Electrofuel developed from green hydrogen and carbon dioxide tested in practice for first time in Finland

The E-fuel project of VTT and partners has developed a concept for producing electrofuel from green hydrogen and carbon dioxide using a combination of different methods. On Nov. 21, this paraffinic E-fuel was tested for the first time in Finland on a diesel-powered tractor at AGCO Power's Linnavuori factory in Nokia. The new electrofuel is also suitable for vehicles that are difficult to electrify, and is therefore an important step in the development of sustainable fuel solutions.

Global climate goals require drastic changes in all aspects of life. Carbon capture and utilization are key to moving towards sustainable fuel solutions for transport. The E-fuel project, coordinated by VTT, has combined high-temperature electrolysis, carbon capture and Fischer-Tropsch hydrocarbon synthesis to develop electrofuel production for commercial and industrial scale. New methods have made the production of green hydrogen much more efficient than before.

"Using Finnish technology, we have succeeded in producing E-diesel, or electrofuel, from green hydrogen and carbon dioxide on a pre-commercial scale. The fuel can be used to replace fossil diesel in sectors that are difficult to electrify, such as heavy road transport and shipping. It can also be used in machinery. Our next step is to obtain information on the usability of the fuel in a field test," says VTT Research Professor Juha Lehtonen.

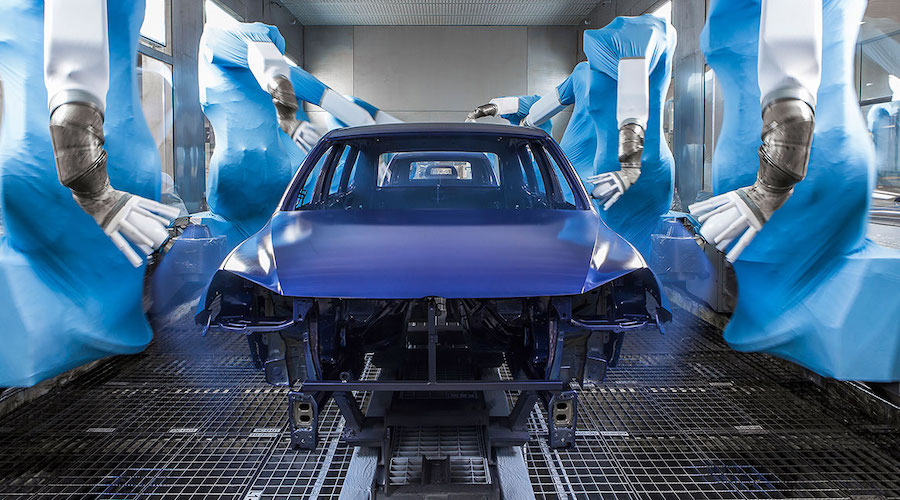

Electrofuel being tested at the AGCO Power factory in Nokia

The project has produced hundreds of kilograms of synthetic hydrocarbons for sustainable transport fuel. The hydrocarbons have then been refined at Neste into a drop-in paraffinic diesel, which was now being tested at AGCO Power's Linnavuori plant in Nokia.

"The Valtra T235D tractor, powered by AGCO Power's 74 LFTN diesel engine, was fueled with the new E-diesel and, during the test drive, which lasted several hours, fuel consumption and the carbon dioxide, nitrogen oxides, fine particles and other substances in the exhaust emissions were measured. The E-diesel produced in the project is expected to be of high quality and meet current road diesel fuel standards," says AGCO Power's director of engineering, Kari Aaltonen.

New electrofuel can be used in existing diesel engines

There is no single solution to future emission reductions. AGCO Power's engine plant is also investing in research and development and exploring a wide range of options for reducing emissions from agriculture.

"We are developing solutions for different types of machinery to meet the needs of farmers, for example with electric batteries, hydrogen, methane and methanol," says Aaltonen.

It is important that emissions and fossil fuel use can be significantly reduced by means other than the direct electrification of transport.

"Sustainable fuels suitable for the current diesel engine fleet, such as drop-in E-diesel, can be blended with fossil diesel completely freely and still meet the quality requirements of paraffinic diesel according to the EN 15940 standard," Aaltonen continues.

According to Päivi Aakko-Saksa, principal research scientist at VTT, based on previous experience with paraffinic fuels, the E-diesel being tested is also expected to be an environmentally friendly alternative to fossil diesel in terms of local emissions.

"By analyzing the results of the Nokia test run, we will see whether E-diesel is also an environmentally friendly alternative with regard to harmful exhaust emissions," she says.