Iraqi PM visits Syria in first trip since Syrian war

Sun, July 16, 2023

By Timour Azhari

BAGHDAD (Reuters) - Iraqi Prime Minister Mohammed Shia Al-Sudani began an official visit to Syria on Sunday, the first by an Iraqi premier since the outbreak of the Syrian war in 2011, in a trip aimed at securing their shared border and bolstering economic ties.

Iraq and Syria, which have close economic, military and political ties to regional heavyweight Iran, maintained relations throughout Syria's civil war even as other Arab states withdrew their ambassadors and closed their embassies in Syria.

Baghdad and Damascus, along with Shi'ite armed groups backed by Iran, cooperated in the fight against militant group Islamic State, which spread from Iraq into Syria and at one point controlled more than a third of both countries.

Farhad Alaaldin, foreign affairs adviser to the prime minister, said Sudani was set to discuss combatting the flow of drugs, especially the amphetamine Captagon, and preventing the infiltration of Islamic State militants over their shared 600km border.

The prime minister would also discuss trade and economic cooperation and possibilities for reopening an oil export pipeline in the Mediterranean, which could help Iraq diversify its export routes, he said.

Sudani's visit comes as other countries, including Saudi Arabia, rebuild relations with Damascus after years of tensions.

Syria was suspended from the Arab League in 2011 over Assad's brutal crackdown on protests and several Gulf states supported the armed opposition to his rule.

But Assad has regained control of most of Syria with military and economic support from Russia and Iran, Syria was readmitted to the Arab League in May, and regional countries are seeking dialogue with him to end drug smuggling and return millions of refugees.

Syria has agreed to help end drug trafficking across its borders with Jordan and Iraq.

Top Syrian officials and relatives of Assad have been put on sanctions lists in recent months in the United States, United Kingdom and European Union over their alleged ties to the trade.

The Syrian government denies involvement in the drug trade.

(Reporting by Timour Azhari; Editing by Alexandra Hudson)

Sun, July 16, 2023

By Timour Azhari

BAGHDAD (Reuters) - Iraqi Prime Minister Mohammed Shia Al-Sudani began an official visit to Syria on Sunday, the first by an Iraqi premier since the outbreak of the Syrian war in 2011, in a trip aimed at securing their shared border and bolstering economic ties.

Iraq and Syria, which have close economic, military and political ties to regional heavyweight Iran, maintained relations throughout Syria's civil war even as other Arab states withdrew their ambassadors and closed their embassies in Syria.

Baghdad and Damascus, along with Shi'ite armed groups backed by Iran, cooperated in the fight against militant group Islamic State, which spread from Iraq into Syria and at one point controlled more than a third of both countries.

Farhad Alaaldin, foreign affairs adviser to the prime minister, said Sudani was set to discuss combatting the flow of drugs, especially the amphetamine Captagon, and preventing the infiltration of Islamic State militants over their shared 600km border.

The prime minister would also discuss trade and economic cooperation and possibilities for reopening an oil export pipeline in the Mediterranean, which could help Iraq diversify its export routes, he said.

Sudani's visit comes as other countries, including Saudi Arabia, rebuild relations with Damascus after years of tensions.

Syria was suspended from the Arab League in 2011 over Assad's brutal crackdown on protests and several Gulf states supported the armed opposition to his rule.

But Assad has regained control of most of Syria with military and economic support from Russia and Iran, Syria was readmitted to the Arab League in May, and regional countries are seeking dialogue with him to end drug smuggling and return millions of refugees.

Syria has agreed to help end drug trafficking across its borders with Jordan and Iraq.

Top Syrian officials and relatives of Assad have been put on sanctions lists in recent months in the United States, United Kingdom and European Union over their alleged ties to the trade.

The Syrian government denies involvement in the drug trade.

(Reporting by Timour Azhari; Editing by Alexandra Hudson)

Iraqi premier in Syria for first visit in over a decade to discuss boosting cooperation

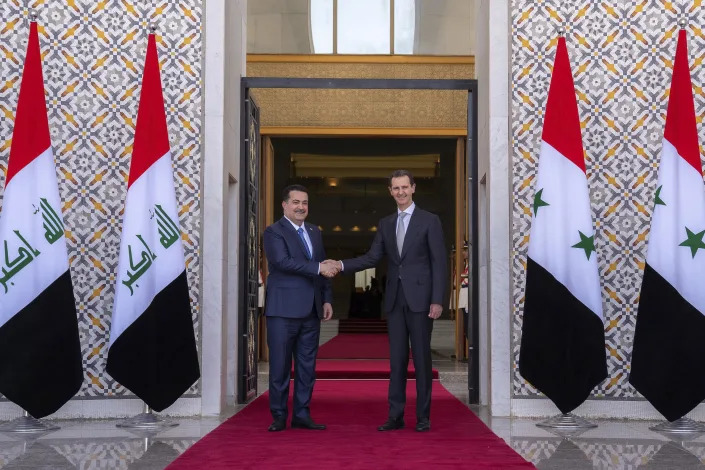

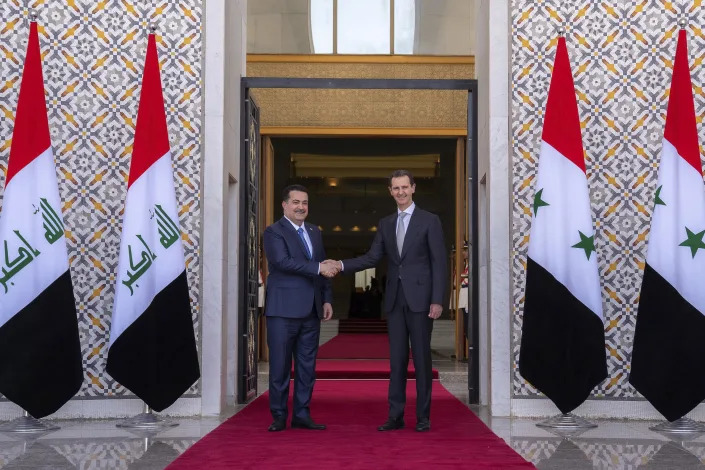

In this photo released by the Syrian official news agency SANA, Syrian President Bashar Assad, right, welcomes Iraq's Prime Minister Mohammed Shia al-Sudani during a welcome ceremony in Damascus, Syria, Sunday, July 16, 2023. Iraq's prime minister held talks Sunday with Syrian President Bashar Assad in Damascus during the first such trip by an Iraqi premier to the war-torn country since the 12-year conflict began.

(SANA via AP)

SAMAR KASSABALI and ABDULRAHMAN ZEYAD

Updated Sun, July 16, 2023

DAMASCUS, Syria (AP) — Iraq’s prime minister held talks Sunday with Syrian President Bashar Assad in Damascus during the first trip of its kind to the war-torn country since the 12-year conflict began.

The two leaders told reporters that they discussed fighting drugs, the return of Syrian refugees and the imperative of lifting Western sanctions imposed in Syria. They also talked about Israel's strikes on the war-torn country and water shortages in the Euphrates River that cuts through both countries because of projects in Turkey.

Iraq and Syria have had close relations for years even after many Arab countries withdrew their ambassadors from Damascus and Syria’s membership in the 22-member Arab League was suspended because of the crackdown on protesters in 2011.

Assad received Mohammed Shia al-Sudani, who was heading a high-ranking delegation, at the presidential palace in Damascus. They discussed mutual relations and cooperation between the two neighboring countries among other issues, according to the office of Syria’s president.

Al-Sudani’s office said in a statement that talks revolved around ways of expanding cooperation in the fields of trade, economy, transportation, tourism, how to combat climate change and collaboration to fight terrorism.

Security cooperation against extremist groups was likely to top the agenda for the two-day visit. The two countries, where Iran enjoys wide influence, have a joint 600 kilometer-long (373-mile) border. In June 2014, the Islamic State group declared the establishment of a self-styled “caliphate,” a traditional model of Islamic rule, in wide areas under its control in Iraq and Syria.

After a yearslong campaign that left tens of thousands dead in both countries, IS was defeated in Iraq in 2017 and in March 2019 in Syria. In recent years, Syrian government forces regained control of much of Syria with the help of Russia and Iran.

Earlier this year, Syria’s membership in the Arab League was reinstated and Assad attended the Arab summit that was held in Saudi Arabia in May.

Assad referred to Turkey without naming it as being behind the “theft” of Iraq and Syria's shares in the Eurphrates River in what is affecting agriculture in both countries. Assad also said that they discussed cooperating on fighting drugs, a scourge he said is "no different from terrorism as it can destroy the society the way terrorism does.”

Syria's conflict that started in March 2011 has killed half a million people and displaced half the country's pre-war population of 23 million, including more than 5 million who are refugees.

“We are interested in working through official and government channels to solve the issue of refugees and guarantee a safe return for them as soon as the situation becomes stable in places where they reside,” al-Sudani said. Iraq is hosting about 250,000 Syrian refugees.

Al-Sudani was invited to visit Damascus during a trip by Syria’s Foreign Minister Faisal Mekdad to Baghdad last month.

The Iraqi prime minister said countries around the world that have citizens in Syria's al-Hol camp, home to tens of thousands of mostly women and children linked to IS, should start working on repatriating them as Baghdad is doing.

Al-Hol camp in northeast Syria near the Iraqi border holds about 51,000 people, including the wives, widows and other family members of IS militants. Most are Syrians and Iraqis. But there are also around 8,000 women and children from 60 other nationalities who live in a part of the camp known as the Annex. They are generally considered the most die-hard IS supporters among the camp residents.

Many countries are refusing to repatriate their citizens out of concern that they might be a security threat. Iraq has repatriated hundreds of families over the past months where they undergo rehabilitation programs.

The U.S. has a presence in both Syria and Iraq and Syrian officials have been calling for the withdrawal of American troops from the country who first arrived in 2015.

On any given day there are at least 900 U.S. forces in Syria, along with an undisclosed number of contractors attempting to prevent the resurgence of the Islamic State group. U.S. special operations forces also move in and out of the country but are usually in small teams and are not included in the official count.

U.S.-led coalition forces have officially ended their combat mission in Iraq, but continue to play an advisory role to Iraqi forces in the fight against the Islamic State extremist group.

____

Zeyad reported from Baghdad. Associated Press writer Bassem Mroue contributed from Beirut.

SAMAR KASSABALI and ABDULRAHMAN ZEYAD

Updated Sun, July 16, 2023

DAMASCUS, Syria (AP) — Iraq’s prime minister held talks Sunday with Syrian President Bashar Assad in Damascus during the first trip of its kind to the war-torn country since the 12-year conflict began.

The two leaders told reporters that they discussed fighting drugs, the return of Syrian refugees and the imperative of lifting Western sanctions imposed in Syria. They also talked about Israel's strikes on the war-torn country and water shortages in the Euphrates River that cuts through both countries because of projects in Turkey.

Iraq and Syria have had close relations for years even after many Arab countries withdrew their ambassadors from Damascus and Syria’s membership in the 22-member Arab League was suspended because of the crackdown on protesters in 2011.

Assad received Mohammed Shia al-Sudani, who was heading a high-ranking delegation, at the presidential palace in Damascus. They discussed mutual relations and cooperation between the two neighboring countries among other issues, according to the office of Syria’s president.

Al-Sudani’s office said in a statement that talks revolved around ways of expanding cooperation in the fields of trade, economy, transportation, tourism, how to combat climate change and collaboration to fight terrorism.

Security cooperation against extremist groups was likely to top the agenda for the two-day visit. The two countries, where Iran enjoys wide influence, have a joint 600 kilometer-long (373-mile) border. In June 2014, the Islamic State group declared the establishment of a self-styled “caliphate,” a traditional model of Islamic rule, in wide areas under its control in Iraq and Syria.

After a yearslong campaign that left tens of thousands dead in both countries, IS was defeated in Iraq in 2017 and in March 2019 in Syria. In recent years, Syrian government forces regained control of much of Syria with the help of Russia and Iran.

Earlier this year, Syria’s membership in the Arab League was reinstated and Assad attended the Arab summit that was held in Saudi Arabia in May.

Assad referred to Turkey without naming it as being behind the “theft” of Iraq and Syria's shares in the Eurphrates River in what is affecting agriculture in both countries. Assad also said that they discussed cooperating on fighting drugs, a scourge he said is "no different from terrorism as it can destroy the society the way terrorism does.”

Syria's conflict that started in March 2011 has killed half a million people and displaced half the country's pre-war population of 23 million, including more than 5 million who are refugees.

“We are interested in working through official and government channels to solve the issue of refugees and guarantee a safe return for them as soon as the situation becomes stable in places where they reside,” al-Sudani said. Iraq is hosting about 250,000 Syrian refugees.

Al-Sudani was invited to visit Damascus during a trip by Syria’s Foreign Minister Faisal Mekdad to Baghdad last month.

The Iraqi prime minister said countries around the world that have citizens in Syria's al-Hol camp, home to tens of thousands of mostly women and children linked to IS, should start working on repatriating them as Baghdad is doing.

Al-Hol camp in northeast Syria near the Iraqi border holds about 51,000 people, including the wives, widows and other family members of IS militants. Most are Syrians and Iraqis. But there are also around 8,000 women and children from 60 other nationalities who live in a part of the camp known as the Annex. They are generally considered the most die-hard IS supporters among the camp residents.

Many countries are refusing to repatriate their citizens out of concern that they might be a security threat. Iraq has repatriated hundreds of families over the past months where they undergo rehabilitation programs.

The U.S. has a presence in both Syria and Iraq and Syrian officials have been calling for the withdrawal of American troops from the country who first arrived in 2015.

On any given day there are at least 900 U.S. forces in Syria, along with an undisclosed number of contractors attempting to prevent the resurgence of the Islamic State group. U.S. special operations forces also move in and out of the country but are usually in small teams and are not included in the official count.

U.S.-led coalition forces have officially ended their combat mission in Iraq, but continue to play an advisory role to Iraqi forces in the fight against the Islamic State extremist group.

____

Zeyad reported from Baghdad. Associated Press writer Bassem Mroue contributed from Beirut.