A surgeon general report once cleared the air about smoking. Is it time for one on vaping?

MIKE STOBBE

Mon, January 15, 2024

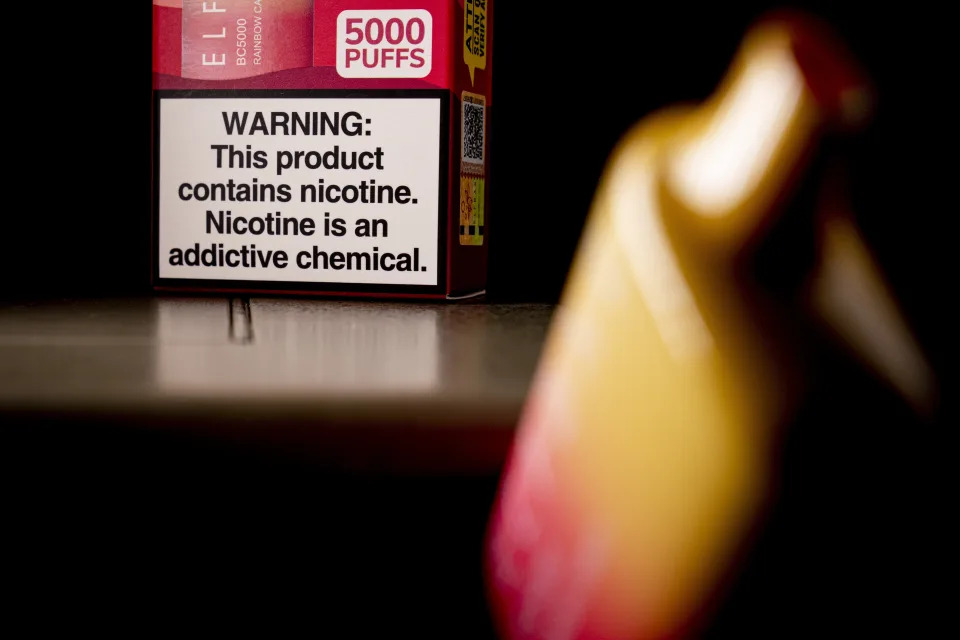

Vaping Health Effects

- A health warning is seen on the packaging of a disposable vaping pod device in Washington

on Monday, June 26, 2023. Sixty years ago, the U.S. surgeon general released a report that settled

a longstanding public debate about the dangers of cigarettes and led to huge changes in smoking

in America. Some public health experts say a similar report could help clear the air about vaping.

(AP Photo/Andrew Harnik, File)

NEW YORK (AP) — Sixty years ago, the U.S. surgeon general released a report that settled a longstanding public debate about the dangers of cigarettes and led to huge changes in smoking in America.

Today, some public health experts say a similar report could help clear the air about vaping.

Many U.S. adults believe nicotine vaping is as harmful as — or more dangerous than — cigarette smoking. That’s wrong. The U.S. Food and Drug Administration and most scientists agree that, based on available evidence, electronic cigarettes are far less dangerous than traditional cigarettes.

But that doesn’t mean e-cigarettes are harmless either. And public health experts disagree about exactly how harmful, or helpful, the devices are. Clarifying information is urgently needed, said Lawrence Gostin, a public health law expert at Georgetown University.

“There have been so many confusing messages about vaping,” Gostin said. “A surgeon general’s report could clear that all up.”

One major obstacle: E-cigarettes haven’t been around long enough for scientists to see if vapers develop problems like lung cancer and heart disease.

“There’s a remarkable lack of evidence,” said Dr. Kelly Henning, who leads the public health program at Bloomberg Philanthropies.

SMOKING AND VAPING

Cigarette smoking has long been described as the leading cause of preventable death in the United States. The Centers for Disease Control and Prevention puts the annual toll at 480,000 lives. That count should start to fall around 2030, according to a study published last year by the American Journal of Preventive Medicine, thanks in part to a decline in smoking rates that began in the 1960s.

Back then, ashtrays were everywhere and more than 42% of U.S. adults smoked.

On Jan. 11, 1964, U.S. Surgeon General Luther Terry released an authoritative report that said smoking causes illness and death — and the government should do something about it. The report is considered a watershed moment: In the decades that followed, warning labels were put on cigarette packs, cigarette commercials were banned, governments raised tobacco taxes and new restrictions were placed on where people could light up.

By 2022, the adult smoking rate was 11%.

Some experts believe e-cigarettes deserve some of the credit. The devices were billed as a way to help smokers quit, and the FDA has authorized a handful of e-cigarettes as less-harmful alternatives for adult smokers.

Vaping’s popularity exploded in the 2010s, among both adults but and teens. In 2014, e-cigarettes surpassed combustible cigarettes as the tobacco product that youth used the most. By 2019, 28% of high schoolers were vaping.

U.S. health officials sounded alarms, fearing that kids hooked on nicotine would rediscover cigarettes. That hasn’t happened. Last year, the high school smoking rate was less than 2% — far lower than the 35% rate seen about 25 years ago.

“That’s a great public health triumph. It’s an almost unbelievable one,” said Kenneth Warner, who studies tobacco-control policies at the University of Michigan.

“If it weren’t for e-cigarettes, I think we would be hearing the public health community shouting at the top of their lungs about the success of getting kids not to smoke,” he said.

VAPING’S BENEFITS AND HARMS

Cigarettes have been called the deadliest consumer product ever invented. Their smoke contains thousands of chemicals, at least 69 of which can cause cancer.

The vapor from e-cigarettes has been estimated to contain far fewer chemicals, and fewer carcinogens. Some toxic substances are present in both, but show up in much lower concentrations in e-cigarette vapor than in cigarette smoke.

Studies have shown that smokers who completely switch to vaping have better lung function and see other health improvements.

“I would much rather see someone vaping than smoking a Marlboro. There is no question in my mind that vaping is safer,” said Donald Shopland, who was a clerk for the committee that generated the 1964 report and is co-author of a forthcoming book on it.

But what about the dangers to people who have never smoked?

There have been 100 to 200 studies looking at vaping, and they are a mixed bag, said Dr. Neal Benowitz, of the University of California, San Francisco, a leading academic voice on nicotine and tobacco addiction. The studies used varying techniques, and many were limited in their ability to separate the effects of vaping from former cigarettes smoking, he said.

“If you look at the research, it’s all over the map,” Warner said.

Studies have detected bronchitis symptoms and aggravation of asthma in young people who vape. Research also indicates vaping also can affect the cells that line the blood vessels and heart, leading to looks for a link to heart disease. Perhaps the most cited concern is nicotine, the stimulant that makes cigarettes and vapes addictive.

Animal studies suggest nicotine exposure in adolescents can affect development of the area of the brain responsible for attention, learning and impulse control. Some research in people suggests a link between vaping and ADHD symptoms, depression and feelings of stress. But experts say that the research is very limited and more work needs to be done.

Meanwhile, there’s not even a clear scientific consensus that vaping is an effective way to quit smoking, with different studies coming up with different conclusions.

CLEARING THE AIR

Last month, the World Health Organization raised alarms about the rapidly growing global markets for electronic cigarettes, noting they come in thousands of flavors that attract young people.

In 2016, U.S. Surgeon General Dr. Vivek Murthy said efforts were needed to prevent and reduce e-cigarette use by children and young adults, saying nicotine in any form is unsafe for kids.

About four months before the report’s release, the FDA began taking steps to regulate e-cigarettes, believing they would benefit smokers.

The agency has authorized several e-cigarettes, but it has refused more than 1 million product marketing applications. Critics say the FDA has been unfair and inconsistent in regulation of products.

Meanwhile, the number of different e-cigarette devices sold in the U.S. has boomed, due largely to disposables imported from China that come in fruit and candy flavors. But vaping by youths has recently been falling: Last year, 10% of high school students surveyed said they had used e-cigarettes in the previous month, down from 14% the year before.

Why the decline? “It’s hard to say what’s working,” said Steven Kelder, a University of Texas researcher.

He mentioned a 2019 outbreak of hospitalizations and deaths among people who were vaping products with THC, the chemical that gives marijuana its high.

The illnesses were traced to a thickening agent used in black market vape cartridges, a substance not used in commercial nicotine e-cigarettes. But it may be a reason many Americans think of e-cigarettes as unsafe, Kelder said.

Sherri Mayfield, a 47-year-old postal worker, remembers the 2019 outbreak and reports of rapid illnesses and deaths in youths. Vaping “absolutely” needs to be studied more, Mayfield said last week while on a cigarette break in New York with some co-workers.

“Cigarettes aren't safe” but at least it can take them decades to destroy your health, she said.

The surgeon general's office said in a statement that the 1964 report “catalyzed a 60-year movement to address the harmful effects of smoking" and suggested similar action was needed to address youth vaping.

Murthy's website, however, currently lists neither vaping nor smoking as a priority issue.

___

The Associated Press Health and Science Department receives support from the Howard Hughes Medical Institute’s Science and Educational Media Group. The AP is solely responsible for all content.