Developers to get cheap land leases in Canadian homebuilding push

, Bloomberg News

Prime Minister Justin Trudeau’s government will provide low-cost leases of public land to developers and push factory construction of homes as part of what it calls a “historic” plan to alleviate Canada’s housing crisis.

Companies that agree to build affordable homes will gain access to “surplus, underused, and vacant lands” owned by the public, the government said, while providing few specific details. The prime minister’s housing strategy, published on Friday, also includes low-interest loans for homeowners who want to add basement suites or laneway houses to their properties.

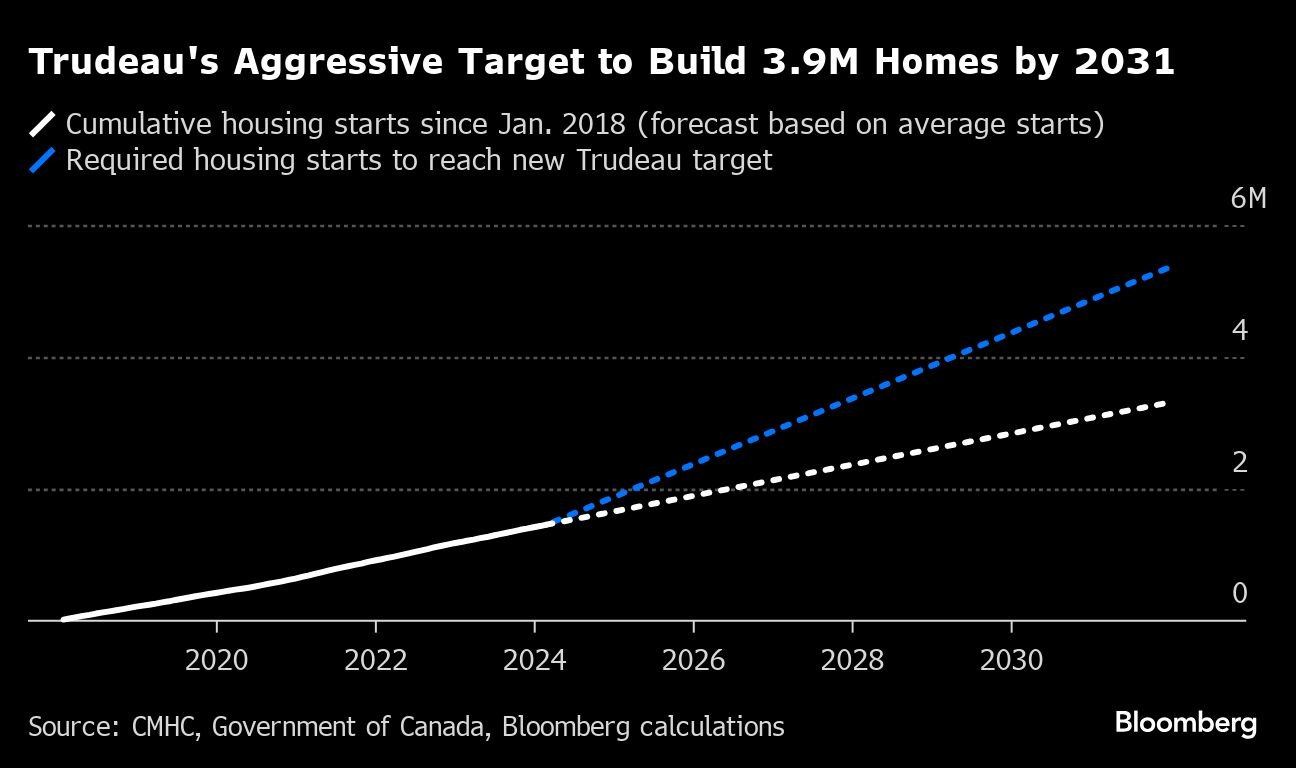

The strategy should allow the country to build about 3.9 million homes by 2031, Trudeau said at a news conference. That would exceed the 3.5 million that the Smart Prosperity Institute has estimated is needed — if provinces and local governments join the initiative with “serious ambition,” Housing Minister Sean Fraser said in an interview.

There were two other points in Canada’s history when it faced a housing shortage close to the current scale, Fraser said. One was following World War II, when soldiers returned and displaced people flooded the country; the second was a generation later, when the baby boomers came of age and needed to house their growing families.

In both instances, the country stepped up to increase its housing stock. But after decades of underinvestment, combined with a growing population, Canada may be facing its biggest housing-supply challenge yet, in Fraser’s view

The federal government is the country’s largest landowner, but Fraser said it is opting for leasing land rather than selling it to keep it public and to retain more control over what gets built. The government says it will work with homebuilders and housing providers to build “on every possible site across the public portfolio.”

“This is the most ambitious plan to build houses in the history of Canada,” Fraser said.

But many parts of the housing strategy need buy-in from provinces and cities — including use of land they own as well. Some premiers, including Quebec’s Francois Legault, have already balked at intrusions into their jurisdiction.

A statement from Conservative Leader Pierre Poilievre’s office pointed to Canada’s housing record under Trudeau, including that it now takes 25 years to save for a down payment in Toronto according to National Bank. Poilievre has promised to incentivize cities to build more housing and penalize those that don’t.

The government’s plan also contains an “industrial strategy for homebuilding,” focusing on prefabricated homes, including 3D-printed properties. This element of the strategy includes a previously announced design catalogue to speed construction and earmarking $500 million in low-cost loans for innovative apartment projects.

Here are some of the other new measures in the housing plan:

- Temporarily increasing the capital cost allowance tax rate to 10 per cent from four per cent to boost builders’ returns

- Creating a new program to allow homeowners to access up to $40,000 in low-interest loans to add a secondary suite to their homes

- Adding $50 million to a foreign credential recognition program to recognize newcomers’ expertise in residential construction and boosting training and apprenticeship programs to help Canadians join the skilled trades

- Consulting on a plan to restrict the purchase and acquisition of existing single-family homes by large corporate investors

- Consulting with the mortgage industry on making a tool available through the Canada Revenue Agency to verify borrower income for mortgages, in an effort to combat fraud

- Investing an additional $1 billion over four years in a program called Reaching Home, which provides funding to communities to help address homelessness

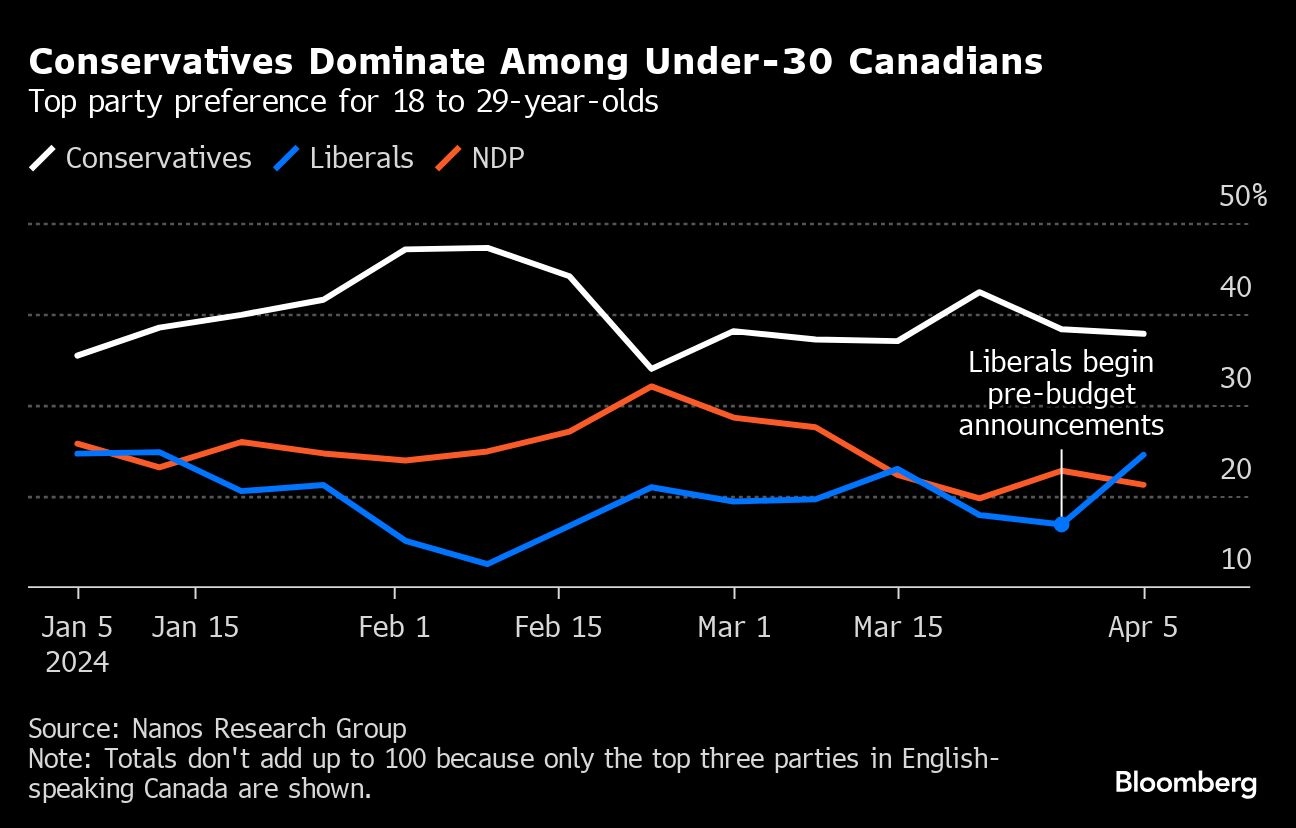

Trudeau has made a series of announcements in advance of the government’s April 16 budget related to helping younger Canadians with high housing costs. The lack of affordability has become a key political issue, helping to sink Trudeau’s popularity among under-40 voters.

Previously announced measures in the housing strategy allowing first-time homebuyers 30-year amortization periods for mortgages on newly built homes and a fund for provinces to help pay for infrastructure if they agree to allow more dense housing.