Stellantis halts construction at Windsor, Ont., EV battery plant

, BNN Bloomberg

Stellantis NV and battery maker LG Energy Solution have halted construction on an electric vehicle battery plant in Windsor, Ont., claiming the federal government has not met its commitments to the project.

A spokesperson for multinational automaker Stellantis said the companies are implementing contingency plans because “the Canadian government has not delivered on what was agreed to.”

“Effective immediately, all construction related to the battery module production on the Windsor site has stopped,” Lou Ann Gosselin said in an email.

The plant was announced in March 2022, citing an investment amount of “more than $5 billion” from both companies together. It was touted by the Ontario government as “the largest auto investment in the province’s history,” expected to be operational by 2025 and create about 2,500 jobs.

A Saturday statement from Windsor Mayor Drew Dilkens said the project is in question due to the federal government not meeting its commitments, “jeopardizing not only the completion of the EV plant but also our efforts to attract additional investment to the region.”

In a letter published on Twitter, Dilkens said he expects the federal government to “follow through” and get the project back on track.

“This counterproductive impasse creates significant challenges and risks thousands of jobs in our community,” Dilkens wrote.

“As the host community, the City of Windsor has the most at risk, and we anticipate the spirit of partnership and collaboration will put us back on the path of completing this significant project.”

A spokesperson for Industry Minister Francois-Philippe Champagne said the federal government is still in talks with the companies.

“We continue to negotiate in good faith with our partners. Our top priority is and remains getting the best deal for Canadians,” Laurie B. Bouchard said in an email. She did not say how much money the federal government offered to Stellantis related to the Windsor plant.

Ontario Premier Doug Ford said Monday that he’s concerned about the project. He said his government had already made an agreement with Stellantis on financial support of $500 million. Ford said his government offered the same amount of money to Volkswagen AG for that company’s recently announced EV battery plant in St. Thomas, Ont.

He urged the federal government to finalize the details of its financial incentives with Stellantis, and “step up” as it did with the Volkswagen plant, a deal that includes federal subsidies worth up to $13 billion on top of a $700 million grant.

“We need the federal government to come to the table and show their support like they have all along,” he said. “I know Mayor Dilkens is quite concerned as well, and so am I.”

Ford said that the province is not able to compete with U.S. green incentives supporting electric vehicle and other technologies, but he argued that federal government should do so.

Canada’s offer to Volkswagen essentially matched what would have been made available in the United States had the company chosen to set up its battery shop there – but Prime Minister Justin Trudeau has since warned that not all companies can expect the same deal.

The president of the union representing about 8,000 Canadian Stellantis workers told Bloomberg News in a Monday interview that time is of the essence for governments to complete negotiations with the company and save the project.

“We’ve dealt with auto companies for a very long time. We know they don’t make threats, they make decisions — and that’s where we are at right now,” Unifor president Lana Payne said.

“The longer this goes on the more precarious it becomes. We’re not dealing with a lot of time here.”

Flavio Volpe, president of Automotive Parts Manufacturers’ Association (APMA) of Canada, said he’s not worried about Stellantis pulling out of Windsor, given that construction of the facility has already started.

“What we’re seeing is a public peek into private negotiations,” Volpe told BNN Bloomberg in a television interview on Monday. “We’re really just grinding out the final details.”

The Stellantis Windsor deal is unique, Volpe said, because it came about before the United States’ Inflation Reduction Act and the extent of its green incentives were revealed, which put pressure on government’s like Canada’s to put more money on the table to compete in subsequent deals like the one with Volkswagen.

Volpe said he expects Stellantis is likely making its case for more funding to compete with the U.S. subsidies on offer, but he’s optimistic that both sides will come to an agreement in the end.

“We will be making batteries in Windsor for the cars that my members supply across this country,” he said.

With files from Bloomberg News

LG, Stellantis project hangs in balance as Canada politicians fight over money

, Bloomberg News

Canada’s industry minister says the Ontario government hasn’t committed to paying its “fair share” to help advance negotiations with automaker Stellantis NV over an electric-vehicle battery plant.

François-Philippe Champagne said the Canadian government will be competitive with the U.S. when it comes to the auto sector. “What we now need is for Ontario to pay its fair share. Full stop. Windsor is a key place to build our EV ecosystem,” the minister said Monday night on Twitter, referring to the southern Ontario city where the plant would be located.

Stellantis and LG Energy Solution Ltd. announced the project last year, but said Monday they’ve halted construction as they wage a battle for more public money from Canada. Prime Minister Justin Trudeau’s government has already offered up to $13 billion to Volkswagen AG to lure a vehicle battery plant to Ontario, Canada’s most populous province and the heart of its auto industry.

Champagne sent the tweet on his way to South Korea, LG’s home country, where he’s on a trade trip with Trudeau. A spokesperson for Ontario Economic Development Minister Vic Fedeli didn’t immediately respond to a request for comment.

Speaking to reporters in Seoul on Tuesday, Champagne said he was looking to Ontario to share in paying for public subsidies for the plant, beyond the typical capital expenditure funding.

“The capital expenditure is the easy part of the equation, which we have always done and we have done with our partners all along,” he said. “What we’re saying now when we say ‘pay their fair share’ is to make sure that they would be with us in terms of production support.”

Stellantis and LG Energy pledged in 2022 to invest more than $4 billion in the Windsor battery facility. Meanwhile, Ontario and Canada promised about C$1 billion to help Stellantis retool two Ontario plants to build electric vehicles.

However, both announcements came months before U.S. President Joe Biden signed the Inflation Reduction Act, which contains rich incentives for EV manufacturing. Trudeau subsequently promised more government assistance to help Canadian manufacturers compete.

Champagne said Tuesday that Stellantis asked his government to come back to the table after the passage of the act. He said negotiations are focused on the battery cell manufacturing plant and his government has promised a “fair deal” in line with what it offered to Volkswagen.

He also said he plans to pull aside and talk to the CEO of LG, Kwon Young-soo, at a state dinner on Wednesday.

Asked whether he thought Stellantis was bluffing when it halted construction and threatened to build the plant elsewhere, the minister said he is “old enough” to know when companies are using negotiation tactics.

“There’s a negotiation, that’s fair. But my job and our job is to fight for Canadians,” he said. “So I’m fighting. We got a good deal with Volkswagen, we’re going to get a good deal with LG-Stellantis and we’re going to get a deal that we can afford as Canadians.”

Ontario Premier Doug Ford earlier told the Canadian Press that the federal government needs to support Stellantis in the same manner as Volkswagen. He also said his province cannot afford to provide subsidies in line with the US government. “It really worries me,” he said. “We need the federal government to come to the table and show their support like they have all along.”

If built, the 45 gigawatt-hour factory would create 2,500 jobs and supply Stellantis’s assembly plant in Windsor and others across North America.

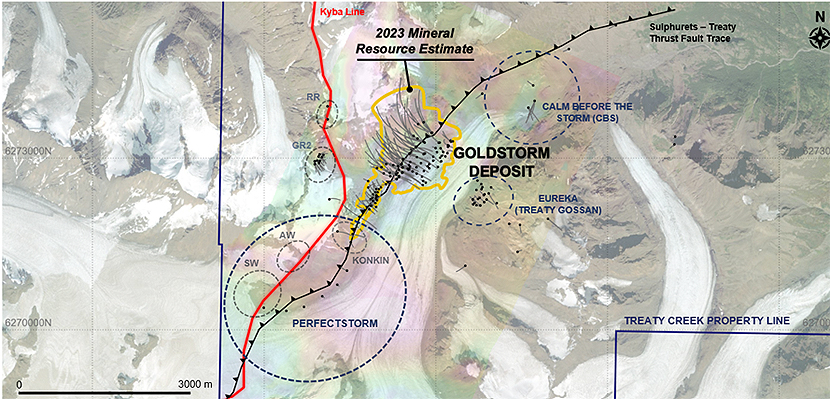

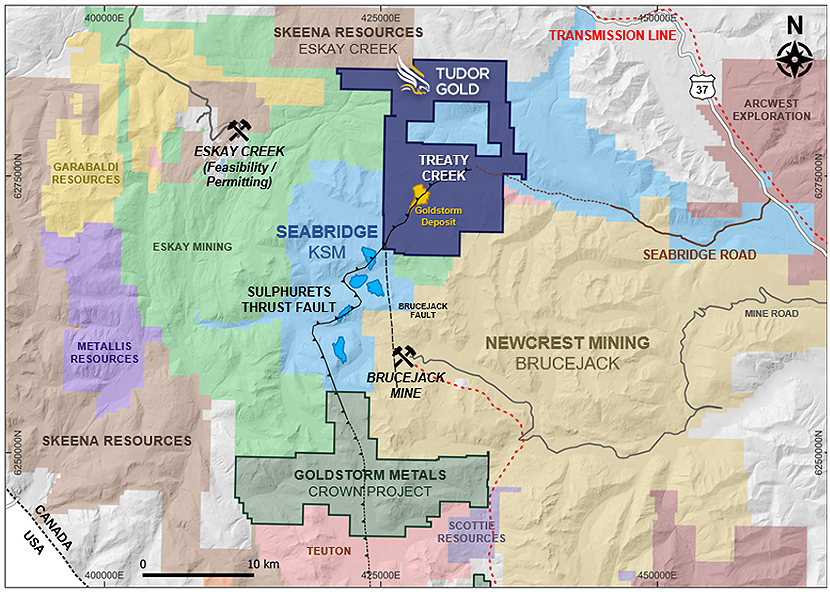

Source: Tudor Gold.

Source: Tudor Gold.