” said Cory Klippsten, CEO of Swan Bitcoin, who for months raised concerns about FTX’s business model. Klippsten is publicly enthusiastic about bitcoin but has long had deep skepticism about other parts of the crypto universe.

Bankman-Fried founded FTX in 2019, and it grew rapidly — it was recently valued at $32 billion. The son of Stanford University professors, who was known to play the video game “League of Legends” during meetings, Bankman-Fried attracted investments from the highest echelons of Silicon Valley.

Sequoia Capital, which invested in Apple, Cisco, Google, Airbnb and YouTube, described their meeting with Bankman-Fried as likely “talking to the world’s first trillionaire.” Several of Sequoia’s partners became enthusiastic about Bankman-Fried following a Zoom meeting in 2021. After several more meetings, Sequoia decided to invest in the company.

“I don’t know how I know, I just do. SBF is a winner,” wrote Adam Fisher, a business journalist who wrote a profile of Bankman-Fried for the firm, referring to Bankman-Fried by his popular online moniker. The article, published in late September, was removed from Sequoia’s website.

Sequoia has written down its $213 million in investments to zero. A pension fund in Ontario, Canada wrote down its investment to zero as well.

In a terse statement, the Ontario Teachers’ Pension Fund said, “Naturally, not all of the investments in this early-stage asset class perform to expectations.”

But up until last week, Bankman-Fried was seen as a white knight for the industry. Whenever the crypto industry had one of its crises, Bankman-Fried was the person likely to fly in with a rescue plan. When online trading platform Robinhood was in financial straits earlier this year--collateral damage from the decline in stock and crypto prices--Bankman-Fried jumped in to buy a stake in the company as a sign of support.

When Bankman-Fried bought up the assets of bankrupt crypto firm Voyager Digital for $1.4 billion this summer, it brought a sense of relief to Voyager account holders, whose assets has been frozen since its own failure. That rescue is now in question.

As king of crypto, his influence was starting to pour into political and popular culture. FTX bought prominent sports sponsorships with Formula Racing and bought the naming rights to an arena in Miami. He pledged to donate $1 billion toward Democrats this election cycle--his actual donations were in the tens of millions--and prominent politicians like Bill Clinton were invited to speak at FTX conferences. Football star Tom Brady invested in FTX.

Bankman-Fried had been the subject of some criticism before FTX collapsed. While he largely operated FTX out of U.S. jurisdiction from his headquarters in The Bahamas, Bankman-Fried was increasingly vocal about the need for more regulation of the cryptocurrency industry. Many supporters of crypto oppose government oversight. Now, FTX’s collapse may have helped make the case for stricter regulation.

One of those critics was Binance founder and CEO Changpeng Zhao. The feud between the two billionaires spilled out onto Twitter, where Zhao and Bankman-Fried collectively commanded millions of followers. Zhao helped kickstart the withdrawals that doomed FTX when he said Binance would sell its holdings in FTX’s crypto token FTT.

“What a s**t show ... and it’s going to be crypto’s fault (instead of one guys’s fault),” Zhao wrote on Twitter on Saturday.

The rapid collapse of cryptocurrency exchange FTX into bankruptcy last week has also shaken the world of philanthropy, due to the donations and influence of FTX founder Sam Bankman-Fried in the “effective altruism” movement

THALIA BEATY and GLENN GAMBOA

November 14, 2022,

FILE - Signage for the FTX Arena, where the Miami Heat basketball team plays, is illuminated on Saturday, Nov. 12, 2022, in Miami. The rapid collapse of cryptocurrency exchange FTX into bankruptcy last week has also shaken the world of philanthropy, due...Show more

The Associated Press

NEW YORK -- The rapid collapse of cryptocurrency exchange FTX into bankruptcy last week has also shaken the world of philanthropy, due to the donations and influence of FTX founder Sam Bankman-Fried in the “effective altruism” movement.

The FTX Foundation -- and other related nonprofits mostly funded by Bankman-Fried and other top FTX executives – says it has donated $190 million to numerous causes. Earlier this year, the foundation’s Future Fund announced plans to donate an additional $100 million, with hopes of donating up to $1 billion in 2022. Because of the bankruptcy, that won't be happening now.

And donations to numerous nonprofits, even those that have already received money from groups related to Bankman-Fried, are now in doubt.

FTX, the hedge fund Alameda Research, and dozens of other affiliated companies sought bankruptcy protection in Delaware Friday after the exchange experienced the crypto equivalent of a bank run. Customers tried to remove billions of dollars from the exchange after becoming concerned about whether FTX had sufficient capital.

Bankman-Fried has resigned from the company. His net worth, estimated earlier this year at $24 billion, has all but evaporated, according to Forbes and Bloomberg, which closely track the net worth of the world’s richest people.

On Thursday night, FTX Future Fund’s leadership team resigned, warning grantees that they were unlikely to pay out promised funds.

“We are devastated to say that it looks likely that there are many committed grants that the Future Fund will be unable to honor,” the team wrote in a joint post in the Effective Altruism Forum. “We are so sorry that it has come to this.”

ProPublica, the investigative journalism nonprofit, said it has been told by Building a Stronger Future, a foundation funded by Bankman-Fried, that the remaining two-thirds of its $5 million grant to report on pandemic preparedness and biothreats is now on hold.

ProPublica received one-third of the grant in February and expected one-third annually until 2024. The nonprofit said Building a Stronger Future is assessing its finances and that it was talking to other funders about taking on some of its grant portfolio.

“Regardless of what happens with the remainder of the grant, we are deeply committed to this important work and the team we have assembled to pursue it,” the nonprofit said in a statement. “We will use other resources to make sure that work continues.”

Bankman-Fried, 30, is the best-known proponent of the “effective altruism” social movement which believes in prioritizing donations to projects that will have the largest impact on the most number of people. Dustin Moskovitz, co-founder of Facebook and current Asana CEO and co-founder, and his wife Cari Tuna, are also major funders and backers of the movement, which also emphasizes that the lives of all people should be weighted equally, regardless of where they live now or if they will inhabit the earth generations in the future.

“I wanted to get rich, not because I like money but because I wanted to give that money to charity,” Bankman-Fried told an interviewer in a YouTube video called “ The Most Generous Billionaire,” published in January last year.

His ability to promote himself and FTX gave the exchange a higher profile than larger companies. FTX purchase the naming rights to the Miami Heat's home arena last year, though Miami-Dade County decided Friday to terminate its relationship with the company and rename the arena. It purchased a buzzed-about ad during this year's Super Bowl.

Bankman-Fried did set up a philanthropic infrastructure through his exchange, FTX, which promised that 1% of its crypto exchange fees would be donated to charities. It also matched user donations made through its platform up to $10,000 a day. In total, the company said more than $24 million was donated through user fees, donations and its matching program before it suspended its services.

Some “effective altruism” proponents advance the idea that making a lot of money is ethical as long as your goal is ultimately to give it away — sometimes shortened to “earning to give.” Bankman-Fried believed in this, signing The Giving Pledge in June as a promise that he would give away the majority of his wealth.

However, some now blame Bankman-Fried's “effective altruism” mindset for FTX’s troubles.

“Either ('effective altruism') encouraged Sam’s unethical behavior, or provided a convenient rationalization for such actions,” tweeted Moskovitz, who has also signed The Giving Pledge. “Either is bad.”

William MacAskill, a philosophy professor at Oxford University and a co-founder of the “effective altruism” movement, condemned Bankman-Fried for allegedly misusing customer funds.

“Sam and FTX had a lot of goodwill,” MacAskill, who was also an unpaid advisor to the FTX Future Fund, wrote in a thread on Twitter. “And some of that goodwill was the result of association with ideas I have spent my career promoting. If that goodwill laundered fraud, I am ashamed.”

MacAskill’s book, “What We Owe The Future,” prompted a wave of media coverage of the “effective altruism” movement this summer.

Requests for comment were sent to the largest grantees listed on the FTX Future Fund’s website, including other “effective altruism” advocates like the Long-Term Future Fund and the Centre for Effective Altruism and Longview.

In an interview with The Associated Press in May, Nick Beckstead, the CEO of FTX Foundation until he resigned Thursday, said there were about five people working at the foundation and that they were still working out how the various philanthropic projects started by Bankman-Fried would be structured.

“It’s a bit shoestring,” he said.

The community grew out of the work of philosophers at Oxford, including MacAskill, and debates of the merits of approaches and proposals on forums reflect the high-flying thinking of its origins.

Beckstead acknowledged the community can be “strange and intense,” but also that its emphasis on quantifying impact helps decide where to direct donations. Beckstead did not immediately respond to a request for comment.

“What is the cost per life saved or what is the cost per quality adjusted life year from this kind of activity?,” he previously said were some of the questions he likes to try to answer, drawing on input from subject matter experts.

—————

Associated Press coverage of philanthropy and nonprofits receives support through the AP’s collaboration with The Conversation US, with funding from Lilly Endowment Inc. The AP is solely responsible for this content. For all of AP’s philanthropy coverage, visit https://apnews.com/hub/philanthropy

Exclusive: An inside look at FTX's financials ahead of its bankruptcy filing

As FTX Trading Ltd. was filing for Chapter 11 bankruptcy in the U.S. on Friday, investors were still reviewing the company’s private financial documents.

Those reviews follow a frenzied week of discussions between the company’s founder – and now former chief executive officer – Sam Bankman-Fried and potential investors in an attempt to save the cryptocurrency exchange business.

“FTX is raising roughly $6-10 billion of liquidity this week. We are very open to structures here, and can be flexible,” one of the documents from an online data room reads.

FTX’s Chapter 11 filing said that approximately 130 affiliated companies have commenced voluntary proceedings. But the crisis has ensnared many others outside its immediate circle such as lender BlockFi, a troubled digital-asset lender once worth US$3 billion but which has now limited activity on its platform. The company paused client withdrawals late Thursday, citing “a lack of clarity” over the status of FTX US as well as the uncertainty afflicting FTX.com and sister trading house Alameda Research.

According to multiple sources who were in direct contact with Bankman-Fried in the past 24 hours, an inside look at FTX’s financial picture left them surprised, considering the once high flying cryptocurrency trading platform had been valued at US$25 billion last year.

“This data room was put together quickly,” said one source who had engaged with FTX in the past day. “There were some huge demands put on Sam. He is under extreme stress.”

Some of that can be seen in the documents, which were obtained by BNN Bloomberg through multiple sources.

“These are rough values, and could be slightly off,” one statement reads, in regards to the company’s balance sheet. “There is also obviously a chance of typos, etc,” the Microsoft Excel spreadsheet authored by Bankman-Fried goes on to say.

The Excel document also includes another mea culpa from Bankman-Fried following an itemized breakdown of FTX’s financial assets and cryptocurrency holdings that show the company has nearly US$9 billion in liabilities and about US$900 million in liquid assets on its balance sheet.

“There were many things I wish I could do differently than I did, but the largest are represented by these two things: the poorly labeled internal bank-related acount (sic), and the size of customer withdrawals during a run on the bank,” according to the document.

Nov 11, 2022

Despite FTX crisis, it's not the end for the crypto sector, says industry insider

The Canadian Press

It's been a wild week in the crypto market following the collapse of exchange platform FTX, but an industry insider says that while the situation is probably one of the most unfortunate events in the history of the asset class, it's not the end for the sector.

Crypto prices sank dramatically after rival exchange platform Binance pulled out of a deal to purchase FTX earlier this week, citing significant concerns around reports of mishandled funds and regulatory investigations.

And on Friday, FTX filed for bankruptcy and CEO Sam Bankman-Fried stepped down.

FTX was valued earlier this year at US$32 billion.

Brian Mosoff, chief executive at Ether Capital, a Toronto-based firm that provides investors access to the cryptocurrency ethereum, said even though retail investors are on edge due to uncertainty around the worth of crypto assets, those that understand the technology that underpins cryptocurrencies -- blockchain -- likely believe that the sector still has potential.

"I don't think that people are thinking that the space goes away. I do think investors recognize that the sector is here to stay," he said "What it looks like and who the players are, those are different questions."

This year hasn't been particularly great for the crypto market in general, with the price of bitcoin tumbling significantly after reaching an all-time high of over US$68,000 in November of last year.

The digital asset industry saw nearly US$2 trillion in market value wiped out in the first few months of the year -- a staggering US$300 billion during the week of May 9 alone.

Bitcoin was trading at US$16,790.40 on Friday afternoon. The cryptocurrency is down more than 19 per cent over the past five days.

Mosoff said this year will wash out "a lot of the scam and hype assets" that came about in 2020 and 2021.

He said investors will likely become more conservative in their exposure to the space, choosing to hold just a little bit of bitcoin and a little bit of ether, the two most common crypto assets.

Mosoff added that the events of this year will force other crypto trading platforms to be more transparent.

It's not just your individual investors who have put money into crypto; major funds have also been taking a chance on the space.

In a statement released Thursday, the Ontario Teachers' Pension Plan said it invested US$95 million into both FTX International and the U.S. entity.

Teachers' said any financial loss on its investment in FTX will have limited impact on the pension plan because the investment represents less than 0.05 per cent of its total net assets.

The FTX incident highlights why regulatory oversight of the crypto industry is critical and reinforces the importance of clear regulation, Mosoff explained.

"I think this will be a marker where it's time now for the U.S. and Canada to clarify a lot of the regulatory rules to allow the businesses that want to be more compliant and more transparent to act in a responsible way," he said.

"The question is, what is an appropriate framework for regulation? Who are the appropriate players and the right level of transparency? Do investors want to use these third-party siloed, you know, custodians or exchanges to facilitate all their activities? Or does the space go back a little bit more to its roots?"

FTX hurtles toward bankruptcy with US$8B

hole, U.S. probe

, Bloomberg News

The crisis engulfing Sam Bankman-Fried’s FTX.com is rapidly worsening, with the onetime crypto wunderkind warning of bankruptcy if his firm can’t secure funds to cover a shortfall of as much as US$8 billion.

Bankman-Fried informed investors of the gap on Wednesday, shortly before rival exchange Binance abruptly scrapped a takeover offer. He said FTX.com needed $4 billion to remain solvent and is attempting to raise rescue financing in the form of debt, equity, or a combination of the two, according to a person with direct knowledge of the matter.

“I f---ed up,” Bankman-Fried told investors on the call, according to people with knowledge of the conversation. He said he would be “incredibly, unbelievably grateful” if investors could help.

An FTX representative declined to comment.

The acknowledgment of his firm’s deepening troubles and limited options is a stunning turn for Bankman-Fried, who was once worth $26 billion and likened to John Pierpont Morgan. It also underscores the uncertainty hanging over FTX, its clients and cryptocurrency markets.

U.S. authorities are investigating FTX, the vast bulk of Bankman-Fried’s wealth has evaporated and rivals are benefiting from his woes. Robinhood Markets Inc. has seen its biggest crypto inflows ever in the last two days, Chief Executive Officer Vlad Tenev said Thursday. Binance and Coinbase Global Inc. have also seen large inflows, data from CryptoQuant show.

Investor Sequoia Capital wrote down the full value of its holdings in FTX.com and FTX.us, an indication that the firm sees no clear path to recouping its investment.

BIG-NAME BACKERS

Hanging in the balance as the exchange teeters is not just the fate of its investors and lenders but anyone who has been unable to retrieve customer assets since it halted some withdrawals earlier in the week. The failure of crypto firms Celsius and Voyager saw billions in client money tied up in bankruptcy proceedings.

FTX has a prominent list of backers such as Sequoia Capital, BlackRock Inc., Tiger Global Management and SoftBank Group Corp.

Still, Bankman-Fried remained defiant during a hectic period of roughly 24 hours that included mounting speculation that Binance wouldn’t go through with the deal.

He repeatedly told investors during the conference call on Wednesday afternoon that it was simply not true that Changpeng Zhao was walking away from the takeover, the person said.

About an hour later, Binance said it was indeed backing out.

“Our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help,” Binance, the crypto exchange founded by Zhao, said in a statement.

In addition to the financial strains, FTX is drawing attention from US authorities.

The Securities and Exchange Commission and the Commodity Futures Trading Commission are investigating whether the firm properly handled customer funds, as well as its relationship with other parts of Bankman-Fried’s crypto empire, including his trading house Alameda Research, Bloomberg News reported Wednesday. Officials from the Justice Department also are working with SEC attorneys, one of the people said.

Zhao said in a memo earlier on Wednesday that there was no “master plan” to take over FTX, and that “user confidence is severely shaken.”

The renewed concern about contagion risk is showing up in the plunging prices of digital assets. Bitcoin fell below $16,000, the lowest in two years, after Binance’s announcement.

Coinbase Chief Executive Officer Brian Armstrong said Tuesday in a Bloomberg TV interview that if the deal with Binance fell through, it would likely mean FTX customers would take losses.

“That’s a not a good thing for anybody,” he said.